Controlling your emotions can be one of the hardest parts of investing. It can be near impossible to block out our emotions from our investment decisions. And because emotionally-driven investment decisions left unchecked can become the number one detractor to investment returns in the long term, it is critical to understand and enforce your own emotional fortitude where investing is concerned.

Anything can impact how we feel about investments on a given day, the dog ate your shoe(s), you watched something entertaining on tv, or the CEO of the company you invested in tweets. We can also feel overly confident in the markets when they go up and be very fearful when they decline.

Typically markets decline when something negative happens to the general economy, and if this negative stimulus emotionally impacts us, it can taint our view of investing.

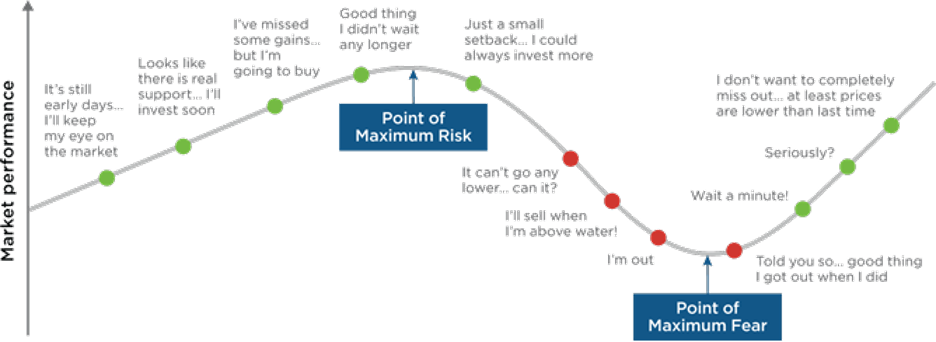

The cycle of emotions when investing is as follows:

Source: Dynamic Funds

Warren Buffett (CEO of Berkshire Hathaway) famously said, “Be fearful when others are greedy and greedy when others are fearful.”In practice, this can be much harder as it is very tempting to get caught up in the greed and harder to ignore the fear when markets are tough.

Never before have we seen this cycle play out more predictably than we have over the last 9 months. Initially, many investors dismissed COVID-19 as nothing more than the flu, and believed that the ensuing lockdowns would be short lived. Once it was realized that COVID-19 would be around for much longer than originally thought, many made a move to sell. This was done too late, though, as the stock market sold off very quickly into the COVID-19 crisis. Many then waited on the sidelines for COVID-19 to “pass” while the market recovered due to various factors.

One way to mitigate the above emotional cycle is to work with an investment advisor who can help you stay invested at the bottom of the cycle and keep a cool head at the top.

Typically, the market trend’s best performing days occur as the market trend turns from negative to positive or in reaction to a positive surprise. A profound example occurred last week as a result of the vaccine announcement from Moderna and Pfizer. While the announcements themselves were not a surprise, the 90+% efficacy against COVID-19 was not anticipated. This led to one of the best single-day performances in the market in over a decade. If you were completely on the sidelines, it would be tough to make up the performance.

Your investment advisor should work with you to help you stay invested even when things seem darkest.

Source: Bloomberg. S&P/TSX Composite Total Return Index, January 1, 2008, to December 31, 2019. It is not possible to invest directly in an index. Original investment, $10,000. Assumes reinvestment of all income and no transaction costs or taxes. Value of investment calculated using compounded daily returns. Missing 10, 20, and 30 best days excludes the top, respective return days.

It should be noted that the above graphic does not mean do nothing in the face of a crisis. There will be investments that will be impacted in different ways by certain crises. It is fascinating to note that internet technology companies had the toughest time in the dot com crash. In 2008 it was the real estate and financial market. During COVID-19, it has been energy, travel, and leisure. The key is to not give in to the temptation to sell everything and move to cash. That behavior could result in missing out on the best days in the markets.

If you are concerned about the volatility of your investments, then you should work with your advisor to design a well-diversified portfolio that includes assets that are not correlated to each other.

This COVID-19 pandemic, more than any other event in recent history, has impacted our emotions. The key to superior investment performance through COVID-19 has not been to sell and stay on the sidelines. It has been to stay invested appropriately. It remains easier said than done to go against our emotions and stay invested when things seem bleakest. Time and time again, though, maintaining fortified emotions is the approach that will lead to better investing outcomes.