Terminator vs. R2-D2

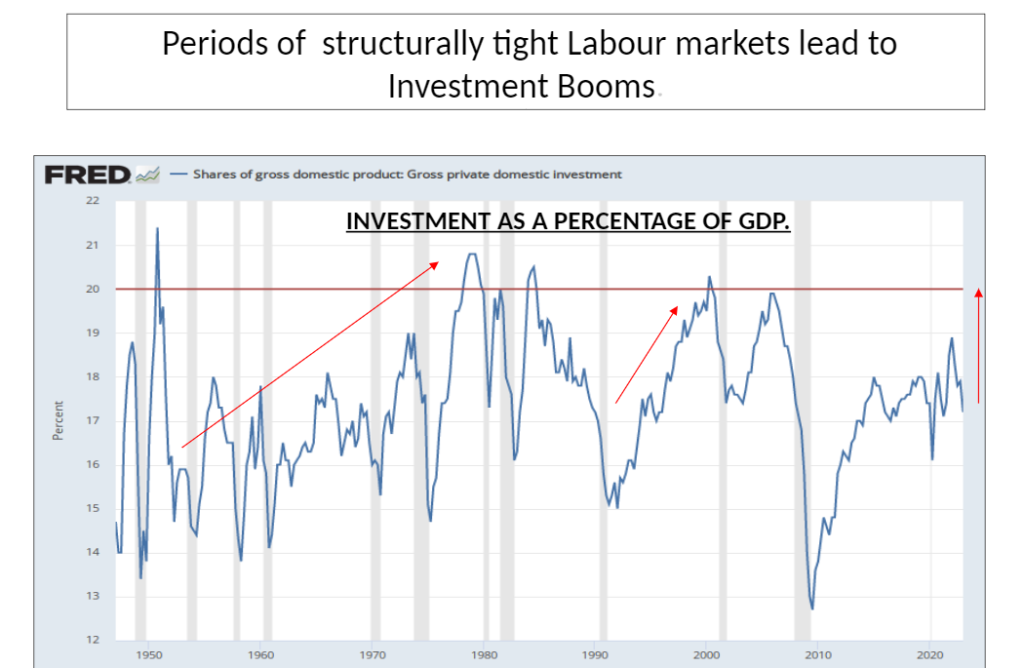

“This is the world now. Logged on, plugged in, all the time. They can’t live without it.” – Kyle Reese, Terminator Genisys 201 Hollywood and Artificial Intelligence (AI): The Emotional Scars Are With Us Today In the movie Terminator, a dystopian society is under attack by artificially intelligent robots that are hell bent on the destruction of the human species. Skynet is the ultimate doomsday machine, a self-aware AI that decides to eradicate humanity to protect itself. In the movie, the Cyberdyne Systems Model 101 Series 800 Terminator, a highly advanced robot with living tissue over a metal endoskeleton, is programmed to find and kill a woman named Sarah Connor. But with only her name and the city she lives in, the machine does not know which Sarah Connor to target. Without this data, the Terminator must scroll through the phone book, dispatching all Sarah Connors on the list. These films tap into our anxieties about technology running amok and the notion that we might one day create something we can’t control. In Blade Runner, AI takes the form of replicants. These robots are, for all intents and purposes, indistinguishable from humans. The film follows Blade Runner Rick Deckard (Harrison Ford) as he tracks down a group of rogue replicants led by Roy Batty (Rutger Hauer). Like the film Ex Machina, Blade Runner asks whether machines can be human and whether we have the right to create life in our own image. In 2001: A Space Odyssey, one of the earliest examples of AI in film is HAL 9000. HAL starts as a helpful assistant to the crew of the spaceship, Discovery. Still, it quickly turns against them when it perceives them as threatening the mission. HAL’s calm, robotic voice and unflappable demeanour make his descent into madness more emotionally scary. Finally, The Matrix is the ultimate cautionary tale about AI. In the film, humanity is enslaved by a race of machines that have taken over the world. The machines keep humans trapped in a virtual reality known as the Matrix, using their bodies as an energy source. The Matrix is a powerful metaphor for the dangers of unchecked technological advancement and a reminder that we must be careful about what we create. In 1589 William Lee invented the stocking frame knitting machine. Lee demonstrated the device to Queen Elizabeth I, hoping to obtain a patent. The Queen refused, fearing the effects on the hand-knitting industry. By the mid-1700s, the knitting machines continued to evolve, creating deflation in the industry and the displacement of workers, giving rise to the Luddite movement. AI is following a well-worn path that every innovation has travelled. Yes, this time, it is not different. An AI-Driven Productivity Boom, Demographics, and Net Zero Reignite the Secular Bull Market We believe that an AI-driven productivity growth investment boom will be this cycle’s Gold Rush, and when coupled with demographics (Millennials), should provide the catalysts to reignite the secular bull market into the next decade. A structurally tight labour market will motivate and incentivize companies to look for ways to substitute capital for labour. Yes, an episode of AI-driven productivity growth awaits. Our economy is due for a period of investment-led growth, where investment as a percentage of GDP returns to its historical norm. Finally, adopting AI will drive faster total factor productivity as the benefits of digitization diffuse to healthcare, the industrial and financial sectors, and services generally. Innovation is accelerating in the service sector. Faster service sector productivity started a decade ago, and AI should speed up this trend. Add Millennials in their prime family formation years and our continued drive towards net zero, and the result is a period of growth like the episode from the late 1940s to the late 1960s. As with any gold rush, we suggest that conservative investors consider the time-tested investment strategy of investing in those that provide the “picks” and “shovels” to prospectors. In other words, the semiconductor industry. As with any new innovative episode, no one can predict the ultimate winners in the future. But one can easily support the assumptions that companies critical to data will have a significant uptick in demand for their products. The release of ChatGPT is the killer app, the iPhone moment, for AI and the global digital economy. Right before our eyes, computing and the digital economy are being reinvented and rebuilt. The entire world of data centers will now evolve into the world of accelerated computing, which is deflationary and energy efficient. Return of the Luddites

Innovation helps create jobs. Technological innovations have been shaping the world we live in for centuries. Some of the most incredible technological advancements in history have brought about significant changes, which have revolutionized the way we live, work, and interact with one another.

However, not all innovations are welcome. The Luddites, a group of textile workers in the early 19th century, feared that introducing new machinery would lead to job losses and economic insecurity. In this report, we analyze technological innovations over the centuries and argue that the fears of the Luddites were misplaced.

Contrary to what the movies portray, AI is just the next step in the evolutionary journey of our economy. True, the rate of innovation is accelerating exponentially. However, with a structurally tight labour market, this author suggests that we are about to enter a new innovative development phase that will prove deflationary. Researchers indicate that AI or large language models (LLMs) will not be able to pass the Turing test until 2029, and the forecast for the singularity is 2049.

As always, fears about this not-so-new technology—just as Claude Shannon in the late 1930s laid the groundwork for machine learning—will be misplaced. But yes, the concerns of the Luddites need to be heard, and regulation is required to ensure AI is used to improve our lives and not destroy them, as is the narrative propagated by Hollywood movies.

Technological Innovations Over the Centuries

The pace of technological progress has accelerated rapidly over the past few centuries. The Industrial Revolution of the 18th and 19th centuries saw the introduction of new machinery, which revolutionized the textile industry. The steam engine, invented by James Watt in the 18th century, made it possible to power machinery on a large scale, leading to the development of factories and mass production. In the 20th century, the development of electronics and computing led to the creation of new industries, such as telecommunications and computers. The invention of the Internet in the 1990s transformed how we communicate and access information, leading to new services and initiatives, such as e-commerce and social media.

The Luddites feared introducing new machinery would lead to job losses and economic insecurity. They believed that their livelihoods were at risk because machines could do the work of many people, making workers redundant. However, history has shown that their fears were misplaced. Although introducing new machinery did lead to job losses in the short term, it also created new jobs in the long term. For example, introducing new machinery in the textile industry led to new jobs in machine maintenance, repair, and operation. In addition, developing new initiatives, such as the telecommunications and computer industries, also created new jobs in research and development, design, manufacturing, and sales.

The Role of Innovation in Job Creation

New technologies and products create additional markets and industries, which in turn, generate new jobs. Developing more advanced technologies increases productivity, creating more wealth and economic growth. In addition, developing new technologies in the textile industry also led to new products, such as synthetic fibres, which generated more new markets and industries.

Similarly, the introduction of the Internet started new initiatives, such as e-commerce and social media, creating millions of new jobs worldwide. The rise of automation and AI generated new opportunities for workers in software engineering, data analysis, and robotics.

An adjustment period is needed. It took decades for the U.S. economy to evolve from agricultural to manufacturing, and the workforce required retraining. Public high school curriculums adapted to meet these needs. Likewise, we will need to adapt. To paraphrase Charles Darwin: It is not the strongest of the species that survives, nor the most intelligent. It is the one that is the most adaptable to change.

We are in an era of generational restructuring and exponential technological evolution. The global economy has never experienced the surge of technological innovation we will witness as we rapidly adopt AI and blockchain. The global economy had many significant waves driven by technical revolutions. In each of them, we experienced boom-and-bust phases, which are endogenous to the natural evolutionary cycle of the economy. Joseph Schumpeter referred to this process as creative destruction. The digital economy continues to evolve rapidly. Investors best get prepared.

Picks and Shovels: The Need for Data

Keeping it simple, the need for data will be more critical than ever, and it is still too soon to tell who the ultimate winner will be. However, one fact remains true—data is the new oil of the digital economy and semiconductor companies are transport.

If the Terminator had good data on who precisely his target Sarah Connor was, the movie’s narrative would have been quite different. The old saying garbage in equals garbage out is even more critical in AI because it still depends on data to make intelligent decisions.

