July 5, 2022

Download this article as a PDF.

“Every theory is a self-fulfilling prophecy that orders experience into the framework it provides.” — Ruth Hubbard

The old saying “don’t fight the Fed” has been a golden rule in investing that has served investors well for many decades. Yet, today, confidence in the Fed’s performance has waned, with market pundits criticizing the central banks for waiting too long to fight inflation. With newly aggressive rate hike moves at a time when economies are slowing, the Federal Reserve has confused many observers with its recent statement: “overall economic activity appears to have picked up.” However, there may be method to the Fed’s perceived madness. While its communication strategy has helped to tighten credit markets to this point, the move to aggressively hike rates is expected to kick off a cognitive feedback loop: Investors will be convinced that inflation will be beaten, which will push down inflation hedges in commodities and further accelerate the disinflationary forces that currently underlie the global economy.

Planting the Seeds for a Pivot

When the Fed increased rates by 75 bps in June, fears of an economic backdraft were quickly ignited: With extreme levels of debt and already slowing growth, it is largely acknowledged that economies are not well-positioned to handle high-interest rates. Yet, for those who were carefully listening to the Fed’s Q&A period (after its obligatory ritualist proclamation about the goal of price stability and 2% inflation!), Powell’s answers offered a glimmer of hope. Could we be witnessing the early planting of seeds for the Fed pivot? To be clear, we should expect another 75-bps hike in July. However, if the data emerges as expected, a shallow recession and a Fed pivot in the fall may be the planned path forward. If this is the case, investors can also expect a pivot from the tragedy narrative to one of rebirth to end the year.

Today, the Federal Reserve, the Bank of Canada and other global central banks, excluding the Bank of Japan and the Central Bank of China, are focused on fighting an inflation spike caused by the events of two exogenous supply shocks. While central bankers know that current inflation can only be somewhat affected in the short term by dramatically raising interest rates to contract demand, they have additionally been challenged by the threat of populism. High inflation has created economic struggles for Main Street.

American linguist and cognitive scientist Noam Chomsky once said: “The principle that human nature, in its psychological aspects, is nothing more than a product of history, and given social relations removes all barriers to coercion and manipulation by the powerful.” Policymakers understand the threat of populism and thus the potential consequences of their actions for Main Street remain key to their decision-making.

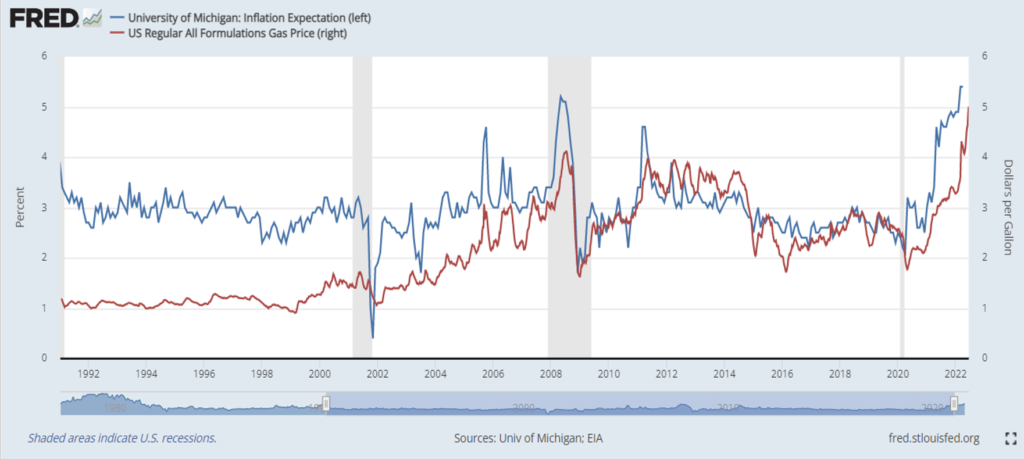

Consumer confidence has fallen to significant lows. As consumer sentiment is largely influenced by the price of gasoline at the pump, the University of Michigan consumer sentiment reading has dipped to levels not seen since the Global Financial Crisis. Chair Powell has now acknowledged that the Fed is concerned about “headline CPI” and the inflationary expectations represented by the University of Michigan survey. It is true that raising interest rates does not directly affect commodity prices, but slowing the economy into a recession will have a second-order effect of causing gasoline and other commodities prices to fall, thus reducing inflationary expectations.

Relationship Between Inflation Expectations and Gas Prices

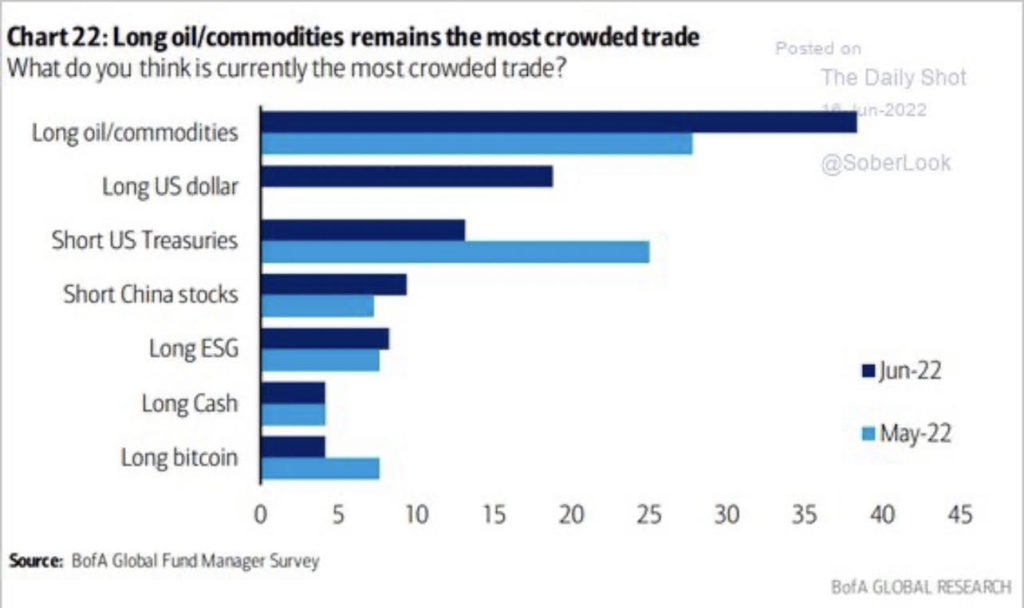

This is partly because many investors have used oil and natural gas as their preferred inflation hedge. Up until now, the oil and commodities trade has been most popular as inflation has prevailed.

Long Commodities Remain the Most Crowded Trade

Central bankers understand that current inflation can only be somewhat affected in the short term by dramatically raising interest rates to contract demand. However, an aggressive move to increase rates sends a message to Main Street that the Fed will do whatever it takes to defeat inflation. This classic use of “economic coercion” is a subtle and nuanced strategy that buys time for global economies and policymakers. By front-loading interest rate increases with two aggressive 75-bps rate moves, this is the credible threat that markets need — one which the Fed’s communication strategy could not achieve.

This will also change the behaviour of Wall Street. Once the Fed initiates this feedback loop, commodity prices should decline as investors who use commodities as inflation hedges will look to liquidate their positions, due to the belief that inflation will be defeated through slowing economic growth and possible recession. This is a real-time example of what George Soros classically referred to as “reflexivity.” This feedback loop is expected to contribute to tempering inflation.

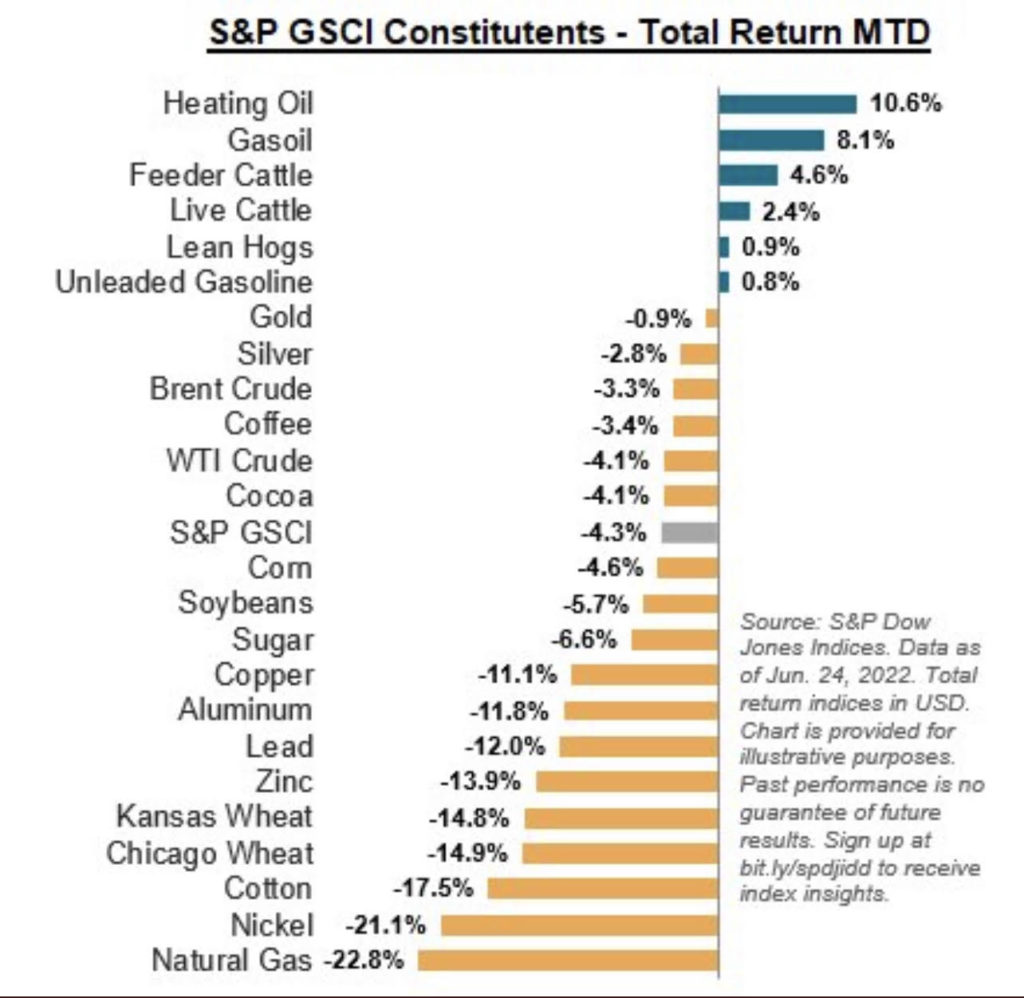

At the same time, the Fed is acutely aware of the risk of a potential repeat financial crisis that would largely affect Main Street through rising unemployment. This suggests that the Fed will pivot much earlier than many expect. The implementation of economic coercion may end up being the untold story of 2022. I believe that the expectation for continued aggressive rate hikes by the Fed has already set this process into motion. We may already be seeing reflexivity beginning to take course, noting the recent drop in commodities prices.

June Month-to-Date Total Return on Commodities

Without declining energy prices, the Fed can’t pivot. In addition, while raising interest rates will decelerate already slowing economies, consider that inflationary expectations tend to dramatically fall in a recession. As such, a shallow recession implicitly gets the Fed what it wants. However, let’s be clear — the Fed’s record on generating a soft landing is not good. Almost every recession since WWII has been preceded by an oil price shock, and, concomitantly, energy prices will significantly decline as the economy slows down.

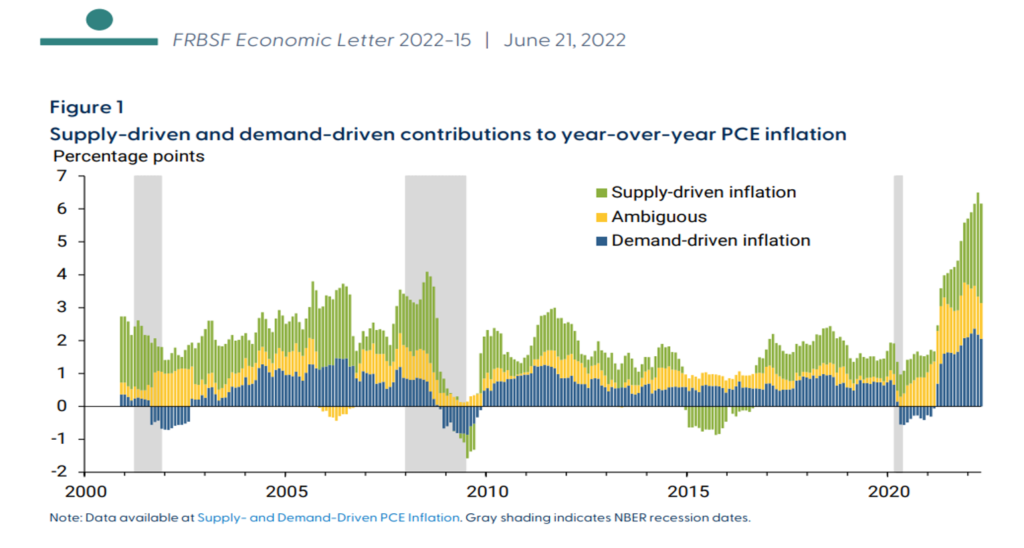

The Early Signs: Will Allow for a Pause in the Fall

Today, there is early evidence that economic and price data has finally started to move in a direction that will allow the Fed to pause come its September meeting. New research by the San Francisco Federal Reserve has deconstructed inflation, suggesting that over 50% can be attributed to supply side effects. As these pressures begin to reverse, will we witness rapid disinflation over the coming months?

