Download this article as a PDF.

The summer did not see much respite from the volatility that has gripped the financial markets. The bearish commentators continue to evoke fears that the aggressive moves by the central banks in raising interest rates will inevitably push economies into recession. It is therefore not surprising that many of us feel we are already in recession1 — the current narrative, alongside an increasing cost of living, the higher cost of borrowing and financial market declines, certainly hasn’t helped to support optimism.

While it may be difficult to put a positive spin on today’s situation given the challenges, consider that Canada continues to be in a comparatively favourable position globally. There have been positive disinflationary signals as commodities prices, notably energy, have been moderating, supply chains are being fixed and consumer spending is slowing in certain areas. Canada holds an enviable position as a net exporter of both food and energy due to our vast domestic resources. Will inflation continue to slow? Recent U.S. data has been disappointing, suggesting inflation has been more persistent than expected, and in many other parts of the world it continues to accelerate. Europe has been particularly affected, with inflation surpassing the double-digit mark in many nations and an energy crisis only expected to worsen as the winter months arrive.

As such, the near-term outlook collides with the broader forces of the central banks who have yet to give up their fight against inflation. The lagging effects from the ongoing rate hikes are expected to continue slowing economic growth, which suggests continued volatility for the financial markets over the near term.

We know, however, that the financial markets, like economies, are cyclical and periodic declines will occur on a regular basis. It may also be worth pointing out that the markets and economies don’t always move the same way at the same time. A recent study looked back at recessions in the U.S. since 1945, suggesting that the S&P 500 Index actually rose an average of one percent across all recessionary periods. And, in almost every recession, the markets began their climb well before its end.2

As we navigate through these periods, two elements deserve emphasis: diversification and quality. Spreading assets across different sectors, asset classes, market caps or regions, among others, continues to be a proven way to increase stability and lower risk. Those who consider high quality investments will also worry less about enduring values in uncertain times, secure in the knowledge that any price setbacks should be temporary. Managing risks in these and other ways can help cope with the unavoidable volatility.

Downturns and economic challenges of one sort or another are a common occurrence in modern capital markets. Periods of retrenchment have always been followed by new growth, economic expansion and improved equity values. There is little reason to expect otherwise in this cycle. And, markets can change their course even when sentiment may appear at its lowest. Keeping this in mind, having the perseverance to stick to your wealth plan is important. Patience may be one of our greatest allies to see us through this period.

1. theglobeandmail.com/canada/article-majority-of-canadiansthink-country-is-in-a-recession-fear-prices-will/; 2. forbes.com/sites/sergeiklebnikov/2022/06/02/heres-how-the-stock-marketperforms-

during-economic-recessions/

BACK-TO-SCHOOL TIME

Your RESP Withdrawal Questions Answered

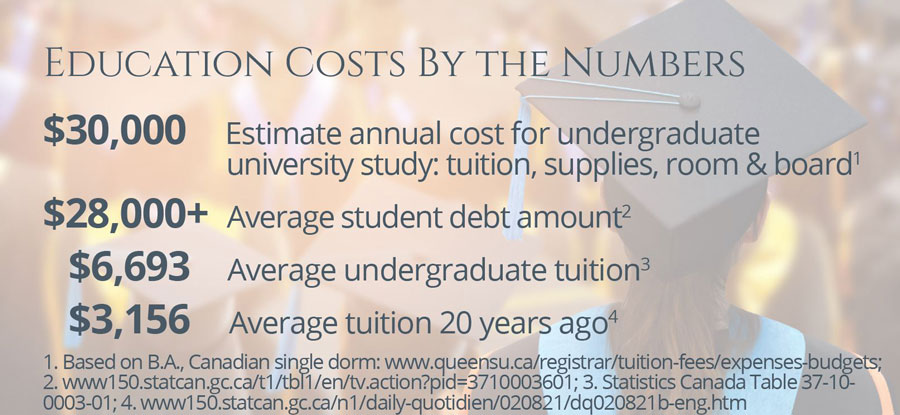

With the kids back in school, we have been receiving a good number of Registered Education Savings Plan (RESP) questions. Given the volatile markets, for those with young children still years away from attending post-secondary school, it may be an opportune time to contribute. For those looking to access RESP funds, some have asked about deferring withdrawals until certain investments can regain their values. Here are some answers to your RESP withdrawal questions.

-

- What portion of my RESP withdrawal is taxable? It’s important to distinguish between the two types of RESP withdrawals for educational purposes. The educational assistance payment (EAP) consists of any income earned or grants accumulated in the plan and is taxable in the hands of the beneficiary/child attending a qualifying educational program. The post-secondary education (PSE) payment represents funds the subscriber contributed to the RESP and is

not subject to tax. When you withdraw from the RESP, you need to specify the type of withdrawal you wish to make. We can assist with identifying each component of the RESP. - What is the best RESP withdrawal strategy? Students typically do not have significant income, so it generally makes sense to exhaust EAPs first, while the child attends school and has a lower marginal tax rate. If the RESP is large, it may be prudent to spread EAPs over several years to reduce the potential tax that may be incurred in any one year. This is because the student can potentially take advantage of several tax credits to offset EAP income. Consider that the basic personal amount for the 2022 tax year is $14,398. Assuming a federal tuition tax credit of $6,700 combined with this amount, the federal tax credits would total $21,098, meaning that a student with no other income in the year could potentially receive $21,098 of EAPs in 2022 and pay no tax.

- With market volatility, should I defer RESP withdrawals? While it may be prudent to wait for investment values to rebound, other considerations may impact your decision. Keep in mind that the basic personal amount is a non-refundable tax credit, so it must be used in the current tax year. The tuition credit can be carried forward. If the student has other income, such as from scholarships or a part-time/summer job, this, alongside a larger EAP, may put the student into a higher marginal tax bracket. Even worse, if you delay withdrawals and the student ends up dropping out of school, any remaining income/grant money may be taxable to you, the subscriber, and subject to an additional penalty tax.

- What if my child doesn’t attend post-secondary school? While original contributions/PSEs can be withdrawn without tax consequences, grants and income earned inside the plan may be subject to repayment and tax penalties, respectively. There may be an opportunity to transfer eligible funds to a sibling’s RESP, or income (as an “accumulated income payment” (AIP)) to the subscriber’s Registered Retirement Savings Plan (RRSP), subject to available contribution room to a maximum of $50,000. Remember also that the RESP can stay open for up to 36 years if a beneficiary has a change of heart and decides to pursue post-secondary education.

- What portion of my RESP withdrawal is taxable? It’s important to distinguish between the two types of RESP withdrawals for educational purposes. The educational assistance payment (EAP) consists of any income earned or grants accumulated in the plan and is taxable in the hands of the beneficiary/child attending a qualifying educational program. The post-secondary education (PSE) payment represents funds the subscriber contributed to the RESP and is

As you plan your RESP withdrawals, please call with any questions. We continue to advocate the RESP for a child’s post-secondary education.

RISING INTEREST RATES

Looking Back, Looking Forward: Housing in Canada

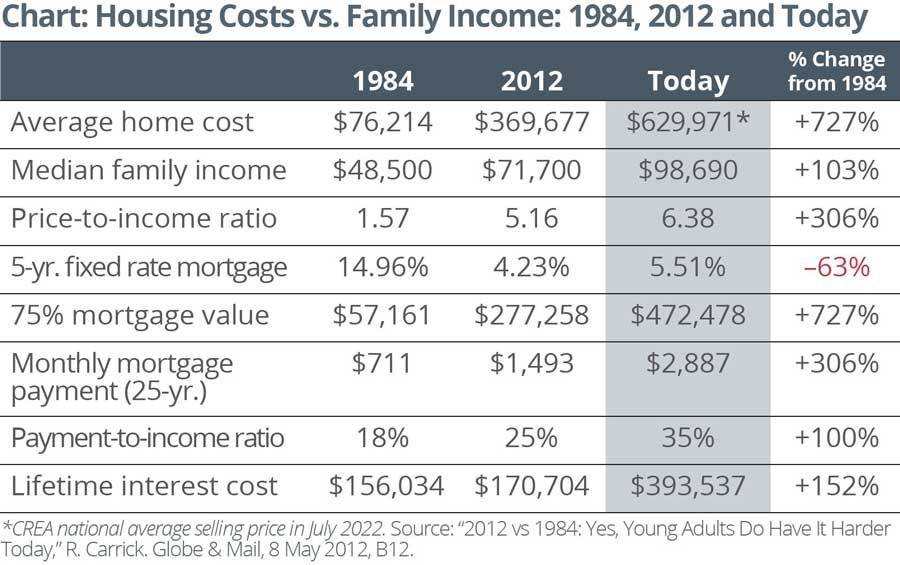

A decade ago, an article published in the Globe & Mail looked at the housing market around 30 years before to answer the question: Do young adults have it harder today? The conclusion: “Back in my day, economically speaking, life was easier.”

Given the significant increase in housing prices over the past few decades, and now with interest rates rising as well, one could argue that the same can be said in 2022. It is hard not to feel sympathy for those looking to buy a first home. The chart (right) shows just how difficult it is for first-time home buyers today, compared to back then. While mortgage rates are much cheaper — they aren’t close to the double-digit levels seen in 1984! — the rising cost of the average Canadian home has more than offset this effect.

As interest rates continue to rise, will they work to cool the Canadian housing market? Though there has been some softening over recent months, consider that the average home price is still above pre-pandemic levels. New rules and measures introduced by the federal government in this year’s budget have been targeted to achieving housing affordability, but it remains to be seen whether these will have a marked effect on the housing market going forward. Stay tuned…

Tax – Planning Opportunities

Tax Strategies During Uncertain Times

The markets may not have been too kind thus far in 2022, but there may be ways to engage in tax strategies during these uncertain times:

Donations to Charity — During more challenging economic times, a gift to a charity may be even more appreciated. If you donate shares “in kind” to an eligible charity, you will receive a donation receipt for the fair market value of the shares. If the shares are in a non-registered account and have appreciated in value, the donation will also eliminate the tax liability on the capital gains triggered. However, the shares must be donated in kind — do not sell them first and donate the proceeds, as part of the tax benefit will be lost. For securities that have declined in value, consider selling them and donating cash. You’ll be entitled to the capital loss, as well as a donation tax credit.

Tax-Loss Selling — With the challenging markets, you may find that some investments have declined in value. If investments held in non-registered accounts are sold for less than their original cost, this will result in a capital loss. For tax purposes, 50 percent of the loss can be used to offset taxable capital gains realized during the year. If you don’t have sufficient taxable capital gains to offset the losses, the net capital loss can be carried back three taxation years, or carried forward indefinitely to use against net capital gains. Be aware of the superficial loss rules, which may defer, suspend or deny the capital loss if you or an affiliated entity acquires the same security 30 days before/after the date of the loss transaction.

Gifts to Adult Children — Gifting investments that have declined in value to an adult child will not only trigger a capital loss in your hands but can put subsequent capital gains/income in the hands of someone in a lower tax bracket, resulting in less taxes payable for a family unit. For estate planning, transferring assets to children while alive can simplify an estate and reduce its value, subjecting it to less probate fees or estate administration tax (if applicable) at death.

Shifting Assets to a TFSA or RRSP — During uncertain times, many quality investments may have price setbacks that are temporary. Some investors may wish to repurchase an investment that has lost value and continue holding it for the longer term. Keeping in mind the superficial loss rules, once 30 days have passed, contributing funds to a registered account like a TFSA or RRSP (subject to available contribution room) may be a way to potentially benefit from a tax opportunity if the investment regains its value. With the TFSA, any future capital gains will not be taxed. With the RRSP, future growth will be tax sheltered and investors will receive a tax deduction for the contribution on their taxable income; however, original contributions and any gains will be subject to tax when withdrawn.

ESTATE PLANNING

The Benefits of Naming the Estate as Beneficiary

As you think about your estate plan, one important undertaking is naming and updating your beneficiaries. Note: In Quebec, beneficiary designations on registered accounts are generally not allowed to be made directly in the plan documentation and must be made within the will.