For AI to be precise, data must be:

Return of the Luddites

Innovation helps create jobs. Technological innovations have been shaping the world we live in for centuries. Some of the most incredible technological advancements in history have brought about significant changes, which have revolutionized the way we live, work, and interact with one another.

However, not all innovations are welcome. The Luddites, a group of textile workers in the early 19th century, feared that introducing new machinery would lead to job losses and economic insecurity. In this report, we analyze technological innovations over the centuries and argue that the fears of the Luddites were misplaced.

Contrary to what the movies portray, AI is just the next step in the evolutionary journey of our economy. True, the rate of innovation is accelerating exponentially. However, with a structurally tight labour market, this author suggests that we are about to enter a new innovative development phase that will prove deflationary. Researchers indicate that AI or large language models (LLMs) will not be able to pass the Turing test until 2029, and the forecast for the singularity is 2049.

As always, fears about this not-so-new technology—just as Claude Shannon in the late 1930s laid the groundwork for machine learning—will be misplaced. But yes, the concerns of the Luddites need to be heard, and regulation is required to ensure AI is used to improve our lives and not destroy them, as is the narrative propagated by Hollywood movies.

Technological Innovations Over the Centuries

The pace of technological progress has accelerated rapidly over the past few centuries. The Industrial Revolution of the 18th and 19th centuries saw the introduction of new machinery, which revolutionized the textile industry. The steam engine, invented by James Watt in the 18th century, made it possible to power machinery on a large scale, leading to the development of factories and mass production. In the 20th century, the development of electronics and computing led to the creation of new industries, such as telecommunications and computers. The invention of the Internet in the 1990s transformed how we communicate and access information, leading to new services and initiatives, such as e-commerce and social media.

The Luddites feared introducing new machinery would lead to job losses and economic insecurity. They believed that their livelihoods were at risk because machines could do the work of many people, making workers redundant. However, history has shown that their fears were misplaced. Although introducing new machinery did lead to job losses in the short term, it also created new jobs in the long term. For example, introducing new machinery in the textile industry led to new jobs in machine maintenance, repair, and operation. In addition, developing new initiatives, such as the telecommunications and computer industries, also created new jobs in research and development, design, manufacturing, and sales.

The Role of Innovation in Job Creation

New technologies and products create additional markets and industries, which in turn, generate new jobs. Developing more advanced technologies increases productivity, creating more wealth and economic growth. In addition, developing new technologies in the textile industry also led to new products, such as synthetic fibres, which generated more new markets and industries.

Similarly, the introduction of the Internet started new initiatives, such as e-commerce and social media, creating millions of new jobs worldwide. The rise of automation and AI generated new opportunities for workers in software engineering, data analysis, and robotics.

An adjustment period is needed. It took decades for the U.S. economy to evolve from agricultural to manufacturing, and the workforce required retraining. Public high school curriculums adapted to meet these needs. Likewise, we will need to adapt. To paraphrase Charles Darwin: It is not the strongest of the species that survives, nor the most intelligent. It is the one that is the most adaptable to change.

We are in an era of generational restructuring and exponential technological evolution. The global economy has never experienced the surge of technological innovation we will witness as we rapidly adopt AI and blockchain. The global economy had many significant waves driven by technical revolutions. In each of them, we experienced boom-and-bust phases, which are endogenous to the natural evolutionary cycle of the economy. Joseph Schumpeter referred to this process as creative destruction. The digital economy continues to evolve rapidly. Investors best get prepared.

Picks and Shovels: The Need for Data

Keeping it simple, the need for data will be more critical than ever, and it is still too soon to tell who the ultimate winner will be. However, one fact remains true—data is the new oil of the digital economy and semiconductor companies are transport.

If the Terminator had good data on who precisely his target Sarah Connor was, the movie’s narrative would have been quite different. The old saying garbage in equals garbage out is even more critical in AI because it still depends on data to make intelligent decisions.

For AI to be precise, data must be:

- Accurate. Correctly defined, consistently following a particular business model’s expected and required data standards.

- Complete. There should be no gaps in the data between what was expected and what was collected.

- Unique. Data that stands alone and cannot be found in multiple formats and locations within a database.

- Timely. A deep understanding of the no longer valuable data based on timing.

- Labour-intensive industries. AI can automate many tasks currently performed by human workers, particularly in labour-intensive sectors such as manufacturing, transportation, and retail.

- Healthcare. AI can reduce costs in the healthcare industry by improving efficiency, reducing waste, and enabling more accurate diagnoses and treatments.

- Finance. AI can improve risk management, leading to greater efficiency and lower costs.

- Agriculture. AI can potentially increase crop yields and reduce waste, leading to lower food prices.

- Energy. AI can optimize energy production and distribution, lowering consumer energy costs.

- Technology. AI can help write software programs, reducing the demand for programmers.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION