Download this PDF here.

Dow at One Million?

When the Dow Jones Industrial Average (Dow) crossed a new high of 40,000 in May, it achieved a milestone that appeared implausible given recent popular sentiment. Just two years earlier, central banks were still on the path of aggressively hiking rates to curb inflation. Gloomy equity market forecasts abounded. Fast forward to today, and interest rates remain higher than anticipated. Many valuation models use interest rates to discount future cash flows: higher rates lower a company’s future earnings and put downward pressure on stock prices. Alongside slower economic growth and high debt levels, the future has appeared cloudy through many lenses. Yet, markets can often be confounding.

From an economic perspective, this period has been described by some as a liminal space, a transition between ‘what was’ and ‘what’s next’ — a sort of “in-between” economy that’s neither great nor terrible. It’s a fair observation and perhaps explains why financial narratives seem varied and shifting. In December, many market observers believed we had inflation in check; yet the anticipated rate cuts did not largely materialize in the first half of the year — the Bank of Canada was the first G7 central bank to reduce rates in June. To preserve credibility, central banks have been moving cautiously after being criticized for their slow response to rising inflation; the consequences of the 1970s still loom large.

Nobody wants a repeat of the 1970s, a time when inflation persisted for an entire decade at an average of 8 percent per year, alongside high unemployment, or stagflation.1 It was only when then-Fed Chair Paul Volcker raised rates to a whopping 20 percent by 1981 that inflation would be conquered, but not without significant pain. Today, labour markets remain resilient amid easing inflation — an enviable outcome. Consider that inflation and unemployment traditionally exhibit an inverse correlation, and multiple studies suggest that higher unemployment depresses our well-being more than inflation, in some cases up to five times as much!2

Where are economies and the financial markets headed? Looking forward, it’s worth recounting a prediction made by renowned investor Warren Buffett years ago: Expect the Dow to reach one million in 100 years.3 At first glance, this may seem like quite the assertion considering the Dow hovered at a mere 100 points just 100 years ago.4 However, looking deeper at the numbers, the Dow needed to compound at less than 4 percent annually to achieve Buffett’s target at that time. Today, the S&P/TSX would need an annual return of 4 percent to reach 1,000,000 by 2124.

Yet, Buffett’s intent wasn’t to propose whether an arbitrary benchmark could be achieved. Rather, he meant to inspire confidence in future growth. History has shown that equities outperform most asset classes over time; not surprising given the general upward trajectory of corporate profits. This doesn’t imply that there won’t be challenges along the way — today, there are many. Yet, we continue to overcome these challenges because one thing hasn’t changed: the human condition to advance and grow. As investors, we shouldn’t lose sight of the growth yet to come, and we can all benefit should we choose to participate. I am here to provide wealth management strategies and support to navigate this liminal space — as we progress toward the one million mark.

I hope you will find some time to relax and rejuvenate this summer. As always, I remain here to support any investment needs.

1. https://www.bankofcanada.ca/2019/02/price-check-inflation-in-canada/;

2. https://www.wsj.com/articles/inflation-and-unemployment-both-make-you-miserable-but-maybe-not-equally-11668744274; 3. https://www.cnbc. com/2017/09/21/dow-1-million-warren-buffett-says-it-can-happen.html; 4. http://www.fedprimerate.com/dow-jones-industrial-average-history-djia.htm

SUMMER BRINGS HOME-BUYING SEASON

FHSA or HBP: Reasons to Prioritize the FHSA

As a result of the federal budget increasing the withdrawal amount for the Home Buyer’s Plan (HBP), some clients have asked which plan is better for younger family members: the First-Home Savings Account (FHSA) or the HBP, via the Registered Retirement Savings Plan (RRSP).

As a reminder, the FHSA is a registered account that allows tax-deductible contributions and tax-free withdrawals for the purchase of a first home. Annual contributions of $8,000 to a lifetime limit of $40,000 can grow on a tax-sheltered basis. The account can remain open for 15 years. The HBP allows first-time buyers to tap their existing RRSP, subject to conditions, for a tax-free withdrawal of up to $60,000. The amount must be repaid within 15 years; otherwise, it will be considered taxable income. Until now, the repayment period began in the second year after the first withdrawal. However, the budget has proposed to temporarily defer this start by three additional years.

Simply put, the FHSA allows holders to save and grow funds, whereas the HBP acts as an interest-free loan from the RRSP. While both can be used to purchase a first home, if funds are limited, which should be prioritized?

In many cases, the FHSA may be beneficial and here are reasons why:

1. Starting early, you may be able to access a greater amount —With both the FHSA and RRSP, starting early allows greater time for funds to grow on a tax-deferred basis. Given the FHSA’s 15-year limit, if an investor opens the account at age 18, by maximizing contributions from the outset, at a five percent annual return the account could grow to over $75,000 by age 33, more than the $60,000 withdrawal limit via the HBP.

2. Greater withdrawal flexibility — Funds can be withdrawn tax free from the FHSA for the purchase of a new home. HBP withdrawals are only tax free if repaid within a certain time.

3. Unused amounts — If not used to purchase a first home, FHSA amounts can be transferred to the RRSP. This won’t affect existing RRSP contribution room and effectively increases the overall RRSP contribution room. Of course, the choice may be impacted by various factors, such as timing. At the end of the day, both the FHSA and the HBP, through use of the RRSP, provide excellent tax-advantaged opportunities to build wealth for the purchase of a first home. Where possible, younger folks should maximize contributions to both. If you have family members needing assistance opening the FHSA, please call the office.

WHAT’S BEHIND OUR INCREASING EXPENDITURES?

Three Perspectives on Our Higher Cost of Living

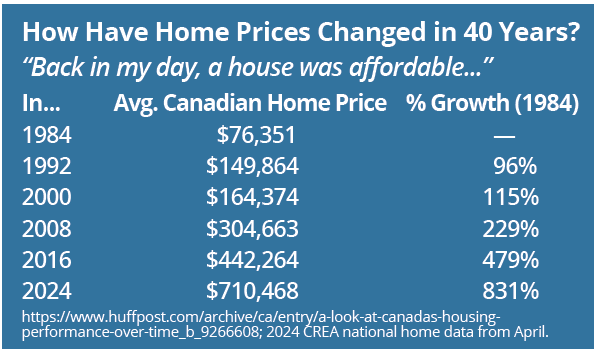

With higher inflation, the increasing cost of living has been top of mind for many Canadians. While there has been good news on the inflation front given continuing signs of easing, here are three perspectives on our rising cost pressures.

1. Today, less of our paycheques go to necessities. Despite a substantial rise in grocery costs, it may be surprising that the proportion of income spent on necessities has declined substantially over time. In 1961, Canadians spent 33.9 percent of family income on food and clothing; today, this has declined to just 14.6 percent. This is largely because incomes have grown faster.

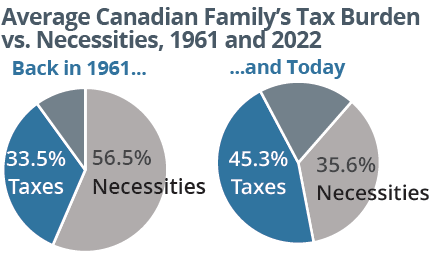

2. Which expenditure has grown the most? Taxes. According to the Canadian Consumer Tax Index, the average Canadian family spends 45.3 percent of income on total taxes, compared to 35.6 percent on necessities. Since 1961, there has been a 2,778 percent rise in the taxes we pay, outpacing increases in the Consumer Price Index (that measures changes in prices), which has increased by 863 percent.

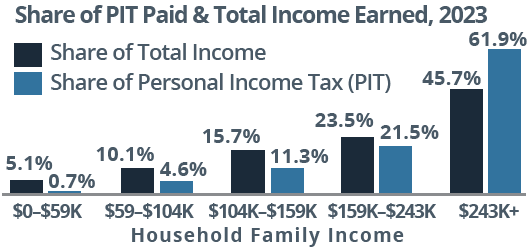

3. Higher-income taxpayers shoulder the heaviest tax burden. When comparing the share of taxes paid to the share of income, the highest income earners pay the most tax. The top 20 percent of income earners (with family income over $243,000) pay 61.9 percent of personal income taxes (PIT) yet represent 45.7 percent of total income. Every other income group pays a smaller share of PIT.

1. & 2. https://www.fraserinstitute.org/studies/taxes-versus-necessities-of-life-canadian-consumer-tax-index-2023-edition; 3. https://www.fraserinstitute.org/studies/measuring-progressivity-in-canadas-tax-system-2023

INCREASES TO THE CAPITAL GAINS INCLUSION RATE

To Defer or Not to Defer: Realizing Capital Gains

The proposed* increases to the capital gains inclusion rate have prompted some investors to ask the tax-planning question: To defer, or not to defer? Tax deferral is commonly viewed as a way for investors to create greater future returns, since funds that might otherwise go to paying tax can remain invested for longer-term growth. Yet, with increases to the capital gains inclusion rate, individuals may be evaluating the possibility of deferred taxation at higher rates against accelerated taxation at a lower rate.

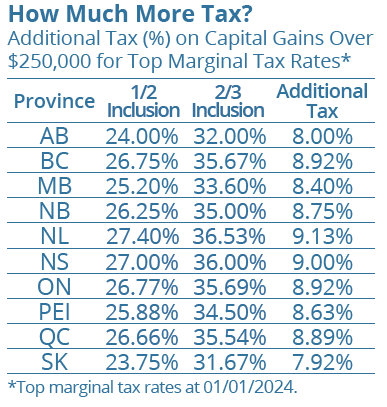

As of June 25, 2024, the capital gains inclusion rate increases from 1/2 to 2/3 (50 to 66.67 percent) for corporations and trusts, and for individuals on the portion of realized gains in the year that exceeds $250,000.

As one scenario, for a realized gain of $100,000 at a marginal tax rate of 48 percent, an investor would save $8,000 in tax by realizing a gain at the 1/2 inclusion rate, rather than realizing the gain at the 2/3 inclusion rate. However, this comes at the cost of “pre-paying” $24,000 in capital gains taxes. If this amount was instead invested in a portfolio returning 5 percent per year, it would take 9 years of tax-deferred growth at the higher 2/3 inclusion rate to beat the $8,000 in tax savings.

Here are some considerations for individual investors:

Spread gains over multiple years — Where possible, consider realizing gains over multiple years to make use of the lower inclusion rate (under $250,000) compared to a larger realized gain in a single year.

Harvest gains — Deliberately selling and rebuying stocks to trigger a capital gain may be a way to reset book value over time. This strategy is often considered for years when an investor is in a lower tax bracket, but may be used to capitalize on the lower inclusion rate each year. The decision may depend on a variety of factors such as time horizon, current/future tax rates and potential growth rate of investments.

Donate securities — Assuming the new rules apply to the deemed disposition of assets at death, if you are considering donations to support a legacy, the use of publicly-listed securities may be beneficial.

Any accrued capital gain is excluded from taxable income and a donation receipt equal to the value of the donated securities will be received. Note: For large donations other than in the year of death, the Alternative Minimum Tax may apply.

Business owners — Evaluate whether certain assets should be held in the corporation or owned personally. For corporations, there is no

$250,000 threshold and 2/3 of realized gains are taxable.

Plan Ahead: For many, the increased inclusion rate will mean higher future tax liabilities. Planning ahead is important. The use of insurance or other planning techniques may help to cover a higher tax bill, such as on the transfer of a family property or on death. For business owners, the use of corporate-owned insurance or an individual pension plan may support a business’ tax strategy. Forward planning can also help access available exemptions, such as the lifetime capital gains exemption. As tax planning remains an important part of wealth planning, seek advice.*Please note: Legislation has not been enacted at the time of writing.

A BRIEF LOOK AT INDICES

Does the Dow Matter? What’s in an Index

The Dow Jones Industrial Average (DJIA or Dow) is one of the most widely watched stock market indices and the second oldest in the world. Created in 1896 by Charles Dow, then-editor of the Wall Street Journal, it originally comprised 12 companies from traditional heavy industries, such as Chicago Gas and National Lead, giving it the name ‘Industrial Average.’ Today, the index represents 30 companies, with its composition constantly evaluated and periodically revised to include leading blue chip companies across a variety of industries.

What makes the Dow unique is that it is “price-weighted,” measured by the sum of component share prices divided by a divisor that adjusts for a stock split or dividend. In contrast, indices like the S&P/TSX Composite, S&P 500 and NASDAQ are ‘value-weighted’ based on constituent market capitalization (share price times outstanding shares).

Is the Dow a good gauge of the U.S. economy? Over its lifetime, it has faced many critics. Some argue it is too narrowly focused, while others suggest its price-weighted methodology is flawed because higher-priced stocks tend to have greater influence over lower-priced counterparts.

For example, the same price change for a lower-priced stock will not impact the index as much as that of a higher-priced stock, despite a greater percentage change for the lower-priced stock.

The Dow Today: Does It Matter?

What is particularly notable today is that the Dow’s rise may signal more robust market breadth, suggesting that recent equity market gains are not largely driven by just the technology sector. Consider that the tech sector accounts for 58.8 of the NASDAQ and 29.0 percent of the S&P 500, yet only 18.6 percent of the Dow.

Taking a broader perspective, while indices often have their limitations, they remain valuable as indicators and benchmarks of performance. The long history and ongoing advancement of the Dow Jones Industrial Average, in particular, should remind investors of the enduring trend of economic growth and continued progress.

Summer Perspectives: Live Long and Prosper

Better Health & Better Wealth

Many of us remember the classic Star Trek mantra ‘live long and prosper,’ which may be worth reflection as we enter the leisurely summer months. The keys to a longer and more prosperous life are often rooted in fundamentals that include both health and wealth.

Better Health, Better Wealth

Not surprisingly, physical, mental and financial well-being are interconnected. Perhaps one of the simplest associations between health and wealth is the cost of maintaining unhealthy habits. Consider that kicking a $5 per day smoking habit would save $1,825 annually, which could accumulate to over $150,000 in 30 years at an annual rate of return of 6 percent. While we are fortunate in Canada to have a social system that supports healthcare costs, unlike the U.S., taxpayers still bear the burden. The latest reports suggest that chronic diseases, many preventable, account for more than $80 billion in annual healthcare costs in Canada.1

However, the connections extend beyond the financial burden of unhealthy habits. Studies continue to show a strong correlation between physical fitness and financial fitness.2 To some extent, this is because greater income and wealth provide resources to protect and improve health. Yet, it may go deeper than just resources. Accumulating wealth and improving health are guided by similar principles — both require consistency and discipline. Whether it’s saving and investing to grow a future nest egg or reshaping healthy habits through physical activity or better eating, consistency can pay dividends down the road. The benefits of these investments can compound over time. Often, people fail in their health and wealth goals because they succumb to immediate temptations rather than stay focused on longer-term objectives. As one expert noted, when it comes to health, “dollar-cost average your energy into healthful activities and the returns might surprise you.” The same can be said about investing.

The 100-Year-Old Marathoner: It’s Never Too Late to Start

Many of us spend the first 20 to 30 years of our working lives prioritizing wealth accumulation, often directing less of our attention to our health. However, the good news is that it’s never too late to shift focus. While starting to save for retirement at age 70 is never ideal, paying more attention to our health can begin at any age. There are inspiring examples: Richard Morgan, a 93-year-old, four-time rowing champion with the fitness level of a 40-year-old, didn’t begin exercise training until age 73. Feeling “somewhat at loose ends” in retirement, he started training after attending a rowing practice with his grandson.3 Similarly, the world’s oldest marathoner ran his last marathon at age 100 in Toronto, having taken up running at the ripe age of 89 to overcome grief.4

Better lifestyle choices are also linked to greater longevity. With the rising prevalence of diseases like obesity, Alzheimer’s and early-onset cancer, many studies suggest that basic lifestyle changes including exercise, healthy diet and adequate sleep may be keys to addressing their disproportional growth.

Indeed, adopting consistent and disciplined approaches — in both health and wealth management — can yield profound and far- reaching returns. It’s all good food for thought in the pursuit of living long and prospering.

1. https://www150.statcan.gc.ca/n1/pub/82-003-x/82-003-x2020010-eng.htm; 2. https://internationalservices.hsbc.com/content/dam/hsbc/hsbcis/docs/reports/asia-wealth/hsbc-life-factor-study.pdf; 3. https://www.washingtonpost.com/wellness/2024/01/16/fitness-aging-richard-morgan/; 4. https://olympics.com/en/news/who-is-fauja-singh-oldest-indian-origin-british-marathon-runner

Health, Wealth & Investing — The Ozempic Effect

The healthcare industry is experiencing a remarkable period of innovation and growth. One area garnering significant attention is the development of weight loss drugs that mimic the hormone GLP-1. These drugs help regulate hunger to combat obesity, which affects around 30 percent of Canadian and 40 percent of U.S. adults. This advancement has not only attracted considerable interest from celebrities and the media, but has also led to substantial increases in the share prices of pharmaceutical companies producing these drugs. Some equity values have risen by double digits over the past year, reflecting the market’s confidence in this burgeoning field. Goldman Sachs, a leading investment banking firm, projects that the global market for obesity drugs could reach $100 billion by 2030.5

Some suggest we are at a pivotal moment, marking the early stages of what could be a revolutionary period in the development and commercialization of new drugs. This is being fueled by significant advances in biotechnology, artificial intelligence (AI) and information technology, and is expected to support the treatment of a wide range of conditions, including obesity, diabetes, Alzheimer’s and more. It’s an exciting time for innovation and disruption in this space and, for investors, the potential transformation may provide opportunities.

5. https://www.goldmansachs.com/intelligence/pages/anti-obesity-drug-market.html

Newswire

Quarterly Investment Insight – Summer

Download this PDF here.

Dow at One Million?

When the Dow Jones Industrial Average (Dow) crossed a new high of 40,000 in May, it achieved a milestone that appeared implausible given recent popular sentiment. Just two years earlier, central banks were still on the path of aggressively hiking rates to curb inflation. Gloomy equity market forecasts abounded. Fast forward to today, and interest rates remain higher than anticipated. Many valuation models use interest rates to discount future cash flows: higher rates lower a company’s future earnings and put downward pressure on stock prices. Alongside slower economic growth and high debt levels, the future has appeared cloudy through many lenses. Yet, markets can often be confounding.

From an economic perspective, this period has been described by some as a liminal space, a transition between ‘what was’ and ‘what’s next’ — a sort of “in-between” economy that’s neither great nor terrible. It’s a fair observation and perhaps explains why financial narratives seem varied and shifting. In December, many market observers believed we had inflation in check; yet the anticipated rate cuts did not largely materialize in the first half of the year — the Bank of Canada was the first G7 central bank to reduce rates in June. To preserve credibility, central banks have been moving cautiously after being criticized for their slow response to rising inflation; the consequences of the 1970s still loom large.

Nobody wants a repeat of the 1970s, a time when inflation persisted for an entire decade at an average of 8 percent per year, alongside high unemployment, or stagflation.1 It was only when then-Fed Chair Paul Volcker raised rates to a whopping 20 percent by 1981 that inflation would be conquered, but not without significant pain. Today, labour markets remain resilient amid easing inflation — an enviable outcome. Consider that inflation and unemployment traditionally exhibit an inverse correlation, and multiple studies suggest that higher unemployment depresses our well-being more than inflation, in some cases up to five times as much!2

Where are economies and the financial markets headed? Looking forward, it’s worth recounting a prediction made by renowned investor Warren Buffett years ago: Expect the Dow to reach one million in 100 years.3 At first glance, this may seem like quite the assertion considering the Dow hovered at a mere 100 points just 100 years ago.4 However, looking deeper at the numbers, the Dow needed to compound at less than 4 percent annually to achieve Buffett’s target at that time. Today, the S&P/TSX would need an annual return of 4 percent to reach 1,000,000 by 2124.

Yet, Buffett’s intent wasn’t to propose whether an arbitrary benchmark could be achieved. Rather, he meant to inspire confidence in future growth. History has shown that equities outperform most asset classes over time; not surprising given the general upward trajectory of corporate profits. This doesn’t imply that there won’t be challenges along the way — today, there are many. Yet, we continue to overcome these challenges because one thing hasn’t changed: the human condition to advance and grow. As investors, we shouldn’t lose sight of the growth yet to come, and we can all benefit should we choose to participate. I am here to provide wealth management strategies and support to navigate this liminal space — as we progress toward the one million mark.

I hope you will find some time to relax and rejuvenate this summer. As always, I remain here to support any investment needs.

1. https://www.bankofcanada.ca/2019/02/price-check-inflation-in-canada/;

2. https://www.wsj.com/articles/inflation-and-unemployment-both-make-you-miserable-but-maybe-not-equally-11668744274; 3. https://www.cnbc. com/2017/09/21/dow-1-million-warren-buffett-says-it-can-happen.html; 4. http://www.fedprimerate.com/dow-jones-industrial-average-history-djia.htm

SUMMER BRINGS HOME-BUYING SEASON

FHSA or HBP: Reasons to Prioritize the FHSA

As a result of the federal budget increasing the withdrawal amount for the Home Buyer’s Plan (HBP), some clients have asked which plan is better for younger family members: the First-Home Savings Account (FHSA) or the HBP, via the Registered Retirement Savings Plan (RRSP).

As a reminder, the FHSA is a registered account that allows tax-deductible contributions and tax-free withdrawals for the purchase of a first home. Annual contributions of $8,000 to a lifetime limit of $40,000 can grow on a tax-sheltered basis. The account can remain open for 15 years. The HBP allows first-time buyers to tap their existing RRSP, subject to conditions, for a tax-free withdrawal of up to $60,000. The amount must be repaid within 15 years; otherwise, it will be considered taxable income. Until now, the repayment period began in the second year after the first withdrawal. However, the budget has proposed to temporarily defer this start by three additional years.

Simply put, the FHSA allows holders to save and grow funds, whereas the HBP acts as an interest-free loan from the RRSP. While both can be used to purchase a first home, if funds are limited, which should be prioritized?

In many cases, the FHSA may be beneficial and here are reasons why:

1. Starting early, you may be able to access a greater amount —With both the FHSA and RRSP, starting early allows greater time for funds to grow on a tax-deferred basis. Given the FHSA’s 15-year limit, if an investor opens the account at age 18, by maximizing contributions from the outset, at a five percent annual return the account could grow to over $75,000 by age 33, more than the $60,000 withdrawal limit via the HBP.

2. Greater withdrawal flexibility — Funds can be withdrawn tax free from the FHSA for the purchase of a new home. HBP withdrawals are only tax free if repaid within a certain time.

3. Unused amounts — If not used to purchase a first home, FHSA amounts can be transferred to the RRSP. This won’t affect existing RRSP contribution room and effectively increases the overall RRSP contribution room. Of course, the choice may be impacted by various factors, such as timing. At the end of the day, both the FHSA and the HBP, through use of the RRSP, provide excellent tax-advantaged opportunities to build wealth for the purchase of a first home. Where possible, younger folks should maximize contributions to both. If you have family members needing assistance opening the FHSA, please call the office.

WHAT’S BEHIND OUR INCREASING EXPENDITURES?

Three Perspectives on Our Higher Cost of Living

With higher inflation, the increasing cost of living has been top of mind for many Canadians. While there has been good news on the inflation front given continuing signs of easing, here are three perspectives on our rising cost pressures.

1. Today, less of our paycheques go to necessities. Despite a substantial rise in grocery costs, it may be surprising that the proportion of income spent on necessities has declined substantially over time. In 1961, Canadians spent 33.9 percent of family income on food and clothing; today, this has declined to just 14.6 percent. This is largely because incomes have grown faster.

2. Which expenditure has grown the most? Taxes. According to the Canadian Consumer Tax Index, the average Canadian family spends 45.3 percent of income on total taxes, compared to 35.6 percent on necessities. Since 1961, there has been a 2,778 percent rise in the taxes we pay, outpacing increases in the Consumer Price Index (that measures changes in prices), which has increased by 863 percent.

3. Higher-income taxpayers shoulder the heaviest tax burden. When comparing the share of taxes paid to the share of income, the highest income earners pay the most tax. The top 20 percent of income earners (with family income over $243,000) pay 61.9 percent of personal income taxes (PIT) yet represent 45.7 percent of total income. Every other income group pays a smaller share of PIT.

1. & 2. https://www.fraserinstitute.org/studies/taxes-versus-necessities-of-life-canadian-consumer-tax-index-2023-edition; 3. https://www.fraserinstitute.org/studies/measuring-progressivity-in-canadas-tax-system-2023

INCREASES TO THE CAPITAL GAINS INCLUSION RATE

To Defer or Not to Defer: Realizing Capital Gains

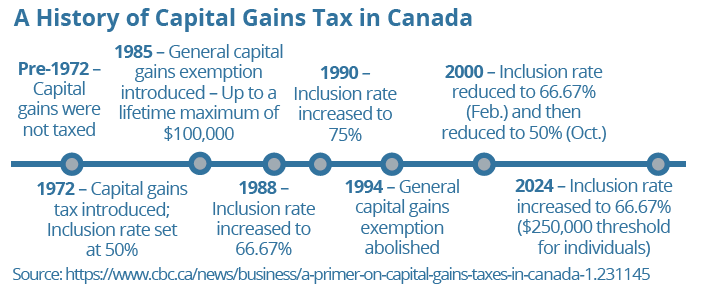

The proposed* increases to the capital gains inclusion rate have prompted some investors to ask the tax-planning question: To defer, or not to defer? Tax deferral is commonly viewed as a way for investors to create greater future returns, since funds that might otherwise go to paying tax can remain invested for longer-term growth. Yet, with increases to the capital gains inclusion rate, individuals may be evaluating the possibility of deferred taxation at higher rates against accelerated taxation at a lower rate.

As of June 25, 2024, the capital gains inclusion rate increases from 1/2 to 2/3 (50 to 66.67 percent) for corporations and trusts, and for individuals on the portion of realized gains in the year that exceeds $250,000.

As one scenario, for a realized gain of $100,000 at a marginal tax rate of 48 percent, an investor would save $8,000 in tax by realizing a gain at the 1/2 inclusion rate, rather than realizing the gain at the 2/3 inclusion rate. However, this comes at the cost of “pre-paying” $24,000 in capital gains taxes. If this amount was instead invested in a portfolio returning 5 percent per year, it would take 9 years of tax-deferred growth at the higher 2/3 inclusion rate to beat the $8,000 in tax savings.

Here are some considerations for individual investors:

Spread gains over multiple years — Where possible, consider realizing gains over multiple years to make use of the lower inclusion rate (under $250,000) compared to a larger realized gain in a single year.

Harvest gains — Deliberately selling and rebuying stocks to trigger a capital gain may be a way to reset book value over time. This strategy is often considered for years when an investor is in a lower tax bracket, but may be used to capitalize on the lower inclusion rate each year. The decision may depend on a variety of factors such as time horizon, current/future tax rates and potential growth rate of investments.

Donate securities — Assuming the new rules apply to the deemed disposition of assets at death, if you are considering donations to support a legacy, the use of publicly-listed securities may be beneficial.

Any accrued capital gain is excluded from taxable income and a donation receipt equal to the value of the donated securities will be received. Note: For large donations other than in the year of death, the Alternative Minimum Tax may apply.

Business owners — Evaluate whether certain assets should be held in the corporation or owned personally. For corporations, there is no

$250,000 threshold and 2/3 of realized gains are taxable.

Plan Ahead: For many, the increased inclusion rate will mean higher future tax liabilities. Planning ahead is important. The use of insurance or other planning techniques may help to cover a higher tax bill, such as on the transfer of a family property or on death. For business owners, the use of corporate-owned insurance or an individual pension plan may support a business’ tax strategy. Forward planning can also help access available exemptions, such as the lifetime capital gains exemption. As tax planning remains an important part of wealth planning, seek advice.*Please note: Legislation has not been enacted at the time of writing.

A BRIEF LOOK AT INDICES

Does the Dow Matter? What’s in an Index

The Dow Jones Industrial Average (DJIA or Dow) is one of the most widely watched stock market indices and the second oldest in the world. Created in 1896 by Charles Dow, then-editor of the Wall Street Journal, it originally comprised 12 companies from traditional heavy industries, such as Chicago Gas and National Lead, giving it the name ‘Industrial Average.’ Today, the index represents 30 companies, with its composition constantly evaluated and periodically revised to include leading blue chip companies across a variety of industries.

What makes the Dow unique is that it is “price-weighted,” measured by the sum of component share prices divided by a divisor that adjusts for a stock split or dividend. In contrast, indices like the S&P/TSX Composite, S&P 500 and NASDAQ are ‘value-weighted’ based on constituent market capitalization (share price times outstanding shares).

Is the Dow a good gauge of the U.S. economy? Over its lifetime, it has faced many critics. Some argue it is too narrowly focused, while others suggest its price-weighted methodology is flawed because higher-priced stocks tend to have greater influence over lower-priced counterparts.

For example, the same price change for a lower-priced stock will not impact the index as much as that of a higher-priced stock, despite a greater percentage change for the lower-priced stock.

The Dow Today: Does It Matter?

What is particularly notable today is that the Dow’s rise may signal more robust market breadth, suggesting that recent equity market gains are not largely driven by just the technology sector. Consider that the tech sector accounts for 58.8 of the NASDAQ and 29.0 percent of the S&P 500, yet only 18.6 percent of the Dow.

Taking a broader perspective, while indices often have their limitations, they remain valuable as indicators and benchmarks of performance. The long history and ongoing advancement of the Dow Jones Industrial Average, in particular, should remind investors of the enduring trend of economic growth and continued progress.

Summer Perspectives: Live Long and Prosper

Better Health & Better Wealth

Many of us remember the classic Star Trek mantra ‘live long and prosper,’ which may be worth reflection as we enter the leisurely summer months. The keys to a longer and more prosperous life are often rooted in fundamentals that include both health and wealth.

Better Health, Better Wealth

Not surprisingly, physical, mental and financial well-being are interconnected. Perhaps one of the simplest associations between health and wealth is the cost of maintaining unhealthy habits. Consider that kicking a $5 per day smoking habit would save $1,825 annually, which could accumulate to over $150,000 in 30 years at an annual rate of return of 6 percent. While we are fortunate in Canada to have a social system that supports healthcare costs, unlike the U.S., taxpayers still bear the burden. The latest reports suggest that chronic diseases, many preventable, account for more than $80 billion in annual healthcare costs in Canada.1

However, the connections extend beyond the financial burden of unhealthy habits. Studies continue to show a strong correlation between physical fitness and financial fitness.2 To some extent, this is because greater income and wealth provide resources to protect and improve health. Yet, it may go deeper than just resources. Accumulating wealth and improving health are guided by similar principles — both require consistency and discipline. Whether it’s saving and investing to grow a future nest egg or reshaping healthy habits through physical activity or better eating, consistency can pay dividends down the road. The benefits of these investments can compound over time. Often, people fail in their health and wealth goals because they succumb to immediate temptations rather than stay focused on longer-term objectives. As one expert noted, when it comes to health, “dollar-cost average your energy into healthful activities and the returns might surprise you.” The same can be said about investing.

The 100-Year-Old Marathoner: It’s Never Too Late to Start

Many of us spend the first 20 to 30 years of our working lives prioritizing wealth accumulation, often directing less of our attention to our health. However, the good news is that it’s never too late to shift focus. While starting to save for retirement at age 70 is never ideal, paying more attention to our health can begin at any age. There are inspiring examples: Richard Morgan, a 93-year-old, four-time rowing champion with the fitness level of a 40-year-old, didn’t begin exercise training until age 73. Feeling “somewhat at loose ends” in retirement, he started training after attending a rowing practice with his grandson.3 Similarly, the world’s oldest marathoner ran his last marathon at age 100 in Toronto, having taken up running at the ripe age of 89 to overcome grief.4

Better lifestyle choices are also linked to greater longevity. With the rising prevalence of diseases like obesity, Alzheimer’s and early-onset cancer, many studies suggest that basic lifestyle changes including exercise, healthy diet and adequate sleep may be keys to addressing their disproportional growth.

