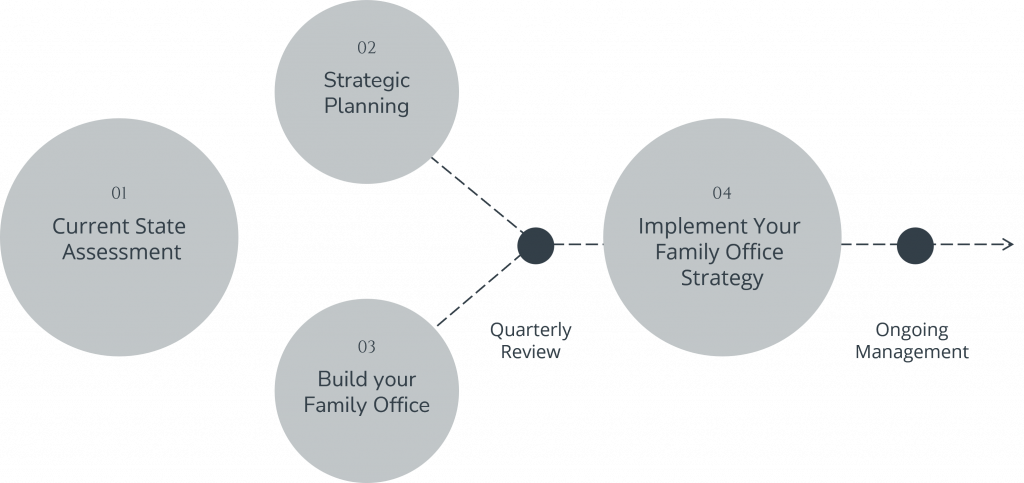

Our Difference

Your Financial Stewards

Managing every aspect of your finances – from business to personal

Think of us as your family’s chief financial officer. We can help with your investment planning, retirement planning, tax planning, estate planning, charitable giving, education planning and to prepare for any financial situations you and your family may find yourselves in.

Discretionary Portfolio Management

Find comfort in smart investment strategies that are tailored to you.

The Rosedale Family Office utilizes discretionary management to alter investment strategies and react to changing political, economic or investment climates. This helps our client’s portfolios capture market upside while ensuring an appropriate risk adjusted return.

Family & Business Wealth Advisory

Stay focused on personal, family or business goals with strategic guidance.

We work with our clients to learn their personal, family and business goals and help them stay focused on those goals with specific strategies to achieve them. This means constructing financial plans, navigating tax and estate planning, working through family and business succession planning, and ensuring budgets are adhered to. Our clients lives are complicated so we work with them to ensure their core financial goals are focused on and achieved.

100 Years Combined Experience

Feel confident in our reputation, expertise and reliability.

Our founding team at Rosedale Family Office has a comprehensive perspective on wealth management. They represent years of expertise, consistency, stability and trust.