The U.S.’s Tech-Driven Reinvention

“Never bet against America.” – Warren Buffett

Ray Kurzweil, computer scientist and futurist, once said, “The past is over; the present is fleeting; we live in the future.” This sentiment echoes through our current moment as we stand on the threshold of an era defined by technological advancement, navigating a myriad of complex challenges and opportunities.

As Mark Twain is said to have pointed out, “History doesn’t repeat itself, but it often rhymes.” In today’s world, where social media engagement often fosters sensationalism, echoes of the past can be heard. Some argue that the COVID-19 shutdown and subsequent reopening marked the most pivotal economic event in recent history. My perspective differs. While the pandemic’s gravity is undeniable, assuming it will have lasting structural implications seems imprudent. As we venture into 2024, investors should prepare for 150 basis points (bps) of rate cuts, a return to the pre-pandemic deflationary structural forces—such as significant debt levels—fluctuating globalization, demographic influences, and accelerating digitization.

The investment landscape is set to shift significantly. The next two years will usher in a new phase. Central banks will focus on supporting economic growth, reshaping market expectations. We expect the effects of extreme fiscal policy to wane. Inflation fears will give way to concerns about economic growth and deflation, triggering interest rate reductions.

Investors need to allocate capital to sectors and industries likely to outperform in this environment. A technology wave not seen since the mid 1990s—with the start of the internet and the mass adoption of the personal computer—is about to transform our global economy. Unlike the 1990s, however, innovation can be found in every sector. Companies that embrace digitization, irrespective of industry and geography, will be the ones that gain market share in the coming slow-growth environment.

While many continue to put forth the thesis that we are witnessing the end of the American Empire, I disagree. The unique American spirit—its readiness to embrace change, risk, and reinvention—is deeply rooted in the historical narrative known as the American Jeremiad. This discourse of decline and renewal, which emerged in early American Puritan society, has spurred a call to action. It has instilled in the American spirit a readiness to self-criticize, adapt, evolve, and strive for a better future.

This spirit is embodied in the audacious companies listed on the NASDAQ-100 Index, guiding the nation’s technological and economic evolution. As we enter an era of exponential technological growth, we find compelling reasons for preferring the U.S. over Canada, and the NASDAQ-100 over the S&P/TSX Composite Index. Simply put, productivity growth in the U.S. is significantly stronger than in Canada. We align ourselves not just with a market or an economy, but with a profound narrative of progress, a relentless drive for self-improvement, and a strong belief in the power of innovation to shape the future. As Warren Buffet says, “Never bet against America.”

A Look Back at 2023

In late 2022, my call was for a soft-landing south of the border, with the U.S. Federal Reserve pausing in 2023 and innovation leading the way. Now, as we look to 2024, that narrative continues to unfold. The global economy has begun to decelerate, with gross domestic product (GDP) in many areas close to recessionary levels and the U.S. the standout in terms of resilience. Prudence forces us to realize that the extreme levels of fiscal policy in the U.S. and Canada have been a major driver of economic growth, and in 2024 what was once a tailwind becomes a headwind.

The U.S. economy is heading into a transitional phase, where the sugar high of fiscal policy wears off, and an episode of secular stagnation takes centre stage. Nonetheless, my prediction for the U.S. stands and will indicate the continued resilience and strength of its economy from the private sector. Furthermore, core inflation has seen a significant decline. The normalization of labour markets has continued, as have the significant disinflationary forces in the pipeline for 2024. As we move forward, the outlook remains promising, with limited recession risk in the U.S. The same cannot be said for Canada.

In 2024, based on the earlier call for a soft landing and the Federal Reserve’s pause in hikes, interest rates are positioned to potentially return to pre-pandemic levels or even pre-Global Financial Crisis (GFC) levels. Currently, no one really knows. This transition period will most likely follow a volatile path over the next two years, presenting investors with the potential for better forward returns on fixed-income assets. Moreover, the U.S. growth story remains robust on a relative basis, with innovation leading the way. As a result, the U.S. dollar is expected to remain strong, providing stability and advantages for U.S. markets.

Considering my earlier predictions from 2022 and current outlook for the year ahead, it becomes evident that the U.S. economy and investment landscape are well-positioned for success. Therefore, investors should look to capitalize on the presented opportunities. While the global market outlook for 2024 is complex, my baseline forecast is that returns in credit, equities, and commodities will outperform cash. This suggests a consideration for a balanced portfolio asset mix, with an emphasis on the favourable outlook in U.S. markets, secular growth, and duration.

What Awaits After the Sugar High is Over?

Reflecting on historical precedents, such as the economic recovery following the First World War, we find hope. After the war and the Spanish Flu, a “Forgotten Depression” led to financial hardships. Yet, what followed was a resurgence driven by innovations, the advent of electricity, and new production processes. The Roaring Twenties became synonymous with progress and prosperity.

Today, we see the potential for a similar post-pandemic recovery. Technological advancements and disruptive innovations, fuelled by a global knowledge exchange, can reshape industries. Companies harnessing these opportunities, such as Walmart and Exxon, are likely to succeed in the coming years. Eventually, everyone will need to follow.

Through 2024 and into 2025, economic growth is expected to be below trend, with disinflation gaining momentum. Central Banks will cut interest rates to support economic growth. The dangerous cocktail of excessive government debt and high interest rates points to a period of austerity. Investors should prepare for another episode of secular stagnation and deflation. Declining interest rates support allocations to bonds, while slowing economic growth suggests favouring growth over value.

After the sugar high of extreme fiscal policy wears off, we will face a technology wave similar to the 1920s and the 1990s. In this era, digitization and demographics will shape social and investment norms, forcing every company to embrace technology. It’s essential that investors approach the future with curiosity, adaptability, and a willingness to ride the upcoming wave of transformation.

Demographics is Destiny

The social unrest we currently face and impact on the global economy is not unprecedented. For example, by examining generational dynamics in the 1960s and the push for social change, we are reminded that “demographics is destiny.” In the 1970s, baby boomers greatly influenced social policies like “Guns and Butter” and “The Great Society,” leading to an inflationary spike. Historic events such as Woodstock, the Summer of Love, and Vietnam War protests symbolized the baby boomers’ pursuit of a progressive society. However, the 1960s also saw considerable upheaval, including the assassinations of significant leaders and protests at Kent State University. After this inflationary spike, attitudes shifted towards centrism.

Technology, and millennials’ consumption and investment preferences will play a similarly crucial role today. Like baby boomers, millennials yearn for social change, but their outlook is uniquely shaped by technology and global interconnectedness. They approach investments from a global macro perspective and are more inclined towards Bitcoin than gold. Harnessing the technological power and creative potential of this generation is essential to overcoming economic stagnation.

