Huckleberry Finn Is Not Tom Sawyer.

“Corruption, embezzlement, fraud, these are all characteristics which exist everywhere.” — Alan Greenspan

When one thinks of blockchain, one quickly thinks of Bitcoin, NFTs, and cryptocurrencies. Just as so many confuse Mark Twain’s Huckleberry Finn with Tom Sawyer, to the point where the rock band Rush makes satirical fun of the mischaracterization at their concerts with a short South Park cartoon. With the collapse of FTX and the fraud surrounding the crypto space, many have jumped to the incorrect conclusion that the era of blockchain is over, done, akin to the long list of bubbles throughout history. Unfortunately, fraud happens all the time. As former Federal Reserve Chair Alan Greenspan states: “Corruption, embezzlement, fraud, these are all characteristics which exist everywhere.” Thus, the FTX scandal will not stop blockchain—an open-source, transparent, distributed-ledger innovation— from transforming business practices.

Blockchain is a foundational, decentralized, distributed-ledger technology that allows for secure and transparent recordkeeping and data transfer. Simply put, it’s the most significant innovation in record keeping since double-entry bookkeeping was invented centuries ago in Florence, Italy. Blockchain can revolutionize a wide range of industries by providing a secure and immutable way to track and verify transactions and other types of data exchanges. In the enterprise, it has the potential to significantly improve efficiency, security and trust in various business processes, and it has the potential to transform operations. Will the events surrounding the FTX collapse hinder its adoption? No. As with any foundational technology, fraud is a part of it— and often typical of any innovation that is transforming society.

The History of Blockchain

Contrary to popular belief, blockchain has been developing for decades. For many, the story of Bitcoin began in 2008, when a whitepaper was published by Satoshi Nakamoto (who went to great lengths to remain anonymous and perhaps may not even exist in person, but rather, represents a cyberpunk group). The backstory started during the Second World War, when cryptography—a means of coding secret information—was used as a tactic of war. Bitcoin and other blockchain currencies rely on cryptography practices to maintain their fidelity. In the 1980s and 1990s, a group of cypherpunks [1] would meet and communicate about the potential to use complex math to improve the world, including cryptography, economics, and censorship. They planted the roots of today’s populist movement, and their writings laid out the assumptions that would drive the basis for the cryptocurrency space. Simply put, the first iteration of the internet that we use today was designed to be something other than the foundational backbone of the global economy or the foundation of a digital platform for business practices. Blockchain is just a part of the natural continuation of this gradual evolutionary process.

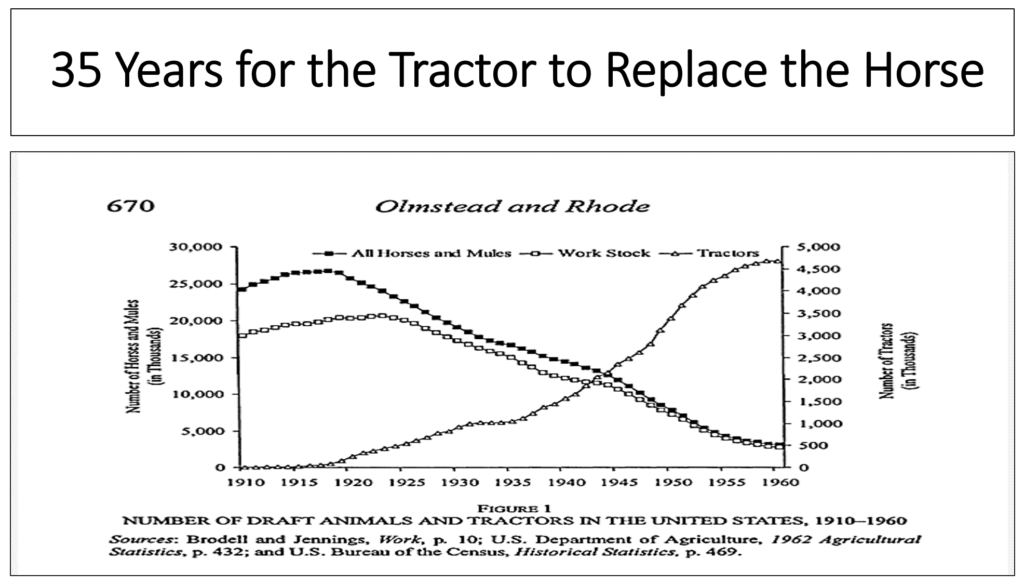

In the late 1950s, the U.S. developed a backup communication system that could be used during a nuclear war with Russia—the foundation for what we know today as the internet. The internet protocol, TCP/IP, took more than 30 years to transform and reshape our economy.

