From tools to fight abusive tax planning to combatting the cost of living, we break down how Canadians across the country will be impacted by the newly announced 2023 Federal Budget in Canada.

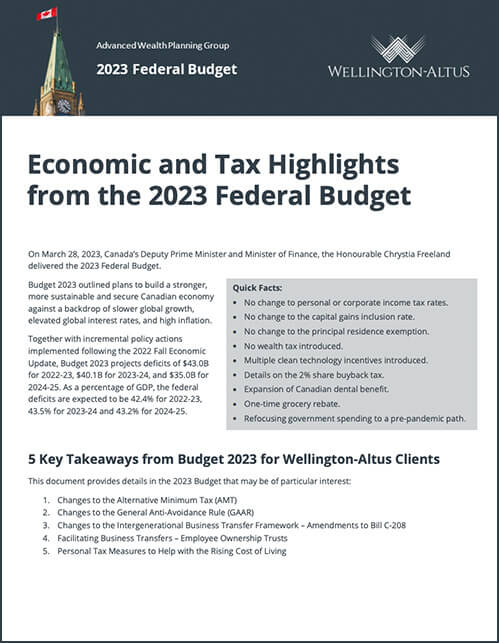

Click on the image below to download a PDF of all the details to the 2023 Federal Budget that investors need to know:

- -> Economic and tax Highlights from the 2023 Federal Budget

- -> 5 key takeaways from Budget 2023 for The Wong Group clients

- -> Alternative Minimum Tax (AMT) for High-Income Individuals

- -> General Anti-Avoidance Rule (GAAR)

- -> Strengthening the Intergenerational Business Transfer Framework

- -> Employee Ownership Trusts (EOTs)

- -> Personal Tax Measures to Aid Affordability

- -> An Affordable Place to Call Home

If you have any questions about how this relates to you or your investment portfolio and financial plan, please give us a call at 778 655 2410 or email us at thewonggroup@wellington-altus.ca

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager & Senior Wealth Advisor

Wellington-Altus Private Wealth Inc.

Board Director

Wellington-Altus Financial Inc.