Trump’s Trade War Escalates: A New Stage in Market Turmoil

Sharp overnight losses in the U.S. Treasury Market signal a new, unwanted, escalation in the Trump Trade War. We’re at the “wrecking ball” part of the process—the only good news is that this brings us closer to the end—now the adults have to get involved. In my 27 year career, I’ve seen these before—they follow a somewhat predictable pattern—let’s dig in.

The Treasury Shock: What Just Happened

On April 9, the U.S. Treasury Market experienced forced liquidation, suggesting a major blow-up in the financial market. Interest rates spike 0.5% overnight on the U.S. 10 year bond:

Charts courtesy of StockCharts.com

This is a significant problem that will require the intervention of central bank officials. Fingers are being pointed at a hedge fund blowing up or at China selling its U.S. Treasuries. The latter explanation seems less likely than the former.

The Six-Step Crisis Playbook: What Happens Next

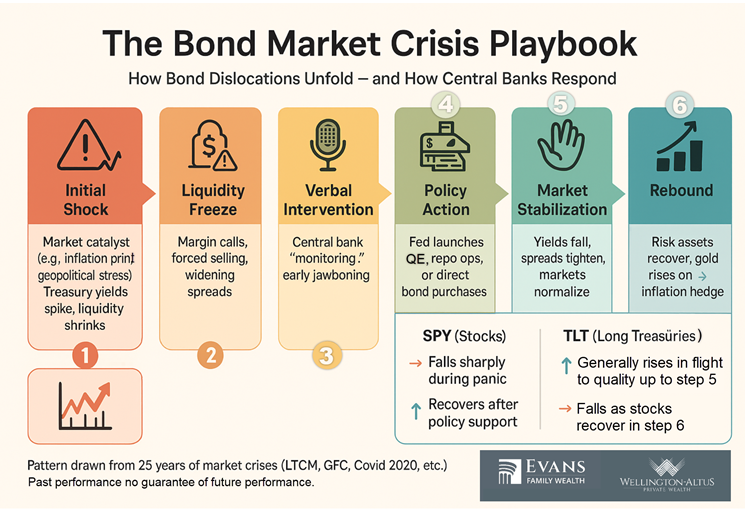

Unfortunately, this signals more selling in all risk assets. Based on historical precedence, we can expect a six step process to unfold in the days to come. It roughly follows the pattern shown below:

At the time of writing, I believe we are hours away from step three—Verbal Intervention. The Federal Reserve almost certainly has to address investors and attempt to calm these disorderly markets. Their job here is to alleviate panic and assure that they remain in control and able to respond. Almost certainly, their verbal intervention will be inadequate, that means step four Policy Action looms.

Rate Cuts on the Horizon: A Shift in Federal Reserve Strategy

Until now, the Federal Reserve has stubbornly held interest rates high on the worry that tariffs might be inflationary. I’d expect an emergency rate cut soon. The truth is that the world is increasingly in serious risk of recession, oil prices have collapsed over 30% year over year and inflation is the least of the current risks. Whether rate cuts are sufficient remains to be seen. I bring no special expertise except bitter experience and my view is that this problem will require more, rather than less interventions.