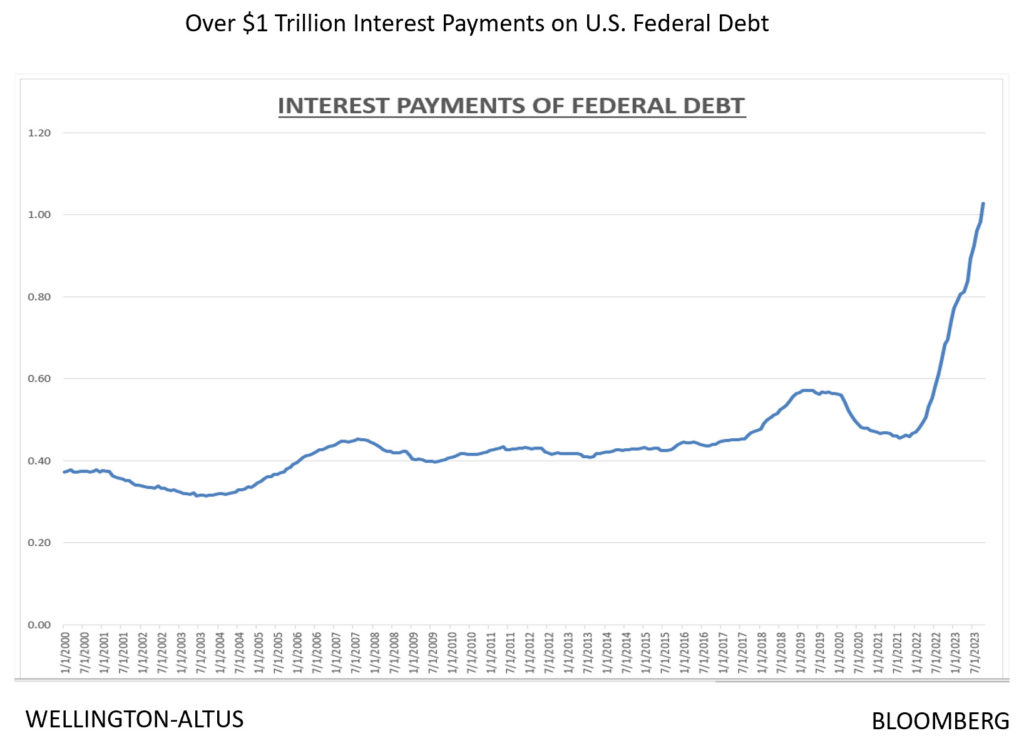

However, there is a risk to our forecast, which lies in unchecked fiscal policy. Interest payments on U.S. government debt are on track to surpass $1 trillion annually, and there is a lack of acknowledgment among younger generations that permanent inflation is a direct consequence of fiscal policy. If deficits continue to grow and government spending resembles that of wartime, it will lead to higher inflation and interest rates. The current concerns of housing affordability and the cost of living have become paramount. In my opinion, based on these factors, millennials are likely to follow in the footsteps of baby boomers and prioritize fiscal responsibility going forward.

The End of the Fed “Put”

