The Illusion of Speed

Download the full PDF here.

It has been said that “there are decades where nothing seems to happen, and there are weeks where decades happen.” The sweeping global tariffs, announced by the U.S. on April’s “Liberation Day,” caught the world off guard—disrupting long-held norms in global trade and world order. This may signal the beginning of a new chapter—one where political disruption, rapidly shifting policies and the velocity of digital information collide.

We’ve seen a wave of financial market volatility triggered by how rapidly these changes were communicated—and perceived. In today’s hyper-connected world, the pace of modern life has never been faster. That same urgency has seeped into the way we make decisions.

Technology underpins this behavioural shift. The average investor now holds a stock for just months—down dramatically from the multi-year horizons of previous generations.1 A recent study found that many retail investors spend less time researching a stock than they do reading a restaurant menu.2 The result? Decisions are driven more by momentum and emotion than thoughtful, long-term planning.

Markets, too, have become increasingly reflexive. April’s rapid selloff, followed by the swift recovery in May, shows how quickly sentiment can shift.

Similarly, the U.S. administration’s approach has been characterized by rapid disruption, with some describing it as a “move fast and break things” approach.3 The speed at which new policies are introduced amplifies the perception of urgency—even when outcomes remain uncertain, or when policies may later be changed—or even reversed.

Yet amid this policy whiplash, a shift may be taking place: a move away from globalization toward greater national protectionism, security and economic self-sufficiency. This pivot has raised deeper questions about the role of the U.S. as the dominant superpower. During April’s volatility, a sharp selloff in U.S. Treasurys raised concerns—particularly as China, which holds about one-sixth of all foreign-owned U.S. Treasurys, has been increasing its gold reserves. Subdued demand for the U.S. dollar—once the default safe haven—has prompted questions about its future as the global reserve currency. Since the start of the year, its value has fallen by around 9 percent4—a rare and significant drop. Questions about waning confidence in U.S. global leadership have emerged. To paraphrase one analyst: “You can’t antagonize and influence at the same time.”

This environment should serve as a reminder: speed does not always equate to change. The illusion of speed—fueled by technology and policy turbulence—can distort our sense of urgency and lead us to chase headlines rather than stay grounded in fundamentals. It’s a dynamic that can leave investors vulnerable to short-term noise. Investing, at its core, rewards patience.

While the events of April may already feel like a distant memory, it’s understandable that the market movements were unsettling for many. If you have friends or family who could benefit from our approach, we would be happy to offer support. We’ve navigated these challenging times before and continue to provide value through a disciplined process.

After a spring marked by ‘weeks where decades seemed to happen,’ may your summer days be filled with many slow and relaxing moments.

1. https://www.visualcapitalist.com/the-decline-of-long-term-investing/; 2. https://www.wsj.com/finance/investing/buying-stocks-research-study-2a839a4a; 3. A term coined in the tech industry; 4. To end of May, per ICE U.S. Dollar Index.

BRIDGING THE HOUSING AFFORDABILITY GAP

Supporting a Home Purchase? Five Questions to Ask

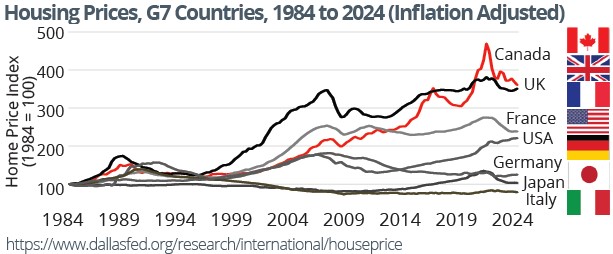

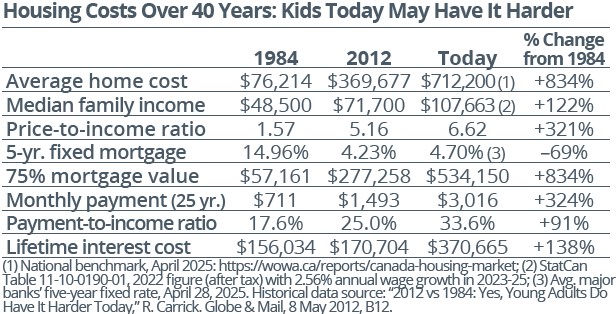

Without a doubt, home ownership has become increasingly out of reach for younger generations (chart, bottom right). Canadian home prices have risen faster than in any other G7 country—nearly quadrupling over 40 years (graph, top). As such, many families are stepping in to help.

Beyond easing financial stress, this support can have added benefits. Many high-net-worth individuals value the opportunity to see their wealth in action during their lifetime. Lifetime gifting can also simplify estate administration and, depending on province, may reduce probate fees.

Still, meaningful support requires thoughtful planning to avoid unintended consequences. Here are five key questions to consider:

- How will this impact my own finances? Many people draw from lifetime savings to provide support. It’s essential to assess how this could affect your long-term financial security—especially given increased life expectancy and the rising cost of long-term care.

- How do I structure my support? Support can take many forms, including gifting cash, loaning funds, co-signing a mortgage or purchasing a property in your own name—each with different tax and family law implications.* Remember, gifting means giving up control. Smaller, ongoing support may allow the recipient to leverage tax-advantaged tools like the Tax-Free Savings Account (TFSA) or First Home Savings Account.

- What are the family law implications? If the recipient is in a relationship that ends, gifts or property could be subject to division, depending on provincial family law. There may be ways to protect the intent of your support, such as through the use of formal ownership agreements or cohabitation agreements.*

- Are there tax implications? While Canada has no gift tax, some arrangements can trigger taxable events. For example, co-owning a property with the recipient may protect your share, but if it’s not your principal residence, you could face capital gains tax upon its sale or disposition. Large gifts from taxable investment accounts could also trigger capital gains or income tax.

- Will this affect my estate plan? If you have multiple children who are intended beneficiaries, a gift to one child can affect how you equalize your estate. A strategic approach might include integrating gifting into an estate equalization plan—through lifetime gifts or testamentary planning using trusts or insurance.

*Consult legal and tax professionals to understand the implications of any strategy.

MACROECONOMIC PERSPECTIVES

A Credit Downgrade: What’s in a Rating?

In May, Moody’s downgraded the U.S. credit rating from the top Aaa to Aa1. This move by one of the major credit rating agencies—S&P and Fitch are the other two—raised the question: Does a downgrade matter?

First, what is a rating? A credit rating assesses a borrower’s ability and willingness to repay debt. Unlike personal credit scores, which typically range from 300 to 900, government credit ratings are expressed as letter grades, with AAA representing the highest quality and lowest risk. A downgrade implies an increasing likelihood that a government may default on its bonds.

Why does this matter? A downgrade generally means investors demand higher interest rates to compensate for added risk. Higher interest payments raise the cost of government borrowing. To sustain spending, more bonds must be issued—further increasing the debt burden. In the U.S., interest payments have become the second-largest federal expense, surpassing defence spending in 2024.

While credit downgrades can shake investor confidence, equity markets had a muted response, briefly jittering. This was partly because the move wasn’t a surprise, lagging similar downgrades by Fitch in 2023 and S&P in 2011. However, bond prices have come under pressure, sending yields higher, with the 30-year rate surpassing 5 percent in May. It comes at a time when a Republican tax bill rekindled debate about the sustainability of the U.S. deficit and spending.

There are likely to be ripple effects. A surge in U.S. mortgage rates may dampen consumer spending. Credit card and auto loan rates are less likely to be affected, as they tend to follow the federal funds rate more directly.

Why is this significant for Canada? Canada is among the few nations still holding the top credit rating from at least two major agencies. Fitch downgraded Canada in 2020 due to pandemic-related spending. While Canada’s credit outlook remains stable, a downgrade would be unwelcome. Net debt is not out of step with other AAA-rated economies, but gross debt levels are high, and rising interest rates would raise debt-servicing costs—straining future budgets. The heightened focus on global debt may help explain why Prime Minister Carney has opted to delay the release of the federal budget, usually delivered in the spring. Credit agencies continue to evaluate sovereign debt positions, and the U.S. downgrade follows a move by Moody’s to downgrade France at the end of 2024.