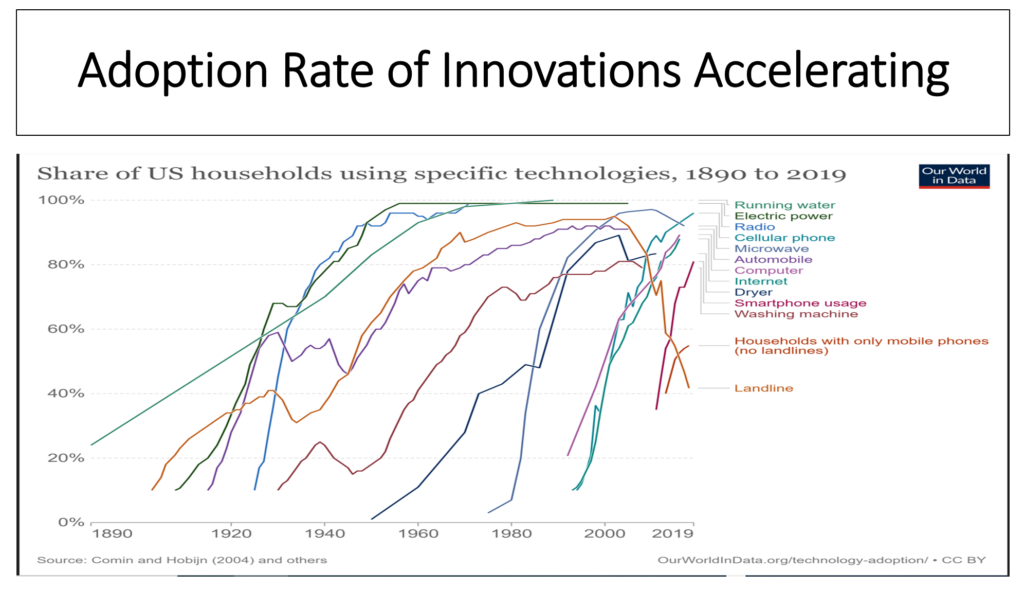

Central to my thesis is thinking of blockchain as the evolution of an internet protocol that also embodies the most significant record-keeping innovation in centuries, planting the seeds for how profound the changes to business practices will be. Too many people forget the early days when dial-up internet was slow, and very few people had access to it. The bursting of the internet bubble, the proclamations that the internet was a fad, a scam. What’s an email? Yet, by 2005, with the rise of the smartphone, massive and rapid adoption occurred. The adoption curve of blockchain should follow the same path. Today we take for granted that our governments, companies, and global economy are based on an internet-driven, platform-based business model. But it’s built on an internet protocol never designed for such a task. The events surrounding FTX and other fraudulent events in the crypto space will not stop this evolutionary process. Just as the collapse of the Time Warner AOL merger did not stop Netflix from implementing its vision of streaming content over the internet. Unfortunately, evolution is not clean.

The Future of Blockchain

As with many innovations, such as railroads, canals or the internet, after a period of hype or novelty, and with the bubble bursting, the invention slowly affects how an economy evolves. Typically, the evolutionary process happens in waves. With blockchain, radical foundational shifts in record-keeping will change how a company acts internally and externally. Companies can no longer ignore this natural evolutionary process; blockchain will disrupt many industries, just as the internet did to the brick-and-mortar retail industry. As with any innovative bubble, fraud should be expected. The collapse of FTX fits perfectly into the historic evolutionary narrative. What it signifies is that the blockchain is about to enter a new era, an era of mass adoption. The events surrounding the FTX collapse will not affect the uptake of blockchain innovation. My thesis is that secular forces that point to an acceleration of the rate of adoption are a more powerful force. We are in the age of exponential growth. Central to the blockchain’s adoption rate is Metcalfe’s Law, which identifies the value of a network as proportional to the square of the number of its nodes or end users. The notion is analogous to the business concept of a ‘network effect’, in that it provides both added value and a competitive advantage. For example, Amazon may or may not have had the best website, but it had the most users. Because this is so difficult to replicate, the power of the network drove out other competition.

The value and evolution of blockchain will adhere to the same mathematical concept. Metcalfe’s Law was conceived by George Gilder but is attributed to Robert Metcalfe, co-inventor of Ethernet (1980). We intuitively assume that innovation will be constant. History proves otherwise.

The blockchain is a foundational technology, but it’s also true that the adoption of innovation is accelerating exponentially. From a mathematical perspective, we assume that the rate of innovation is constant because our short-term outlook gives us the illusion that it is linear and not exponential. Today, we take for granted that SpaceX can land a rocket on an autonomous drone in the middle of the ocean without conceptualizing the massive nonlinear technological achievement that it truly is. The simple point is that the adoption rate of blockchain continues to gather pace.

Hidden behind high-profile companies with naming rights on sports stadiums, entrepreneurs are building the blockchain infrastructure that will be the backbone of our new digital economy. In health care, blockchain technologies focus on lowering costs and securing patient data. In supply chain and logistics, companies such as Grain Chain are providing a producer-to-consumer food traceability platform. In finance, the digitization of assets is a secular theme in which firms such as BlackRock and ICE are participating. Real estate, media, industrial and machinery, manufacturing, retail, voting, entertainment and advertising, to name a few, are industries starting to implement blockchain. Once you understand that blockchain and crypto are just distant cousins, the mathematical concept of Metcalfe’s Law predicts that its adoption will be faster than consensus expects. As with any new innovation mischaracterizations will continue to happen. But as Neil Peart and Pye Dubois wrote in Tom Sawyer. [2] “He knows changes aren’t permanent. But change is.”

Blockchain is about to go mainstream, and like every other innovation before it, when it happens it will be taken for granted.

– Dr. James Thorne

[1] A sci-fi genre involving a group of independent hackers who go against a mega-corporation or government

[2] Tom Sawyer, Rush, Moving Pictures; Music Geddy Lee and Alex Lifeson, Lyrics Neil Peart and Pye Dubois. 1981.