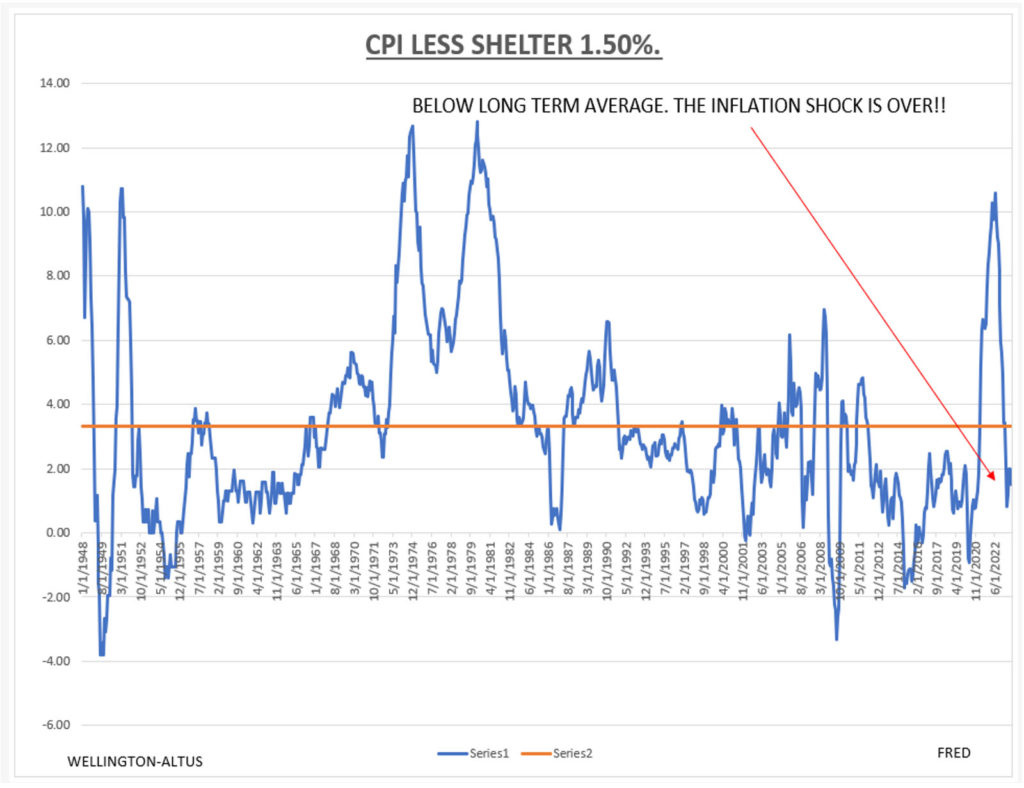

As we emerge from the COVID-19 pandemic, we’re left to wonder what lies ahead for interest rates. If one removes shelter—a lagging variable—the Bank of Canada’s real overnight rate now surpasses three per cent, and inflation is declining, threatening to tighten financial conditions in an already fragile economy. Applying the same lens to the U.S. Consumer Price Index (CPI) calculation, inflation is already close to the Federal Reserve’s two per cent target. Moreover, according to the U.S. Bureau of Labor Statistics, 70 per cent of the total increase in Core CPI on a year-over-year basis is attributed to the shelter component. The challenge for the Federal Reserve is to maintain price stability and full employment, necessitating rate cuts into 2025. Contradicting the narrative of “higher for longer,” significant interest rate reductions are expected to begin in 2024, indicating a return to a bond bull market. While the end of the “Fed put” attracts views for pundits on Fintwit, the fact remains that central bankers are committed to achieving price stability and a robust jobs market.

The intensifying forces of digitization, demographics, globalization, and debt have added complexity to the current investment environment. Our short-term base case (2024- 25) suggests a return to 2.5 per cent for the Bank of Canada overnight rates by mid-2025. Investors should anticipate a rate cut of 150 bps in 2024 and not discount the possibility of a further reduction in 2025.

Since the 1990s, western economies have been grappling with the threat of deflation and secular stagnation. Quantitative easing, although implemented, failed to stimulate economic growth or inflation. When the COVID-19 pandemic struck, U.S. Federal Reserve Chair Jerome Powell utilized section 13-3 of the Federal Reserve Act to fortify the U.S. and global economy. This strategy proved effective during the exogenous economic shock of the pandemic in 2021. However, during the fog of the pandemic, the leftover capital was then used by government officials to pursue their long-term political objectives, resulting in inflation.

The adage “once bitten, twice shy,” seems applicable to the Federal Reserve’s future approach, suggesting a reluctance to repeat this strategy. To clarify, this doesn’t mean the elimination of the “Fed put,” but rather it implies that the central bank is unlikely to become subordinate to the Treasury in the foreseeable future. While this approach was effective, it has also been highly inflationary. As it stands, it’s too early to tell if we are in a new higher interest-rate regime. It’s possible we go back to the pre-GFC interest-rate regime, or that central bankers have overtightened, and we go back to pre-COVID-19 levels. The era we are about to enter is the transition period, and a COVID-19 sugar high hangover awaits.

Suffice to say, rates will decline in 2024. As for the end of the “Fed put,” it’s folly to even speculate. As the old saying goes, we will cross that bridge when we get to it.

Risk is Perverse

American financier Michael Milken observed in the 1970s that promising companies were undervalued while aging businesses received favourable ratings. The fear of the unknown was also apparent in the 1990s when the internet emerged. Despite technology’s transformative impact, many dismissed it as a scam. This bias against innovative companies prevails today, shaping our perception even though technology has grown exponentially. In an evolving world, we need to understand subconscious biases can distort our risk perception. As Ray Kurzweil suggests, “The past is over; the present is fleeting; we live in the future,” and yet too many investors get comfort from investing in the past.