THINKING AHEAD:

Planning a Tax-Efficient Withdrawal Strategy

“A dollar’s value depends on the tax trail it travels.”

How and when you access your income sources can influence the taxes you pay, your eligibility for government benefits and your long-term financial health. Whether you’re accumulating wealth, transitioning between career stages or planning for retirement, a tax-efficient withdrawal strategy can make a meaningful difference. Here is a brief look at common income sources and ideas to help you optimize withdrawals or manage income streams more effectively:

Non-Registered Accounts — Tax treatment depends on the type of income: interest (fully taxable), dividends (eligible for a dividend tax credit) or capital gains (50 percent is taxable). Tax-loss harvesting can offset capital gains to reduce your overall tax bill.

Registered Retirement Savings Plan (RRSP) — Withdrawals are fully taxable and subject to withholding tax. Importantly, once funds are withdrawn, contribution room is permanently lost.

TFSA — Offers significant benefits as growth is tax free and withdrawals are not taxed. This means withdrawals do not affect income-tested government benefits. Any amount withdrawn can be recontributed in the following calendar year.

Employment Income — If you continue to work while drawing income from other sources, consider how employment income will stack with taxable withdrawals. In high-income years, deferring benefits (if possible) or adjusting other withdrawals may help reduce the overall tax burden.

Here are additional considerations for those nearing retirement:

Canada/Quebec Pension Plan (CPP/QPP) — CPP/QPP benefits are taxable income. Timing matters:

Starting early reduces benefits by 7.2 percent per year before age 65. Delaying increases payments by 8.4 percent per year after age 65, to a maximum of 42 percent by 70. The total benefit received can impact income level and tax situation.

Old Age Security (OAS) — OAS is a taxable benefit starting at age 65. If you expect higher income later in life, here are two considerations: i) Clawback—If net income exceeds $93,454 (2025), OAS is reduced by 15 percent of the excess. At $151,668 (ages 65 to 74), it is fully clawed back; and ii) Delaying OAS—

This increases the benefit up to 36 percent by age 70.

Registered Retirement Income Fund (RRIF) — Mandatory RRIF withdrawals begin the year after the RRIF is opened, increasing taxable income. Some choose to begin RRSP withdrawals earlier to manage future tax exposure or reduce the risk of triggering the OAS clawback.

Company Pension — Pension income is taxable. After age 65, the pension tax credit may help offset the tax liability. Consider timing your pension’s start with other sources of income to manage your tax liability.

Don’t Forget: Income Splitting — Couples can sometimes lower their combined tax burden by splitting certain types of income, especially when one has significantly higher income. For retirees, shifting eligible pension income may reduce taxes or the OAS clawback. In cases of continued employment, coordinating taxable income (particularly after 65) may yield tax savings over time. Planning together can lead to better outcomes.

Building a tax-efficient income plan involves many moving parts. Knowing how and when to draw income may help reduce taxes and preserve benefits. Alongside tax advisors, we can help develop a strategy that balances cash flow needs, tax implications and government benefits to support your long-term financial goals.

PERSPECTIVES ON MARKET VOLATILITY

The Merits of Hanging in (& Why April Felt So Bad)

It’s been a wild ride this year—and we’re only halfway through.

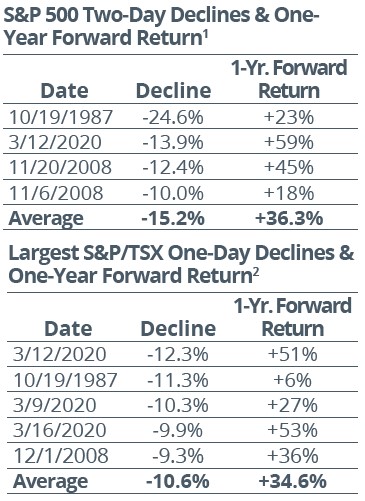

If April’s market movements felt unsettling, you weren’t mistaken. While volatility is a natural part of equity markets, the magnitude of April’s decline was unusual. A two-day drop of more than 10 percent in the S&P 500, seen over April 3 and 4, is rare and has occurred only four times since 1980: on Black Monday in 1987, twice during the 2008 Global Financial Crisis (GFC) and in the early days of the 2020 pandemic.

It’s worth repeating: while it might feel tempting to exit the markets during turbulent periods, doing so can come at a cost. One reason is that some of the best-performing days often follow the worst. Exiting the markets after a decline may mean missing out on these gains, which can then make re-entering even more difficult. We saw this play out in the spring when April’s sharp drop was followed by a swift recovery in May.

While markets don’t always rebound immediately, time has a powerful way of smoothing even the sharpest declines. In the year following the worst two-day drops, the S&P 500 posted an average gain of 36.3 percent. Similarly, after the largest one-day declines in the S&P/TSX, the average one-year forward return was +34.6 percent.

One of the benefits of navigating through challenging markets like the GFC and the pandemic is

that we have accumulated invaluable experience. Time and again, we are reminded that you can’t keep the markets—or the economy— down for long.

Even the darkest nights eventually give way to dawn—and patience remains one of an investor’s

great virtues.

1. BMO Capital Markets, U.S. Strategy Report, April 6, 2025. 2. BMO Capital Markets, Canadian Strategy Report, April 6, 2025. Calculations based on BMO Capital Markets Investment Strategy Group calculations, Factset, Compustat, IBES.

Summer Vacation Time:

Seven Reasons to Unplug (From Your Smartphone)

The double-edged sword of the information age is that it often feels as though the world is getting worse, even as many things have been gradually improving. While access to information has never been greater, the headlines are driven by negativity and sensationalism, rarely highlighting the progress being made.

Yet, we’re living in one of the most remarkable periods in human history. Life expectancy and wealth are at record highs; poverty, child mortality and violence are at multi-decade lows. Innovation continues to shape a world with more opportunities than ever. But progress rarely makes front-page news—it happens quietly, gradually and often goes unnoticed.

This summer, perhaps it’s time to take a break from the headlines. Here are seven reasons why our hyperconnected world may be impacting our investing focus—and why unplugging might be more beneficial than you’d expect:

- Shorter holding periods can reduce returns — The average investor today holds a stock for just five months—compared to nearly eight years in the 1950s.¹ With real-time market access at our fingertips, it’s easy to confuse access with insight, which may be encouraging more frequent trading. Yet, research shows that frequent trading can hurt performance: An investor who was out of the market during the top 10 trading days for the S&P 500 Index from 1993 to 2013 would have achieved a 5.4 percent annualized return, instead of 9.2 percent by staying invested.2

- We are increasingly making impulsive decisions — A recent study from the NYU Stern School of Business found that the median individual investor spends just six minutes researching a stock before buying it online.3 Technology not only speeds up access to information, but also our reactions to it—often encouraging decisions that are more emotional than analytical. Consider this: for every 100 millisecond improvement of Amazon’s site load time, revenue reportedly increases by one percent.4 Speed can drive impulsive behaviour.

- Frequent portfolio checks increase the likelihood of seeing short-term losses — The average person checks their phone 352 times a day—about once every 2 minutes and 43 seconds.5 With access to our financial accounts at our fingertips, chances are many investors are checking portfolios more frequently. Yet, frequent checks increase the likelihood of seeing short-term losses. For example, if you were to check the S&P/TSX Composite Index on a daily basis, you’d see a negative return around 48 percent of the time, compared to only around 28 percent of the time when checking annually.6 Consider that losses tend to feel twice as painful as gains feel rewarding.

- Too much news may impact our well-being — Many of our phone checks lead to the news headlines. While the media has always skewed to reporting negative news because it attracts more attention, recent research suggests that it has become increasinglymore negative.7 “Doomscrolling”—the habit of endlessly consuming negative news—was added to the Merriam-Webster dictionary in 2021, a sign of just how common it’s become. While staying informed is important, constant exposure to distressing headlines has been linked to increased anxiety and depression. Research suggests that reducing screen time—even by a little—can lead to noticeable improvements in mental well-being within just a few weeks.8

- Negativity bias can cloud investment thinking — Our brains are hardwired to protect against threats. This survival instinct can cause us to act on negative news. Research also shows that social media amplifies herd behaviour, especially during times of market stress—often leading to emotionally-charged decisions that stray from long-term plans.9

- Time is a limited resource — Indeed, time may be one of our most finite assets—and yet, we often spend more of it on screens than we realize. One statistic suggests the average adult logs at least 4 hours and 39 minutes a day on their phone, or almost 70 days per year.10 Over a typical adult lifetime, that adds up to almost 12 years of screen time! Of course, smartphones have helped to improve efficiency—today, we can order food, book a ride, track our health or pay a bill—all via our smartphones. However, if you’ve ever lost an hour to TikTok or Instagram, it’s worth asking: How much of life is being traded for scrolling?

- Unplugging can help rebalance perspective — Stepping away—even briefly—from constant connectivity may help to refocus on what matters most: time with family, personal growth or whatever brings you joy and purpose. That’s where we, as your advisors, come in. One of our roles is to help simplify your financial life so you can feel confident focusing on what is truly important.

In a world that is constantly connected, why not consider unplugging?

1. https://www.visualcapitalist.com/the-decline-of-long-term-investing/; 2. https://www. cfainstitute.org/-/media/documents/support/future-finance/avoiding-common-investor-mistakes.pdf; 3. https://www.wsj.com/finance/investing/buying-stocks-research-study-2a839a4a; 4. https://www.forbes.com/sites/steveolenski/2016/11/10/why-brands-are-fighting-over-milliseconds/; 5. https://www.asurion.com/connect/news/tech-usage/; 6. Based on S&P/TSX Composite changes in daily and annual performance for the past 40 years; 7. https://www.bbc.com/future/article/20200512-how-the-news-changes-the-way-we-think-and-behave; 8. https://bmcmedicine.biomedcentral.com/articles/10.1186/s12916-025-03944-z; https://www.researchprotocols.org/2024/1/e53756/; 9. https://www. sciencedirect.com/science/article/abs/pii/S1059056023001326; 10. https://www.statista. com/statistics/1045353/mobile-device-daily-usage-time-in-the-us/

Newswire

Quarterly Investment Insights – Summer 2025

The Illusion of Speed

Download the full PDF here.

It has been said that “there are decades where nothing seems to happen, and there are weeks where decades happen.” The sweeping global tariffs, announced by the U.S. on April’s “Liberation Day,” caught the world off guard—disrupting long-held norms in global trade and world order. This may signal the beginning of a new chapter—one where political disruption, rapidly shifting policies and the velocity of digital information collide.

We’ve seen a wave of financial market volatility triggered by how rapidly these changes were communicated—and perceived. In today’s hyper-connected world, the pace of modern life has never been faster. That same urgency has seeped into the way we make decisions.

Technology underpins this behavioural shift. The average investor now holds a stock for just months—down dramatically from the multi-year horizons of previous generations.1 A recent study found that many retail investors spend less time researching a stock than they do reading a restaurant menu.2 The result? Decisions are driven more by momentum and emotion than thoughtful, long-term planning.

Markets, too, have become increasingly reflexive. April’s rapid selloff, followed by the swift recovery in May, shows how quickly sentiment can shift.

Similarly, the U.S. administration’s approach has been characterized by rapid disruption, with some describing it as a “move fast and break things” approach.3 The speed at which new policies are introduced amplifies the perception of urgency—even when outcomes remain uncertain, or when policies may later be changed—or even reversed.

Yet amid this policy whiplash, a shift may be taking place: a move away from globalization toward greater national protectionism, security and economic self-sufficiency. This pivot has raised deeper questions about the role of the U.S. as the dominant superpower. During April’s volatility, a sharp selloff in U.S. Treasurys raised concerns—particularly as China, which holds about one-sixth of all foreign-owned U.S. Treasurys, has been increasing its gold reserves. Subdued demand for the U.S. dollar—once the default safe haven—has prompted questions about its future as the global reserve currency. Since the start of the year, its value has fallen by around 9 percent4—a rare and significant drop. Questions about waning confidence in U.S. global leadership have emerged. To paraphrase one analyst: “You can’t antagonize and influence at the same time.”

This environment should serve as a reminder: speed does not always equate to change. The illusion of speed—fueled by technology and policy turbulence—can distort our sense of urgency and lead us to chase headlines rather than stay grounded in fundamentals. It’s a dynamic that can leave investors vulnerable to short-term noise. Investing, at its core, rewards patience.

