It’s a few days before the November 3rd U.S. election, and it’s being positioned as the most important in a generation. Supporters of each side are digging in. According to an October 25th Reuters poll, over 40% of each candidate’s supporters have indicated they won’t accept the result if their preferred candidate loses. Meanwhile, after a devasting human and economic toll has already been incurred, Covid-19 cases are spiking around the world and triggering new rounds of closures and restrictions.

On a lighter note, the prospect of a Canadian winter with limited opportunity to escape to warmer climates may also be weighing on sentiment. Despite the seemingly gloomy near-term horizon, our economic outlook for 2021 remains positive, and we expect several sectors of the market to perform well over the next 6-12 months.

Much real and virtual ink has been consumed in recent weeks dissecting the various U.S. election scenarios. There are eight theoretical outcomes with the White House, Senate, and House of Representatives all up for grabs (nine if you consider a contested election as a short-term scenario). With the Democrats expected to maintain control of the House of Representatives easily, the likely number of scenarios is reduced by half.

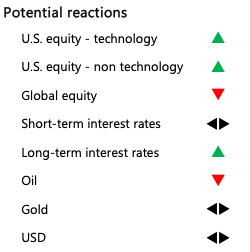

Below are the four most likely U.S. election outcomes and our best estimate of short-term capital market reactions. As we have throughout this volatile year, we remain agile to take advantage of opportunities and are prepared to manage through the election period regardless of the outcome. Please note that the financial market scenarios listed below have been calibrated for one or more vaccine approvals and broad vaccine distribution by mid-2021, as discussed in our October newsletter, Positioning For a Vaccine.

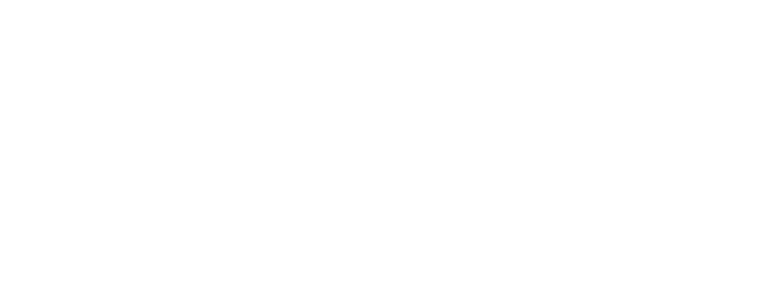

Outcome 1

President: Biden

Senate: Democrat

House: Democrat

This “blue wave” scenario carries a 40%-50% probability. Although a Democrat sweep comes with a likelihood of higher taxes, global equity markets should respond positively as Covid-related stimulus is likely to be highest under this outcome. Markets should also respond favourably to reduced gridlock in Washington and improved tone to international trade. This scenario would also hasten the transition from fossil fuels to renewable energy and provide the largest boost in healthcare and infrastructure spending. Larger fiscal deficits would likely accelerate U.S. dollar depreciation and put upward pressure on long-term interest rates. Combined with increased stimulus, broad vaccination starting in the second half of 2021, recovering consumer sentiment, and relatively low interest rates, this scenario should promote recovery in the hardest-hit areas of the economy and equity market (except oil/gas).

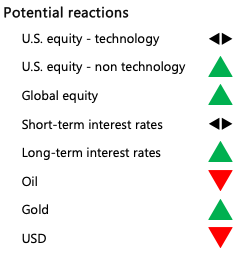

Outcome 2

President: Trump

Senate: Republican

House: Democrat

This “status quo” scenario has a 25%-35% probability and would likely result in a smaller stimulus package and heightened risk of further international trade hostilities. As markets are not currently pricing in this gridlock scenario, global equity market reaction may be mixed, with U.S. holding steady or improving slightly but global markets declining. Clean energy sectors gaining in recent months are likely to decline while oil/gas recovers somewhat.

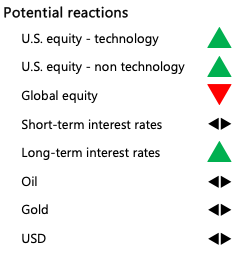

Outcome 3

President: Biden

Senate: Republican

House: Democrat

A change in the White House but status quo in Congress carries a 20% probability. This outcome would likely result in a scaled-down version of scenario one above but greeted favourably nonetheless by capital markets, particularly if a cooperative mood is ushered into Washington. 2022 Senate elections, which will see 22 Republican and 12 Democrat seats up for election, will be an opportunity for less gridlock during the second half of a potential Biden administration.

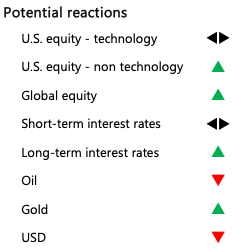

Outcome 4

President: Trump

Senate: Democrat

House: Democrat

This is the least likely of the four scenarios and would resemble a more downbeat version of scenario two above. A combative relationship between the White House and Democrat-controlled Congress would ensure that very little gets accomplished in Washington.

The magnitude of early voting/mail-in ballots combined with close races in key battleground states has increased the chance that a clear victor does not emerge on November 3.

Furthermore, the failure of one of the presidential candidates to concede also raises the spectre of a hung verdict and potential legal challenges à la Bush vs. Gore in 2000. In the aftermath of the 2000 election, the S&P500 Index declined by 8% over a three-week period after the November 8th election and partly recovered after the U.S. Supreme Court helped decide a winner on December 12th that year. Notwithstanding the scenarios above, markets generally abhor uncertainty, and we expect an undecided or contested election to trigger heightened volatility, albeit short-lived.

Eventually, we expect markets to regain solid footing regardless of who the final winner is. As Canadians, we can only watch the spectacle of the U.S. election from the sidelines. And while each of us may have their own preference or opinion regarding the U.S. election, we manage client portfolios based on economic analysis, valuation, and risk assessment.

Just beyond the U.S. election lies potentially favourable vaccine news

While market volatility could spike in the days before and after the U.S. election, we expect this instability to be temporary and plan to use it as an opportunity to raise our equity exposure consistent with our constructive outlook for 2021/2022. As outlined in our September 2020 Love Letter, we have started to position our managed portfolios to benefit from a gradual return to normal that would be facilitated by one or more vaccine approvals. As of the time of writing, three leading Covid-19 vaccine candidates (Pfizer/BioNTech, Moderna, AztraZeneca/Oxford) are expected to submit interim phase three study results to regulators by the end of November. Pending regulatory approval, emergency use could be authorized soon after, and wider dissemination likely in Q2/Q3 2021.

We expect the market’s forward-looking orientation to continue pricing in vaccine news well ahead of an eventual broad economic reopening. Since early September, it is noteworthy that market leadership has transferred from “stay-at-home” sectors such as Technology to “reopening” sectors such as Financials, Industrials (including airlines, railways), Consumer (including hotels, restaurants), and Real Estate (REITs). We expect these trends to continue and be fueled by upcoming vaccine announcements. Ever conscious of the relationship between risk and reward, we are selecting investment opportunities based on valuation, balance sheet quality, and management experience.