The Maradona & Cantillon Effects: 2022 — The Year of The Fed!

Download this article as a PDF.

“I am Maradona, who makes goals, who makes mistakes I can take it all, I have shoulders big enough to fight with everybody.” – Diego Maradona

Often referred to as the “goal of the century,” Diego Maradona, an Argentinian football player of small stature, ran 60 yards past five opponents to score the final goal in the Argentina versus England game of the 1986 World Cup. It was one of the most anticipated matches in the aftermath of the Falklands War. Yet, what made this truly extraordinary was that Maradona ran virtually in a straight line. How do you overcome five world-class defenders while running in a straight line? It all came down to expectations: The players believed that he would run to the left or right. In fact, even Maradona later admitted that he was supposed to pass the ball.

Monetary policy may work in a similar fashion. Sometimes, the markets react to what the central banks are expected to do. As such, central banks may have the ability to influence the path of the economy without making substantial moves in monetary policy. In 2005, then Bank of England Governor Lord Mervyn King reminded financial circles of this “Maradona Effect,” suggesting that the expectations of future monetary policy actions can sometimes be just as important as the actual policy moves that are made.

This may be occurring today. Chairman Powell has pivoted many times over the past two years, from dovish to hawkish, affecting expectations of rate hikes. Yet, in 2022, we submit that he may just run a straight line and keep interest rates close to current levels, all while the capital markets continue to react to what they expect him to do.

As such, we believe that 2022 will be the Year of the Fed: with the Fed’s actions, or perhaps even just the expectations of those actions, having a significant impact on the markets for the coming year. Today, the capital markets are positioned for rising rates. However, we suggest that the Fed is more progressive than the market gives credit for, and there will be no “Volcker shock.” Our base case assumes that rates will remain close to current levels, and investors will need to adjust for overcompensating long-term inflationary expectations. This is likely to contribute to a volatile first half of the year. However, the tapering of quantitative easing (QE) will help to support risk assets in the second half, and the view of the world will be much different to end the year. Assuming continued progress in overcoming the pandemic, our 2022 target for the S&P 500 is 5,300, based on earnings of $240.

The Fed: More Progressive Than the Market Gives Credit For?

Our view is that the Fed will continue to reveal a more progressive policy stance in 2022. At Jackson Hole two years ago, Chairman Powell acknowledged that the Fed was making a generational pivot in order to focus on the existential threats of climate change and income inequality. In his speech, he implicitly stated that he understood the negative effects that central bank policies have had on society. Since the 2000s, central banks began to run out of policy tools because interest rates fell to their lowest historic levels. As such, in order to deal with major financial crises, many opted to increase the money supply. In doing so, this helped fuel the income disparity problem we are facing today.

This outcome may be attributed to the “Cantillon Effect.” In the 18th century, French banker and philosopher Richard Cantillon in ‘An Essay on Economic Theory’ proposed that “he who was close to the king and the wealthy” benefitted most from a distribution in the increase of the money supply. Thus, the further you were from the distribution, the more you were harmed. Money, in other words, is not neutral, and money printing has distributional consequences that operate through the price system. This can explain why income inequality has increased.

Income inequality has never been the focus for central bankers. At the end of WWII, society was tasked with rebuilding and the technology developed during the war spurred economic growth to support rising wages and increasing standards of living. Inflation and the economy ran hot, which allowed the economy to grow out of the excessive level of debt accumulated during the war. The end of the British Empire and European colonialism ushered in a new era of rules-based global order: Bretton Woods, the United Nations, NATO, GATT, and the Treaty of Rome. Then, there was the demographic explosion by the Boomers that would help to support decades of strong economic growth and a period in which modern capitalism was unleashed under the opportunity of the “American Dream.”

Fast forward to today and the Millennials now see that there is no American Dream. The golden age of capitalism is dead, and more progressive policymakers may be slowly accepting the blame for borrowing from today’s youth to pay for the indiscretions of previous generations.

Maradona Returns: No Volcker Shock!

Given that our base case assumes a more progressive Fed than the street is modeling, we suggest that interest rates will not be raised three or four times as consensus currently accepts. Instead, we believe that the Fed’s strategy will be to mirror the Maradona effect, with expectations anchored by the suggestion that policy options can be taken to reduce complacency in the markets, yet ultimately nothing will transpire.

Why will rates remain close to current levels? First, with significant and continuing income disparity, the Fed recognizes how fragile economic recovery is. With high levels of debt globally, and governments still needing to service this debt, we will need a few years of financial repression before interest rates can go up in earnest. A small increase may be tested, but this will likely have the potential to be reversed. Recall in 2018, when Chairman Powell stated that the natural level of interest rates was much higher than the street had factored in, and that tightening would be put on autopilot, implying the contraction of the Fed balance sheet would continue irrespective of market and economic conditions. The result was a severe market correction, viewed by many as a policy mistake.

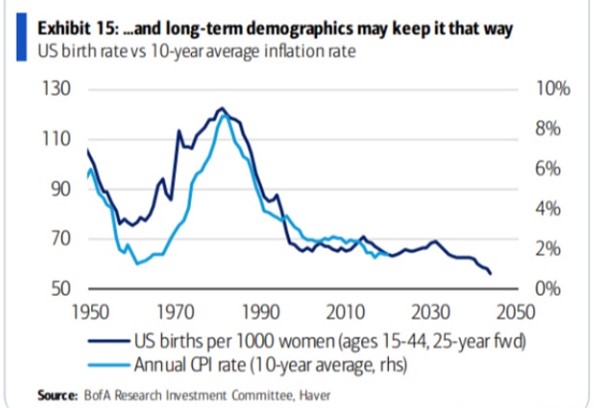

We also cannot ignore the strong structural forces of deflation that are being overlooked by many market pundits. To be clear, our view is that demographics, technology, debt-to-GDP, and globalization are secular deflationary forces that have not gone away, and, in some instances, have even strengthened. The inflation caused by Covid-19 was a supply shock, not a demand shock as so many believe. There still exists excess capacity globally under Covid’s distorted guise. Supply shocks will eventually dissipate, and deflationary forces will reappear.

Demographic Forces Are Deflationary: U.S. Birth Rate vs. 10-Year Average Inflation Rate

The progressive evolution of the U.S. Federal Reserve may also be evident in the Powell-Brainard partnership. Vice-Chair Brainard’s focus has been on the 24-month core Personal Consumption Expenditures Price Index (PCE), not the 12-month core PCE that many pundits focus on, explicitly stating that she uses a longer-view lens to look beyond pandemic-related inflation pressures. The 24-month core PCE, while increasing, is at levels seen in the mid-1960s, not the late-1970s when the Volcker shock was initiated.

24-Month Core PCE: Brainard’s Longer-Term Inflation Measure

Acceleration of the Taper: Another Reason for Tempered Rates

The acceleration of tapering, which is effectively the slowing of quantitative easing (QE), will also provide the opportunity for continued patience by the Fed in raising interest rates. Not surprisingly, QE distorts inflationary expectations; slowing the growth of the Fed balance sheet should reduce distortions in asset markets.

The tapering involves the Fed reducing its purchases of Treasury inflation-protected bonds, or TIPS. Consider that the Fed owns almost 25% of the TIPS market! According to data from the St. Louis Federal Reserve, since 2003 the yield on 10-year inflation-adjusted TIPS has averaged positive 87 bps. Since the implementation of QE in April of 2020, the yield has averaged negative 84 bps, which suggests a distortion of 1.71%.

Ironically, a rapid unwinding of QE would theoretically reduce both inflationary expectations and the need for interest rates hikes. Its purchases have depressed yields on 10-year inflation adjusted bonds, a critical component of calculating the 10-year breakeven rate. It is this breakeven rate that so many pundits use to support the proclamation that inflation is running rampant. What will they say when the rate on the 10-year breakeven rapidly falls?

What Lies Ahead?

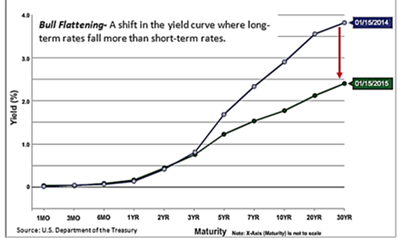

While the Fed will end its large-scale asset purchases, or QE, in the spring, an important question for investors is whether the Fed will begin its balance sheet contraction, or Quantitative Tightening (QT) in 2022. We suggest not. A reduction in inflationary expectations will allow the Fed more latitude to be patient in its contraction of the balance sheet and interest rates hikes. However, we expect the street to misinterpret the Fed in the first half of 2022, continuing to follow the narrative that the Fed is hawkish and positioning for inflation in the early part of the year. As the year progresses and inflation declines more prominently, the street will recognize that the current and aggressive stance towards interest rate hikes is misplaced. If this is the case, the excessive short position on U.S. Treasurys will need to be covered, resulting in what the credit market refers to as a “bull flattener.” As the markets adjust, the yield curve will flatten. As the yield curve flattens, risk assets will appreciate. In 2014 when we experienced the last bull flattened, the S&P 500 was up close to 11%.

What Lies Ahead: A Bull Flattener?

In 2022, expect slowing, but positive, economic growth. Consumer demand will continue to be solid, however the economy will be counter-balanced by a fiscal drag as Covid-19 programs wind down. We are likely to hear a new narrative focused on disinflation, with an increasing realization by the street that deflation still remains a concern. Perhaps we are seeing some evidence of this changing stance beginning to take shape today, with declining yields on long-term bonds even as the economy posts strong inflation numbers.

What should investors do?

For 2022, investors will experience a nuanced journey that will be volatile and fraught with risk, but will present opportunities in which active management should outperform passive. This will be a stock picker’s market.

Throughout 2022, many will realize the error of their ways and accept that assuming hyperinflation and a policy response like the Volcker shock was folly. As the market comes to the realization that the Fed will not contract the balance sheet or raise rates at the pace currently priced in, price-to-earnings ratios will not contract as much as the market anticipates and we expect secular growth names to outperform. As the year progresses, economic growth will slow as the effects of fiscal and monetary policy wane. Inflation will evolve into disinflation. We should expect a back end-loaded year for equity investors in 2022. Nominal economic output and earnings growth will exceed expectations.

In terms of sector specifics, commodities prices will moderate, crypto will continue to gain a larger acceptance by institutional investors, gold will perform well, as will green-economy-related commodities and those tied to carbon credit pricing. Areas in the economy that benefit from the reopening trade will also do well, as economies continue to progress in the return to normalcy.

Various tail risks have the potential to derail our base case, including the complete eradication of Covid-19 (which we, unfortunately, see as unlikely), rapidly rising interest rates, and a financial crisis within emerging markets, to name a few. As in any evolutionary process, one cannot rule out periods in which we take the proverbial “two steps back.” Yes, investors need to prepare for rate hikes – a policy mistake is a possibility in 2022. However, should the Fed continue to maintain patience as inflation tempers through tapering and the return of the deflationary forces that existed prior to the Covid pandemic, we maintain that 2022 will end up a fine year for equity markets.

As we suggested in our September 2021 Market Insights, 2022 may turn out to be a Goldilocks year for risk assets – no hyperinflation, no deflation, lower economic and earnings growth (yet still positive!), disinflation and a patient Federal Reserve: not too hot, not too cold; just right. With a 2022 target for the S&P 500 of 5,300, based on earnings of $240, it may provide opportunities for those investors who take an active and nuanced investing approach.

Stay tuned, as 2022 will largely be the Year of the Fed.

James E. Thorne, Ph.D.

[1] “Monetary Policy: Practice Ahead of Theory.” Mervyn King, Governor of the Bank of England, May 17, 2005.

[2] Based on the Gordon Growth Model assuming an equity risk premium of 3.5% and risk-free rate of return of 1%.

[3] “Navigating Delta Headwinds on the Path to a Full Recovery,” Governor Lael Brainard, September 27, 2021. Annual Meeting of the National Association for Business Economics, Arlington, Virginia.

[4] The 10-year breakeven is calculated by subtracting the yield of the 10-year TIPS from the yield on a 10-year Treasury. The Federal Reserve purchases TIPS as part of their QE program, substantially suppressing their yield and making inflationary expectations higher than they would otherwise be.

[5] Quantitative tightening (QT): reducing the size of the Federal Reserve balance sheet.

[6] A bull flattener is a yield-rate environment in which long-term rates are decreasing more quickly than short-term rates. In the short term, a bull flattener is a bullish sign that is usually followed by higher stock prices and economic prosperity.

[7] Stock Trader’s Almanac 2022.

[8] “Covid’s Lasting Economic Scar and a Goldilocks in 2022,” September 2021 Market Insights, James Thorne.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable.

The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION