Mount St. Helens Eruption, May 18, 1980 (Google images)

The Pressure Builds: A Lesson from Mount St. Helens

The destruction of a mountain began with a tectonic plate sliding only 1 1/2 inches a year.

Year after year, the Juan de Fuca Plate crept beneath its continental neighbour, leaving voids that magma rushed to fill. Earthquakes punctuated the process, but on the surface, the mountain hardly seemed to notice—inside the pressure was building.

In March, a sudden swarm of quakes fractured new fissures, channelling even more magma upward. With each passing day, the north summit began to bulge, rising as much as 500 feet—pushed higher by the incredible pressure of the magma. Imagine the force required to lift a mountain 500 feet! At 8:32 a.m. on May 18,1980, Mount St. Helens erupted.

Mount St. Helens before and after (Google images)

The Global Economic Eruption: How MAGA Policies Are Reshaping the World

It turns out the global economic order isn’t so different from Mount St. Helens. Instead of magma building pressure, the global economic order has erupted due to MAGA. It’s been a long time coming.

The Liberal International Order (LIO) that was ushered in after the Second World War reached its apex with the collapse of the Soviet Union which heralded a unipolar world. In truth, scholars debate whether it ever actually existed—pointing out that the United Nations and the 1948 Universal Declaration of Human Rights coexisted with contemporaneous covert CIA coups and proxy wars. Over the last 80 years, pressures have built, and the summit has swelled. For better or worse, the earthquake of the Trump presidency has caused an eruption. Canadian investors (and taxpayers) need to pay attention.

“Germany’s chancellor-in-waiting didn’t wait for the final results of his country’s election on Sunday to herald a new era in Europe. Declaring the U.S. indifferent to this continent’s fate, Friedrich Merz questioned the future of NATO and demanded Europe boost its own defences. Quickly.” —source.

Europe has gotten the message—has Canada?

Canada’s Opportunities in a Changing Global Order

While the eruption of Mount St. Helens was a catastrophe which irrevocably changed the landscape—it was not the end of the world. So too with the changing world order. Investors need to quickly pivot from outrage and disbelief to pragmatic realism. In a changing world, much of what Canada offers will continue to be in high demand. Consider the following:

-

Oil Exports Remain Strong

- Trump is not even proposing to tariff our oil exports at the top level. The U.S. needs our crude (so does the rest of the world). Now that the twinning of the TMX pipeline is basically complete we will be able to 3x our exports to Asian markets and reduce our dependence on the U.S.

-

Liquefied Natural Gas (LNG) is a Growth Opportunity

- Canada ranks fourth in the world in LNG supply but only sixth in the world in exports. We need to build the infrastructure to supply like minded countries. This will build allies while it creates revenue.

-

The Melting Northwest Passage Could Be Canada’s Advantage

- The melting north-west passage has Trump interested in Greenland and Canada’s North due to the possible shipping lanes that might open. NORAD modernization should benefit Canadian suppliers just as the DEW line did in the 1950’s. If it’s valuable to Trump, it’s valuable to Canada—we need to prioritize icebreakers to open (and defend) the north. Imagine the Suez Canal with walls of ice—opened and closed by Canadian icebreakers collecting a shipping toll for access. We secure the north and generate revenue.

-

Canada’s Rare Earth Minerals Are in High Demand

- Canadian minerals and rare earth minerals (particularly in the north) are a bounty that is in demand. We need a moonshot type program to fast track these projects.

-

Canada’s Technology Sector Can Lead the Way

- Canadian technology hubs in Waterloo and elsewhere could lead the way in drone and other power projections. We need a DARPA program in Canada to commercialize the research that is generally flowing south of the border.

