The first fundamental difference between investing and gambling is gambling has a net negative profit potential at the beginning of the activity. On the other hand, investing is the opposite as even if you blindly left money in an S&P 500 ETF, you will make money over time. Investing also involves discipline, dedication, time, diversification, skill, and patience if you invest in individual stocks.Investing requires a thesis that you believe will prove out over time, resulting in a more significant investment return. We generally must look to where things are going, not to where they have been.

We invested in Ford in November 2020 for several reasons. We anticipated that as the economy re-opens, more people will be able to go to dealerships to buy cars. This increase in sales would increase the amount of money they make, which would make the shares that we purchase more valuable over time. Also, Ford was trading at a significant discount to its electric peers, and we knew Ford was unveiling all-electric models of its cars. Their partnership with Rivian was starting to bear fruit while Tesla’s partnership with GM was blowing up. These factors combined with work on their balance sheet, cash flows, debt structure, and previous earnings reviews led to a clear investment thesis that we are now watching play out. This investment took careful thought and consideration. Gambling, on the other hand, only takes a roll of the dice.

When you gamble, the starting proposition is that you will lose money. As a result, casinos are one of the most profitable businesses. Gambling is “playing games of chance for money”. We are all very familiar with games of chance. Some, you may even enjoy the occasional game yourselves. Scratch cards at the corner store, blackjack, roulette, horse racing; are all prevalent and tempting forms of entertainment. These games have distinct probabilities of success built into their construction. As a player, you may have a hot streak, but the reality is the odds are not in your favour. When you are gambling, you are taking money directly from the house and putting it in your pocket when you win. When you lose, the money goes directly to the house. Casinos’ are pretty good at taking money out of people’s pockets based on their size and grandeur. When you invest, what is happening is that the company you are purchasing shares in becomes more valuable.

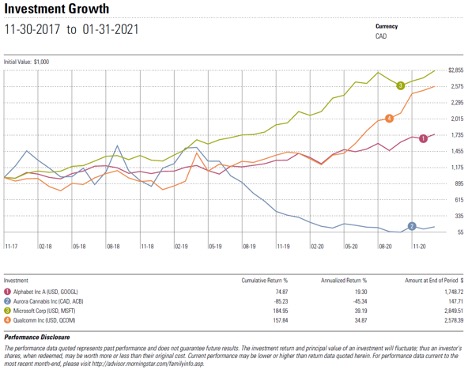

Enter speculative investments. These are typically riskier investments that carry a higher potential for loss and can be akin to gambling. The reason is that these investments, for example, could not currently have any earnings, so the value of your shares depends on the company’s ability to turn a profit in the future. If the company fails to hit the growth necessary to achieve that profit, then your shares are worth considerably less, or nothing at all. When gains are top of mind and losses are harder to recall, investors become overconfident in the market, which typically results in risk-taking.When looking for opportunity investments that are not speculative, we look for companies that have misunderstood businesses (our Ford example) or have secular growth drivers (ie. SolarEdge). We do not risk that a company won’t hit its profitability targets and reduce our equity’s value. Over time many speculative investments will fail. Many people thought that marijuana stocks were stable investments, but since legalization in Canada, they have cratered in value, with many companies going bankrupt. Both Ford and SolarEdge currently make money. Even if their businesses stop growing, the shares we own carry value.

Aurora Cannabis growth of $1,000 since September 2017 vs Alphabet, Microsoft, Qualcomm:

When looking at a new investment in a business, several factors are considered to ensure it is a profitable investment. If you are considering a speculative investment, it is vital to know that it’s akin to gambling.

While it can be hard in practice, patience is one of the most valuable qualities when investing successfully for the long term. Patience and discipline will always help keep the urge to gamble on that “guaranteed” speculative stock tip in check.