While the events of April may already feel like a distant memory, it’s understandable that the market movements were unsettling for many. If you have friends or family who could benefit from our approach, we would be happy to offer support. We’ve navigated these challenging times before and continue to provide value through a disciplined process.

After a spring marked by ‘weeks where decades seemed to happen,’ may your summer days be filled with many slow and relaxing moments.

1. https://www.visualcapitalist.com/the-decline-of-long-term-investing/; 2. https://www.wsj.com/finance/investing/buying-stocks-research-study-2a839a4a; 3. A term coined in the tech industry; 4. To end of May, per ICE U.S. Dollar Index.

BRIDGING THE HOUSING AFFORDABILITY GAP

Supporting a Home Purchase? Five Questions to Ask

Without a doubt, home ownership has become increasingly out of reach for younger generations (chart, bottom right). Canadian home prices have risen faster than in any other G7 country—nearly quadrupling over 40 years (graph, top). As such, many families are stepping in to help.

Beyond easing financial stress, this support can have added benefits. Many high-net-worth individuals value the opportunity to see their wealth in action during their lifetime. Lifetime gifting can also simplify estate administration and, depending on province, may reduce probate fees.

Still, meaningful support requires thoughtful planning to avoid unintended consequences. Here are five key questions to consider:

*Consult legal and tax professionals to understand the implications of any strategy.

MACROECONOMIC PERSPECTIVES

A Credit Downgrade: What’s in a Rating?

In May, Moody’s downgraded the U.S. credit rating from the top Aaa to Aa1. This move by one of the major credit rating agencies—S&P and Fitch are the other two—raised the question: Does a downgrade matter?

First, what is a rating? A credit rating assesses a borrower’s ability and willingness to repay debt. Unlike personal credit scores, which typically range from 300 to 900, government credit ratings are expressed as letter grades, with AAA representing the highest quality and lowest risk. A downgrade implies an increasing likelihood that a government may default on its bonds.

Why does this matter? A downgrade generally means investors demand higher interest rates to compensate for added risk. Higher interest payments raise the cost of government borrowing. To sustain spending, more bonds must be issued—further increasing the debt burden. In the U.S., interest payments have become the second-largest federal expense, surpassing defence spending in 2024.

While credit downgrades can shake investor confidence, equity markets had a muted response, briefly jittering. This was partly because the move wasn’t a surprise, lagging similar downgrades by Fitch in 2023 and S&P in 2011. However, bond prices have come under pressure, sending yields higher, with the 30-year rate surpassing 5 percent in May. It comes at a time when a Republican tax bill rekindled debate about the sustainability of the U.S. deficit and spending.

There are likely to be ripple effects. A surge in U.S. mortgage rates may dampen consumer spending. Credit card and auto loan rates are less likely to be affected, as they tend to follow the federal funds rate more directly.

Why is this significant for Canada? Canada is among the few nations still holding the top credit rating from at least two major agencies. Fitch downgraded Canada in 2020 due to pandemic-related spending. While Canada’s credit outlook remains stable, a downgrade would be unwelcome. Net debt is not out of step with other AAA-rated economies, but gross debt levels are high, and rising interest rates would raise debt-servicing costs—straining future budgets. The heightened focus on global debt may help explain why Prime Minister Carney has opted to delay the release of the federal budget, usually delivered in the spring. Credit agencies continue to evaluate sovereign debt positions, and the U.S. downgrade follows a move by Moody’s to downgrade France at the end of 2024.

THINKING AHEAD:

Planning a Tax-Efficient Withdrawal Strategy

“A dollar’s value depends on the tax trail it travels.”

How and when you access your income sources can influence the taxes you pay, your eligibility for government benefits and your long-term financial health. Whether you’re accumulating wealth, transitioning between career stages or planning for retirement, a tax-efficient withdrawal strategy can make a meaningful difference. Here is a brief look at common income sources and ideas to help you optimize withdrawals or manage income streams more effectively:

Non-Registered Accounts — Tax treatment depends on the type of income: interest (fully taxable), dividends (eligible for a dividend tax credit) or capital gains (50 percent is taxable). Tax-loss harvesting can offset capital gains to reduce your overall tax bill.

Registered Retirement Savings Plan (RRSP) — Withdrawals are fully taxable and subject to withholding tax. Importantly, once funds are withdrawn, contribution room is permanently lost.

TFSA — Offers significant benefits as growth is tax free and withdrawals are not taxed. This means withdrawals do not affect income-tested government benefits. Any amount withdrawn can be recontributed in the following calendar year.

Employment Income — If you continue to work while drawing income from other sources, consider how employment income will stack with taxable withdrawals. In high-income years, deferring benefits (if possible) or adjusting other withdrawals may help reduce the overall tax burden.

Here are additional considerations for those nearing retirement:

Canada/Quebec Pension Plan (CPP/QPP) — CPP/QPP benefits are taxable income. Timing matters:

Starting early reduces benefits by 7.2 percent per year before age 65. Delaying increases payments by 8.4 percent per year after age 65, to a maximum of 42 percent by 70. The total benefit received can impact income level and tax situation.

Old Age Security (OAS) — OAS is a taxable benefit starting at age 65. If you expect higher income later in life, here are two considerations: i) Clawback—If net income exceeds $93,454 (2025), OAS is reduced by 15 percent of the excess. At $151,668 (ages 65 to 74), it is fully clawed back; and ii) Delaying OAS—

This increases the benefit up to 36 percent by age 70.

Registered Retirement Income Fund (RRIF) — Mandatory RRIF withdrawals begin the year after the RRIF is opened, increasing taxable income. Some choose to begin RRSP withdrawals earlier to manage future tax exposure or reduce the risk of triggering the OAS clawback.

Company Pension — Pension income is taxable. After age 65, the pension tax credit may help offset the tax liability. Consider timing your pension’s start with other sources of income to manage your tax liability.

Don’t Forget: Income Splitting — Couples can sometimes lower their combined tax burden by splitting certain types of income, especially when one has significantly higher income. For retirees, shifting eligible pension income may reduce taxes or the OAS clawback. In cases of continued employment, coordinating taxable income (particularly after 65) may yield tax savings over time. Planning together can lead to better outcomes.

Building a tax-efficient income plan involves many moving parts. Knowing how and when to draw income may help reduce taxes and preserve benefits. Alongside tax advisors, we can help develop a strategy that balances cash flow needs, tax implications and government benefits to support your long-term financial goals.

PERSPECTIVES ON MARKET VOLATILITY

The Merits of Hanging in (& Why April Felt So Bad)

It’s been a wild ride this year—and we’re only halfway through.

If April’s market movements felt unsettling, you weren’t mistaken. While volatility is a natural part of equity markets, the magnitude of April’s decline was unusual. A two-day drop of more than 10 percent in the S&P 500, seen over April 3 and 4, is rare and has occurred only four times since 1980: on Black Monday in 1987, twice during the 2008 Global Financial Crisis (GFC) and in the early days of the 2020 pandemic.

It’s worth repeating: while it might feel tempting to exit the markets during turbulent periods, doing so can come at a cost. One reason is that some of the best-performing days often follow the worst. Exiting the markets after a decline may mean missing out on these gains, which can then make re-entering even more difficult. We saw this play out in the spring when April’s sharp drop was followed by a swift recovery in May.

While markets don’t always rebound immediately, time has a powerful way of smoothing even the sharpest declines. In the year following the worst two-day drops, the S&P 500 posted an average gain of 36.3 percent. Similarly, after the largest one-day declines in the S&P/TSX, the average one-year forward return was +34.6 percent.

One of the benefits of navigating through challenging markets like the GFC and the pandemic is

that we have accumulated invaluable experience. Time and again, we are reminded that you can’t keep the markets—or the economy— down for long.

Even the darkest nights eventually give way to dawn—and patience remains one of an investor’s

great virtues.

1. BMO Capital Markets, U.S. Strategy Report, April 6, 2025. 2. BMO Capital Markets, Canadian Strategy Report, April 6, 2025. Calculations based on BMO Capital Markets Investment Strategy Group calculations, Factset, Compustat, IBES.

Summer Vacation Time:

Seven Reasons to Unplug (From Your Smartphone)

The double-edged sword of the information age is that it often feels as though the world is getting worse, even as many things have been gradually improving. While access to information has never been greater, the headlines are driven by negativity and sensationalism, rarely highlighting the progress being made.

Yet, we’re living in one of the most remarkable periods in human history. Life expectancy and wealth are at record highs; poverty, child mortality and violence are at multi-decade lows. Innovation continues to shape a world with more opportunities than ever. But progress rarely makes front-page news—it happens quietly, gradually and often goes unnoticed.

This summer, perhaps it’s time to take a break from the headlines. Here are seven reasons why our hyperconnected world may be impacting our investing focus—and why unplugging might be more beneficial than you’d expect:

In a world that is constantly connected, why not consider unplugging?

1. https://www.visualcapitalist.com/the-decline-of-long-term-investing/; 2. https://www. cfainstitute.org/-/media/documents/support/future-finance/avoiding-common-investor-mistakes.pdf; 3. https://www.wsj.com/finance/investing/buying-stocks-research-study-2a839a4a; 4. https://www.forbes.com/sites/steveolenski/2016/11/10/why-brands-are-fighting-over-milliseconds/; 5. https://www.asurion.com/connect/news/tech-usage/; 6. Based on S&P/TSX Composite changes in daily and annual performance for the past 40 years; 7. https://www.bbc.com/future/article/20200512-how-the-news-changes-the-way-we-think-and-behave; 8. https://bmcmedicine.biomedcentral.com/articles/10.1186/s12916-025-03944-z; https://www.researchprotocols.org/2024/1/e53756/; 9. https://www. sciencedirect.com/science/article/abs/pii/S1059056023001326; 10. https://www.statista. com/statistics/1045353/mobile-device-daily-usage-time-in-the-us/

Recent Posts

February Market Insights: Fortress America and the Colony Next Door

The Trump Doctrine envisions a sovereign, American-led Western Hemisphere. But where does that leave Canada—and how do we secure our own economic sovereignty? James Thorne shares his thoughts in his February Market Insights.

January Market Insights: The 2026 Market Forecast

A new market cycle is taking shape. In his January Market Insights, James Thorne shares his thoughts on the market outlook for 2026. Investors should lean in – being underallocated could be the biggest risk of all.

Quarterly Investment Insights – Winter 2026

It is the end of an era: after 60 years at the helm, one of the world’s most closely watched investors has stepped down as CEO. Very few people stay in one role for six decades. For context, the median tenure with a single employer dropped to 3.9 years in the U.S., while the average working life spans roughly 37 years.1 This puts into perspective the remarkable length of Warren Buffett’s leadership of Berkshire Hathaway—nearly twice the span of a typical career. Even if you don’t subscribe to Buffett’s investing philosophy, the scale of his accomplishments is clear. After taking control in 1965, he transformed Berkshire from a struggling textile mill into a multi-national conglomerate holding company, growing its share price from about $19 to roughly $745,000—a cumulative gain of nearly 4,000,000 percent! In 2024, Berkshire became the first U.S. non-tech company to surpass a trillion-dollar market capitalization.

December Market Insights: 2026 and the King Dollar Revival

What will define 2026? In his December Market Insights, James Thorne examines the resilience of “King Dollar” in a year that will be defined by structural renewal, disciplined markets, and an unfolding capital expenditures supercycle.

November Market Insights: Wealth in a CapEx Supercycle

Everyone’s talking about an AI bubble – but are we missing the real story? In his November Market Insights, James Thorne explains why the real AI opportunity can be found in the CapEx supercycle buildout.

The opinions contained herein are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Wellington-Altus Private Wealth. Assumptions, opinions and information constitute the author’s judgement as of the date this material and subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. All third party products and services referred to or advertised in this presentation are sold by the company or organization named. While these products or services may serve as valuable aids to the independent investor, WAPW does not specifically endorse any of these products or services. The third party products and services referred to, or advertised in this presentation, are available as a convenience to its customers only, and WAPW is not liable for any claims, losses or damages however arising out of any purchase or use of third party products or services. All insurance products and services are offered by life licensed advisors of Wellington-Altus.