Overview

- Portfolio and Market Performance

- Portfolio Update

- Holding Highlight

- Rapid-Fire Earnings

- Market Outlook

Portfolio and Market Performance

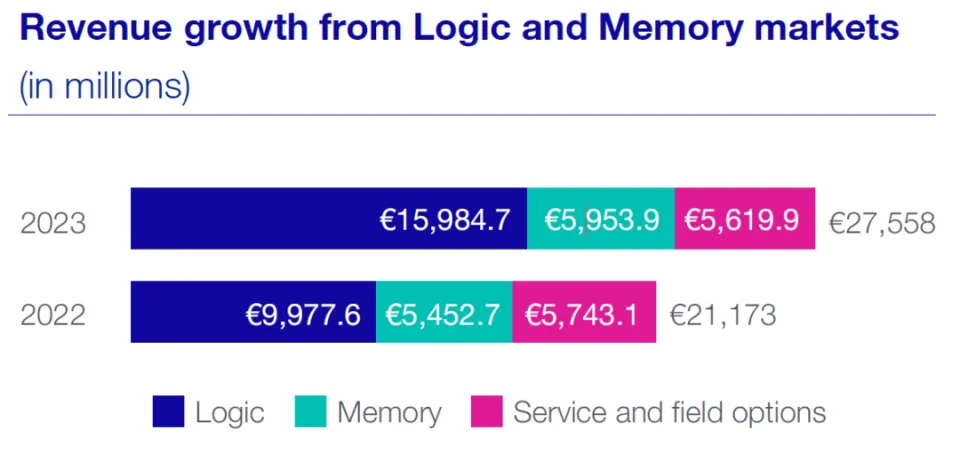

Year-to-Date Performance as of February 29, 2024

- S&P/TSX 60 Total Return, C$: 2.5%

- S&P 500 Total Return, US$: 7.1%

- S&P Canada All Bond Index Total Return, C$: -1.6%

- NASDAQ Composite Total Return, US$: 7.3%

- Dow Jones Industrial Average Total Return, US$: 3.8%

For context, Canada’s largest mutual fund is the RBC Select Balanced Portfolio, at about $50 billion in assets and a fee of about 2%. It returned 3.3% year-to-date, 2.9% over 3 years, 5.4% over 5 years, and 6.2% since inception (December 1986).

The Conservative Equity Portfolio returned 10.5% year-to-date, 8.1% over 3 years, 12.8% over 5 years, and 13.3% since inception (October 2015).

The Diversified Income Portfolio, which is our balanced portfolio used for many of our clients’ registered accounts, returned 3.4% year-to-date, 5.1% over 3 years, 9.1% over 5 years, and 9.0% since inception (July 2017).

The Focused Total Return Portfolio returned 11.8% year-to-date, 12.7% over 3 years, and 20.7% since inception (April 2020).

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

We started to trim Nvidia as it has appreciated significantly over the past year. The stock bottomed in October 2022 around US$120 per share and now trades close to US$900. Our long-term view on Nvidia has not changed; however, we are reducing the position from an 8.5% weighting to 6% weighting. We always look at our model portfolio from the perspective of if this is the weighting we want based on today’s information and environment – as though we were setting up the portfolio from scratch each and every day.

With the proceeds we added to a few existing names in the portfolio we felt were underweight.

We also added a new company to the portfolio: ASML.

Holding Highlight

ASML

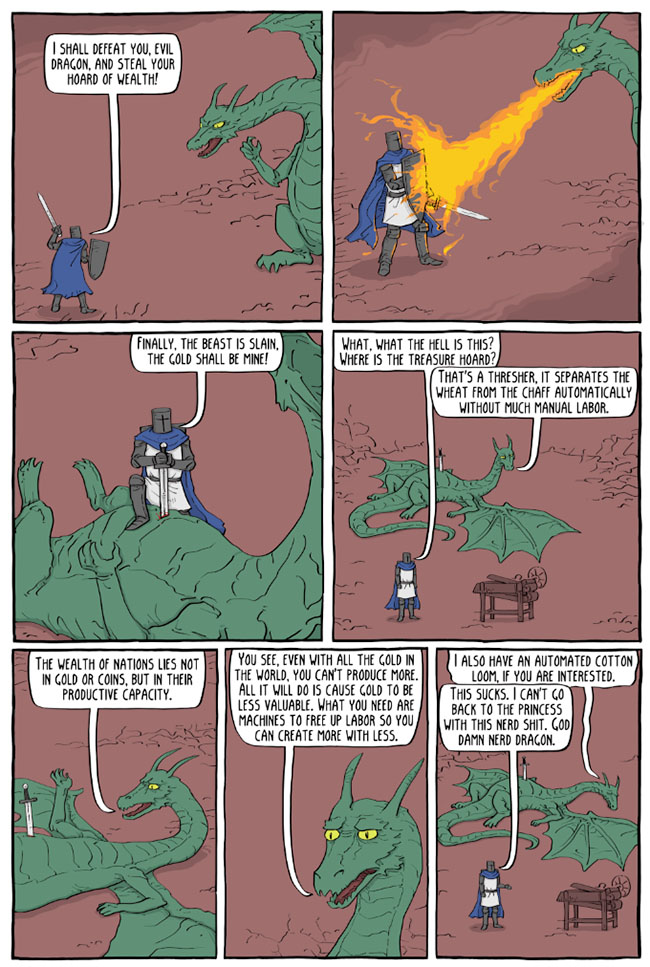

The technology that is needed to build the artificial intelligence (AI) chips of today is Nobel prize worthy. Companies need to be laser focused on a single task, in other words, specialize. This is why Intel has not been able to keep up in the chip wars – they tried to be vertically integrated rather than single-task focused.

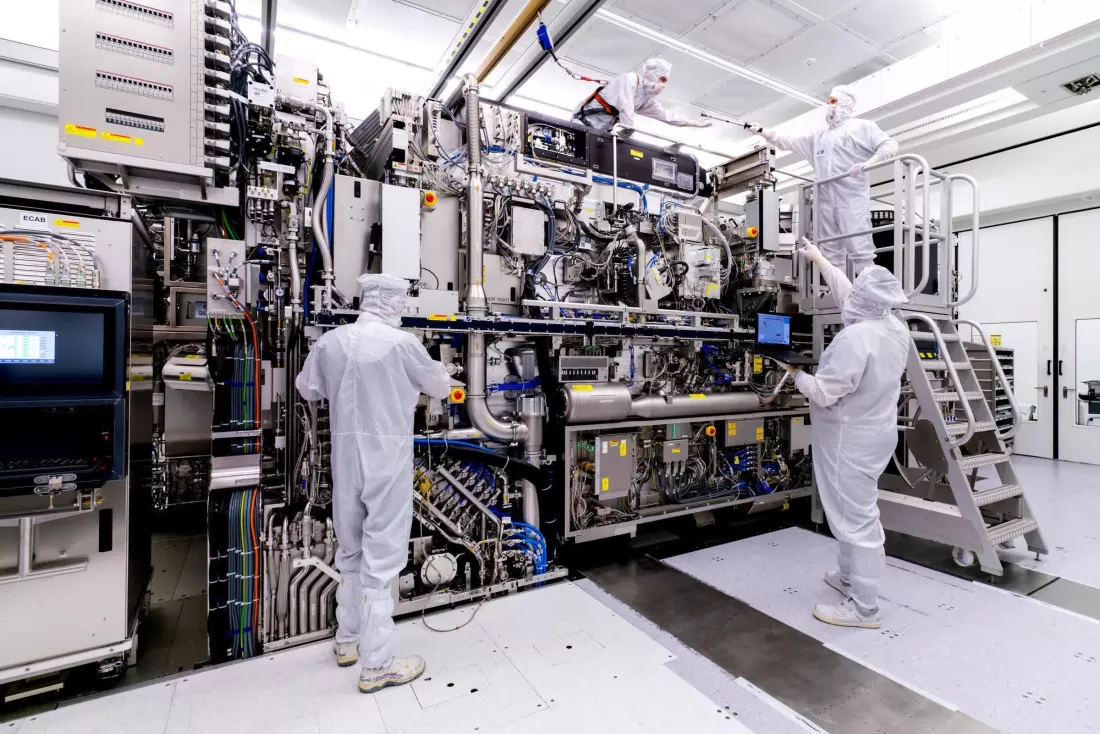

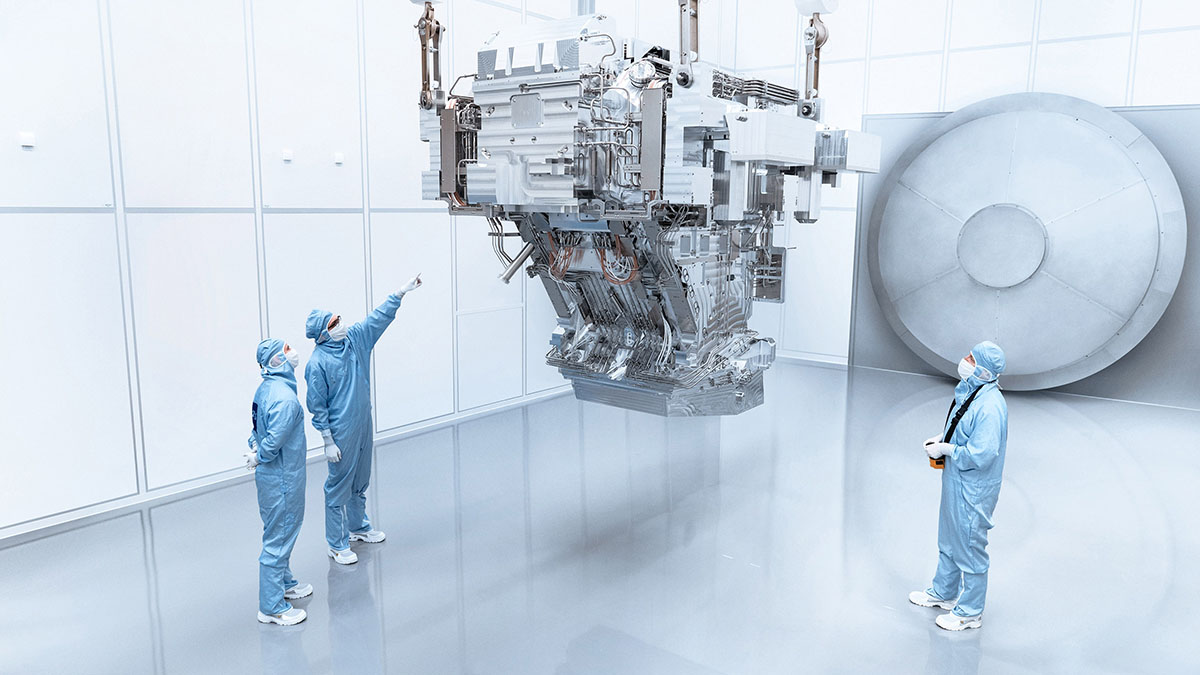

ASML, or Advanced Semiconductor Materials Lithography, makes what many will call the most advanced and complex machines on the planet, EUV Lithography Machines, which are used to manufacture the most advanced and complex products on the planet, microchips. These machines print the core component or brain of AI and the servers that host everything we do digitally. An example would be the Nvidia H100 AI microchip, which sells for around $40,000 each, while the competing AMD chip is selling for about $15,000 each. That makes each of the most advanced wafers made by these machines worth around $1 million to $3 million.

In our opinion today, the best chips in the world are designed by Nvidia, manufactured by TSMC, and the machines that make the chips are made by ASML. Think of it as Nvidia designs the chips and requests TSMC to build a lab facility in order to make the chips, then TSMC buys the machines that make the chips from ASML and runs them in their lab. No other company or government in the world can do what they do.

A single one of these machines is the size of a tractor trailer truck. They are so heavy that it takes 3 to 6 cargo planes to deliver them, moving about 180 tons. They are incredibly expensive, with the most recent models costing around $200 million each. There aren’t a lot of machines at this price point; the nearest comparable would be an F22 stealth fighter at $140 million.

These machines are the most critical piece of equipment in chip manufacturing. They dictate both the capabilities of the chips due to how many transistors they can fit in a small space, and the speed at which you can make them.

On the topic of size, ASML’s lithography machines cut channels that are 10 nanometers wide. For context, that’s about 50 silicone atoms across – around the size of a few strands of DNA, or 1/1000th the size of a red blood cell.

The company has a multi-year order backlog for these products. One reason why we wanted this company in our portfolio is because it acts as a natural hedge to geopolitical semiconductor risks, particularly in Taiwan. The best way to reduce this sort of risk is to build a huge amount of new chip factories and spread them out around the world.

We see ASML as a critical company with attractive growth, with a monopoly in one of the highest growing areas of the economy, that also reduces the risks inherent in other businesses we own such as Nvidia, AMD, and Apple.

What looks like an oil refinery is actually Intel’s new chip manufacturing facility under construction in New Mexico. A large portion of the cost was paid for with subsidies from the U.S. CHIPS Act.

Here’s a good CNBC video that looks into ASML: https://youtu.be/iSVHp6CAyQ8?feature=shared.

For some context, see our illustration below.

Source: Existential Comics

Rapid-Fire Earnings

Nvidia – In 2020 when we first started buying Nvidia, the company had $10 billion in sales and was trading at 40x earnings. This year, the company is expected to do over $100 billion in sales and currently trades for 35x this year’s projected earnings. The reason the stock keeps going up is because the earnings keep going up. The market underestimated how much revenue Nvidia would have and now the stock is adjusting to its fair value.

Around the same time as the impressive earnings release, company president Jensen Huang was talking to different governments around the world encouraging them to build their own country level AI servers, which is another level of scale beyond the commercial side.

Costco – Ecommerce sales were up 18% on the quarter. A bit less revenue than expected but more earnings and continued growth illustrate strong cost control discipline. Costco added 2.4 million more memberships in the last two quarters, another story on cutting down on shared memberships like Netflix.

Company CFO Richard Galanti said on inflation: “In the last quarter, we estimated that year-over-year inflation was approximately zero to 1%. We now say that in Q2, it was essentially flat. And not withstanding essentially flat, we’re taking price reductions where we can.”

Royal Bank of Canada and Toront-Dominion Bank – The earnings were fine. Both stocks are still down over the past 2 years, Royal between -7% to -12% and TD between -14% to -22%. We believe most of the selling has come from U.S. investors. We believe U.S. investors are attempting to short the Canadian real estate market by selling Canadian banks. National Bank of Canada is the only Canadian bank that is not dual listed; it’s up 10% over the last 2 years since March 2022 and is trading at an all-time high. The stock was also much less volatile than Royal and TD over the same period.

North American banks – Between the 6 major Canadian banks, they had put aside more than $4 billion for loan losses; everyone was expecting this degree of defaults. Every quarter where there isn’t a big negative is a good thing. Not great, not bad.

We saw another regional bank teetering on insolvency as New York Community Bank was having issues, replacing its CEO and having to get a $1 billion cash infusion from a group of financial institutions last week. This bank had a large amount of loan exposure to New York real estate and fell afoul of a common trend of having a large increase in cash deposits during the pandemic with a mismatch in duration between their deposits and loans.

In short, interest rates are causing a storm out there and poorly captained ships are more likely to run aground, so we are being cautious.

BCE/Telus – The regulators and government told them they had to share all their fiber optic infrastructure, and to provide cheaper billing. The most recent demands pushed them over the edge it seems and now BCE is cutting employees and selling TV stations, getting rid of anything that doesn’t make money. They’re currently in a war with the government and in full cost-cutting mode.

Imagine you spent the money to build a really nice lemonade stand, then the government walked in and said they wanted to encourage competition so you have to let other people use your lemonade stand to sell lemonade so they could compete against you, and they are going to force you to do it at a price they choose.

As an aside, this is a prime example of the pitfalls of socialism. We have some of the highest cellphone bills in the developed world because our phone companies had to build cell towers in the arctic and pour money into regional TV and radio stations that were losing money due to the inevitable train killing all local media called the internet. Too much regulatory interference caused market inefficiencies.

Don’t get us wrong; we understand the need for national communications infrastructure and local news, but pushing too hard against the winds of change can have bad outcomes.

Berkshire Hathaway – Our favourite quote by Warren Buffett from this year’s letter to shareholders is a reminder of why stock prices seemed to fly all over the place the last few years while the business remain solid: “Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school.”

Markets will continue to fluctuate from fear to greed.

Market Outlook

We are in the early stages of a bull market. Some in the mainstream media that have been bearish for the past 2 years “sitting on the sidelines waiting for a good time to invest” are calling this a market bubble after the market is up around 30% off its lows. But in reality, the market is up only 10% over the last 2 years from its previous high in December 2021. Let’s not overthink it. We are in the early stages of a technology evolution that will last to the end of the decade. Own quality, stay invested, and expect 5-10% pullbacks every year or so. Corrections are what keep a bull market healthy.

~~~

We are looking forward to hosting you at our client appreciation event next month, and hope to see you there.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045