Canada Must Act Now to Stay Competitive

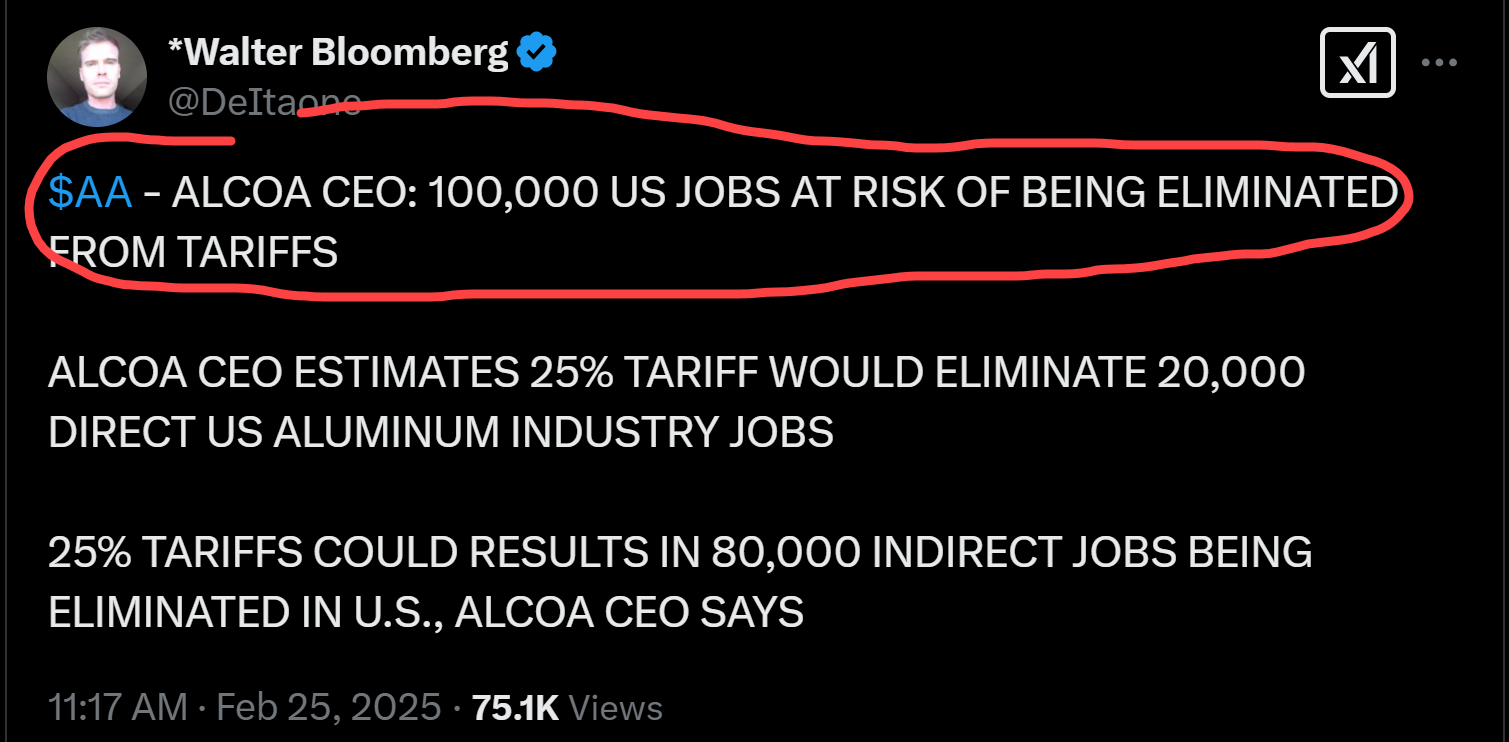

Do you see the theme here? Canada is far from powerless. We have levers that we can and should pull to compete in the changing world order. As investors, we should also be dubious of Trump’s ability to execute this transition without losing support. Yesterday the CEO of Alcoa (the largest aluminum producer in North America) fired one of the first warning shots. Wait until United Auto Workers (UAW) revolt…

Market Reactions: What Investors Need to Know

Simultaneously, some of the largest hedge fund managers are getting nervous. They correctly point out that Trump’s tariffs are a tax on consumers, that DOGE is an austerity measure, and that low immigration is negative for growth.

As Steve Cohen, founder of Point72 Asset Management puts it: “this is a toxic brew” and he is now bearish the U.S. economy and stock market for the first time in years—source.