Indeed, adopting consistent and disciplined approaches — in both health and wealth management — can yield profound and far- reaching returns. It’s all good food for thought in the pursuit of living long and prospering.

1. https://www150.statcan.gc.ca/n1/pub/82-003-x/82-003-x2020010-eng.htm; 2. https://internationalservices.hsbc.com/content/dam/hsbc/hsbcis/docs/reports/asia-wealth/hsbc-life-factor-study.pdf; 3. https://www.washingtonpost.com/wellness/2024/01/16/fitness-aging-richard-morgan/; 4. https://olympics.com/en/news/who-is-fauja-singh-oldest-indian-origin-british-marathon-runner

Health, Wealth & Investing — The Ozempic Effect

The healthcare industry is experiencing a remarkable period of innovation and growth. One area garnering significant attention is the development of weight loss drugs that mimic the hormone GLP-1. These drugs help regulate hunger to combat obesity, which affects around 30 percent of Canadian and 40 percent of U.S. adults. This advancement has not only attracted considerable interest from celebrities and the media, but has also led to substantial increases in the share prices of pharmaceutical companies producing these drugs. Some equity values have risen by double digits over the past year, reflecting the market’s confidence in this burgeoning field. Goldman Sachs, a leading investment banking firm, projects that the global market for obesity drugs could reach $100 billion by 2030.5

Some suggest we are at a pivotal moment, marking the early stages of what could be a revolutionary period in the development and commercialization of new drugs. This is being fueled by significant advances in biotechnology, artificial intelligence (AI) and information technology, and is expected to support the treatment of a wide range of conditions, including obesity, diabetes, Alzheimer’s and more. It’s an exciting time for innovation and disruption in this space and, for investors, the potential transformation may provide opportunities.

5. https://www.goldmansachs.com/intelligence/pages/anti-obesity-drug-market.html

Recent Posts

February Market Insights: Fortress America and the Colony Next Door

The Trump Doctrine envisions a sovereign, American-led Western Hemisphere. But where does that leave Canada—and how do we secure our own economic sovereignty? James Thorne shares his thoughts in his February Market Insights.

January Market Insights: The 2026 Market Forecast

A new market cycle is taking shape. In his January Market Insights, James Thorne shares his thoughts on the market outlook for 2026. Investors should lean in – being underallocated could be the biggest risk of all.

Quarterly Investment Insights – Winter 2026

It is the end of an era: after 60 years at the helm, one of the world’s most closely watched investors has stepped down as CEO. Very few people stay in one role for six decades. For context, the median tenure with a single employer dropped to 3.9 years in the U.S., while the average working life spans roughly 37 years.1 This puts into perspective the remarkable length of Warren Buffett’s leadership of Berkshire Hathaway—nearly twice the span of a typical career. Even if you don’t subscribe to Buffett’s investing philosophy, the scale of his accomplishments is clear. After taking control in 1965, he transformed Berkshire from a struggling textile mill into a multi-national conglomerate holding company, growing its share price from about $19 to roughly $745,000—a cumulative gain of nearly 4,000,000 percent! In 2024, Berkshire became the first U.S. non-tech company to surpass a trillion-dollar market capitalization.

December Market Insights: 2026 and the King Dollar Revival

What will define 2026? In his December Market Insights, James Thorne examines the resilience of “King Dollar” in a year that will be defined by structural renewal, disciplined markets, and an unfolding capital expenditures supercycle.

November Market Insights: Wealth in a CapEx Supercycle

Everyone’s talking about an AI bubble – but are we missing the real story? In his November Market Insights, James Thorne explains why the real AI opportunity can be found in the CapEx supercycle buildout.

The opinions contained herein are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Wellington-Altus Private Wealth. Assumptions, opinions and information constitute the author’s judgement as of the date this material and subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. All third party products and services referred to or advertised in this presentation are sold by the company or organization named. While these products or services may serve as valuable aids to the independent investor, WAPW does not specifically endorse any of these products or services. The third party products and services referred to, or advertised in this presentation, are available as a convenience to its customers only, and WAPW is not liable for any claims, losses or damages however arising out of any purchase or use of third party products or services. All insurance products and services are offered by life licensed advisors of Wellington-Altus.