Challenging these biases is critical, as well as understanding that innovative companies aren’t necessarily riskier but often offer the potential for significant growth opportunities. To navigate investment complexities, investors need to focus on markets and sectors that embrace innovation and show growth potential. For instance, favouring the U.S. over Canada suggests recognizing the U.S. market’s robust technologically innovative ecosystem, entrepreneurial spirit, and capital access. This preference acknowledges the potential for exponential growth and American companies’ adaptability, along with a diversified economy. The number of companies evolving are such that one can build a diversified portfolio encompassing all aspects of the digital global economy.

What Should Investors Do?

The U.S., represented by the NASDAQ-100, offers an innovative, dynamic environment conducive to harnessing exponential technological growth, outshining the more conservative Canadian market and the TSX. By opting for the U.S. and NASDAQ-100, investors align themselves with a powerful ethos of progress, relentless self-improvement, and bold innovation. While there are innovative and evolving firms in Canada, investors favouring home companies should focus on stock selection.

Although the Magnificent 7 holds significance, it’s essential to recognize the potential in other companies, similar to the post-Second World War era’s Nifty 50. With declining interest rates projected until 2025, a bond bull run seems imminent. Moreover, the mass adoption and acceptance of digital assets, including Bitcoin, Ethereum, and the tokenization of real-world assets, cannot be overlooked. Risk assets should perform well until 2025’s end, despite expected natural, healthy market corrections. Until 2026, investors should capitalize on these corrections.

Summary of 2024 Forecast

- The U.S. economy should achieve a soft landing, whereas the Canadian economy could face a hard landing.

- Below trend economic growth, rapidly declining inflation, interest rate cuts, and a stop to quantitative tightening.

- Long duration assets will outperform. Cash as an asset class will underperform.

- Investor fears will shift from inflation to growth and deflation as we head back to secular stagnation.

- Forecast 150 bps of rate cuts with a bull market for bonds, banks and home builders.

- By the end of 2024, the S&P 500 Index will hit the target of 5400.

- NASDAQ-100 will outperform the S&P 500, which will outperform the TSX.

- Uranium bull market will continue, along with a run in gold as the Federal Reserve cuts interest rates.

- Oil trades between US$70 and US$90.

- Bitcoin bull run will last until late in the third quarter of 2025.

- Federal Reserve will start cutting interest rates in the second quarter of 2024.

- Bank of Canada will cut interest rates before the Federal Reserve, with the overnight rate reaching the terminal rate by the second quarter of 2025.

- U.S. Federal funds rate will hit terminal rate of 2.5 per cent by the fourth quarter of 2025.

- In the next two years, we will find out if interest rates settle at the pre-GFC or pre-COVID-19 level.

In conclusion, my 2024 forecast signals significant shifts in the economic landscape. As we navigate these changes, investors should remember that subconscious biases often skew risk perceptions. By challenging these biases, we can recognize and capitalize on the potential of innovative companies. Furthermore, demographics will continue to play a significant role in shaping social and investment norms.

The experiences of the past, particularly the 1960s and 1970s, offer valuable lessons. Much like baby boomers, millennials are shaping social policies and driving change. Harnessing their technological savvy and creative potential will be crucial in overcoming economic stagnation.

As we prepare for the future, it’s important to remember that the American spirit, with its readiness to embrace change, risk, and reinvention, is deeply rooted in history. This spirit is embodied in the NASDAQ 100, guiding the nation’s technological and economic evolution. As we enter an era of exponential technological growth, we align ourselves not just with a market or an economy, but with a profound narrative of progress, a relentless drive for self-improvement, and an audacious belief in the power of innovation.

In the face of unprecedented challenges, the resilience and adaptability of economies and markets will be tested. However, with careful analysis and innovative thinking, we can navigate these uncharted waters with confidence. As we look ahead to 2024 and beyond, one thing remains certain— given the impressive economic progress in the U.S. since the Second World War, a simple conclusion emerges— “Never bet against America.”