Of Cycles and (Un)Certainty

September saw the Gold Seal Financial Group take to the roads for our annual inspection of the outside-BC facets of the Canadian economy as Brendan, Ryan and Tanya made their way cycling from the western provincial border of Saskatchewan to the Manitoba welcome sign. While the trip had always been intended as the next leg of Brendan’s effort to cross Canada one province at a time, the team was proud to dedicate the ride to Kelowna’s wildfire relief efforts with a fundraiser benefitting local not-for-profit “Mama’s for Mama’s”. Thanks to our donors, sponsors, and dedicated chase-car support, we were able to raise over $5,000 for the cause and even have a little fun along the 635km journey through the Canadian prairies.

The Q3 Asset Mix Committee meeting that took place in a very run-down motel on a long and windy day was a testament to the fact that even in the remote backroads of Canada, wealth management (and our clients) remain our top priority. In fact, we found that there’s something special about eight hours on a bicycle; with nothing but the prairie wind, a wheat field on the left and a canola field on the right. It gives you the time and headspace to reflect on the lessons we can draw from cycling. As our North American economy and markets continue to weather substantial headwinds, we’d like to share some of our most important insights from that trip so that we all know how to prepare and pace as we continue on our journey.

The best plans are not the most defined, but the most dynamic.

The statement “I am going to cycle across Saskatchewan” is about as decision useful as “I would like to retire comfortably”. These are goals; expressions of long-term ideals that necessitate the development of a sound and achievable plan of action. The next step then becomes a further defining of our goals and the natural question then becomes “by when?”. Whether you’re seeking Freedom 55 or determining cycling kilometers required per day to reach your destination, the discussion over the essential questions must be open and candid, recognizing your present circumstances and constraints. When Ryan and Brendan were planning their Saskatchewan trek a few days before they headed out and Ryan admitted that his most recent cycling training session was three months prior, their Saskatchewan plans quickly became a five-day trip instead of four. Transparency is paramount to setting meaningful and achievable progress and milestones.

With the goal better defined (getting across Saskatchewan safely and in one piece), we collectively agreed on achievable milestones that began to shape an action plan. We divided the overall trip into more digestible segments, which would ultimately lead to accomplishing our goal if we stayed the course. The most well-constructed plan is not the one with the most detail on its measures or milestones, but the one that is most resilient to change. Similarly, our capital markets mimic life in that they are both subject to factors out of our control, and the best “training and cycling” plan will always still be vulnerable to the market environment.

Day one of our trip served as a warm-welcome to the province with westerly winds at our back pushing our pace to a generously sustained 44 km/hr. Our team would argue that the markets have enjoyed such wind-at-the-back conditions through most of the past decade. We made more progress towards our overall goal that day, and what’s more – it was easy.

As we added distance and cautiously overshot our Day 1 rest stop, we were very careful to continuously monitor our trusted phone weather app to guide our pacing. Remaining tuned into the environment proved essential as one of our worst fears was confirmed: the wind was unlikely to remain at our backs, instead we would face heavy headwinds over the coming days. Too often, we have seen plans and portfolios that fall victim to this same trope: going too far when conditions are easy leaves you already exhausted and lagging further behind when the winds turn. When conditions are accommodating, it’s important to take advantage of them with moderation. On Day 1, we overshot our anticipated milestone but did not stray too far beyond our planned motel stay – it was important to keep disciplined efforts within our skillsets and abilities.

Both Day 2 and Day 4 were those that Ryan had endearingly titled “Hands Down the Worst Cycling Day of My Life.” These brought conditions that our team feels is more reminiscent of the tightening financial conditions we experience today. Resolve is tested as times are no longer easy, and less progress towards the overall goal is made. The reality of a resilient plan is that milestones are adjustable, and while it’s important to address how to make up lost-ground when times are tough, what doesn’t change is the need to focus on the goal and to keep pedaling. We didn’t change our destination or course when the ride got more difficult, and when you’re already murmuring expletives into the wind, it’s no longer the ideal time to broach the conversation.

It’s important to select the right tool for the job.

Your bike, like your portfolio, is just the tool we’re using to get from point A to B. You can have every new piece of technology on that bike and every new, cool investment in your portfolio, but reaching your destination successfully (and safely) is mostly going to be determined by your own behavior, endurance and ability to stay the course when the road gets rough. In our case, we had set an aggressive distance target and brought aggressive, road-only bikes to meet that target. These are certainly not the bikes we would take if our distance was shorter or if the environment was mountainous instead of a paved road. Different conditions, goals and environments call for different tools. The art and science of portfolio construction is about finding the most comfortable and efficient fit for the financial goals we’re trying to achieve, and even the most accomplished cyclists seek the consult of bike fitting specialists to ensure the best and safest ride. Even within the same set of goals, modifications must be made to our tools to ensure that our journey is not only achievable, but comfortable. For instance, Brendan has the genetics and stature of a Viking, and Ryan very visibly plays computer games at length. The geometry and setup of each of their bikes, while very similar, have been modified to better suit their positions and keep them as comfortable as possible.

While each bike will have some differentiators, there’s a few shared fundamentals that were common in constructing each, just as there are for our investment portfolios. One top priority in fitting a distance-geared road bike is remaining light-weight to reduce unneeded drag, which is also a goal that’s shared with investment selection. We ultimately seek components and investments that are the lightest in fees without sacrificing the structural integrity of our tool for its purpose. Lightest is not always best, and weight as the only priority has a tendency to result in a fragile bike that falls apart before reaching its destination. Similarly, race-to-the-bottom fee structures have a tendency to fall behind in quality and performance. There is a delicate balance that must be achieved whereby we’re willing to take on a degree of weight in the right places to ensure a successful journey, but not so much as to hinder performance.

We must also be cognizant that the accepted “best-fit” of our tool will naturally evolve over time as new technology, components, investments or opportunities become available. Dense metal frames evolved to carbon fiber components just as traditional stock and bond portfolios began to incorporate alternative investments and private market opportunities. It’s accepted that as long as best-fits will continue to evolve, it will remain important to keep abreast of new technology and opportunities and evaluate the role that they may play in ensuring we build the best tool for the job.

Partnerships and your people determine success.

For those that have not yet had the opportunity to go on a long-distance cycle, it can be very easy to think of the sport as a solo activity. Investing has also developed options as a solo sport lately with the emergence and availability of self-directed platforms. And, for a time, both activities can be. It’s not actually until Day 4 when that prairie wind is 29 kms/hr against you that you really appreciate having a partner to rotate into the lead position and cut the wind. The idea behind a peloton riding formation is to share the more strenuous lead position with your partners, rotating to the back when you need to recharge. As you reduce your time in the resistance position, you can ultimately reach further distances together than you would be able to as a solo endeavor. The thing is, when the wind is already at your back and conditions are easy, you’re barely going to notice the impact of that partnership formation on your performance. When the wind is against you, you’re cycling up a hill, or market conditions tighten, not having that partnership puts the ability to accomplish your goal at risk. The relationship goes two ways, and we don’t carry our clients just as we don’t carry the lead constantly. We partner with our clients, and while it’s the efforts and behavior from both sides that are needed to ensure a successful ride, it helps to have an experienced partner that knows how to manage formation and has dealt with winds before.

Less quantifiable is the impact of support in sticking with a plan. A plan can help divide destination goals into meaningful milestones, but milestones don’t get achieved without regular check-ins with your support team. Make no mistake, this was a ride that was taken 15-20 kilometers at a time, each leg divided by meeting with our support vehicle managed by a cheering Tanya. The meetings were a time to evaluate our pace so far and discuss needed changes. Sometimes that was due to factors out of our control like wind or incline, and sometimes it was personal or motivational factors. We made milestone adjustments, we adjusted our tools, and managed nutrition to get us to the next meeting, all the while keeping tabs on the forecast. These pit-stop check-ins were ultimately what made the ride possible, and leaving the day’s plan at “see you in the next town” would have been as disastrous as saying “see you at retirement”.

When recounting highlights of our journey as a team over dinner with a new contact last week, it had come up that we’d done this ride on behalf of our wealth management firm. Our new contact had asked us what our read was on the current market environment, and specifically whether they should be pulling out of the stock market and running to cash. Given the great deal of reflection we’d done on our experience, the questions we had were fairly intuitive:

- Did your destination goal change?

- Under average environments, is your tool suitable to accomplish that goal?

- What’s changed in the environment?

- How is your support team contributing to reaching your destination?

If it’s understood that what we’re dealing with right now is economic headwinds, then we’re almost certainly not throwing out the bike for a new vehicle. We’re not changing our goals or destinations (for many, this is the timing and spending in retirement), and we’re certainly not staying in place or running to cash. We’re ensuring we have the right support check-ins to evaluate the fact that the winds have changed, and we’re making some adjustments accordingly. We’re acknowledging that the greater determinant of success over the long-run won’t be these bike adjustments, but rather our discipline in staying the course, coordinating a partnered strategy to deal with the wind and simply pushing forward one pedal at a time.

During the Asset Mix Committee meeting pit-stop in rural Saskatchewan this September, we made the following bike (portfolio) adjustments to our models:

- Further reduce our exposure to our already underweight Canadian equity position

- Increase our overweight to fixed-income securities, favoring active, higher yielding credit

- Maintain a smaller, moderate underweight to US Equity

- Maintained target positions in alternative and private market investments

Though we’ll be putting our spandex away in favour of snow jackets very soon, we’re still grateful for the opportunity to have our Gold Seal clients along for the ride.

As if cycling across Saskatchewan wasn’t a big enough feat…

The Wellington-Altus Kelowna branch demonstrated their bravery in September as they rappelled down their office tower at Landmark 7. The collective team reached (and doubled!) their fundraising goal for Easter Seals with over $20,000 raised.

Well done to the whole Kelowna team and in particular, our very own Brendan Willis!

Recognized as one of Canada’s Top Growing Companies

The #UnstoppableMomentum continues for Wellington-Altus, with our inaugural placement in The Globe and Mail’s list of Canada’s Top Growing Companies for 2023. This honour is the latest in a series of industry accolades recognizing the firm’s impressive accomplishments. We at the Gold Seal Financial Group are proud to call Wellington-Altus our home, and we know our clients feel the same way!

Gold Seal Insights

Tanya’s Tips:

Interview with Wealth Professional Canada on transitioning pension assets cross-border.

Cross-border individuals should never make financial decisions when they are feeling under pressure. This is particularly true when it comes to moving retirement assets from the U.S. to Canada. This decision involves many factors that require careful consideration.

Tanya was recently interviewed by Wealth Professional Canada on this important topic. View the Linked-In post and read the interview here.

Brendan’s Banter:

