August 5, 2022

Rebirth or a Financial Crisis

“To be or not to be, that is the question. Whether ‘tis nobler in the mind to suffer the slings and arrows of outrageous fortune.” — Hamlet, Act 3, Scene 1, William Shakespeare

Words and phrases derive much of their meaning from the context in which they are expressed. In Shakespeare’s famous soliloquy, we find Hamlet wondering whether he should continue to be — meaning to exist (to remain alive), or not to exist. One can easily suggest that Shakespeare poses

this question to all of humanity, rather than only Hamlet, and thus is crucial in framing our current investing environment. Given the criticism — or “slings and arrows” — from many that have politicized inflation; the fact that the U.S. Federal Reserve (the Fed) is behind the curve; and the outrageous fortunes of Covid-19 fiscal policy response and extraordinary circumstances of war, central bankers (and the global economy for that matter) are facing their Hamlet moment. Our call: central bankers will choose “to be” and pivot before causing a financial crisis.

St. Louis Federal Reserve President James Bullard states that the tightening cycle of 2022 is very similar to 1994 [1]. In 1994, also a mid-term election year, Newt Gingrich and the Republican party running on the “Contract with America” platform against the Clinton administration created a high degree of political uncertainty. During this period, the Fed raised rates seven times in 13 months, increasing the federal funds rate from 3.05% to 6.05%, and didn’t stop raising rates until the first quarter of 1995. Yet, the stock market anticipated the end of the aggressive tightening cycle as the Fed’s normalization policy reached its inflection point in November of 1994, after the mid-term election. This set up a secular bull market that ran until the end of the decade. Implicit in Mr. Bullard’s framing [2], is the Fed choosing “to be” over “not to be” – a rebirth vs. a financial crisis.

Shifting to today, the Fed recently increased its overnight interest rate by another 75 basis points (bps), bringing the federal funds rate to the long-term terminal level. They also eliminated its forward guidance, which indicates that future rate hikes will depend on incoming data. They are no longer behind the curve, thus implying the most subtle and nuanced of pivots.

As suggested by the immortal words of great American philosopher Yogi Berra, “When you come to a fork in the road, take it.” Late in 2021, we forecasted that in 2022 the Fed and the global economy would reach such a fork. The foundation of my 2022 forecast has been the traditional political mid-term cycle. Contrary to the consensus, I have suggested that central bankers will do what they said they would do: employ the Maradona effect [3] with front-end loaded rate hikes. Where I differ is that once the terminal level of interest rates is reached and price stability is achieved, a policy pivot from uber hawkish will happen quicker than expected. Investors should note that cycles occur quickly and are priced into capital markets even faster. Thus, as the economy and prices decelerate, central bankers will pivot.

The work of American psychologist Stanley Milgram [4] has shaped my biases. Milgram’s work shows how individual decision-makers ignore facts they know to be true to conform to society’s views — in this case, consensus views of the market. Many pundits and investors today choose to ignore the price data presented to us in everyday life, and not question the validity of the backward-looking data we receive from government agencies. An example of this is when gas prices at the pump substantially decline, but that data is not represented correctly in the CPI data released. Very few, if any, question the freshness of the CPI data. This researcher felt it was odd that the June CPI data recorded gasoline prices up 11.2% when prices at the pump declined over 15%. Investors should expect the proclamations that “this is a bear market rally” to continue. The key takeaway from Milgram’s work is that there is safety in numbers. We agree with Howard Marks’ [5] most recent memo, “I Beg to Differ”; that is, we are comfortable with our non-consensus view that the Fed and the Bank of Canada will engineer a soft landing. In fact, a recent presentation by Alan Blinder given at Princeton University [6] concludes that there have been seven softish landings since 1965 and one perfect soft landing in the 1993-1995 tightening episode. The 1995 episode is ironically the episode that James Bullard has asked investors today to anchor off of. Consensus would have you believe soft landings never happen; the historical data suggests otherwise.

Separating the signal from the noise is intricate and complex. Today, we are witnessing a classic example of survivorship bias, a form of selection bias that can lead to overly optimistic or pessimistic beliefs. For instance, even if the underlying data contradicts what we observe in real life, why rock the boat and deviate from consensus?

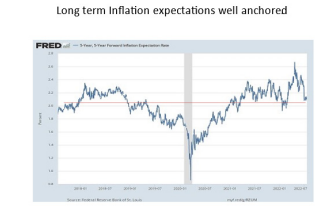

I suggest the economy is slowing and that prices are declining; job data suggest wages are not spiralling out of control. Eurodollar futures markets are pricing in 75 bps of cuts starting in early 2023. In my estimation, long-term inflationary expectations are well anchored, and the Fed will pause in the fall; this is not the consensus view.

Our holistic analysis of the current situation is not one-dimensional, that is, driven only by labour market dynamics tainted by the lingering effects of the pandemic [7]. As the economy slows and prices rapidly decline, so will the slings and arrows (the narrative in the market). Thus, allowing central bankers to generate a soft landing rather than tighten too aggressively, causing a prolonged recession or even a financial crisis. The holistic approach should also have a fiscal policy element. Fiscal policy can and should play a significant role.

Furthermore, it will be interesting to see in a year how much of the inflation we experienced in 2022 was caused by companies taking advantage of the macro environment to increase prices and expand margins. The proclamations by consensus to adopt what many refer to as the Volcker playbook, and solely concentrate on a backward-looking jobs report and volatile headline CPI, should signal to investors that central bankers are indeed having their Hamlet moment.

Behavioural finance teaches us that how we frame the current environment is a critically important element of the decision-making process. Given the extreme risk and adverse positioning in the markets, we suggest that framing the recent market turmoil in the context of a rebirth narrative, “to be” as opposed to “not to be” as Hamlet would say, is the correct framing for investors to employ.

The credit markets concur; Eurodollar futures markets now forecast that interest rates will start to decline in early 2023. As the compression of market cycles amplifies market volatility, investors need to get positioned for the coming pivot by central bankers. The introduction of the rebirth narrative and the recent action of long-duration assets in the credit and equity space suggest that many forward-looking managers are starting to accept our non-consensus view. Equity markets are starting to pivot as we speak.

This Time It’s Different: Central Bankers Get It!

Today, the global economy is dealing with environmental concerns, high inflation, and the rise of populism. With the worldwide economy dealing with the aftershocks of Covid-19 and the war in Europe, citizens worldwide are losing hope. Efforts by central bankers to rapidly raise interest rates while the global financial debt burden is at extreme levels could imply that central bankers are willing to consider a policy mistake — a financial crisis — as an acceptable risk to defeat inflation.

We have theorized that it’s part of a logical strategy of economic coercion to defeat inflation through reflexivity. Like Hamlet, who pretended to be mad for his gain, investors should assume that there is a method behind central bankers’ perceived madness. Their objective is to defeat inflation and return to price stability without damaging the global economy. To wit, the aggressive tightening — front-end loading rate hikes to get to the terminal rate — has always been their proclamation. However, with excessive debt levels, the Fed’s forecasted terminal rate is too high. But as a first step, raising rates to the indicated terminal level by September and then cutting interest rates back in 2023, as St. Louis Fed President James Bullard recently suggested, makes complete sense.

To be clear, I differ from others when analyzing the current environment. The 1997 Long-Term Capital financial crisis and the 2008 financial crisis helped form my biases. I also suggest that the post-WWII era is a better roadmap for investors than the 1970s. My criticism or concern is the willingness of policymakers to ignore the extreme levels of debt that exist today and to assume that the economic data they are anchoring in their policy decisions are permanent and not tainted by two exogenous shocks. The consensus believes that the European Central Bank (ECB), the Fed, and the Bank of Canada (BoC) can raise rates to levels higher than the inflation rate, as they have done in the past. This belief is folly. I believe that solid deflationary forces still exist and that the global economy is now on a glide path back to a period of slow growth, high debt, and secular stagnation, as we saw before the pandemic.

The risk of tightening too much is a global financial crisis; that tail risk is significant yet ignored by many. Policymakers are not omnipotent and make mistakes. Do we forget the statement by Fed officials in 2007 that there would be no subprime mortgage crisis? With the ECB raising rates 50 bps and the subsequent intense selloff in European Sovereign Bond yields, credit markets remember that the ECB raised rates in the summer of 2008. Since the 2008 crisis, there has been no substantial remediation or dealing with a global economy with excess debt levels and central bank intervention. It would be folly for the ECB to continue to raise rates to 2% as many pundits request, and the credit market concurs.

Investors should note the lack of discussion of this significant tail risk while being singularly focused on a tight labour market caused by the Covid-19 crisis. The belief that the current labour market is normal should concern investors and heighten the possibility of a significant policy mistake. I suggest that the data accurately reflect labour force dynamics once workers return to the office. Forward-looking indicators like the ISM Purchasing Managers survey show new orders and employment subcomponents in contraction, below 50. Federal Reserve Regional Surveys and the S&P PMI data unequivocally point to a global economy rapidly decelerating. Through an aggressive communication strategy and front-end loading interest rate hikes, such that we have experienced the most aggressive tightening cycle in history, the goal of defeating inflation while simultaneously achieving a soft-landing is now in sight.

The second 75-bps hike by the Fed suggests that the front-end loading of rate hikes is over; the terminal rate has been reached. In addition, the ending of the Fed’s forward guidance suggests to us a nuanced and implicit policy pivot. The positive response of risk assets reinforces our conclusion. The last step is the explicit pivot, which should happen this fall. Expect risk assets to continue to perform well, anticipating this move as they did in the 1994-95 episode.

What Should Investors Do?

Our forecast was for the markets to follow the traditional mid-term election cycle. The first half would be dominated by political uncertainty and a correction of the S&P 500 of 18- 20%, as predicted by data going back to the end of WWI [8]. As a result, we suggested investors get defensive and raise cash coming into 2022.

The subsequent correction of 24% was the 12th worst in post-depression history. Historical data reveals that investors have been rewarded with above-average returns when buying after a 20% market decline. Data on the mid-term election cycle from WWI to present points to above-average gains for equity investors buying low in the mid-term election cycle. As inflation starts falling towards its forecasted breakeven, stock multiples will have room to expand. If we head back to a period of low growth, inflation, and interest rates, then growth stocks will outperform.

The secular forces of deflation are still present, irrespective of what the pundits proclaim. As political uncertainty declines and data supporting the Fed’s pivot becomes evident, the markets that discount the future should have a strong rally. Thus, we predicted that equity returns would be back-end loaded. No, we did not expect the war in Ukraine and the accompanying inflation spike. But we did forecast that consumption would evolve from goods to services, the economy would open up, and the lasting effects of the pandemic would recede. We thus concluded back in early June that the bottom of the stock market was in and that investors should slowly add risk to their portfolios over the summer.

The delay in appointing U.S. Federal Reserve Chair Jerome Powell and other board members, and the subsequent votes along party lines, were very concerning. The other odd event was the pivot by central bankers on their policy targets from price stability – average inflation targeting Core PCE – to focus on the employment market (the Phillips Curve) and headline CPI. Consensus has taken the bait and implicitly assumes that wage inflation is driving this current inflation spike; however, we disagree. Using the post WWII era as our guide, not the 1970s, we still suggest that the Fed will pivot at the September meeting, and that market consensus will eventually realize central bankers are focused on price stability.

History reveals that policy pivots usually occur once price stability is achieved and prices start to decline, but long before the target objective of 2% Core PCE is reached. The policy normalization arc is upon us, the interest rate peak is in, and equity markets are starting to respond. Our conviction trade since June has been to buy long-duration government bonds, with an eye on manifesting the same and going long duration in equities. Even with the BoC raising rates by 1%, the Canadian 10-year Government Bond yield continues to decline from its peak in early June. The hated technology sector is where investors need to start allocating capital; the short-covering rally has begun.

To me, this market feels like 1994, 2003, and 2009. The stock market rally’s first phase was a classic short-covering rally lasting months in each of these periods and this time, it’s no different. As economic growth, inflation, and interest rates decline, stocks tend to climb a rally of worry. Our recommendation to buy long-dated government bonds because we feel that the peak interest rates are in (a controversial call made in early June), is starting to pan out. As for equities, if we are correct, 12 months out we will be presented with the narrative that it was “easy” if you bought in the summer of 2022. But to quote Charlie Munger, “It’s not supposed to be easy. Anyone who finds it easy is stupid.”

The nuance we suggest is that cycles are now shorter in duration. We are still firmly in the camp that secular deflationary forces are strong. While we may well be in a new era, it may take decades to escape the low growth, secular stagnation environment that so many proclaimed the global economy has now just fled. With the market’s internal dynamics being more dependent on flows into and out of ETFs and structured products, investors need to be even more proactive and forward-looking than they have been in the past.

Simply put, I suggest that investors allocate capital on the premise that central bankers will choose “to be” and engineer a soft landing. Yes, the world and central bankers have answered Hamlet’s question and chosen “to be.” Let the rebirth narrative begin.

— James E. Thorne, Ph.D.

[1 + 2] “St. Louis Federal Reserve President favours 75 basis point rate hike” Nikkei Asia, July 14, 2022.

[3] Maradona scored a famous goal against England in the 1986 World Cup by running straight at the goal. Maradona was able to do this by signalling to defenders that he had a willingness to cut left or right, which he did to score his famous “hand of god” goal.

[4] “Behavioral Study of obedience” The Journal of Abnormal and Social Psychology, 1963.

[5] “I Beg to Differ,” Howard Marks, July 26, 2022.

[6] “Landings Hard and Soft: The Fed 1965-2020,” Alan Blinder, given at Princeton University February 11, 2022.

[7] “Monetary Policy in a World of Conflicting Data,” Governor Christopher J. Waller, July 14, 2022.

[8] Stock Traders Almanac. 2022, page 34.