Every year clients look at the RRSP Deduction Limit Statement on their Notice of Assessment and ask similar questions:

- Is there a difference between a RRSP contribution and a RRSP deduction?

- I have RRSP deduction room and unused contributions — what does this mean?

- My unused contribution room for the year is negative $3,500 — am I in an RRSP overcontribution situation?

Let’s start with fundamentals — the RRSP deduction limit outlines how much an individual can contribute Groupand deduct for personal tax purposes (plus the cumulative $2,000 overcontribution allowance). RRSP contributions are the amounts individuals have deposited into their RRSPs and which may be deducted for income tax purposes. If contributions do not exceed deduction room by over $2,000 there is no cause for concern.

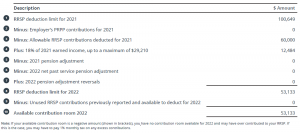

Now let’s look at the RRSP Deduction Limit Statement, which can be found on an individual’s annual Notice of Assessment/Reassessment, CRA’s My Account and MyCRA mobile app.

RRSP deduction limit statement

References to RRSP contributions also include contributions to your pooled registered pension plan (PRPP) and to your and your spouse’s or common-law partner’s specified pension plan (SPP). For more information, go to canada.ca/rrsp or see Guide T4040, RRSPs and Other Registered Plans for Retirement.

This statement is from a 2021 Notice of Assessment.

RRSP Deduction Limit Statement Broken Down

Line 1: RRSP deduction limit for 2021 — reflects RRSP carry forward room available from the prior year of $100,649.

Line 2: Reflects any optional employer Pooled Retirement Pension Plan contributions.

Line 3: This RRSP Deduction Limit Statement also reflects 2021 RRSP contributions of $60,000 that were deducted on the individual’s 2021 personal tax return.

Line 4: Additional RRSP room generated of $12,484 given their 2021 earned income times 18%, up to the annual limit. 2022’s annual RRSP contribution limit was $29,210, and 2023’s is $30,780.

Lines 5-7: Any adjustments related to Registered Pension Plan (RPP) benefits. Adjustments include registered pension plan contributions, net past service or pension adjustment reversals. Such information would have been reflected on an individual’s 2021 T4 or other pension tax slips. It appears this taxpayer is not enrolled in a pension plan with his/her employer.

Line 8: When all these amounts are combined, the RRSP deduction limit for 2022 is calculated. For this individual it is $53,133.

The next two lines can be problematic.

Line 9: Unused RRSP Contributions. This line shows RRSP contributions that have not been deducted for income tax purposes.

Line 10: Available Contribution Room for 2022. This line indicates the maximum RRSP contributions that an individual can deduct in 2022 — the next year. Contributions can be made up to 60 days after the calendar year-end, that is, by March 1, 2023.

Let’s tweak some facts to outline relevant information in Lines 9 and 10:

What if this individual had contributed $100,000 to their RRSP in 2021, but only deducted $60,000 as indicated? The remaining $40,000 would be reflected in Line 9, “Unused RRSP contributions previously reported and available to deduct for 2022.” Given the unused contributions of $40,000 are less than their 2022 RRSP deduction limit of $53,133, the amount on Line 10 would show a positive balance of $13,133 and there is no concern about overcontribution.

Let’s consider a final scenario — let’s say the individual contributed $150,000 to their RRSP in 2021, and again deducted $60,000. The remaining $90,000 is reflected as an unused contribution. Unfortunately, as $90,000 exceeds the individual’s RRSP deduction limit of $53,133 plus the $2,000 the RRSP overcontribution buffer, the individual has overcontributed to their RRSP. Line 10 would show a negative balance of $36,867 and will be subject to the 1% RRSP overcontribution penalty per month.

We hope this explanation of the RRSP Deduction Limit Statement helps in your RRSP planning. Remember, you don’t have to be the expert here — if you have questions, please reach out to your Wellington-Altus advisor.