Download this article as a PDF.

A Registered Disability Savings Plan (RDSP) is a tax-sheltered savings vehicle designed to help families ensure the long-term financial security of a loved one affected by disability.

While Alternative Minimum Tax (AMT) might not be a common discussion point amongst all taxpayers, it’s a concept that’s very worthwhile to understand.

If you reduce a large part of your income by deductions, you might be subject to the AMT. Examples of common deductions for Sweeney Bride clients would be RRSP contributions or flow-through share purchases.

Read what our colleagues at Wellington-Altus have to say about the applications of AMT.

BACKGROUND

The Alternative Minimum Tax (AMT)1 is a second, alternate tax liability calculation that Canadian individuals and trusts must consider annually in parallel with their normal tax liability. First introduced in 1986, AMT was implemented to promote and maintain fairness within Canada’s income tax regime.

Simply, if a taxpayer’s AMT liability exceeds their normal tax liability otherwise calculated, the AMT represents their federal tax liability for the year. There are a few exceptions to AMT, such as in the year of death or bankruptcy for individuals, or for certain types of trusts including alter ego or joint spousal, mutual fund, or employee life and health trusts.

[1] This communication addresses Federal AMT only, not provincial or territorial AMT.

How does it work?

The AMT was designed to ensure that high income earning Canadians do not disproportionately reduce their tax liability by applying various tax advantages, such as reporting considerable exempt income or claiming significant tax deductions or credits. Most taxpayers are unaware of AMT’s existence as they don’t trigger its application. Rather, their normal tax liability calculated exceeds AMT thresholds.

AMT is calculated on Form T691 Alternative Minimum Tax for individuals, or T3, Schedule 12 Minimum Tax for trusts, by:

- Reporting normal taxable income (“Taxable Income” on Line 26000 on a T1 Income Tax and Benefit Return and Line 56 for a T3 Trust Income Tax and Information Return).

- Adjusting for a variety of tax advantages such as increasing taxable income inclusion rates, reducing the deductibility rates for deductions, or limiting tax credits and carry-overs being claimed to determine an “Adjusted Taxable Income” (ATI), commonly known as the AMT Base.

- Applying the AMT Exemption. For 2023 the federal AMT Exemption is $40,000.

- Applying the AMT Rate to the net ATI (i.e., ATI less the AMT Exemption). For 2023 the AMT Rate is 15%, which represents the lowest federal marginal tax rate.

- Deducting allowable non-refundable tax credits from the AMT tax calculated.

When is AMT most often triggered?

Canadian individual taxpayers claiming significant tax-advantaged gains or deductions relative to their income are most likely to trigger AMT. These may include the Lifetime Capital Gains Exemption on qualified capital property, tax shelters such as flow-through shares and/or limited partnerships that reported losses, significant interest and/or carrying charges, or substantial employee stock option deductions, dividend income or share donations.

AMT is not generally an additional tax liability. Rather, it should be viewed as a prepayment of tax given the associated carryforward and credit provisions. If a taxpayer is subject to AMT in a particular year, the difference between their AMT liability and normal tax liability can then be applied as a credit to reduce any normal tax liability to the extent that it exceeds a calculated AMT tax liability over the next seven years, or until the credit is used up, whichever comes first.

AMT changes announced in the 2023 Federal Budget (Budget 2023)

Budget 2023 announced three key proposed changes to the AMT for taxation years that begin after 2023, namely:

- Additions and adjustments to broaden the ATI or AMT Base calculation.

Budget 2023 proposals added to and adjusted the current tax advantages included in the ATI or AMT Base calculation. Table A outlines all proposed additions and adjustments to ATI or AMT Base. - Raising the AMT Exemption from $40,000 to an estimated $173,000 for 2024, which is the fourth federal marginal tax bracket.

- Increasing the AMT Rate from 15% to 20.5%, which is the second lowest marginal tax rate.

With these proposed changes, it’s expected that more than 99% of AMT collected would be paid by taxpayers earning over $300,000 annually, and 80% of the AMT would be paid by those earning over $1 million annually. Clients contemplating 2024 tax events and who may be concerned about AMT being triggered should consult their tax advisor.

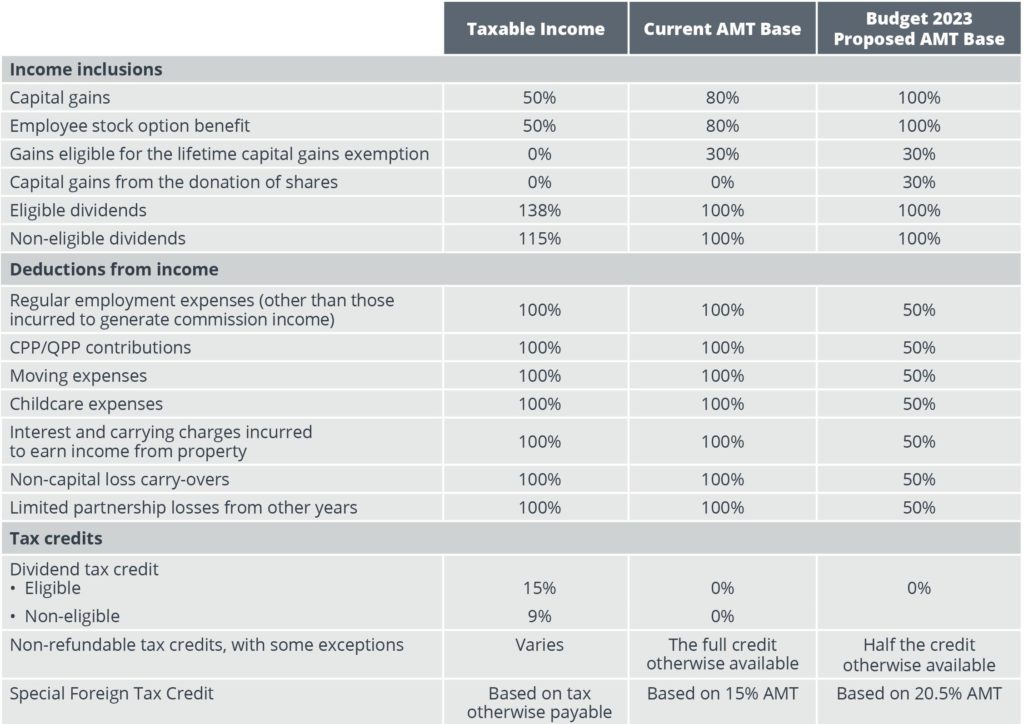

Table A – Budget 2023 Proposed Changes to the Alternative Minimum Tax Base Calculation

The table below summarizes the changes to the calculation of the AMT Base proposed in Budget 2023. The rates in the “Taxable Income” column reflect the percentage included in or deducted from income and the tax credits available when calculating the normal tax liability, assuming all criteria for the deductions and credits are otherwise met and limits are not exceeded.

Changes to the AMT: An example

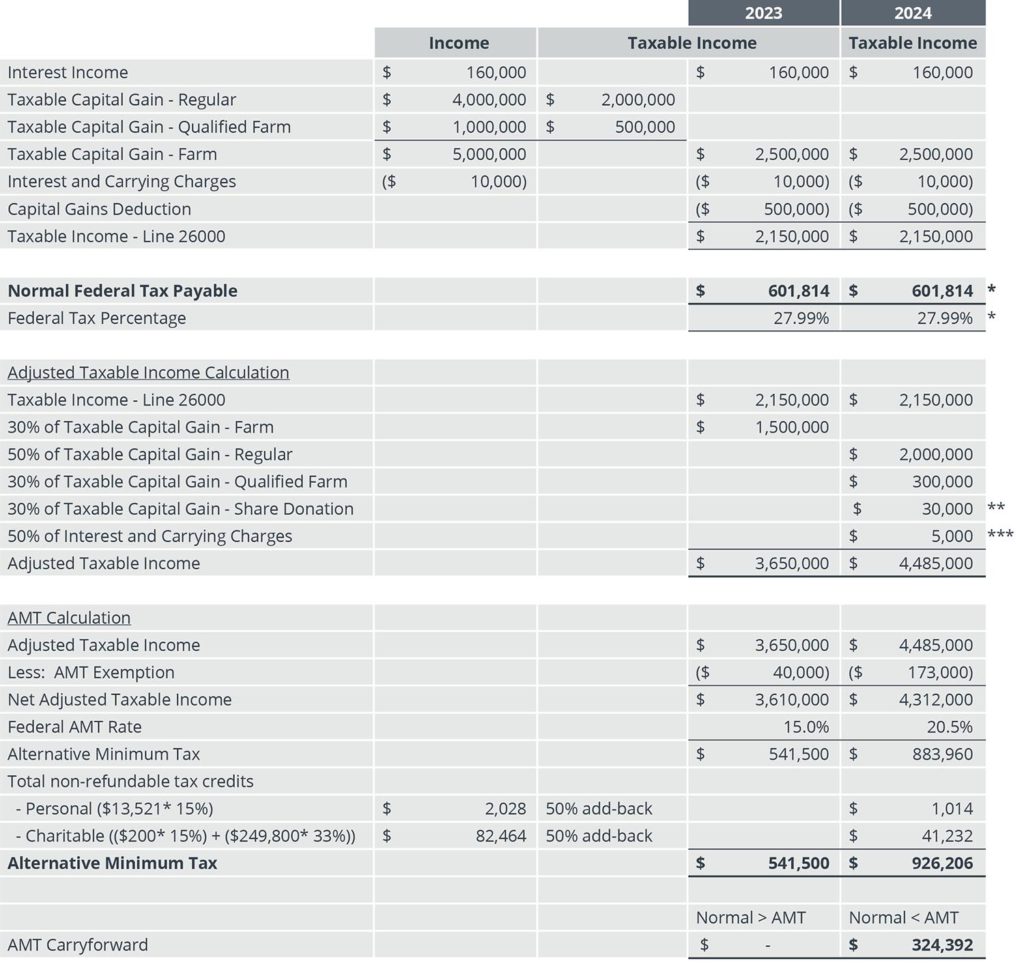

The following example illustrates how the proposed Budget 2023 changes would affect the AMT Base calculation when applied.

Mr. March reported taxable income of $2,150,000 on line 26000 of his T1. Reflected in his taxable income are the following amounts:

- Disposition of his qualified farm corporation shares (proceeds $5,000,000, ACB/PUC $1).

- The lifetime capital gains exemption (LCGE) of $1,000,000 was applied to his qualified farm corporation shares.

- Charitable donation of $250,000. Recognizing his good fortune he donated shares from his Wellington-Altus non-registered account worth $250,000 (ACB $150,000).

- Interest and carrying charges related to his non-registered account of $10,000.

Given his taxable income and tax credits claimed, would Mr. March trigger AMT in 2023 under the existing rules, or in 2024 given the proposed changes outlined in the 2023 Budget?

For 2023, Mr. March does not trigger AMT since only a portion ($1M/$5M = 20%) of his capital gain relating to his qualified farm corporation shares are shielded from income tax using his LCGE. His federal tax rate was close to 28% – almost double the AMT rate of 15%. If his proceeds on the qualified farm corporation shares had been significantly lower, say $1,500,000, AMT would have been triggered as only a sixth of the capital gain would be subject to tax ($1,500,000 CG – $1,000,000 LCGE = $500,000 * 50% inclusion rate = $250,000) at an average federal tax rate close to the AMT rate.

For 2024, the changes to AMT announced in the 2023 Budget mean that Mr. March’s ATI/AMT Base calculation more than doubles to $4,485,000 – by increasing regular capital gains to 100%, adding back 30% of capital gains related to donated shares, and reducing the deduction relating to interest and carrying charges by 50%. The increased ATI/AMT Base, even netted with the higher exemption of $173,000, being subject to the announced AMT rate of 20.5% triggers AMT for Mr. March in 2024.

A detailed breakdown of his normal and AMT tax liability calculations for 2023 and 2024 is shown in the below Table B.

Table B – Mr. March’s anticipated Normal Federal Tax Liability and AMT Tax Liability

* 2023 and 2024 Federal Tax Rates and Tax Brackets anticipated to be the same.

** Charitable donation of $250,000 reported. Donation was funded by shares from his non-registered account which had a FMV of $250,000 and an ACB of $150,000, thus capital gain of $100,000.

*** Interest and carrying charges of $10,000 relating to non-registered account.