In Brief: Tax Planning Before Year-End

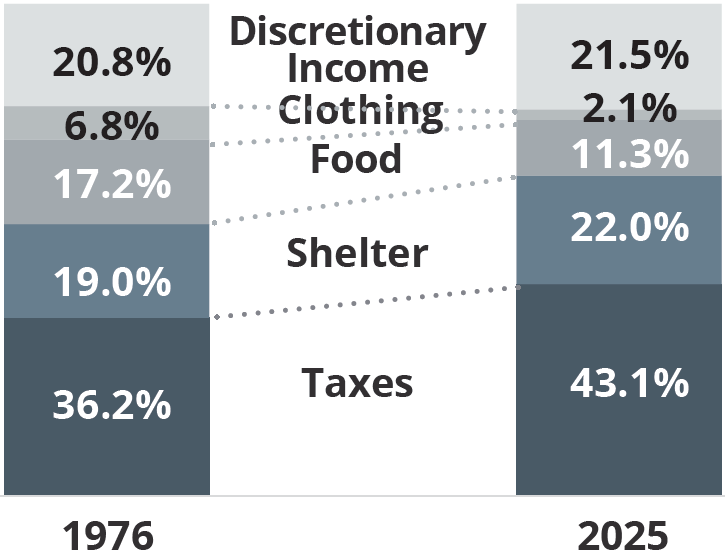

Despite rising living costs, the share of income spent on necessities has declined. In 1976, households spent about 43 percent of their income on shelter, food and clothing. Today, this is around 35 percent. What has risen is the share we pay to taxes. In 2025, the average Canadian family paid 43.1 percent in taxes.1 Put differently, if taxes were paid upfront, the first 158 days’ earnings would go entirely to the government!

This is why tax planning continues to be an important part of wealth planning. As we approach the final months of the year, here are a handful of actions, in brief, that may help improve your tax position in 2025:

Split income. This may include electing to split eligible pension income with a spouse or paying reasonable salaries to family members for services provided to your self-employed business.

Contribute to your RRSP. You still have 60 days after the calendar year end to make contributions for the 2025 tax year, but the earlier you contribute, the greater opportunity for tax-deferred growth.

Consider tax-loss harvesting. Realize capital losses to offset capital gains. Please contact the office well before the end of the year to enact this strategy to allow for sufficient settlement time.

How Our Tax Liability Has Grown Since 1976

Average Income Expenditure Allocation (%)

Give charitably. Gifting publicly-traded securities to a registered charity may offer tax benefits, including eliminating the capital gains tax liability on appreciated securities.

Give charitably. Gifting publicly-traded securities to a registered charity may offer tax benefits, including eliminating the capital gains tax liability on appreciated securities.

Claim the pension income tax credit. If you are 65 years or older and don’t have eligible pension income, consider opening a small RRIF or purchasing an annuity.

Withdraw from the TFSA before year-end.

If you plan to withdraw, consider doing so before the year-end. Contribution room resets at the start of the calendar year, so withdrawals after December 31, 2025,

won’t restore contribution room until January 1, 2027.

Make RESP contributions. While it won’t save tax, you may potentially benefit from the CESGs for 2025. For more information or ideas, please contact the office.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca