Interest is always a challenging concept when first introduced. A typical conversation between parent and child can look like this. Parent: “Your money can earn interest and make more money for you.” Child: “I am interested in how this new interest concept can make my life more interesting.” Interest is a long-term process, and when left to compound, it can be a powerful aid in your savings efforts.

Of course, interest can also be a cost to you in the case of credit cards, mortgage payments, or any interest-bearing loan.

Interest is either charged or earned. How much you are charged and how quickly that amount compounds can lead to confusion. Interest is generally defined as the opportunity cost to utilize someone else’s money. If I were to loan you money for a defined period of time, I would expect you to pay me interest as I cannot use my money while you have borrowed it. In this example, let’s say I loan you $100 for a year and charge a 5% annual interest rate. In one year, you would owe me $105. The $5 I am charging you is the cost to me for not having that money in my pocket.

This article will review three examples of how interest is charged and or earned and how you can use both to your advantage.

Credit Cards

Credit Card debt is typically one of your earliest experiences with charged interest. Credit cards charge a very high interest rate on carried balances (e.g., if you do not fully pay-off your credit card on the due date). Interest charged by credit card companies can be as high as 22%, which will compound quickly.

You can expect to see the following on your monthly credit card statement: statement balance, minimum payment, last payment, last payment date, current payment due date, and so on. The statement balance is the amount you currently owe the credit card company and the amount you should pay every month. If you do not pay this amount, you will be charged interest on the unpaid balance. It should be noted that spending to your credit limit is not wise unless you can pay it off every month.

The credit card company earns income from your statement balance while you incur the cost of carrying the balance. If you pay your credit card balance every month, you will not be charged interest. The minimum payment is the minimum amount the credit company will accept without you defaulting. The company will then charge interest on the balance carried and begin raising the minimum amount owed.

For example, if you carry a $1000 balance, the credit card company will charge a 22% interest rate. You now owe them $1,220, and that interest will be charged monthly, meaning the interest you owe is now accumulating interest. The same happens when you take a cash advance on a credit card, but the interest will be charged upfront and accumulated until the advance is paid off. Once the interest starts accumulating, it can add up fast! Spending within your limits is an early and lifelong lesson to strive for.

Mortgages

One of the largest expenditures you will make in your lifetime is for the purchase of a home. For most Canadians, this is achieved through borrowing an amount of the purchase price from a lender in the form of a mortgage. The interest rate on a mortgage is significantly less than a credit card and many other debt types.

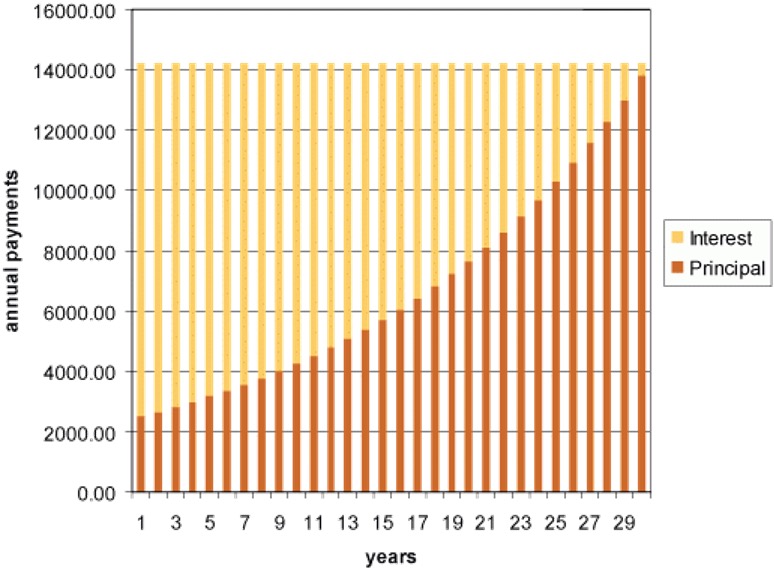

Currently, mortgage rates are at all-time lows, with many buyers qualifying for a mortgage interest rate under 2%. In contrast to the credit card example above, the mortgage payment you make is a combination of some of the principal that was borrowed and interest owing. Your mortgage payment changes as it is renewed (in Canada, we have different fixed and floating mortgage options), but it takes into account the rate of interest paid over the term of the mortgage. When you pay your mortgage, the initial payments are more interest weighted vs. the ending payments that pay more of the principal borrowed. Below is an example of how the proportion of your payment changes over the mortgage life while the payment amount remains relatively stable.

Source: grahamstanley.com

This is a US mortgage example, but the principal remains the same. For Canadian mortgages, the only difference is the payment is adjusted every few years—the lower the interest payment, the lower the cost of your mortgage.

Earning Interest

Many investors earn interest by purchasing debt—the issuer, a person, company, or government. In the investing world, when you buy debt, the amount of interest earned is typically fixed, which results in the term “fixed income”. The debt issuer assures the debt unless they default and cannot pay the interest or principal owed. Government Debt is considered the most secure debt as the government could print money or raise taxes to pay the debt/interest. It does matter, though, which government is issuing said debt and in which currency.

Corporate Debt on the other hand, has varying levels of risk. Investment Grade is low-risk corporate debt and High Yield being the riskier corporate debt. With the higher risk debt, there are higher interest payments. The risk is that the company defaults and can no longer pay the interest or repay the principal borrowed. As you earn interest, you can then invest that interest to earn more interest, the concept of “compounding”, leading to your money working for you. Once you start earning interest and your interest earns you interest, the compounding impact can greatly increase your savings rate. Keep in mind, though, that it’s a long-term process, and when left to compound, it can be a powerful aid in your savings efforts. It should be noted that any interest earned outside of a registered account is taxed at your highest marginal tax rate, and that is why it is always best to purchase fixed income in a registered account.

This was just the tip of the iceberg in terms of learning about interest and the impact it can have on your investment future. There are many other things to consider when looking at interest. Here are just a few:

- The term of the debt (how long until it is fully paid back),

- The frequency of the interest payments (this can range from bi-weekly all the way to all interest paid when the debt is repaid),

- Credit Quality (how likely is it that the person/company/government defaults)

If you would like to chat further about how to minimize interest payments or earn more interest to help achieve your future goals, please let us know how we can help!