The Great Comet of 1811, as imagined by Midjourney

Weightless yet massive, the Great Comet of 1811 glided elliptically through the cosmos, its path dictated by the Sun’s gravity. Accelerating as it neared the Sun, a trail of space dust marked the path of its 2,785-year orbit. We won’t see it again until the 48th century but in 1811 it lit up Earth’s skies for 17 months, a space traveler simultaneously coming and going. Imagine standing on an American plain in 1811, gazing at a brilliant slow-moving streak covering a tenth of the night sky, night after night. Surely a sign—but of what?

Tariffs and the Birth of American Protectionism

Within a year, America would start (and lose) the War of 1812 with what would become Canada. Thwarted on the battlefield, it turned its anti-British sentiment to tariffs. Just as the Great Comet of 1811 led people to reflect on their place in the universe, America was defining its own place in the world—embracing its own industrial revolution. A wave of protectionism took hold to shield its nascent industries.

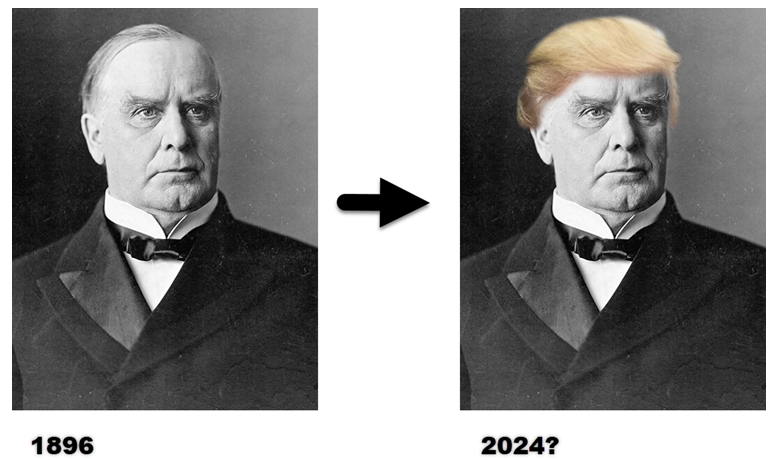

The hyperbolically named “Tariff of Abominations” was enacted in 1828—a policy favoured by the North that ironically fueled tensions with the South contributing to the Civil War. Tariffs steadily increased through the 19th century to new heights under President William McKinley in 1896. McKinley increased tariffs from 38% to nearly 50%, signaling a strong stance against foreign competition.

President William McKinley (then and now 😉) source

Though not a Progressive himself, McKinley’s administration marked the beginning of the Progressive Era. His tariff strategy succeeded in securing a persistent budgetary surplus (achieved without income tax) that funded a new navy, enabled victory in the Spanish-American War, and established the Gold Standard. America was finding its footing on the world stage, protected by tariffs and bolstered by its industrial prowess.

The Post-Second World War Shift to Free Trade

Since McKinley’s era, the politics of tariffs has shifted drastically. For over a century, tariffs gained bipartisan support. After the Second World War, Republicans pivoted to champion free trade—an unsurprising stance, given America’s then-uncontested global manufacturing dominance. Today, with China overtaking this position, protectionist sentiments have reemerged. Tariffs, in many ways, have come full circle.

Tariffs Return in 2024: A New Era?

Just as the Great Comet of 1811 will one day return to our skies, tariffs have returned to American policy. Former President Donald Trump’s 2024 bid seems to channel McKinley’s role, but regardless of one’s view of his platform, his potential victory signals economic shifts investors should take seriously. Here are three key areas to watch:

- Rising Trade Tensions: Export-driven nations like Canada can expect intensifying trade tensions as protectionism takes hold.

- Bitcoin Policy Thaw: While McKinley’s Gold Standard redefined American finance, Trump’s softer stance on Bitcoin could similarly impact the financial landscape.

- Bank Deregulation: Trump’s preference for reducing banking regulations could offer embattled U.S. banks significant relief.

Watch the Video: Tariffs, Comets, and Competition

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen