Commodities are facing headwinds. With the notable exception of gold, most commodities have slumped, largely due to China slipping back into deflation. At the start of the year, many anticipated that commodities were poised for a new “Supercycle” of outperformance. This expectation was rooted in tight supplies (particularly for metals) and increased demand driven by both the global transition to decarbonization (electrification) and the anticipated recovery of the Chinese economy. Now we need to ask: Was this thesis wrong, or is the opportunity still there?

The most significant disappointment for commodity bulls has been the faltering Chinese economy. Economists expected China to reignite global demand as its economy roared back to life. Instead, the recovery has sputtered, and the country has now entered outright deflation.

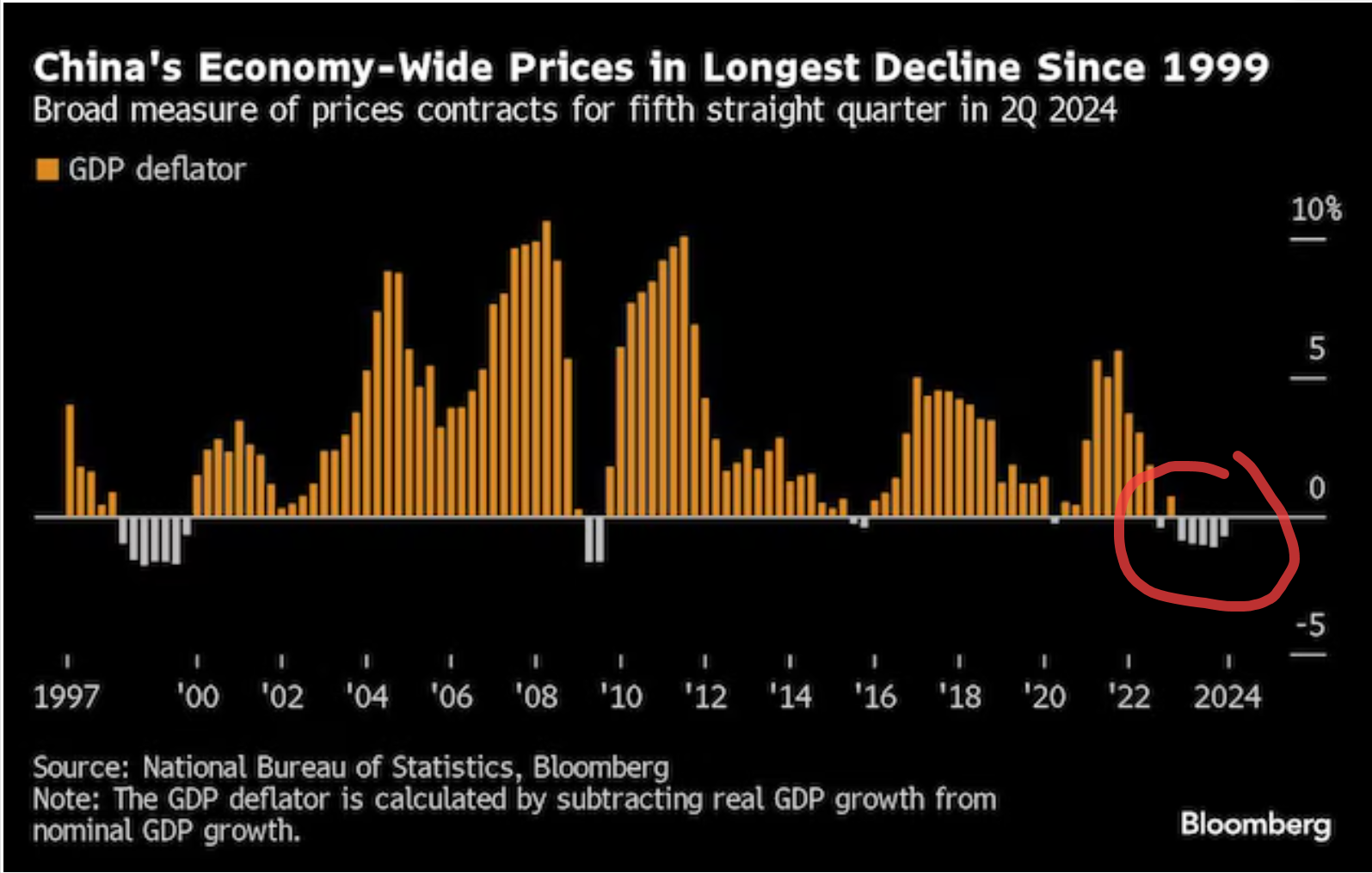

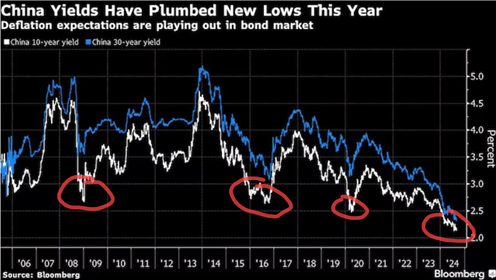

Two charts illustrate the situation:

1. China’s GDP Deflator has turned negative, indicating falling prices. This is supported by collapsing interest rates, which have dropped lower than even the pandemic lows.

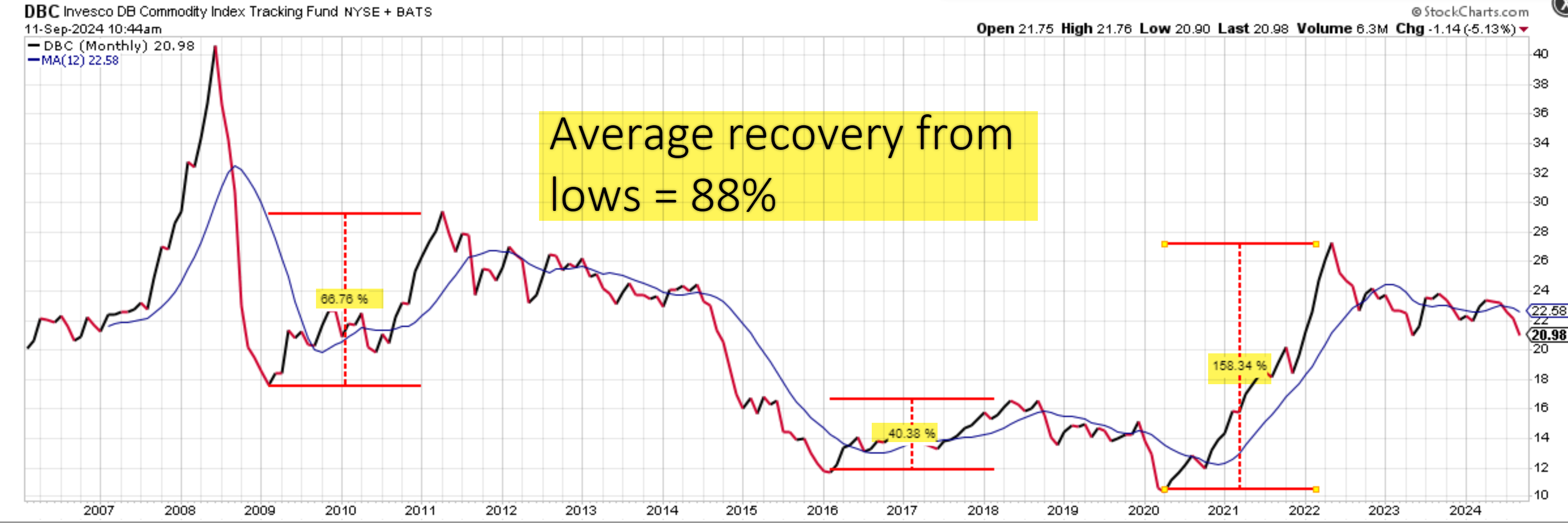

2. A basket of commodities shows a clear correlation with Chinese yields. As Chinese interest rates have reached new lows, commodities have held up relatively well by comparison, suggesting resilience. If you compare the same periods in both charts, commodities tend to rally sharply after rates bottom out.

Despite China’s economic struggles, commodities have not fallen to new lows, unlike Chinese yields. Could this be a sign that the Supercycle thesis is still in play? I remain cautiously optimistic. The resilience of commodities, in the face of such economic challenges, is encouraging.

source: StockCharts.com

China’s recent economic challenges stem not just from overinvestment in housing, which has led to a bust, but also from inefficiencies in manufacturing investments. However, economists are increasingly urging the Chinese government to shift its focus toward stimulating consumer demand directly. The consensus is that putting more money in the hands of households (through cash transfers, tax cuts, and subsidies) could bolster domestic consumption and reverse the deflationary trend. Such a policy shift would support long-term economic rebalancing away from overreliance on investment and exports.

If China does implement these measures, it could reinvigorate demand for commodities and rekindle hopes of a Supercycle. Take another look at the commodity chart. Notice that after prior lows, the average returns have been 88%. That’s the opportunity the bulls are seeing. Timing remains the big question.

In the near term, I’m looking hard at Gold, Uranium, Copper and Gas plays. There can be no energy transition without the latter three and Gold is making near all-time highs. I think this weakness represents a great opportunity for long term investors.

Watch the Video: What is Going on with Commodities?!

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen