Download this article as a PDF.

If you are collecting or have applied to collect your Canada Pension Plan retirement pension benefit…

Did you know you can share CPP income?

Unlike pension or RRIF income, CPP income can’t be split by the taxpayer on their tax return – splitting is applied for through Service Canada.

It also isn’t split 50/50 like traditional pension splitting. Want to know more? Our colleagues at Wellington-Altus have recently posted the answers to many questions you might have about CPP sharing.

—

If you are collecting or have applied to collect your Canada Pension Plan retirement pension benefits (CPP) and have a spouse or common-law partner (CLP) in a lower tax bracket, you may want to consider sharing your CPP benefits with them. Let’s look at the “why, how, what and when” of CPP sharing.

Why share your CPP?

CPP sharing can potentially reduce a family’s tax bill and result in tax savings where one spouse/CLP is receiving higher CPP benefits than the other and is in a higher tax bracket. The strategy effectively shifts CPP benefits to the lower income spouse/CLP who is taxed at a lower tax rate. CPP sharing does not change the total CPP benefits received, rather it changes who reports the CPP benefits and the tax paid on them.

How does CPP sharing work?

A common misconception is that CPP sharing is a completely discretionary split (like eligible pension income splitting) or even a 50/50 split of CPP between spouses. Rather, where only one spouse/CLP has contributed, or where both spouses/CLPs have contributed, the individual with higher CPP benefits shares a portion with their spouse/CLP following a specific formula.

In either scenario, the amount of CPP benefits that can be shared is determined by the “joint contributory period” and the number of years the couple lived together in proportion to their “joint contributory period.”

Calculating the “joint contributory period”

The “joint contributory period” begins when the older spouse/CLP turns 18 and ends when both members of the couple start receiving their CPP retirement pension. If one spouse/CLP has never contributed to CPP, the “joint contributory period” ends when that spouse/CLP turns 70 or the application for pension sharing is received, whichever is earlier.

What CPP Benefits can be shared? An example:

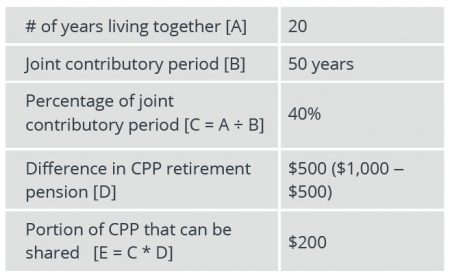

Miesha and Rory have been CLPs for 20 years and Miesha is three years older than Rory. Rory has just turned 65 and applied for CPP, while Miesha began collecting three years ago, also at age 65. Rory is in a higher tax bracket than Miesha and is anticipated to always be.

Their joint contributory period is 50 years – starting when Miesha turned 18, until this year when Rory turned 65 and applied for CPP.

Absent any CPP sharing, Miesha’s CPP benefit is $500/month and Rory’s CPP is $1,000/month. Here is how CPP sharing is calculated based on their situation:

As $200/month of their CPP can be shared, half of that amount ($100/month) can be subtracted from Rory’s CPP and added to Miesha’s CPP. Over the course of one year, Miesha will report $1,200/year more and Rory will report $1,200/year less than if they did not elect to share their CPP, providing the couple with tax savings.

When can CPP sharing occur?

CPP sharing can occur when both spouses/CLP are 60 years of age or over, are living together or involuntarily apart, and one or both have contributed to CPP. An individual may begin sharing their CPP as soon as they apply for their CPP retirement pension.

Do both spouses have to wait until age 65 to begin sharing CPP?

No. CPP sharing may begin as soon as age 60, the earliest age that CPP can be paid, provided both spouses are concurrently receiving CPP, or if one spouse does not have any CPP entitlement, whichever is earlier.

Can CPP sharing be backdated?

No. CPP sharing starts as soon as the Canada Revenue Agency (CRA) approves the application.

When does CPP sharing end?

CPP sharing is temporary and will end the earliest of:

• The month in which either spouse/CLP dies;

• The month spouses divorce;

• The twelfth month after spouses/CLPs separate; and

• The month following receipt of a written request signed by both spouses/CLPs.

Where can I find more information?

Service Canada has a number of forms that must be completed to request CPP sharing or to cease such, depending on the couple’s situation. The Service Canada Information Sheet – How to apply for Pension Sharing of Retirement Pension(s) Canada Pension Plan provides details on how to complete the forms and what supporting documentation needs to be submitted. The forms can be accessed via this link:

https://www.canada.ca/en/services/benefits/publicpensions/cpp/share-cpp.html