Supply Driven Inflation: Over Half of Inflation Today

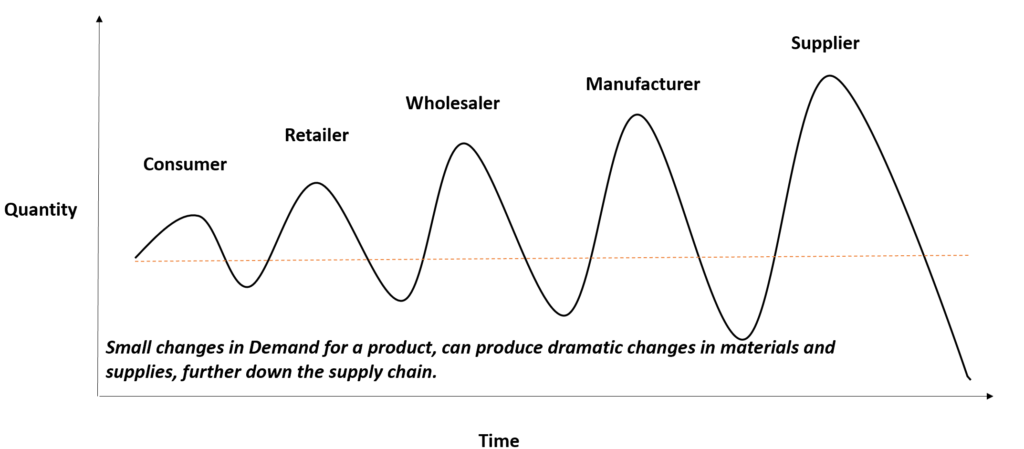

There may already be signs of disinflation. Target and Walmart, along with other retailers, overestimated the demand created at the height of the pandemic, which was further complicated by excessive supply chain bottlenecks that led to the increase in prices we are experiencing today. But these factors are now all reversing. In normal times, the bullwhip effect is a distribution phenomenon for which small changes in demand at the retail level can create progressively larger fluctuations in demand further down the supply chain. The result can be either too much, or not enough, supply at each level of the supply chain.

However, due to the anomalies of the pandemic, the bullwhip effect was generational in magnitude. On one side, there were supply constraints given the global economic shutdowns because of Covid-19. On the other, with incomes heavily supported by fiscal stimulus, and with consumers only being allowed to buy goods and not services, there was an excess in demand. Many retailers also erroneously believed that these consumption patterns would continue. As things return to normal, we are now seeing excess inventories get reclassified as “dead stock,” with prices being significantly cut to avoid a total loss. This is just one example of the deflationary occurrences today. The bullwhip effect is now working in reverse, suggesting a reduction in prices and a dramatic slowdown in economic growth.

The Bullwhip Effect

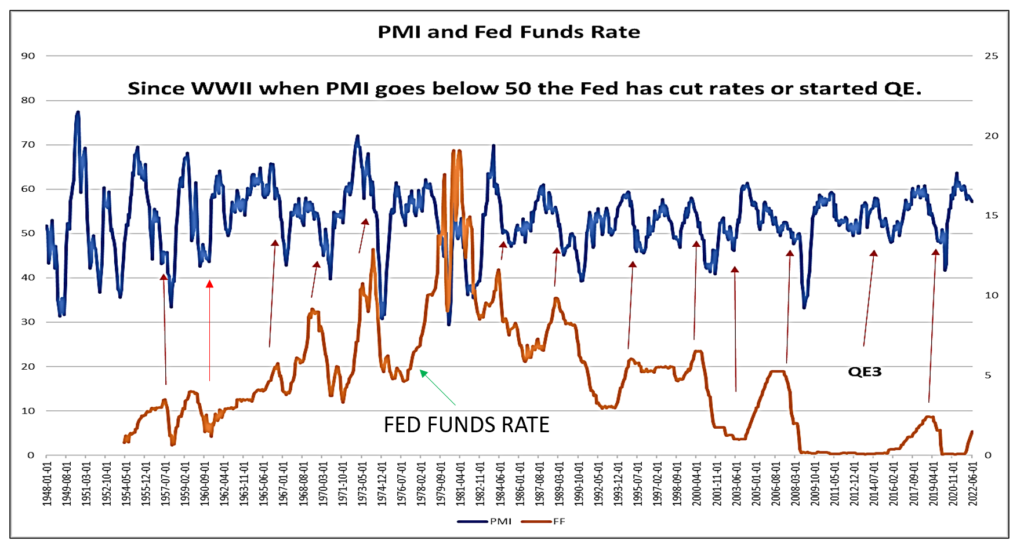

Furthermore, the recent declines in prices will eventually influence the Institute of Supply Management Purchasing Manager Index, or “ISM PMI Prices Paid” sub index, which over the coming months is expected to fall below 50, a level that signals a decelerating economy. More importantly, investors should note that since WWII, the Fed has paused, cut rates or started another quantitative easing (QE) program when the PMI falls below 50. If history is any guide, as fiscal stimulus turns into fiscal drag and the global economy enters a recession, commodity prices decline, supply chain issues abate, inventory destocking accelerates, the unemployment rate increases, the PMI falls below 50… and the Fed pauses.

Since WWII: Fed Cuts When PMI Index Below 50

However, the light at the end of the tunnel is getting brighter for Fed officials, who are aware of the changing dynamics. As Governor Waller recently stated, we should expect another 75-bps rate hike in July, getting the Fed Funds rate very close to the terminal rate forecasted in the Federal Reserve projects. However, more profoundly, Waller says: “I believe in a typical recession there is a decent chance that we will be considering policy decisions in the future similar to those made over the past two years.”8 In other words, according to the Fed: we are not in a new era. After the inflation spike is dealt with, we will likely return to secular stagnation, as I have suggested many times, and not stagflation as many pundits continue to proclaim.

What Should Investors Do?

It is expected that we will endure another 75-bps Fed rate hike in July to reinforce to the capital markets that the Fed is serious about restraining inflation. With this seemingly aggressive move, throughout the summer investors should expect high-frequency macro data to support the thesis that the global economy is going into a recession. However, investors should also expect incoming inflation data to show that we have passed peak inflation — the Fed will have achieved its goal. Once inflation stops surprising to the upside, commodities will cease being the only game in town; this is beginning to occur at the time of writing.

The peak in interest rates in the credit market may very well be in, and the bottoming of equities values looks to be upon us. The high conviction trade at this moment is government bonds, as we continue to get more data that reinforces the view that economies are dramatically slowing and the concern for the markets is growth, not inflation. With a continued focus on the ISM PMI Index, as the economy slows and prices decline, I expect it to fall to a level of 50 by the late summer or early fall. This will allow the Fed to pause and then pivot in the fall, when long-duration assets will outperform. Investors need to be flexible and keep an open mind — if data comes in weaker than expected, the capital markets will start discounting the Fed pivot, allocating capital to long-duration equity assets long before the pivot. My recency bias is shaped by the second half of 2008, when commodity prices dramatically declined, taking headline inflation from 5% to -2% within a very short period. While consensus is positioned for interest rates and commodity prices moving higher, the time to position for inflation was in 2020 and not in the summer of 2022.

As Roosevelt famously declared in his 1933 inaugural address, “there is nothing to fear but fear itself.” For those investors who pay attention to the financial news regularly, the next few months will continue to be dominated by negative news, with consumer confidence continuing at a low and fears of an economic slowdown weighing on investors’ minds. However, Roosevelt’s wisdom should not be lost during these times. As I have suggested before, this time is not different: Don’t fight the Fed. There is method to its madness and long-term investors who embrace the narrative of rebirth and not tragedy should expect to be rewarded.

— James E. Thorne, Ph.D.

[1] Federal Reserve press release, June 15, 2022.

[2] Jamie Dimon says ‘brace yourself’ for an economic hurricane caused by the Fed and Ukraine War. CNBC, June 1, 2022.

[3] Soros suggested that feedback loops exist between expectations and fundamentals that can cause price changes that deviate from equilibrium prices.

[4] “How Much Do Supply and Demand Drive Inflation?” FRBSF Economic Letter, June 21, 2022.

[5] For the economy to be contracting the index number needs to be below 47.5.

[6] Transcript of Chair Powell’s press conference, The Federal Reserve, June 15, 2022.

[7] “The First Steps toward Disinflation,” presentation, Barcelona, Spain, June 20, 2022.

[8] Lessons Learned on Normalizing Monetary Policy, Governor Christopher J. Waller, The Federal Reserve, June 18, 2022.