The Wealthy Mindset – How to Think Differently to achieve Financial Freedom

I often meet with people who have questions about retirement, who feel frustrated, scared or confused about whether they are on the right path to achieve the freedom to live the life they’ve always wanted.

Like them, you may be striving for what I call the “work-optional life” – a lifestyle where you are liberated from the financial stress and the need to rely on a salary or income from your business; a life where you can finally enjoy a reliable and sustainable cash flow from a portfolio of investments that generates steady income to cover all your lifestyle needs, now and in the future.

This Work-Optional Life is possible, but most often what holds people back from achieving this financial freedom, is how they think about money and how they think about building wealth. Here I’ll share with you the 3 key steps to creating a healthier mindset, a “wealthy mindset”, that I’ve found over my past 20 years as a financial professional and as author of “Smart Risk: Invest Like the Wealthy to Achieve a Work- Optional Life”, are the keys to achieving the work-optional life.

STEP 1 – PERSPECTIVE

Think differently and develop a healthier perspective around your wealth

“We can complain because rose bushes have thorns or rejoice because thorn bushes have roses.”

– Abraham Lincoln

Often our perspectives around money, wealth, and retirement, are tinted by how we were brought up to think about money. The emotional component around money is one of the biggest roadblocks to having a healthy perspective about wealth. Think back to your earliest memory of how you earned your first dollar. What did your parents teach you about money? How did it feel to lose a bet, to buy your first home, or to see your kids graduate from college thanks in part to your financial assistance?

Too often, our perspective around money has been affected by some fear of not having enough. In fact, nearly three-in-10 Canadians are not confident they will achieve their financial life goals (28%) 1. Perhaps it’s an early childhood memory of growing up during tough times, or a life experience that led to shame or embarrassment that we wish never to experience again. The goal is to first recognize this mindset and shift from a fear of lack, or “scarcity” mindset toward a feeling of enough, or “abundance” mindset.

A Wealthy Mindset views money as an “enabler”. Money and wealth are tools that enable or empower you to live the life you want, and to feel liberated from the stress of not having enough. However, money and wealth alone will not result in joy or happiness, unless you are equipped with the right “abundance” mindset. To get there, it’s important to remember that instead of seeing wealth as a measure of success, wealth simply enables you to have more (and perhaps more favorable) choices. But it’s still up to you what you do with your wealth. Do you use it to accumulate more things, cars and clothes, or pass on to the next generation? Or do you choose to live a simple life full of love and connected relationships, and let go of the desire for fancy things in favor of interesting travel and life experiences? If your goal is the latter, choosing to view money as an “enabler” of your freedom and lifestyle will be an important first step.

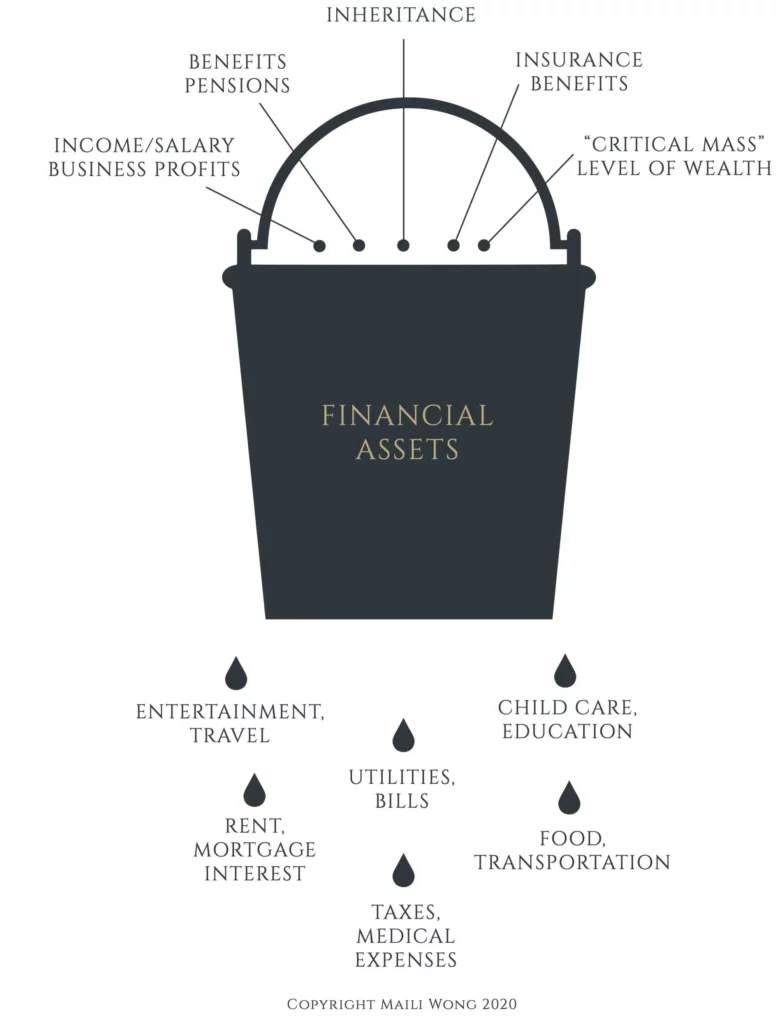

THE LEAKY BUCKET

A wealthy mindset recognizes that what you keep and build is more important than how high your salary or income is. For instance, think of your wealth as water held in a bucket. The more wealth you accumulate, the more water is in the bucket. Trouble is, there are many holes in the bucket.

This leaky bucket represents your financial situation. While there are multiple ways you can “earn” money, i.e. your salary, bonus, inheritance, pensions, etc., money is constantly flowing out of the bucket through leaks like mortgage, groceries, travel, taxes and other expenses. A wealthy mindset looks beyond how high one’s salary or income is before taxes and looks to:

1. Plug the leaks, and

2. Consider how to grow the water in the bucket by investing at a reasonable rate of return.

Thus, a wealthy mindset aware of the Leaky Bucket and focused on building what’s in the bucket will help you sustain a reliable source of cash flow in retirement, independent of your salary or business income, and empower you with greater choice for how you want to live for the rest of your life.

Here are a few common “unhealthy” perspectives that I’ve helped my clients overcome, to enjoy a healthier “Wealthy Mindset”:

Fear of taking risks

Most people fear losing more than they enjoy winning. However, if we repeatedly make choices to avoid loss, then the consequence of playing it too safe might put us at greater risk of not reaching our goal of the work-optional life. Instead, a wealthy mindset can be developed if we seek opportunities where the magnitude and likelihood of a positive outcome is greater than the magnitude and likelihood of a negative outcome. Yes, there may be risk of some loss, but the odds are stacked in your favor toward success. Learning to take smart risks at an early age can help build confidence and resilience to continue taking smarter risks as we get older, to create better outcomes for all.

Overconfidence

Most people feel more confident in areas where they feel familiar vs. areas where they feel less familiar. There is a natural fear of the unknown. However, a little bit of knowledge (i.e. familiarity) can be dangerous, as it can lead people to be more inclined to place bigger bets or feel more confident taking bigger risks than they should. For example, I once met an investor who worked in the oil and gas industry and felt he knew the oil and gas stock market better than most investors. He took bigger bets and invested using borrowed money (i.e. on margin) because he felt he had a better sense of what junior oil and gas companies would hit it big. Unfortunately for him, there were other geopolitical and macro-economic forces at work beyond his working knowledge that caused oil prices to move in the opposite direction than he thought, and his overconfidence cost him hundreds of thousands of dollars. He then came to me for help, and I helped him rebuild his portfolio and diversify into other sectors and asset classes that he had never considered, and he has recovered his losses over the years and is now enjoying a work-optional life.

Anchoring

Many investors anchor their frame of reference on the price they paid for something, refusing to change their position until they can sell at or above that particular price. For example, I once had a client who was planning to sell his house in 2016. Housing prices in Vancouver where he lived had been going up for several years leading up to the peak in 2016, and there was a prevalent view that “Vancouver housing prices would always go up”. While he had received a very strong offer from a buyer back in 2016, he didn’t sell as he was holding out for a higher price. As prices eased off and declined over the next few years, this client refused to sell, with his mentality stuck on the price he was offered during the peak in 2016. He was anchored to what he could have, should have, would have, sold at instead of adapting to the current reality and making a forward-looking choice as to what a sale and downsize would enable him to have in a portfolio of income-generating assets to fulfill his work-optional life.

The first step is awareness that you may have certain beliefs about money or your wealth that hold you back,

and the next step is understanding how to move towards a healthier “Wealthy Mindset” so you may be free to create the life you’ve always wanted.

STEP 2 – PLAN

Develop a Financial Plan and an Investment Plan tailored to your Work-Optional Life

“To invest successfully does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound, intellectual framework for making decisions, and the ability to keep emotions from eroding that framework.”

– Warren Buffett

The goal is to develop both a Financial Plan, and separately, an Investment Plan that is aligned with your Financial plan and they go hand-in-hand. Most investors I’ve met have one or neither, rarely both. While the Financial Plan identifies what you need to have happen to meet your goals, the Investment Plan is the implementation strategy that’s important to help you meet them. Let’s consider why both are important to successfully create the “work-optional life”:

Financial Plan

According to the Financial Standards Council of Canada, Canadians who engage in financial planning report significantly higher levels of financial and emotional well-being than those who don’t.

While you could try to develop a Financial Plan on your own, a Certified Financial Planner (CFP) is equipped with both the expertise and relevant software to help you complete this process.

Begin with the end in mind. To start the Financial Planning process, picture how your “work-optional life” will look and feel, then estimate how much monthly or annual cash flow you would realistically need to have generated for you to maintain this lifestyle.

Then, the CFP would calculate how much you would need in a balanced investment portfolio to reasonably be able to sustain and generate this amount of cash for you. Finally, the CFP would work backwards to determine how much you need to save and invest today in order to get to the point where you’ve built up enough of an investment portfolio to sustain your work-optional life.

These are the basic steps to developing a Financial Plan, while there are also additional steps to a Comprehensive Financial Planning process, like insurance planning, tax and estate planning, and planning around specific goals like your kids’ education.

Investment Plan

After 20 years in the investment industry working in New York City and focused on the global markets, I’ve seen many investment strategies and how some work better than others. Most importantly, every investor needs an Investment Plan that they can stick with.

What I’ve found works best is a disciplined, structured investment approach rooted in financial science that continually stacks the odds of success in investors’ favor. I call it the Smart Risk investment approach. It’s unlike “traditional” investment strategies that are based on stories or “gut feel” of where the market is headed.

The Smart Risk investment approach is both an art and a science and is based on 3 key ideas:

1. Align the investment holdings with the characteristics that have been proven to lead to higher returns over time. A Wealthy Mindset looks for risks that offer a strong probability of higher payoff than the probability of a loss. A Smart Risk investment approach recognizes this and seeks investments with characteristics that offer higher return with less risk.

2. Embrace market volatility. While many people fear market corrections, a Wealthy Mindset using a Smart Risk approach realizes that market downturns are a natural and regular occurrence, and present buying opportunities and entry points for long term gains.

3. Practice smart diversification. The purpose of smart diversification is to lower the risk of your investments, while enhancing the potential return. Too many investors misunderstand or improperly implement this technique. For example, investors sometimes hold several investment accounts at different financial institutions, believing this effectively diversifies their portfolio, when in fact, they often hold similar investments across the different accounts, and are taking more concentrated risk than they thought. Smart diversification is intentional diversification across different classes of assets, different geographical regions, and different industries, whose prices react differently to various economic conditions, building a more resilient portfolio on a strong foundation that can more successfully provide the steady cashflow to support your work-optional life.

STEP 3 – PEOPLE

Surround yourself with a Circle of Trust

“Friends are sometimes a big help when they share your feelings. In the context of decisions, the friends who serve you best are those who understand your feelings but are not overly impressed by them.”

– Daniel Kahneman, author of ‘Thinking Fast and Slow’

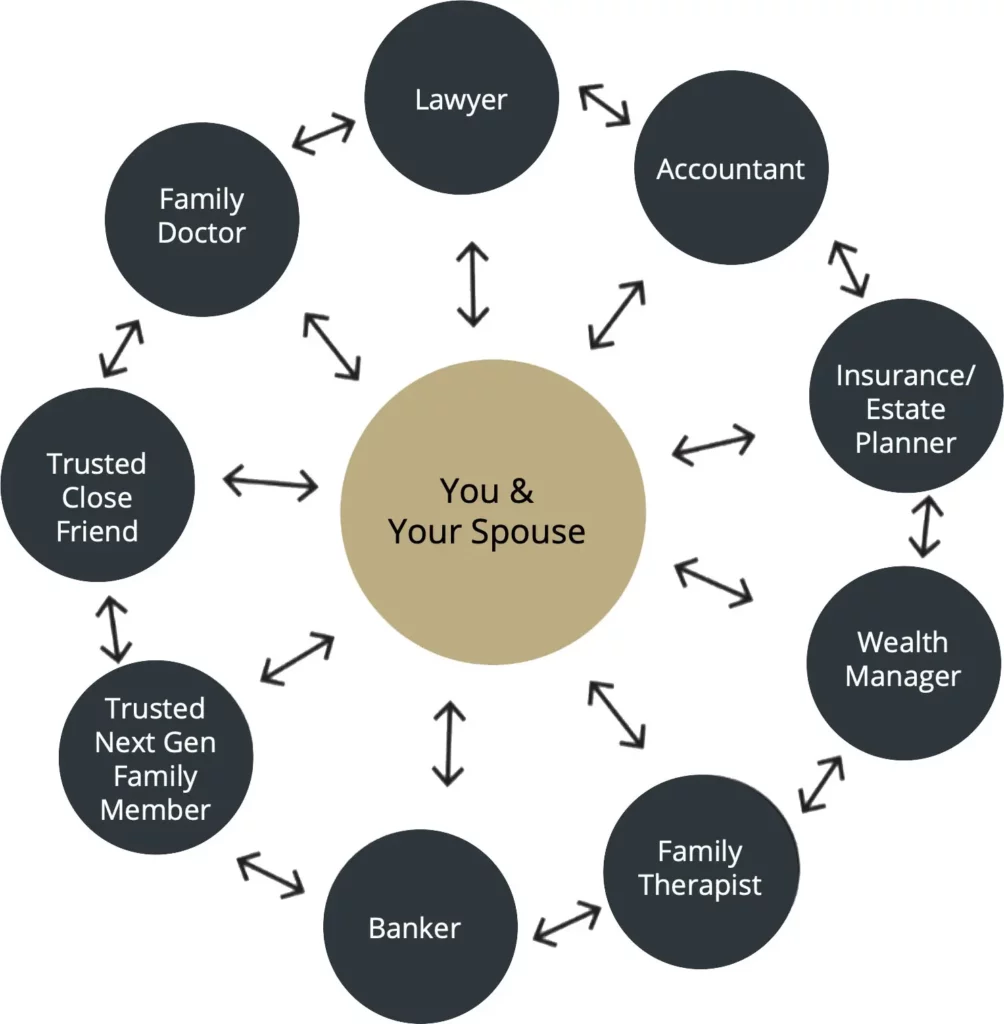

While some Canadians manage their finances on their own, 65% of Canadians over 50 years of age have invested in a professional financial advisor to be on their roster. A study from the Montreal-based Centre for Interuniversity Research and Analysis on Organizations found that those who avail themselves of professional financial advice see their assets grow over time by 1.58 to 2.73 times more than those who act alone. To truly help you attain a Wealthy Mindset about your wealth and keep you on track towards achieving a financially viable retirement, this professional financial advisor must have both expertise and experience, and your best interests in mind.

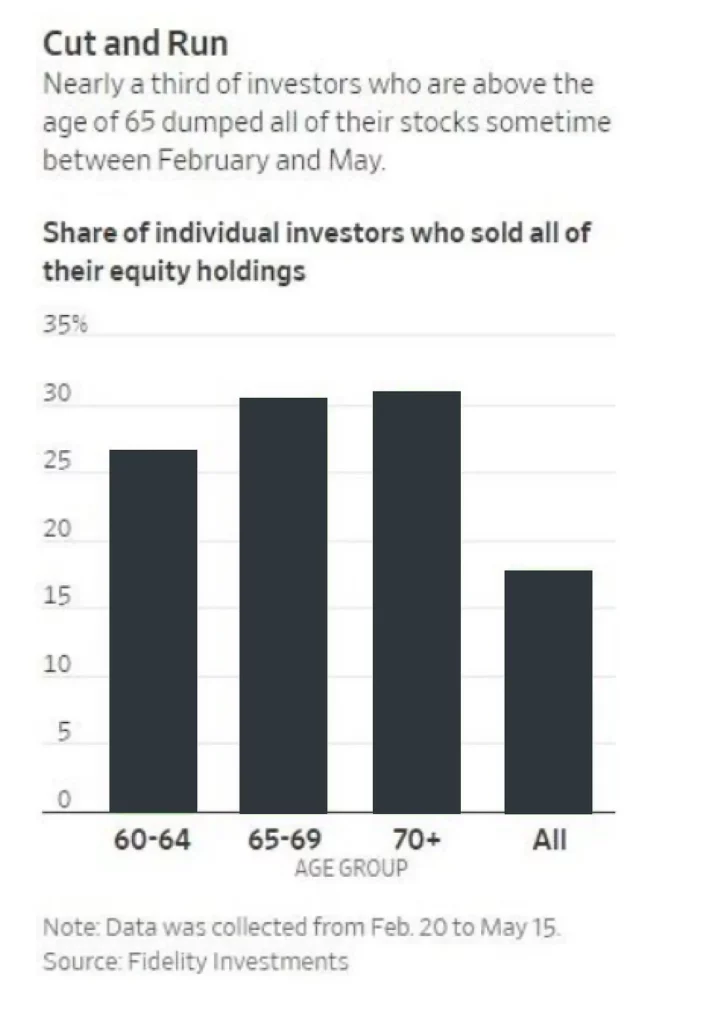

One example of why it’s important to surround yourself with the right people, is during extreme market volatility. During the recent COVID19 global pandemic, 1 in 5 investors sold out in a panic between February and May 2020, locking in losses, according to a Fidelity study.

One of the most valuable aspects of having a professional financial advisor during these times of extreme market volatility, is the value of having sound advice from a professional to talk through the emotional fog and fear. It is the role of the professional advisor to help you instill a healthier mindset to avoid selling out in a panic and stay invested to participate as markets recover.

Invest in building the right group of people or advisors, what I call your “Circle of Trust” to keep you thinking and acting in a financially healthy way.

Characteristics to look for in finding the right professional financial advisor include:

Competence

look for an advisor who has credentials that demonstrate expertise and strong ethics, like the Chartered Financial Analyst (CFA) designation, a global gold-standard in the investment industry. Look for a financial advisor who acts with your best interests in mind, instead of an employee who is motivated to sell you financial products for a commission. Look for a financial advisory firm that offers state of the art technology and disciplined investment processes so your wealth can be resilient through the ups and downs of the market.

Clarity

look for an advisor who acts with integrity and transparency, helping to provide clarity around your investment strategy so you can have confidence in your financial plan, or understand what steps need to be taken to pivot now and get on the right path to achieve your work-optional life.

Congruency with Wealthy Mindset

look for an advisor who takes the time and care to deeply understand your financial goals, values and mindset around your wealth so that you can have confidence to step into financial freedom and achieve the results that matter most to you.

Continuity

look for an advisor who thinks about your long game. This advisor has the ability to plan across multi-generations, create business succession and transition strategies, ensure you’re able to achieve your philanthropic desires, and gives you the continuity you deserve.

Follow these 3 key steps to help you think differently, and shift to a healthier Wealthier Mindset

STEP 1 – PERSPECTIVE

STEP 2 – PLAN

STEP 3 – PEOPLE

This Wealthy Mindset has helped many of our clients achieve the “work-optional life” – a lifestyle where you are liberated from the financial stress and the need to rely on a salary or income from your business; a life where you can finally enjoy a reliable and sustainable cash flow from a portfolio of investments that generates steady income to cover all your lifestyle needs, now and in the future.

Take the next step to having the lifestyle you want, and lets continue the conversation.

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager, Board Director and Executive Vice President at Wellington-Altus Private Wealth and Author of Amazon Bestselling book, “Smart Risk: Invest Like the Wealthy to Achieve a Work-Optional Life”