Why Conservative Investors Should Revisit Bitcoin and Ethereum

Prometheus brought fire to humanity, transforming risk into opportunity through careful application. In 2008, Bitcoin emerged as digital finance’s equivalent breakthrough—not through revolution, but evolution. What began as an experimental monetary technology has matured into an institutional asset class. Sixteen years later, the question for defensive investors is no longer whether crypto belongs in portfolios, but how much allocation serves prudent risk management.

Innovation and risk arrive together; discipline is like the blacksmith’s hearth. The question isn’t if we use the flame, but how we control it. Below, we show what a small, rules-based allocation can do next to a traditional 60% stocks and 40% bonds portfolio.

Bitcoin, Ethereum, Gold, and Stocks at Record Highs

Bitcoin, Ethereum, Gold and the stocks are flirting with or making new all-time highs. Bonds are still the notable underperformers. The full support of the U.S. Government has created regulatory certainty for crypto and stablecoins have emerged as the killer app. The case for crypto as a small but important allocation in conservative portfolios has never been greater.

The chart below shows the relative performance of Bitcoin and Ethereum to stocks and gold over the past 5 years. Bitcoin has increased 10x as much as the TSX 60 and bonds have provided negative total return over that time period.

YCharts.com © 2025 YCharts, Inc. All rights reserved

Why Crypto Is Now De-Risked

While investors remain leery of being burned by Bitcoin and Ethereum, the investment thesis for them has never been more compelling. They have become “de-risked”. With the weight of the U.S. government now behind rather than against them, any lingering questions about their suitability as an investment has been largely eliminated—the question that remains is how much should a conservative investor own.

To be clear, opting out is a reasonable decision. There is no necessity to own any asset—that said, as your investment advisor, I wouldn’t recommend 0%. You can read about our original work, The 5% Solution which illustrated a 2.5% to 5% allocation of Bitcoin in the classic traditional 60/50 (Stock/Bond) portfolio here:

The Prometheus Portfolio: A 15% Alternative Allocation

Today we illustrate an update to that portfolio which combines a more aggressive approach. This isn’t a recommendation—we’re playing the part of Prometheus in this story—bringing fire to the people! What you chose to do with the gift is entirely up to you!

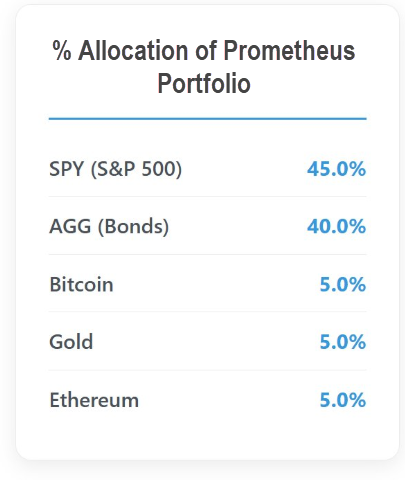

In our illustration, we model the following portfolio which rebalances quarterly compared to the traditional 60/40 portfolio. Essentially we are adding 10% to digital gold and 5% to gold (all at the expense of stocks—though we could make an argument for reducing bonds instead for younger investors).

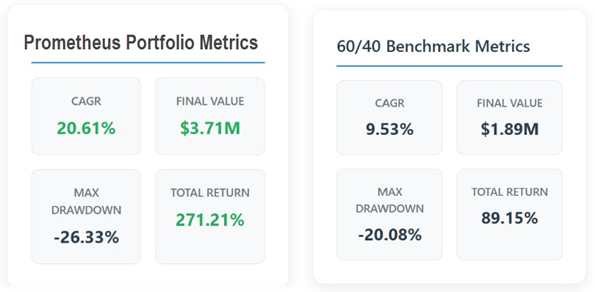

Performance: Prometheus vs. Traditional 60/40

So let’s compare how this “Prometheus Portfolio” would have fared against the 60/40 portfolio. Double the compounded annual return (20.61% vs 9.53%) for a slightly larger maximum drawdown.

For readers (like me) who are more visual, here’s an illustration that shows the growth of $1 million dollars in both models:

Calculations: Glen Evans, data by YCharts.com Past performance does not guarantee future performance.

Harnessing Crypto Volatility Through Rebalancing

Most conservative investors in Canada still shy away from Bitcoin and Ethereum because of their volatility. Respectfully, that’s like avoiding fire because of the heat. The fear of getting burned is a reasonable concern—but like a blacksmith who uses a hearth to control the flame, this model harnesses the volatility of crypto through the rebalancing strategy. In effect we continually “sell high and buy low”. It just works.

Key Takeaways for Conservative Investors

I’ve written many times about Bitcoin (though less about Ethereum). I completely understand the reticence people have—it remains an asset-class that many are deeply suspicious about. That alone is an indication that we are early in the process. So what should you take away from this illustration? Three things:

- Bitcoin and Ethereum appear to have won. The U.S. Government GENIUS Act (now passed) and CLARITY Act (expected to pass this fall) set them up as viable investments—they have gone mainstream.

- If history is a guide, by adding a modest allocation to crypto, conservative investors can improve their returns.

- Embrace the volatility—while I expect the swings to reduce in amplitude, I continue to think Bitcoin and Ethereum will experience dramatic ups and downs. Harness that volatility to your benefit.

At Evans Family Wealth, we consider part of our job to be education. Many in our industry still dismiss Bitcoin and Ethereum as the domain of hackers and drug dealers. That’s just lazy. We group them with Gold because we believe they are important alternative type investments that investors should consider owning.

If we’re right, we are still very early to the story.

Glen Evans

Watch the Video: Bitcoin, Ethereum, Gold

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.