Let’s get Technical on September…

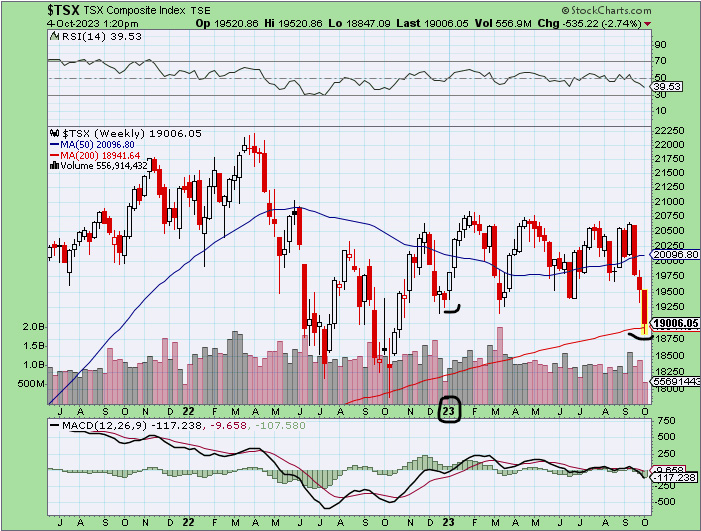

The Gold Seal Financial Group faced headwind cycling across Saskatchewan, much like the headwind (inflation and higher interest rates) the Canadian stock market is currently facing. Below is a weekly chart showing the recent pullback in the Toronto Stock Exchange (TSX). Unfortunately, this pullback has erased all 2023 gains for the Canadian market, with the hardest hit companies being those with elevated debt levels. Naturally, this makes sense as these high-indebted companies are feeling the biggest sting from interest payments eroding their profits. The most notable businesses in this category are the Canadian banks, utilities, power and pipelines stocks, and real estate companies (REITs). Other than oil, these businesses are the bedrock of our index.

During the Gold Seal Financial Group’s recent Q3 Asset Mix meeting, we made the important decision to reduce our Canadian exposure on all Serenity mandates. The timing was critical as this happened just before this most recent pullback. We also took profits in our U.S. holdings and increased our fixed income exposure during this change.

Not surprisingly, the S&P 500 is also retracting from recent highs as their interest sensitive businesses are not immune to higher interest rates and inflation. This index, however, does contain a significant weighting in large technology companies, so is performing better than Canada overall.

This is yet another opportunity to mention the important of patience. There will always be swings in the stock market. For most investors, our emotions can push us to feel like we need to be doing something,… anything, to make the negative emotions stop. This is why it is often the case that investors buy when times feel ‘good’ (at the highs) and sell when times feel ‘bad’ (at the lows). Even right now, your instinct might be telling you to sell everything and buy GICs – afterall, those guaranteed rates sure are attractive (although, very tax inefficient!) Every individual has a unique situation, but generally, this is not the prudent strategy for long-term success. Afterall, those GIC rates will begin to fall and then you may be in the difficult situation of trying to buy back into the market at potentially much higher prices. This is the perfect example of buying high and selling low.

Let’s not be the short-term thinker. For the long-term investor, we remain patient.

Gerry’s Guidance:

September and Market Seasonality: A Quick Glance

September has traditionally been a challenging month for investors. Since 1928, this month stands out for its underwhelming returns, and 2023 was no exception, as Brendan explains in his Banter. The interesting observation? This decline usually hits in the latter half of September. Just as predicted, the S&P500 maintained stability until the 14th, with the losses following in the next nine sessions.

Source: https://theirrelevantinvestor.com/2023/09/27/seasonal-weakness/

While we should all remain steadfast in our investment strategy regardless of monthly trends, knowing these patterns can provide clarity and help keep emotions in check.

The good news is that we’re coming to an end of historical weakness. September’s downturn hasn’t historically extended into the fourth quarter. In fact, the last three years saw Q4 gains of 11.7%, 10.7%, and 7% in 2020, 2021, and 2022 respectively.

In essence, the key to successful long-term investing is not about preemptively acting on seasonal trends, but rather using this knowledge to steady your investing (and emotional) journey.

Jim Thorne Market Insights

Is Something Rotten in the State of Canada?

In the grand theatre of global economics, Canada is taking centre stage. In his recent Market Insights, Dr. James Thorne asks, “Is something rotten in the state of Canada?” and goes behind the curtain to dissect the power struggle between the federal government and Bank of Canada over #Inflation and #InterestRates.

Learn how he thinks it could all play out here.

Noteworthy Links

- High income earners in Canada are already paying their fair share of tax

- 7 Ways to Combat Impulsive Spending

- Young Canadians flocking to First Home Savings Accounts, banks say

- Canadians who travel to Europe will need a permit starting in 2024

- Why spousal RRSPs can still make sense

- Evaluating Inflation Data: the Inflation Shock is Over!

- Which asset class are almost all FAs planning to boost allocations to?

- Canadian economy seen ‘back on its feet’ in 2024

- If Canada’s in a recession, which assets look attractive?