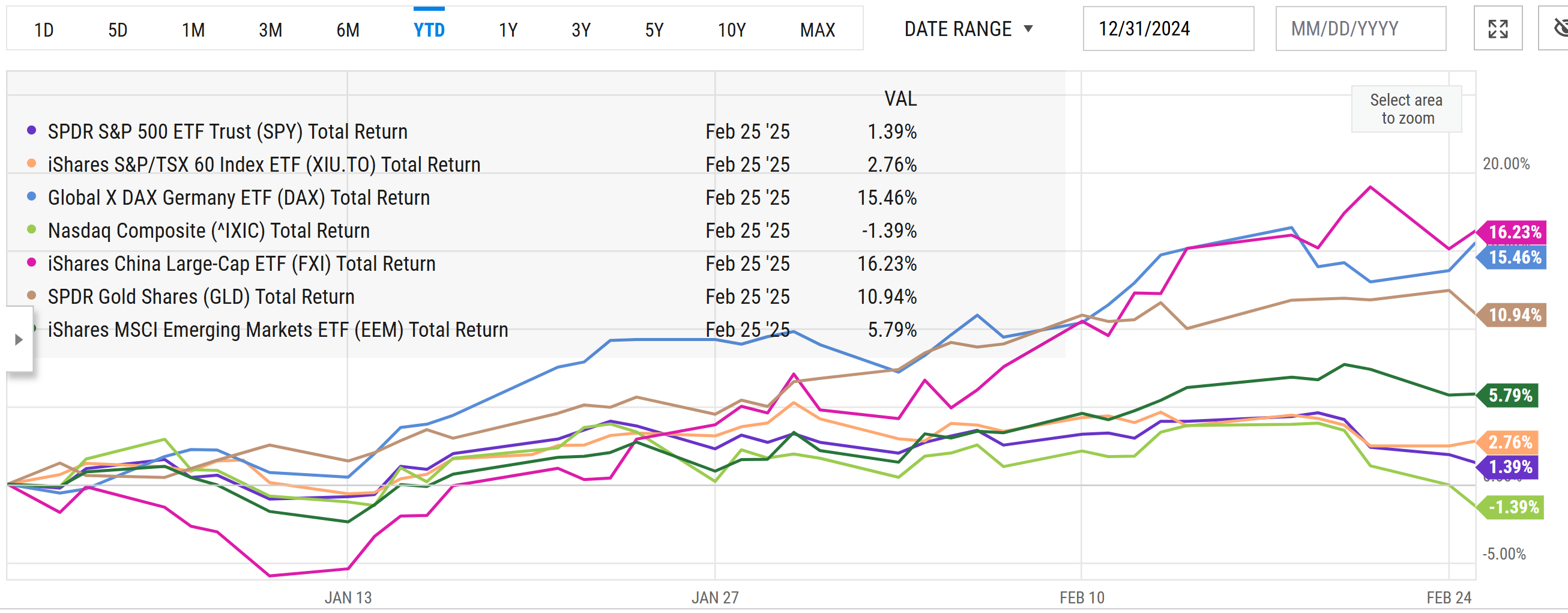

That may explain the recent market volatility and the relatively poor performance of the S&P 500 and the Nasdaq compared to global markets so far this year. As the chart below shows, the U.S. markets are lagging even Canada!

YCharts.com © 2025 YCharts, Inc. All rights reserved

Investor Sentiment and What Comes Next

I’ve rarely heard so much anxiety in the client calls as I’ve heard recently. The point of this note is not to minimize the risks or suggest that we have the answers, but to point out that there will be winners and losers—and to assure you that we’re doing the work to try to help you identify and profit during this transition. February has been a disappointing month (particularly the last week) expect to see that some of January’s gains have been given back. That’s perfectly natural considering the times.

Markets Heal: Lessons from Nature and Investing

Finally, know this—nature (and markets) heal. Yes, Mount St. Helens was transformed by nature, but it remains no less beautiful.

Watch the Video: Markets, Magma and MAGA

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen