Part 2: Canada’s 2024 Economic Storm

In the middle of difficulty, lies opportunity. – Albert Einstein

In this sequel to Is There Something Rotten in the State of Canada? we delve further into the complex web of monetary and fiscal policies that seem at odds with one another, evoking the drama of a Shakespearean play. The phantom of secular stagnation and deflation is likely to haunt us once again in 2024. To quote Macbeth, “By the pricking of my thumbs, something wicked this way comes.” This chilling sentiment resonates when considering the future of Canada’s economy.

The State of the Canadian Economy

A surge of mortgages up for refinancing at current interest rates threatens to significantly curb economic growth for the remainder of the decade, reducing the Bank of Canada (BoC) to a mere player in a tale “full of sound and fury, signifying nothing.” The first step toward averting a crisis is recognizing its presence a notion seemingly overlooked by the BoC and the federal government despite clear signs of looming economic challenges. Therefore, it would be prudent for Canadian investors to diversify their asset allocation beyond Canada to hedge potential risks, adhering to the principle, “to thine own self be true.”

Since the Global Financial Crisis, Canada’s economy has relied heavily on extreme levels of personal and corporate debt. The personal debt to disposable income ratio stands at a staggering 187%, the highest among G7 nations. Corporations are not exempt from this trend, often resorting to debt issuance to maintain high dividends. Bay Street needs to acknowledge its role in this narrative and address the precarious situation.

The BoC’s aggressive interest rate-hiking campaign has catapulted the overnight rate to 5% from 0.25%, pushing Canada’s economy toward financial hardship. Homeowners and corporations are faced with the daunting reality of refinancing at these much higher interest rates, which could significantly impact economic growth for the rest of the decade. Adding to this tragedy is the irony that 30% of the rise in the Consumer Price Index (CPI) can be directly attributed to BoC rate hikes.

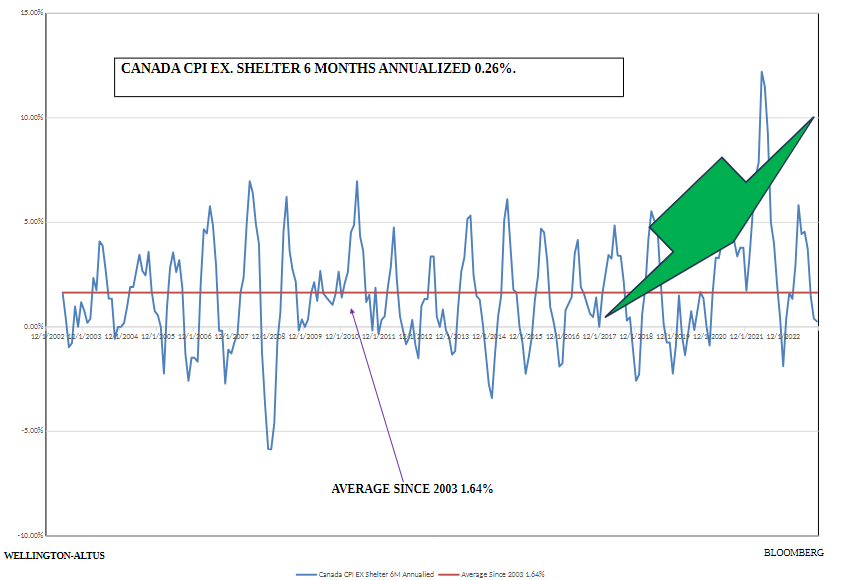

Canadian households are already feeling the burden of these increased financial pressures. The debt service ratio climbed to 15.22% in the third quarter, marking the highest point on record, which dates back to 1990. Additionally, retail sales significantly trail long-term averages (12-month retail sales, excluding autos, is at 0.8%, a full 3.84% below its 30-year average). And finally, the six-month annualized CPI excluding shelter stands at 0.26%, below the lower bound of the BoC’s legislative 1-3% target range. These indicators suggest an economy on the edge of a precipice.

The Canadian economy is alarmingly dependent on credit and real estate. With disappointing productivity growth, Canada’s economic performance may be crippled by the “whips and scorns of time” for years to come.

To counter this, Canada needs a robust industrial policy to facilitate its transition into the digital age. The country must equip itself for the new world of artificial intelligence and blockchain, adopting an industrial policy similar to U.S. President Joe Biden’s CHIPS and Science Act or the U.S.-Japan Digital Trade Agreement.

Demographic challenges also pose a significant hurdle for Canada. In 2022-23, international migration accounted for 98% of population growth, leading to short-term strains on social services, housing markets, and productivity growth. This issue highlights the complexities of fiscal and monetary policies working at cross purposes.

The heightened pressure from immigration on housing and rental markets only exacerbates existing shortages. Ironically, the BoC’s high interest rates have stymied housing supply, contributing to inflationary pressures. A more nuanced approach, such as reducing interest rates to stimulate housing supply, may be essential for the BoC to incorporate into its monetary policy decisions.

On the World Stage

Successfully soft-landing the economy is akin to landing a 747 on a postage stamp—it demands precision, skill, and careful maneuvering. Much like a pilot must deftly navigate a massive aircraft onto a tiny target, policymakers must guide the economy to a gentle landing, avoiding turbulence and ensuring a smooth transition. It’s a daunting task that requires expertise and finesse to prevent a bumpy ride for all aboard.

It appears that U.S. Federal Reserve Chair Jerome Powell is about to achieve this feat, a rare accomplishment previously only attained by former Chair Alan Greenspan in 1995. The stock market’s positive response reflects confidence in this delicate economic maneuver. As Shakespeare once said, “There is a tide in the affairs of men, which taken at the flood, leads on to fortune.” It seems Powell has successfully seized this opportune moment to steer the economy toward stability.

Canada, on the other hand, should prepare for turbulence. International investors are already reevaluating their Canadian investments, and the denial of policymakers is being noted in global capital markets. Immediate policy changes are essential. The sooner the BoC and Ottawa adopt a pragmatic, fact-based perspective on Canada’s financial situation, the better for everyone involved. Investors should not lose hope. “In the middle of difficulty, lies great opportunity.” It is only by recognizing the gravity of the situation and taking decisive action that Canada can hope to avert the impending economic tragedy. In this light, investors can find a safe harbour in U.S. markets.

Facing the Facts

If the BoC does indeed acknowledge the reality of the situation, interest rates could be cut more aggressively than many anticipate. By the end of 2025, the BoC’s overnight rate could drop below 2.5%. But before any recovery can start, a bottom must be hit. Hence, Hamlet’s “the readiness is all.” It would be prudent for investors to brace for volatility and strategize their next moves carefully, especially considering the current economic climate.

As the Canadian economy is exposed to the harsh realities of its financial situation, it is necessary to reflect on the underlying issues and take appropriate action. “The fault, dear Brutus, is not in our stars, but in ourselves.” Like the players in Julius Caesar, our economic fate is not predetermined, but the result of the choices we make. It is critical that we face the reality of our situation and not allow denial to blind us to the necessary changes.

Looking forward, there are several areas where policy changes could help mitigate some economic challenges. Measures could include more accommodative monetary policy, a focus on productivity enhancing investments, and targeted immigration policies that address demographic issues and support economic growth.

Ultimately, addressing these challenges will require concerted effort from all parties involved— policymakers, investors, and citizens alike. As we chart a new course for the Canadian economy, let us remember the wisdom of Shakespeare’s Hamlet: “We know what we are, but know not what we may be.” By acknowledging our current state and working together toward a brighter future, we can help ensure that our economic story does not end in tragedy, but in triumph.

In conclusion, the current state of the Canadian economy is indeed troubling. But if we take the necessary steps to address its problems, we can take advantage of the opportunities that lie within this difficulty. As investors, it’s important to remember that even amidst economic turmoil, there are opportunities to be found. By staying informed and making prudent decisions, investors can navigate the storm and emerge stronger on the other side.