Often, individuals may be focused on certain tax implications associated with naming a beneficiary, such as bypassing probate fees/estate administrative tax in provinces where applicable. If no beneficiary is named, assets that would otherwise pass outside of an estate may be included in the estate and subject to probate. Although tax implications are important, there may be other considerations. For some, naming the estate as the beneficiary may be beneficial under certain circumstances, including the following:

Equalizing the Estate — Naming the estate as a beneficiary may simplify the task of equalizing an estate amongst beneficiaries. For example, if the estate is not named as the beneficiary of the RRSP or Registered Retirement Income Fund (RRIF) (and passes outside of the estate in provinces other than Quebec) and taxes are due on the RRSP/RRIF value, the estate (and the estate’s beneficiaries) will be responsible for the taxes, while the full value of the RRSP/RRIF will pass along to the RRSP/RRIF beneficiary. This may complicate a situation in which the intent is to equalize the after-tax amounts received by all beneficiaries.

Covering Costs of the Estate — Naming the estate as a beneficiary for certain assets, such as life insurance policies, can provide funds

to help cover tax liabilities, such as the capital gains tax liability of an appreciated family vacation home or other costs of the estate.

Maintaining Control — If a beneficiary is not currently financially responsible, you may consider establishing a trust, with the terms

specified in the will. This may help to protect assets until certain requirements are met. Naming the estate as beneficiary can ensure that there are funds available for the trust.

As you review your beneficiary designations, remember to consider the broader implications of your selections. As always, please seek legal advice as it relates to your particular situation.

Your Beneficiaries: Five Questions to Ask

- When was the last time I reviewed/updated my beneficiaries? Have there been recent births, deaths or marriages that may impact my choices?

- If beneficiaries are minors or disabled, do I have a trust in my will or other provisions in place to help manage their assets?

- Have I included secondary or alternate beneficiaries in the event that the named beneficiary(ies) predeceases me?

- Have I considered how I will equalize my estate for multiple beneficiaries to manage potential conflict?

- If I have named a spouse/partner as a beneficiary for the TFSA or RRSP/RRIF (where applicable), do I understand the “successor” designation?

Market Perspectives: The Bulls & the Bears — Don’t Fear the Bear

In the first half of 2022, the S&P 500 Index entered into a bear market prompting some investors to ask: will the Canadian markets follow? As a reminder, a bear market is often defined as a period in which stocks have declined by 20 percent from a previous peak over a period of usually two months or more. So far, the Canadian markets have been comparatively resilient due to a higher composition in resource-related stocks versus the growth and consumer discretionary-heavy S&P 500. Regardless, bear markets are a normal part of the investing cycle. Here are some perspectives on bear markets:

- Bear markets are much shorter than bull markets. Since 1970, we have seen an abundance of ups and downs, and yet the S&P/TSX Composite Index (not including dividends reinvested) has returned an average annual return of over 6 percent. The average bull market, of which there have been nine, has lasted almost 61 months, whereas the average bear market, of which there have been eight, has lasted just under 10 months. Equities continue to be one of the best asset classes in which to grow wealth, but this is not without market fluctuations. The takeaway? Bear markets eventually come to an end, and often more quickly than bull markets.

- Bear markets: often the good comes with the bad. A recent analysis done on the S&P 500 Index showed that the biggest up and down days often occur during down market times.1 Since 1928, there have been 350 trading days when the index was down three percent or worse. There have also been 290 days when it was up three percent or more in a single day. However, more than 90 percent of both volatile days have taken place during a correction of 10 percent or worse. More than 80 percent of those days have taken place during a bear market drawdown of 20 percent or worse. The takeaway? Both the biggest down and up days tend to take place during periods of market drawdowns. This is one reason why it is important to stay invested. By making rash decisions such as exiting the markets during a market drop, you are likely to miss significant upward moves.

- What comes after a bear market? It isn’t uncommon to see significant gains. Here are the five worst bear markets for the S&P 500 Index since 1970 (chart), along with their ensuing one, three and five-year forward returns. Even though it takes a 100 percent gain to make up for a 50 percent loss, the gains were enough to produce overall double-digit returns.

The takeaway? Even the worst bear markets are followed by significant equity value gains. And history has shown that the periods that follow take prices much higher than their former peaks.

Continue Looking Forward

While periods of market declines never feel good for investors, portfolios have been positioned with the expectation that the equity markets will experience both bull and bear market times — this is a normal part of the investing journey. Continue to look forward to better days ahead.

1. https://awealthofcommonsense.com/2022/08/when-is-a-bear-market-over/

Source: S&P/TSX Composite Total Return Index, including dividends reinvested, monthly close from 1/1/70 to 12/31/21.