Rumble’s got it good. Maybe too good! Look at him lying on the couch. That look says – “feel like bringing me a treato?” He’s become accustomed to getting something for nothing (aside from being so handsome!) Investors though, need to be a little more discerning when we’re offered something for nothing.

The “Too Good to Be True” Rule for Investors

David Swensen, the former Chief Investment Officer for the Yale Endowment wrote, “As a general rule of thumb, the more complexity that exists in a Wall Street creation, the faster and farther investors should run.” I’d shorten his rule to one you’ve heard since childhood: “if it sounds too good to be true it probably is!” I’ve followed Swensen’s (and my mother’s) advice by staying away from many ideas including Structured Notes and Private Equity and Credit. That prudence looks to be paying off.

Structured Notes – More Risk Than Reward

Structured Notes typically combine a bond with a derivative (a call or put option – if that sounds complicated there is your first clue). They promise either full or partial principal protection with possible upside within certain stipulations (the devil is in the details). While these products can pay fat commissions, researchers studying them have concluded: “The results clearly show that structured products have dramatically underperformed alternative allocations to stocks and bonds because of overvaluing the products… “Results of our index analysis should cause investors and their advisers to avoid structured products.” – source

Private Equity – Not the Holy Grail of Investing

What about Private Equity? Once again, the pitch sounds too good to be true – higher returns than public markets with lower volatility! Rumble’s ears perk up at the sound of that! Here’s a pro-tip, when a celebrity like Tony Robbins writes a book about Private Equity and Credit and titles it, “The Holy Grail of Investing” – it’s probably best to wonder if the opportunity has passed. – source.

The Downside of Private Equity and Its Unintended Consequences

Sophisticated investors like Swensen’s peers at endowments and pension funds failed to heed his advice. They bought Private Equity (and Private Credit) on the promise of higher returns and lower risk and volatility (and were willing to pay exorbitant fees and agree to hold the investments for many years in exchange). Now the Wall Street Journal is reporting about the unintended consequences of investing in something that sounded too good to be true.

“It is the latest cash crunch to befall retirement funds that have piled into hard-to-sell investments in search of high returns, and spotlights the risks as Wall Street is trying to sell those investments to wealthy households…Large public pension funds have an average 14% of their assets in private equity, while large corporate pensions have almost 13% in private equity and other illiquid assets such as private loans and infrastructure, according to data from Boston College and JPMorgan Chase. Much of the money was committed when low bond yields were dragging down retirement portfolios…Nearly half of private-equity investors surveyed by the investment firm Coller Capital earlier this year said they had money tied up in so-called zombie funds—private-equity funds that didn’t pay out on the expected timetable, leaving investors in limbo. So pension funds are selling private-equity fund stakes secondhand—often taking a financial hit in the process.” – source.

“No Treato?!!” Rumble

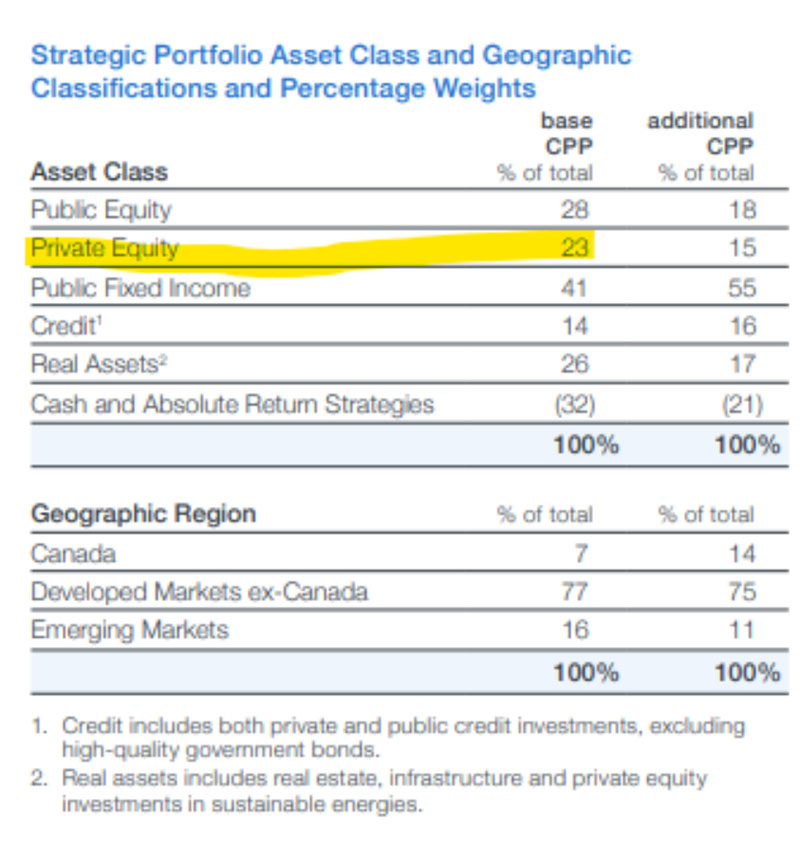

Private Equity Risk for Canadians: A Growing Concern

Think this is just a US problem? Think again, the Canadian Pension Plan has 23% of their assets in Private Equity.

Insulating Portfolios from Risky Financial Products

Admittedly, I’m being a bit harsh here. Investors who fully understand the risks of Structured Notes and Private Equity have every right to risk their capital as they see fit. Some advisors are no doubt finding the perfect use case for these investments. For me, they just never made sense. Too costly and complex. I’ve learned the hard way that this business requires humility. Practitioners who lack it will be taught it – but it will be their clients who pay the price. An unsung part of my job is insulating your portfolios from complex financial products – following Swensen’s advice and running away!

Glen