Bear Markets Are Brutal—But They Set Up Big Rallies

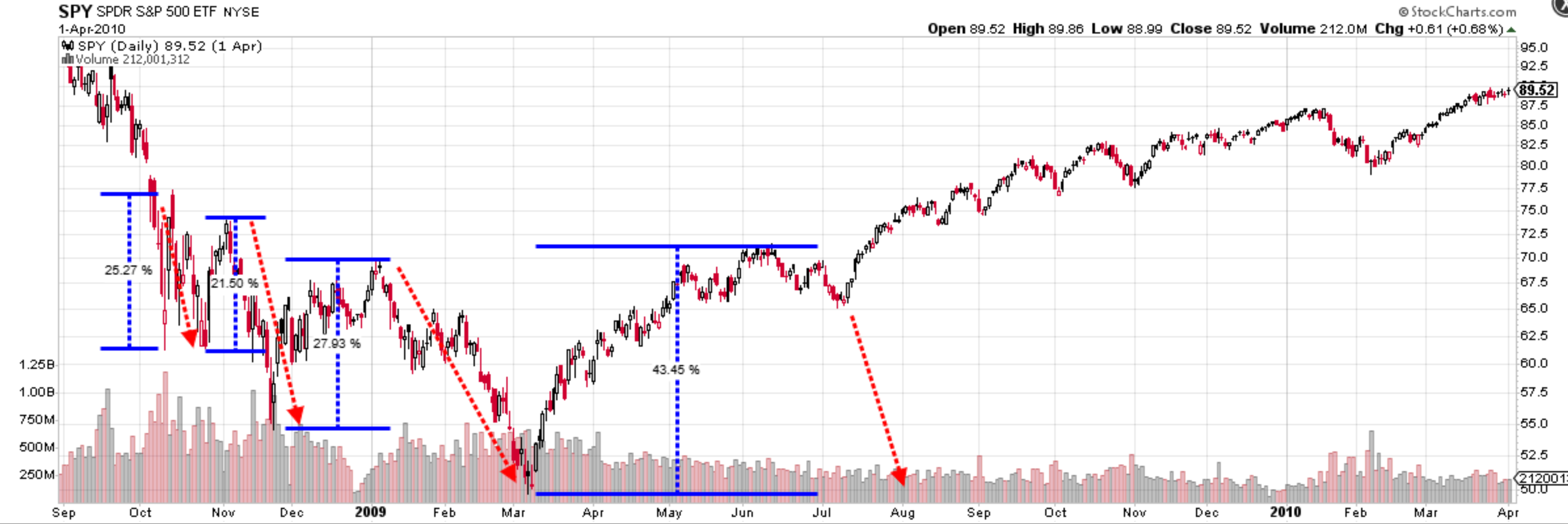

In the end, markets will stabilize and risk markets will rocket—that’s just how this process unfolds. Forced selling pushed prices below fair value which sets up the next rallies. Consider the 2008 Financial Crisis:

Charts courtesy of StockCharts.com

Even in the worst of the bear market, investors watched in disbelief as the S&P 500 rallied 20 to 30% on three separate occasions, each time seeing those rallies fade and new lows emerge. This is what makes bear markets so difficult, investors who sold prior to each of those rallies “knowing” that things were going to get worse watched in disbelief as the market advanced way past the level where they capitulated.

Why Market Timing Rarely Works

Many bought the top of those rallies just in time to suffer new losses. By March of 2009, almost no-one believed the market had bottomed. I remember well how many professionals and pundits fully expected the market to “retest the March lows” in the summer of 2009. Investors who tried to time the market generally missed the full 40% recovery. I was there—these are lessons you never forget.

Feeling Tempted to Move to the Sidelines?

There is a temptation to think that it is preferable to “sit-it out” or “move to the sidelines”. The problem with that thinking is that it fails to answer the more important question—when will you get back in? Said differently, “How will you know when the coast is clear?”

You won’t.

So we sit.

Impatiently. 😀

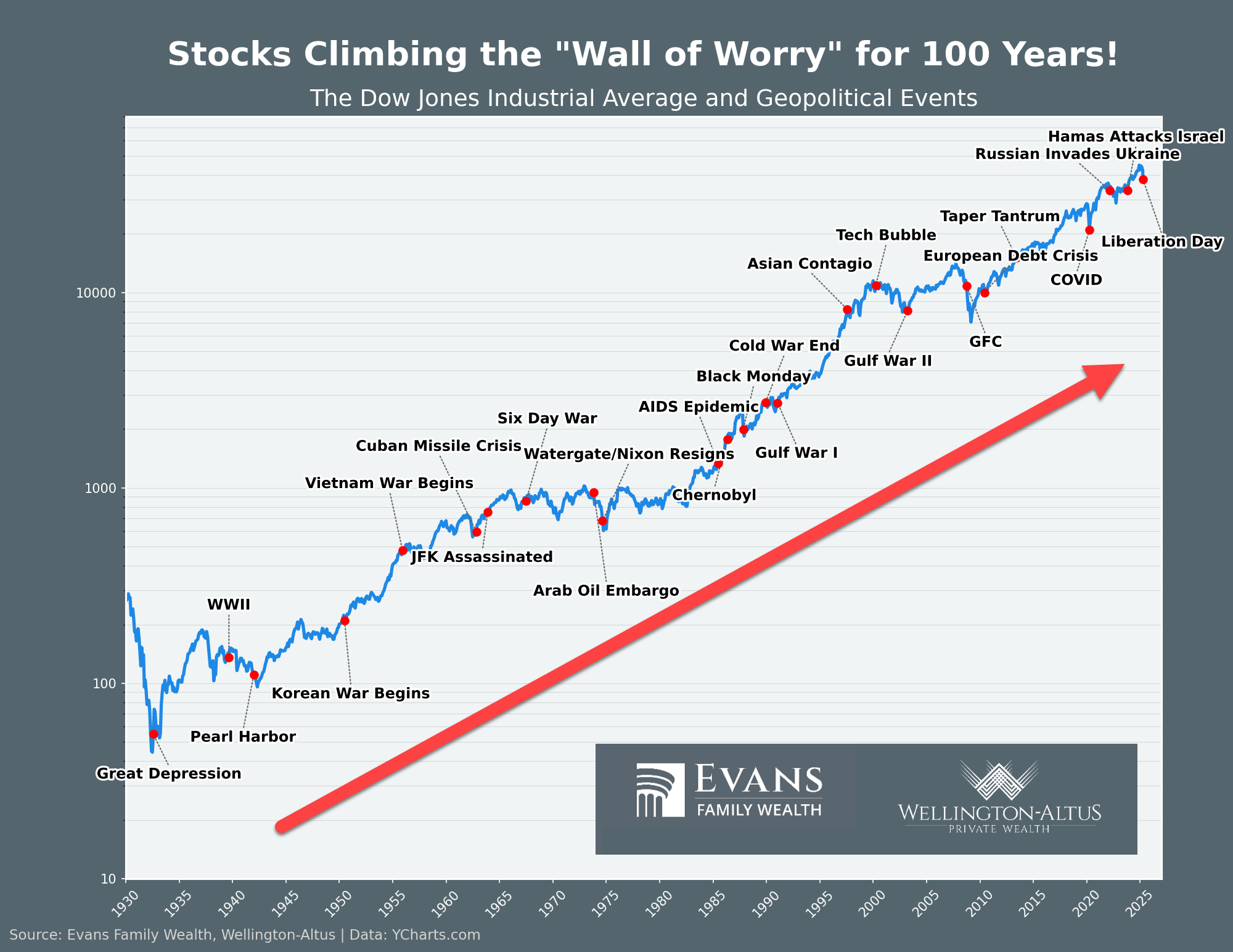

Zoom Out: Crisis Patterns Are Consistent Over Time

There are only two certainties—hindsight is 20/20 and the market will recover. You simply will not know the worst has passed until it has passed. Recovery is certain. Why am I so confident about recovery? 100 years of progress through worse crises than the Trump Wrecking Ball give me the confidence to stay in the game. Here’s a reminder of some of the crises that we’ve weathered together:

Our Role: Help You Stay the Course

We are in a crisis. The Crisis Playbook is now in effect and our most important job is to avoid making mistakes. The biggest mistake is selling and assuming we can get back into the market later. Our biology works against us—especially if we are predisposed to negativity. It’s natural to be concerned—even worried. That’s why our most important job right now may be to help you recover confidence and “zoom-out” to see the longer term implications.

People in your circle are having the same worries that you are. We’re here to help. Please share this message with those you care about—help us, help them.

Watch the Video: Wrecking Ball! How Trump’s Trade War Retreat Sparked a Historic Rally

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen