Wealth Matters Webinar #4: The Work-Optional Life: How to Plan and Retire Early – Financial Planning Tips from the Pros

Planning to retire early, or knowing if one is on track to maintain a stable retirement, is top of mind for many Canadians, especially in light of the pandemic and how it’s impacted our lives.

Click the image above to watch this informative video webinar, where we will address some of the most frequently asked questions about How to Plan and Retire Early, and how to Maintain that Work-Optional Life.

Questions we will address in this live and interactive webinar include:

- – How much do I need to have in order to successfully retire and live a long and happy life?

- – Which one is more important – the RRSP or TFSA?

- – In Retirement, what’s the best way to withdraw funds from my retirement accounts?

- – Should I defer taking my Canadian Pension Plan benefit (CPP) or take it early?

- – What are the top financial risks to your comfortable retirement and work optional life? and much more…

Read on below for valuable tips from our team of Financial Planning and Advanced Wealth Planning professionals.

Welcome and thank you for joining us and our “Wealth Matters” 4-part webinar series, brought to you by my team, The Wong Group at Wellington-Altus Private Wealth.

This webinar series is designed to inspire and inform you by providing connection and trusted Thought Leadership during these uncertain times.

I’m Maili Wong, Executive Vice President, Board Director and Senior Portfolio Manager at The Wong Group at Wellington-Altus, a leading independent boutique wealth management firm dedicated to providing an outstanding client experience.

Today I’m very excited to host this conversation, especially as the recent pandemic has jolted many of us to re-examine our finances and retirement plan.

Joining me today, we have, Cailie O’Hara, a Senior Wealth Planner with Wellington-Altus to join me in conversation about “The Work-Optional Life: How to Plan and Retire Early – Financial Planning Tips from the Pros”.

Slide 2 – The Smart Risk Investing Roadmap

So why do we care about Financial Planning anyways? Well, in fact, it’s one of the key components to achieving the #1 thing that I find Canadian investors are searching for, and that is the confidence and clarity that they can Achieve and Maintain a Work-Optional Life.

What’s a Work-Optional Life? It’s the lifestyle where we are free to live the life we choose, free from financial constraints, where we can choose to do the work that we love without having to rely on it for an income. Instead, we have a portfolio of assets providing a steady stream of cash flow to support our lifestyles. That’s Work Optional.

In my book, “Smart Risk: Invest Like the Wealthy to Achieve a Work-Optional Life”, I outline a roadmap. A roadmap where the end goa is the Work Optional Life, and there are 5 key guideposts to help you get there.

It starts with Purpose – Define your purpose for the money and wealth, then People – Build a Circle of Trust around you to achieve your goals, then the 3rd P is PLAN – create a wealth-catalyzing financial and investment plan, and this is what we will focus on today. Step 4 is Perspective – develop a healthy mindset like the ultra-wealthy.

Step 5 is Positive Action – take that next step towards your Work-Optional Life and being here today counts as one step towards building the awareness and insights toward this goal, so let’s get going!

Slide 3: Agenda for Today’s Webinar

Today we are going to cover a few of the most common questions I get asked as a Financial Planner, along with specific tips on how to Plan for Retiring early, how much to save, which one is more important – the RRSP or TFSA?

We will also fast forward to the Retirement years and look at what’s the best way to Withdraw funds from your retirement accounts – to help you minimize tax and maximize value – so your money can be sustainable, and last throughout your retirement years.

We will also cover whether you should defer your CPP or take it early?

And, what are the top financial risks to your comfortable retirement and work optional life?

Today is an example of how we at The Wong Group leverage thought leadership and proactively bring valuable insights to help our clients, here at The Wong Group.

Slide 4 – The Wong Group

I’d like to express a big thank you to my fantastic team at The Wong Group for all their help making this event and what we do for our clients, possible:

From left to right, we have Jerry, Lena, Cindy, Terry, me, Kareen, Elaine and we are pleased to introduce to you today, Cailie O’Hara – our Advanced Wealth Planning resource.

It is now my pleasure to introduce to you, Cailie O’Hara.

Welcome and thank you for joining us, Cailie!

So Cailie, can you tell us a bit about what you do for our clients at The Wong Group, and how you are part of a broader team of resources that we can make available to our clients as part of our client relationship?

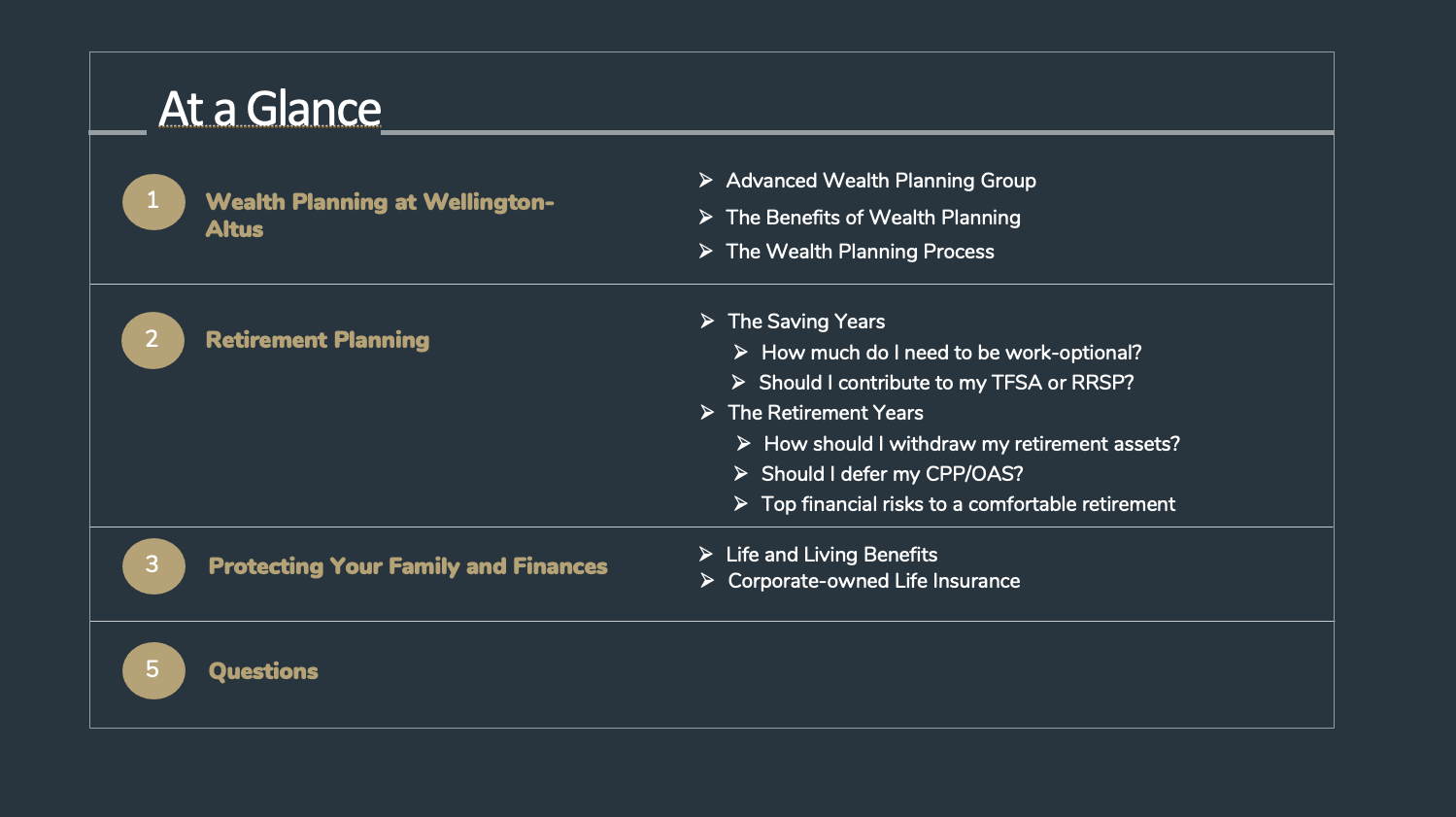

Slide 5: The Advanced Wealth Planning Group

CAILIE:

I am part of the Advanced Wealth Planning Group here at Wellington Altus.

My primary role is to work with clients to create their wealth plans. So what does that mean? Well, we’re not going to just hand you a document with 30 pages of numbers, I promise. What we’re going to do is sit down together and talk through your goals and needs, and then create a plan, that not only addresses those but also prompts dialogue with the other advisors within your Circle of Trust, like your accountant or your lawyer.

So, more on the AWPG. I am one of five team members, soon to be seven. We have three Senior Wealth Planners: Jolene Hall, Alison Forster, and me. We also have an insurance specialist – Connie Gale – who we’ll often work with along with Maili to develop appropriate insurance solution. And last, but certainly not least, we have Michelle Connolly who is our team leader and resident tax and wealth transfer expert.

So even though here in BC, you’ll mostly be working with me – I’m just down the hall from Maili. We do take a collaborative, team-based approach, so our whole team’s expertise is leveraged in the creation of your wealth plan.

MAILI:

What are some of the benefits of engaging in the wealth planning process?

Slide 6: The Benefits of Wealth Planning

CAILIE:

One of my favourite quotes is “A goal without a wish is just a plan.”

We probably all set some lofty resolutions or goals with the New Year, and without a plan to achieve them, they’re probably not going to happen. Wealth planning is no different.

Beyond the obvious benefit of helping, you achieve your goals, the wealth planning process provides benefits along the way.

Maybe most importantly is it reduces financial anxiety and improves your sense of well-being.

It facilitates goal setting. And creates commitment and accountability along the way, because you can see what you need to do to achieve your goals, and the actions you need to take. Ultimately all those benefits lead to increased success in achieving your financial goals.

MAILI:

When we invite our clients to start the Wealth Planning process, what can they expect? Can you walk us through what the process involves?

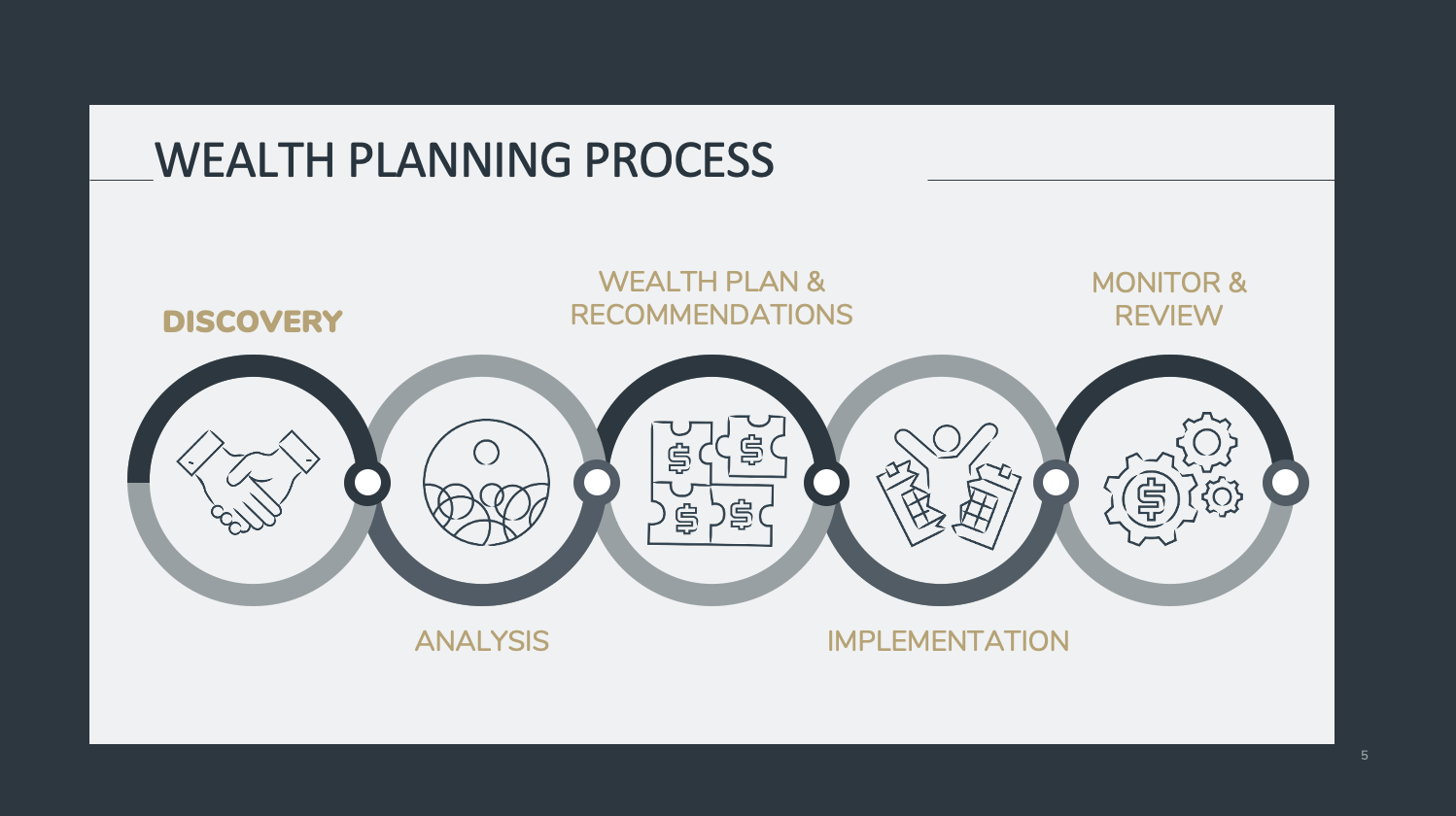

Slide 7: The Wealth Planning Process

CAILIE:

I would be happy to. The Wealth Planning process typically includes 5 stages: Discovery, Analysis, Recommendations and the Financial Plan, Implementation and finally Review.

So the first step, is the Discovery Meeting. This is probably my favourite part of the process, where Maili and I sit down with you (or over Zoom right now) and the sole purpose of the meeting is to get to know you better. The meeting typically involves two parts. The first part is more personal, where we ask about your family, your work, your goals, and values. And then the second half is more numbers based, where we ask about income and expenses, etc. We’ll also ask you to send us some documents, like your mortgage statement or tax returns.

Once we have all the information, we take it away and move on to the next stage Analysis. This is where we review all your information and look to identify any issues or opportunities. An issue may be your Will is out-of-date, or an opportunity may be you should be saving more to your TFSA.

Once we finish our analysis, we start to put together the Wealth Plan. A key difference between our plans and what you get with say, an online calculator, is it is completely tailored to your unique goals and needs with customized This is the point in the process where we review the plan with you; and address any questions you may have.

As part of the plan we include an Action Plan, which is a sort of to-do list of the recommendations. We highlight the professionals you should work with to either discuss or implement the recommendation. So, for anything investment related that would be Maili. For tax planning it would be your accountant. And estate planning your lawyer.

Finally, we recommend you Review your plan on an annual basis with Maili and update every 3 to 5 years or when circumstances change. We always say, this is not a static document, but something that should change and grow as you do.

And that is the process.

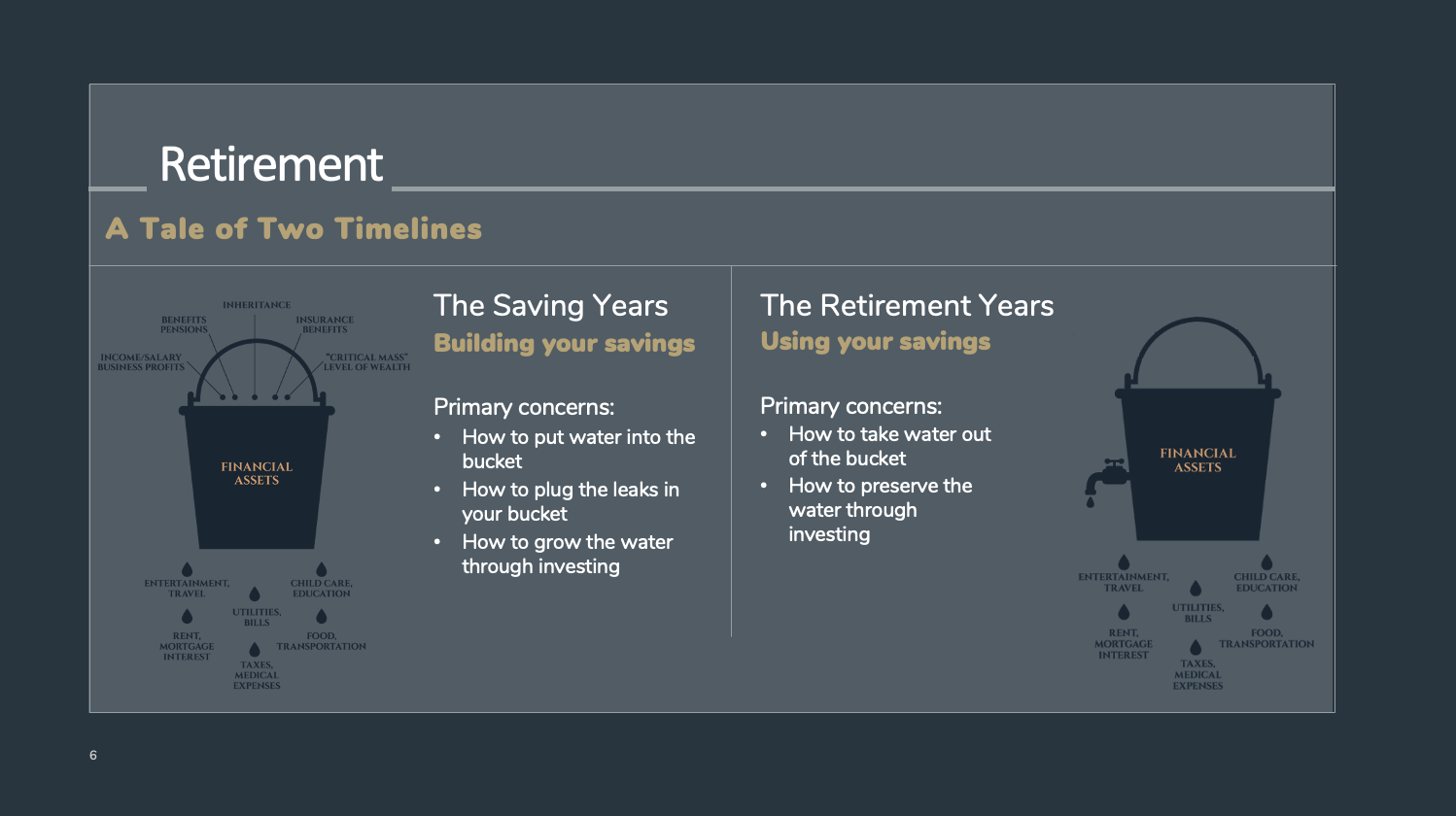

Slide 8: Retirement Planning: A Tale of Two Timelines

MAILI:

In my experience, I’m often asked questions about retirement or more specifically, “How much do I need to save so I can retire comfortably and be work-optional?” or “How do I withdraw from my investments to minimize taxes?” How do you address these types of questions in your planning?

CAILIE:

You’ve brought up a really good point Maili, and that is how we approach a wealth plan is very different depending upon your stage of life. We can think of retirement planning as having two distinct timelines or phases: The Saving Years and the Retirement Years.

First, we have your pre-retirement years, or how we’ve referred to them here – your Saving years. These are typically your 30s, 40s, and often into your 50s. When a person is in their Saving Years, their focus is typically on their, to use one of your terms Maili, their Leaky Bucket. And you can probably explain this better than I can, so I will let you do so.

MAILI:

The Leaky Bucket is an analogy that describes a container holding all of your financial assets. These assets should rise to a level in the bucket that represents a “critical mass” or level of wealth that can sustain you well into your retirement. The problem is, it’s a leaky bucket. Meaning that there are holes in the bucket that drain your assets, like living expenses, mortgage, rent, entertainment, travel, healthcare costs, bills, child care, education, etc. The key is understanding how to get money into your bucket, how to plug the holes in the bucket, and how to invest the stuff in the bucket wisely, so it can earn a reasonable rate of return to build it up to that critical mass level.

CAILIE:

Right, so in your Saving Years we’re looking at how much you’re saving in your bucket, how much is leaving your bucket with expenses, and then given your investment rate of return whether there will be sufficient water in your bucket to retire at your desired age and your desired lifestyle. And so oftentimes, what a person in their Saving Years is looking for from us is to help answer the question, “How much do I need to save to be work-optional by x?” Whether that be 55, 60, or 65.

MAILI:

How does your approach change when planning for individuals close-to or in retirement?

CAILIE:

Well, instead of planning for retirement, we’re planning for your income and cash flow in retirement, or more specifically how to strategically withdraw your savings to minimize taxes and ensure you don’t outlive your retirement assets. So, to use the Leaky Bucket analogy, how to take water out of the bucket thoughtfully, and how to ensure we are preserving the water in the bucket by managing withdrawals.

MAILI:

Next, I thought we could walk through some practical examples.

Slide 9: Meet the Smith’s

MAILI:

I would like to introduce everyone to the Smith’s. Kevin and Sarah Smith are both 40 years old. Kevin earns $100,000 a year working as a Data Analyst and Sarah earns $150,000 a year working as a Software Engineer. They don’t have any children, except their Goldendoodle, Ivy.

Their main expense is their monthly mortgage payment. They also enjoy traveling and dining out.

They are good savers and have already saved $750,000 towards their retirement and make $3,000 in monthly deposits to their investment accounts. But they are wondering if it’s enough. Their question for you is, how much do I need to save to be work-optional at 60?

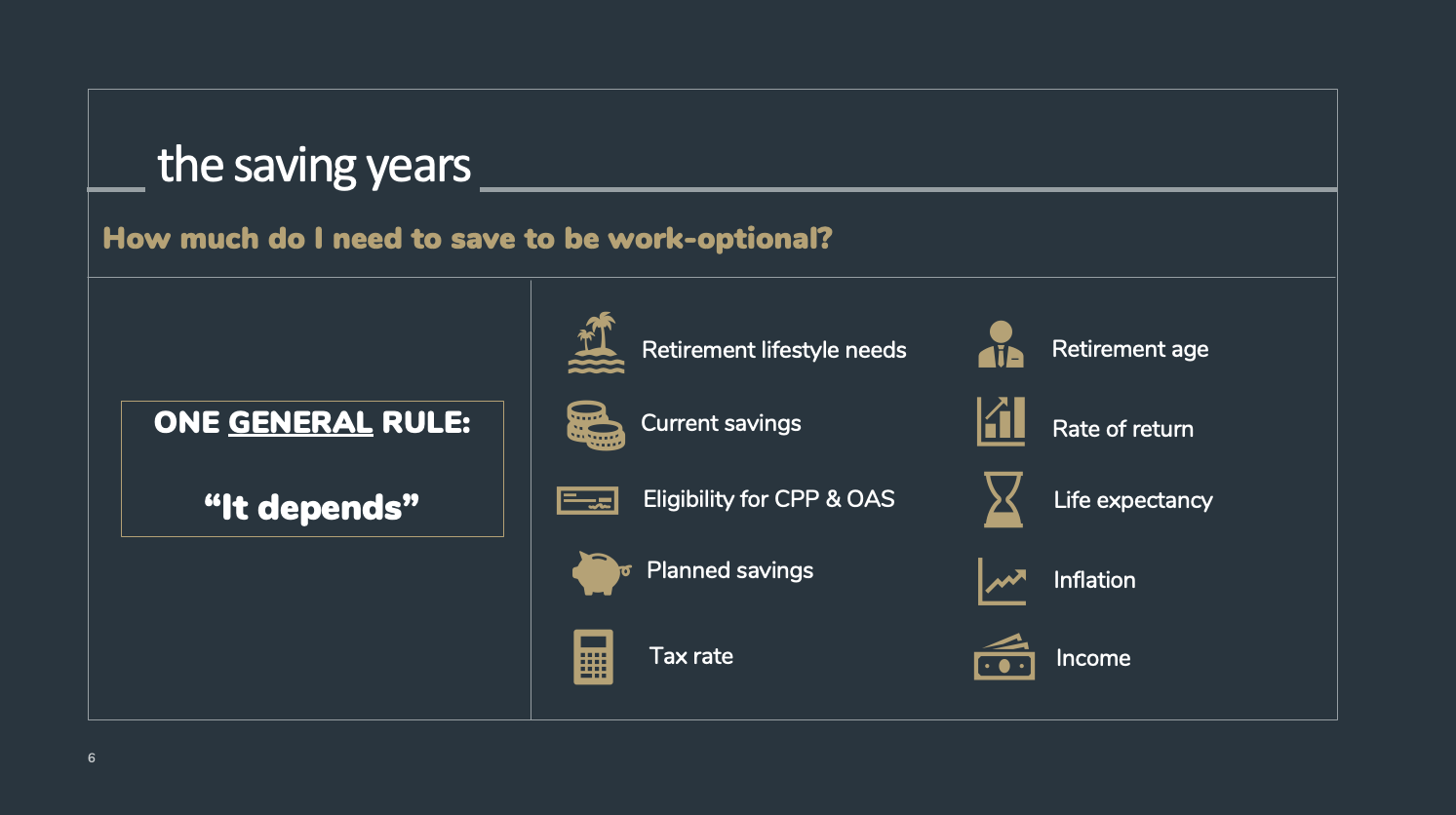

Slide 10: Saving Years: The Work Optional Life – Factors to Consider

CAILIE:

I’m going to start with an annoying answer, and that is, “it depends.” Now, let’s step through some of the factors that we consider:

Your retirement lifestyle needs; what do you need to achieve your desired retirement lifestyle.

At what age do you plan to retire? The earlier you retire, the more savings you’ll require. The later you retire, the less savings you’ll require.

How much do you currently have saved? The more you have saved, the more you’re going to earn from your investments, and the less you’ll have to save going forward.

What is your rate of return? In terms of creating your plan, this is a number we would discuss with Maili based on your risk tolerance and current market conditions. From there we would agree on a conservative number in the event markets don’t perform as expected, and ensure your plan still works.

What other income sources may be available to you in retirement? Do you have a company pension? Are you eligible for the maximum Canadian Pension Plan amount?

Life expectancy. How many years will you require retirement income? Again, for planning purposes we use a life expectancy of 95.

I’m going to leave it there as those are the key considerations we look at when trying to solve for “how much do I need to save to be work-optional?”

Slide 11: Saving Years: The Work Optional Life – Example

MAILI:

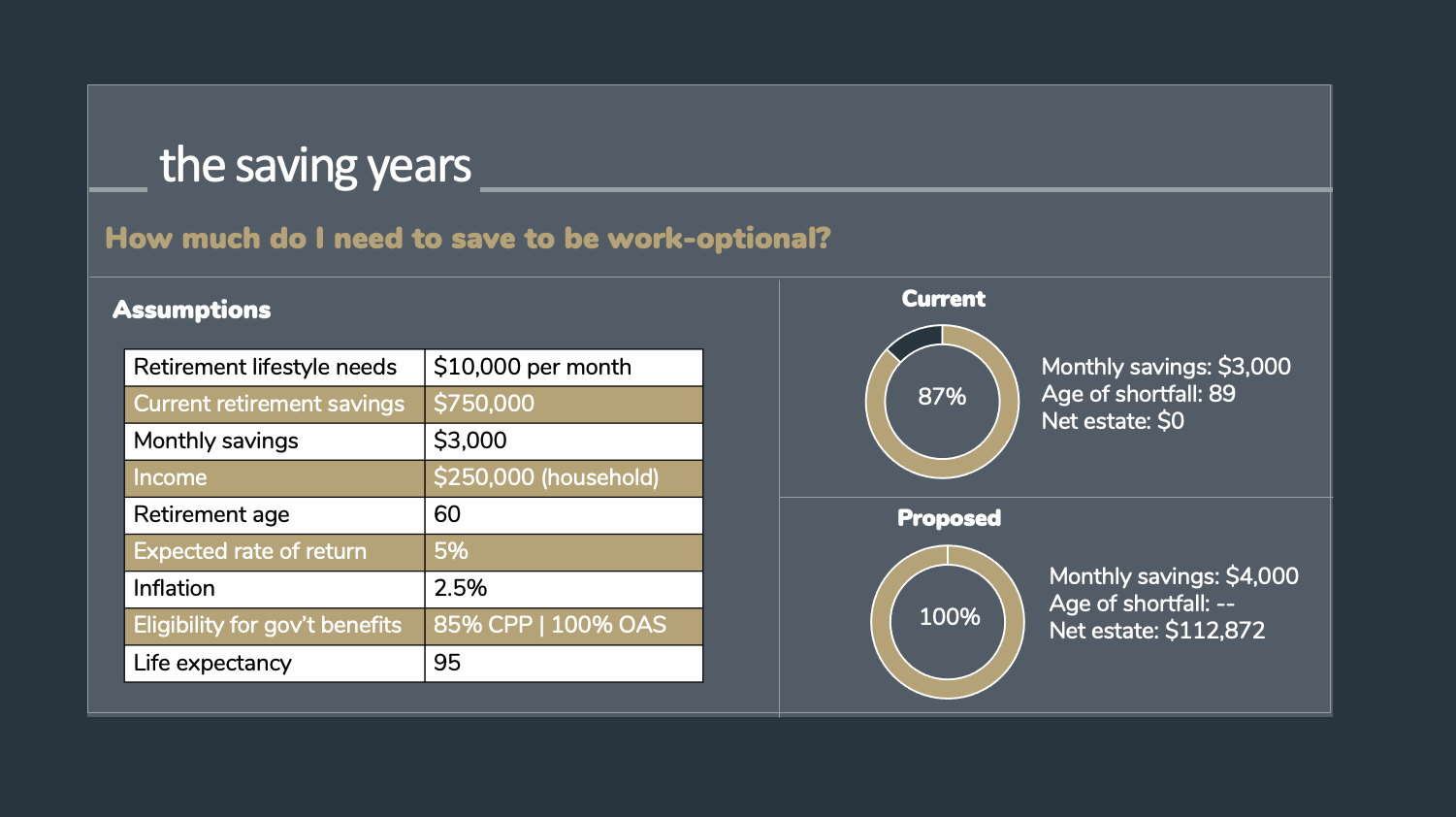

So how would this look for the Smith’s? They want to know if they are saving enough to be work-optional at 60 with a retirement income of $10,000 per month.

CAILIE:

Based on the information you provided Maili, if Kevin and Sarah continue to save $3,000 a month and retire at 60, they are close to achieving their goal, but they’re a bit short. They’re projected to have an income shortfall at age 89.

MAILI:

What can they do to dial it up and get on track?

CAILIE:

Yes, in this scenario if they save an additional $1,000 per month, they’ll be on track to meet their goal. Now, if the Smith’s felt they couldn’t increase their savings then the other option would be to reduce expenses in retirement. And of course, we would present both scenarios to the Smith’s, so they understand their options and can make the decision that’s right for them.

Having that information is great to know now, as they have a lot of time to adjust and plan. If they were closer to retirement the savings required would be greater. Now what if the Smith’s wanted to know where they should save and whether they should prioritize saving to their TFSAs or RRSPs?

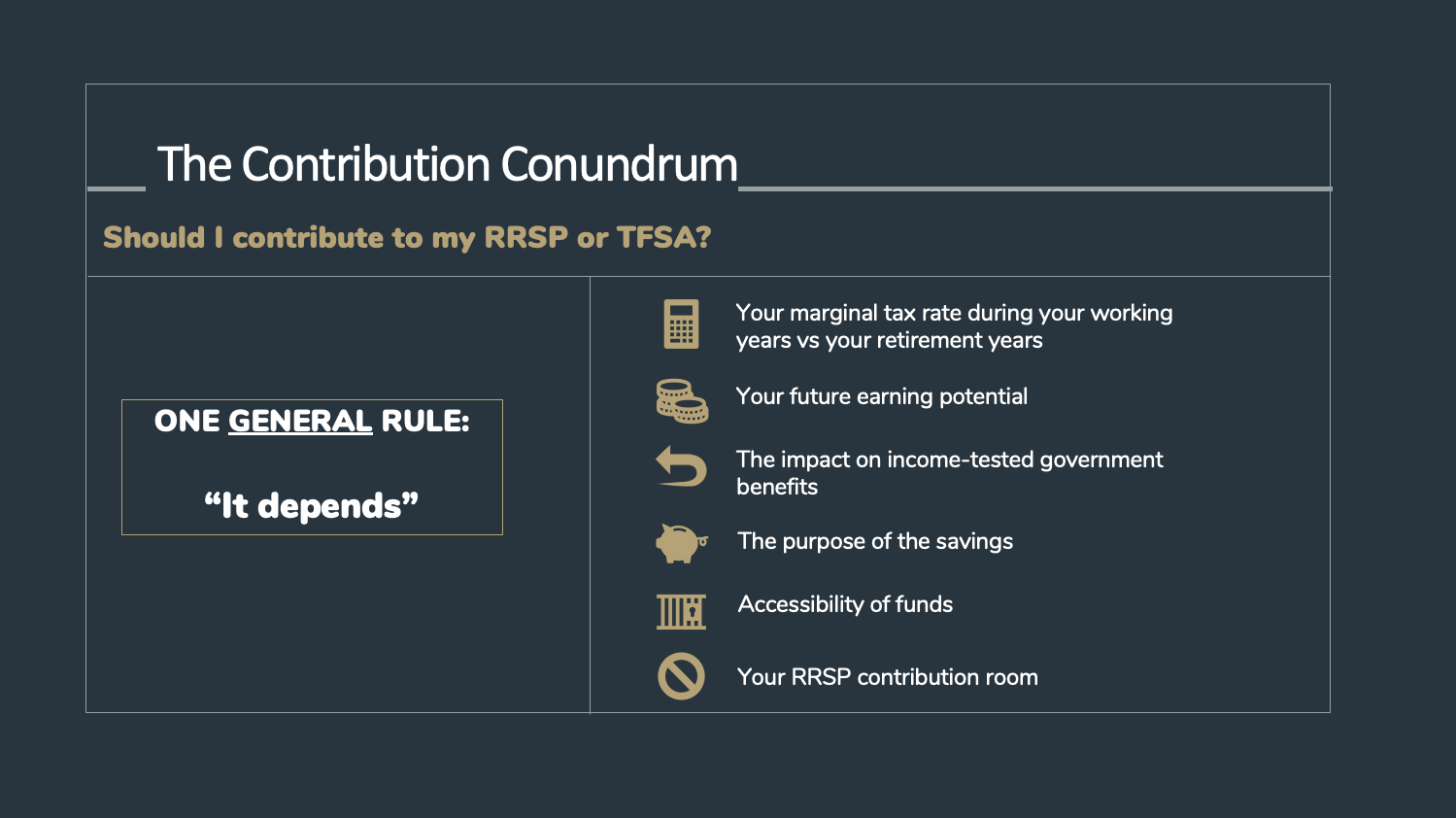

CAILIE:

Great question. While I would love to say one is definitively better than the other, I can’t. Once again it depends…

Slide 12: Saving Years: TFSA vs RRSP – Factors to Consider

CAILIE:

To refresh everyone’s memory:

With a Tax-Free Savings Account or TFSA you do not receive an income tax deduction for your contributions. Your investments within the account grow tax-free, and you can withdraw tax-free.

With a Registered Retirement Savings Plan or RRSP. You receive an income tax deduction based on your contribution. Your investments within the account grow tax-deferred, so while they’re in the account they grow tax-free but withdrawals are fully taxable.

The key difference between the two, is with a TFSA you are paying your tax up-front, and you can withdraw tax free. With an RRSP you are paying your taxes on the back end, and your contribution is effectively tax-free. This is why your marginal tax rate at the time you contribute vs the time you withdraw is a key consideration.

MAILI:

So beyond marginal tax rates what are some of the other factors people should consider?

CAILIE:

Your future earning potential. If you anticipate earning substantially more in the future, you may want to save up your RRSP contribution room for when your marginal tax rate is higher. This may apply to younger people, starting out in their careers.

The impact on income-tested government benefits, such as Old Age Security or OAS. In 2021, if you are eligible for OAS and your net income is exceeds approx. $80,000 your OAS benefit is reduced. Withdrawals from your RRSP are considered taxable income, so it may create a reduction in your OAS benefits depending on your other retirement income sources.

The purpose of your savings. If you have a short- or medium-term savings goal, a TFSA is probably the better option, as withdrawals are tax-free and can be added back to your contribution room in the following year. RRSP withdrawals are fully taxable in the year of withdrawal and contribution room cannot be reinstated. This makes RRSPs more suitable for retirement savings.

This brings us to accessibility or flexibility of funds. TFSAs are more easily accessible which may or may not be a good thing depending on the person or savings goals. If your goal is to save for retirement and you think you may be tempted to access your TFSAs in advance, then maybe an RRSP would be a better choice.

Finally, there’s your RRSP contribution room. With a TFSA there’s no income requirements you’re given annual contribution room every year from the age of 18. For an RRSP you have to have earned income, and your annual contribution room is calculated as 18% of your earned income up to a maximum of around $27,800 in 2021. This may also be reduced if you are part of a company pension plan. So, depending on your RRSP contribution room, a TFSA may be more suitable.

MAILI:

Obviously, there are a lot of different considerations here, which is why we advocate for our clients to have a plan created for their specific situation. But if a couple, like the Smith’s had limited cash flow, what’s a good general guideline to follow?

CAILIE:

Sure, so if we’re looking at it from a purely tax efficiency standpoint, a good rule to thumb to follow is this:

If your current tax rate is higher than your anticipated tax rate in retirement than an RRSP will be more advantageous. If your current tax rate is lower than your anticipated tax rate in retirement than a TFSA will be better. If you expect your current tax rate to be the same in retirement than neither has an advantage over the other.

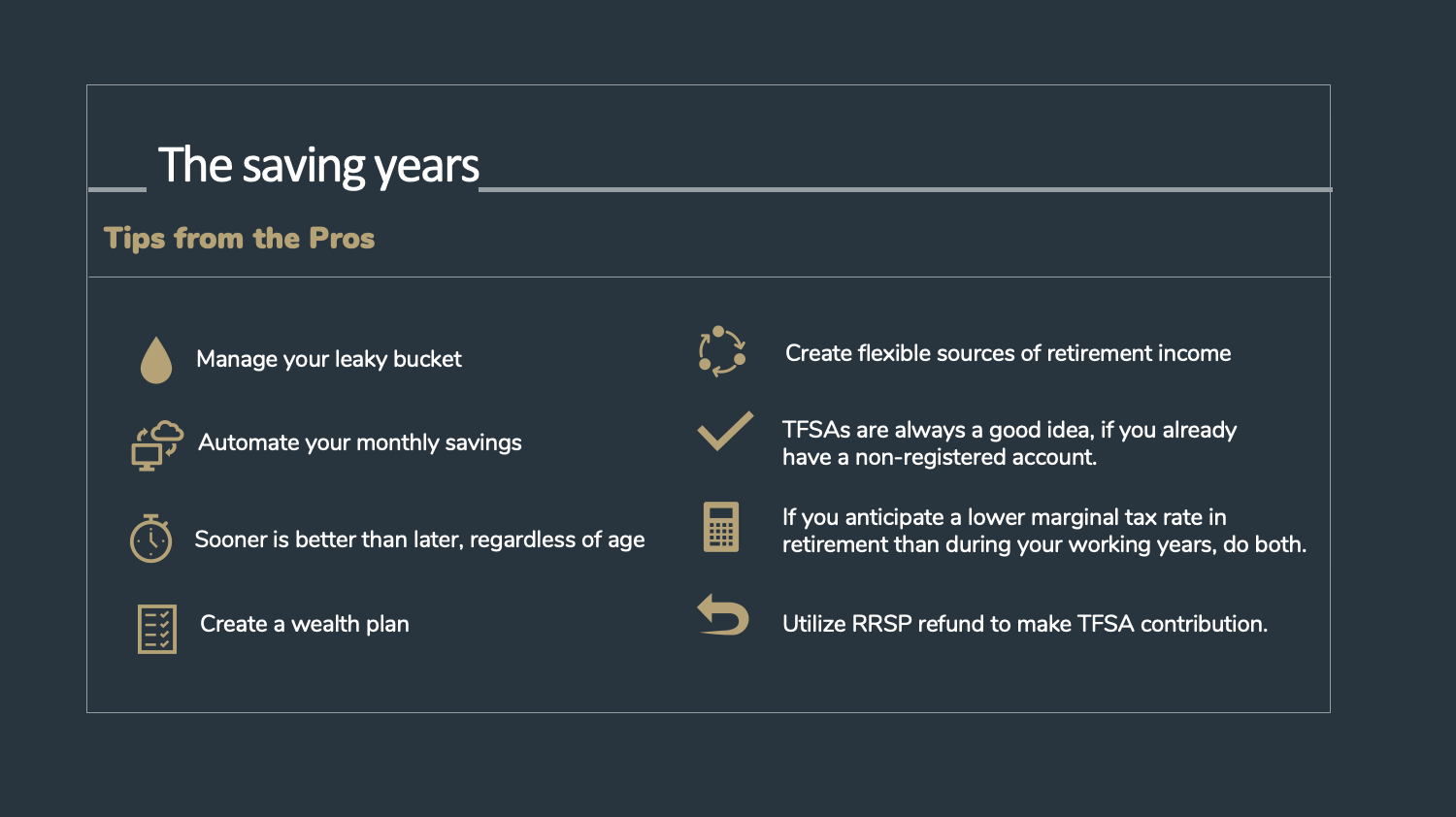

Slide 13: Saving Years: Tips from the Pros

MAILI:

Ok so let’s summarize what we’ve covered so far. Before we move on to the Retirement Years, I thought we could share our top tips for the Saving Years in order to retire early and get to your Work Optional Life sooner.

- Manage your leaky bucket

- Automate your monthly savings

- Sooner is better than later, regardless of age

- Create a financial plan

-

CAILIE:

Mine are a bit more specific to what we’ve discussed so far, but the overarching tip is to create flexible sources of retirement income. Don’t only have RRSPs. Don’t only have a TFSA. Don’t only have a cash account.

TFSAs are always a good idea. They offer tax-free investment growth. If you have a non-registered account, you should also have a TFSA.

RRSPs offer you an opportunity to defer tax. The higher your marginal tax rate, the more advantageous they become. The potential refund provides additional capital to save and invest. So, if you don’t have the cash flow to maximize both your TFSA and RRSP then using your RRSP refund to fund your TFSA is a good strategy.

Ultimately, it’s about taking advantage of these tax-advantaged accounts and creating multiple buckets savings you can access once retired.

MAILI:

Speaking of withdrawing retirement assets, let’s move on to the next timeline – the Retirement Years.

Slide 14: Meet the Kwan’s

MAILI:

This time I would like to introduce you to the Kwan’s. Ian and Nancy Kwan are both 60 years old. They are both recently retired. Nancy worked as an Educational Assistant with the Vancouver School Board and Ian worked as a City Planner. He has a defined benefit pension from his time with the city. They also have savings in their TFSAs, RRSPs, and a cash account. The question they’re asking is, is our money going to last? What’s the most tax efficient way to withdraw from our investments? When should we take CPP and OAS?

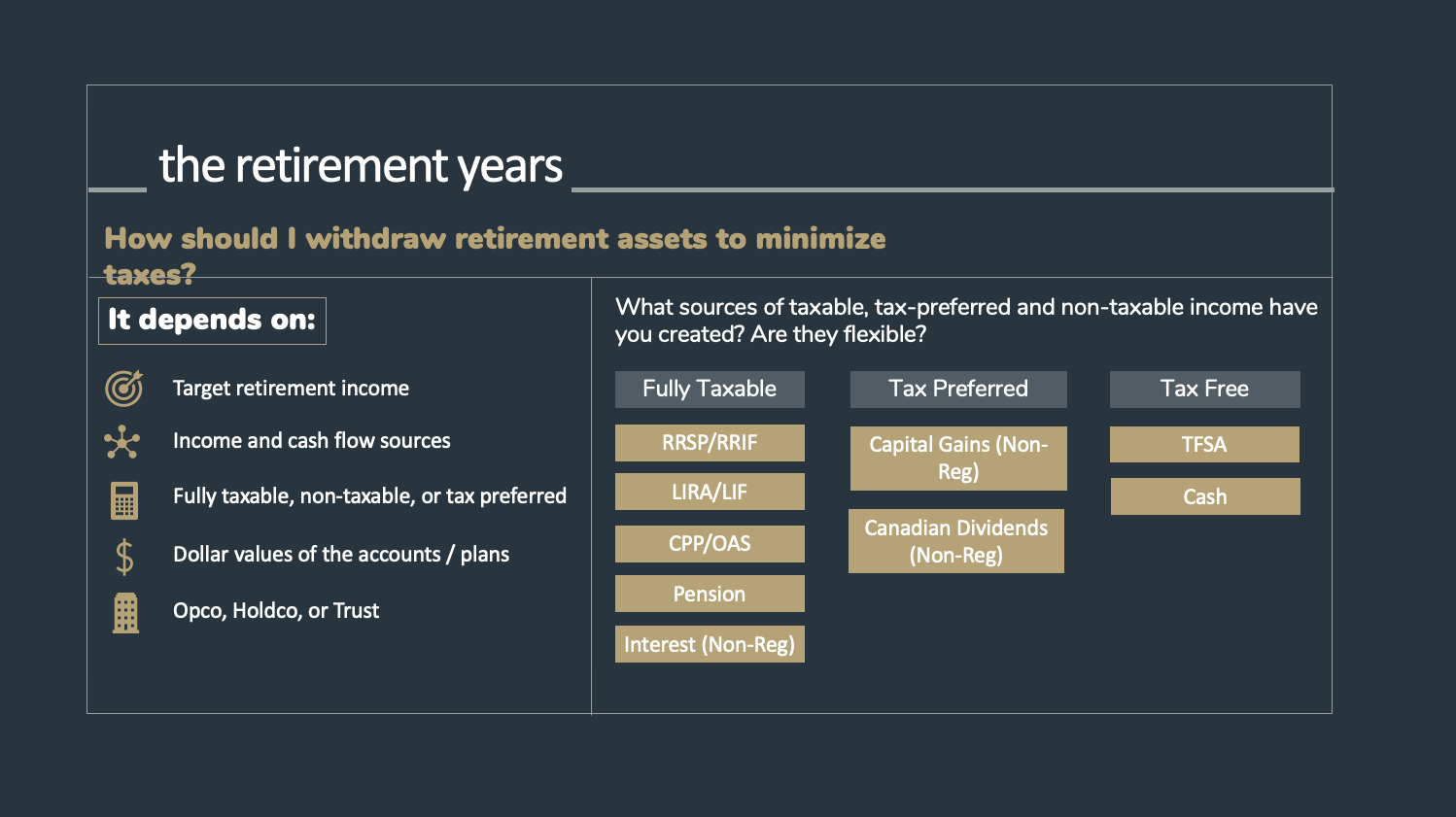

Slide 15: Retirement Years: Withdrawing Retirement Assets – Factors to Consider

CAILIE:

These are all good questions and questions we commonly receive and address every day. In terms of minimizing taxes in retirement it, once again it depends on several factors:

What are your target retirement lifestyle needs? The more income you require, likely the higher your marginal tax rate.

What income and cash flow sources do you have available to you and what is the tax treatment of those sources? Are they fully taxable, like an RRSP withdrawal, non-taxable, like a TFSA withdrawal, or tax preferred, like capital gains?

What are the dollar values of these accounts or plans?

From there we can start to look at where to draw from and when.

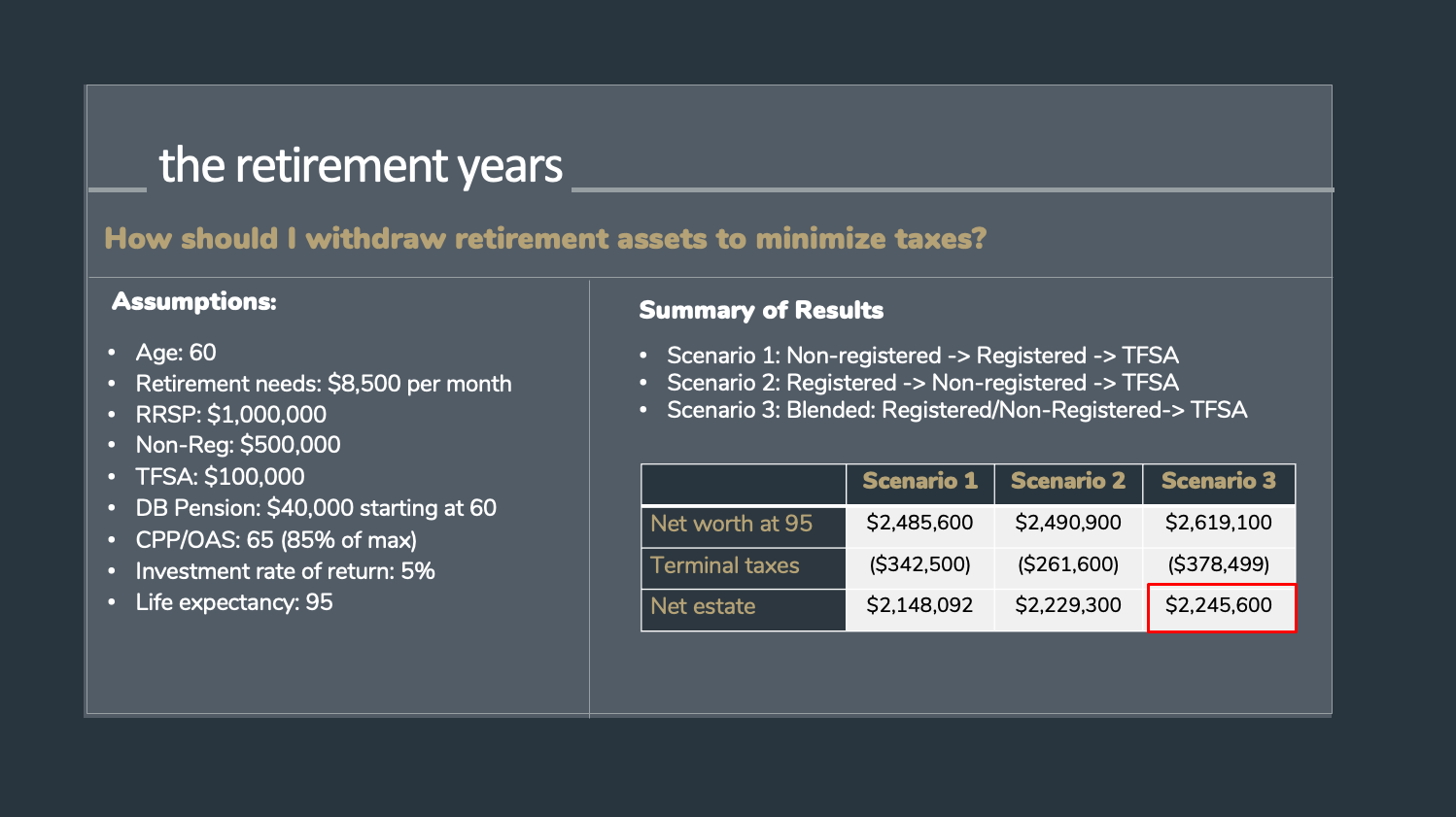

Slide 16: Retirement Years: Withdrawing Retirement Assets – Example

MAILI:

In the Kwan’s situation then, they’ve asked where they should pull from first. They’re 60 so they don’t need to take from their Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF), but should they?

CAILIE:

Well, Maili, first you’re right. The Kwan’s will not be required to make withdrawals from their RRSP or RRIF until the age of 72. But that doesn’t mean they shouldn’t. We looked at three different withdrawal scenarios: should they withdraw from their RRSPs first, their non-registered investments, or do a blended withdrawal, that is a mix of the two.

What we found in this scenario is it was better for the Kwan’s to do a blended withdrawal, that is mostly withdraw from their RRSPs and partially from their non-registered savings.

What we’re looking at to determine which might be best is their net estate in each scenario – that is how much money would be left over after their income needs are met and taxes are paid.

There’s not a huge difference between the scenarios, about $100,000 between the best and worst. In the end, we can see that the Kwan’s end up with the highest net estate with a blended withdrawal, that is drawing additional income 75% from their RRSPs and 25% from the non-registered accounts.

Now this is not meant to be advice that these are the specific numbers you should use, but rather guidance that you’ll likely want to withdraw some from your RRSPs and some from your non-registered accounts. To get specific amounts those are conversations that are best had with your accountant or tax advisor. This guidance may even change throughout your retirement years. Depending on the performance of your various investment accounts and your actual withdrawals, so it is a fluid process.

MAILI:

Another key retirement decision that I’m often asked by retirees is if they should they take their Canadian Pension Plan benefits early or defer them for a higher amount. What’s your take?

Slide 17: Retirement Years: Delaying CPP/OAS – Factors to Consider

CAILIE:

This is a question we’re getting more and more. The main benefit of deferring is of course an increased lifetime benefit. Your Canada Pension Plan benefit, or CPP, is increased by 0.7% per month, or 8.4% per year you defer receipt up to age 70. With Old Age Security your benefit is increased by 0.6% per month you delay, or 7.2% per year up to age 70. The benefit of deferring is obvious, you receive a greater, guaranteed monthly payment for life. There are not too many investments, that are near risk-free, that provide an 8.4% return.

However, that’s not the whole story, which is why if you asked me should you defer CPP and OAS, I would say it depends.

Do you have enough income to last you from retirement to age 70 if you were to defer receipt?

How certain are your other income sources? What are your other income sources? If you have a company pension plan and modest amount of investments, you may prefer to take CPP earlier and preserve your investments, so you have more flexibility. Right, because that’s another consideration, which this table does not factor in, and that is the opportunity cost of earlier investment withdrawals. If you defer receiving these government benefits, then you’re going to have to withdraw more from your investments, which will reduce the capital from which you are able to generate investment returns. On the other hand, if the majority of your retirement assets are personally invested, then it may make sense to defer CPP and OAS and receive an increased guaranteed amount.

Taxes – how does an increased benefit impact your marginal tax rate?

What is your personal preference? With CPP some people feel they’ve paid into it and want to receive it as soon as possible, and others are happy to wait.

Then there’s the potential impact of OAS clawback. For those unaware, if you have taxable income in excess of approximately $80,000 your Old Age Security benefit is reduced. So if an increased CPP benefit puts you over that threshold then it may be best to take it earlier to eliminate the clawback.

And finally, there’s life expectancy. If you are in ill health or anticipate a shortened life expectancy than you’re probably better off receiving CPP and OAS as early as possible to maximize the amount you will receive. If you can see the chart on the right, the longer you live the more advantageous deferral becomes, and the reverse is true as well – the younger you pass away the more advantageous it is to receive these benefits earlier.

So again, it really depends on your situation.

MAILI:

Now we’ve covered tax efficient withdrawals, and CPP/OAS are there any other considerations that our viewers should be aware of?

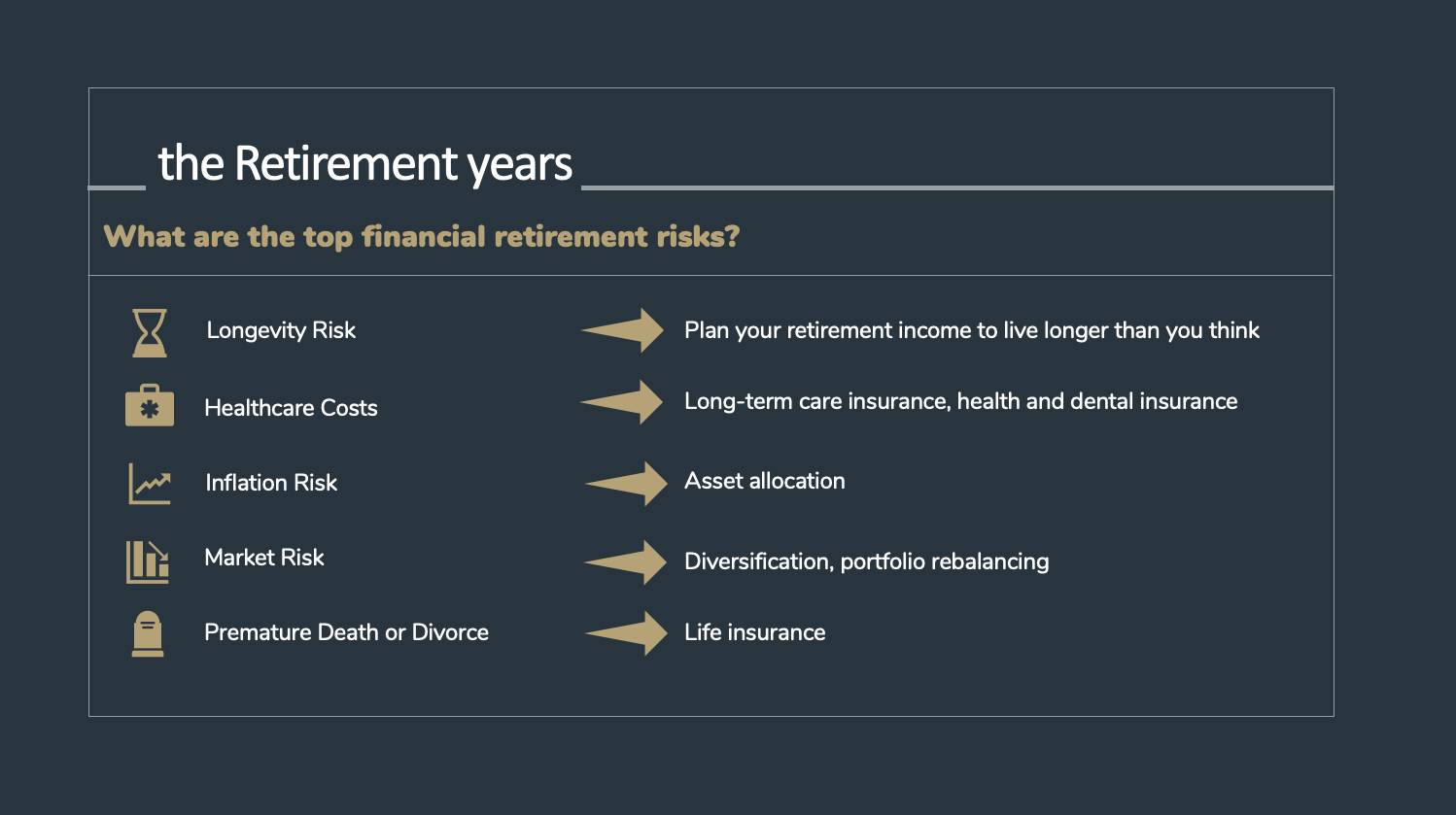

Slide 18: Retirement Years: Top retirement risks

CAILIE:

Yes, there are several risks that we as planners are always thinking about on behalf of clients and we try to address in our plans.

The first, and probably one of the greatest risks is longevity risk. The average life expectancy in Canada is just shy of 82 years of age. That being the average, more and more Canadians are reaching the age of 90 and even 100. Why does this matter for planning? Well if you live longer, you’ll need to support your lifestyle for longer, and your retirement assets to sustain you through that period. To mitigate for this risk, we use a life expectancy of 95 in our plans. To plan for a long life.

Moving on to the next point, a byproduct of living longer are increased healthcare costs. Yes, we are living longer, but that also means we are living longer with illness. One of the greatest risks to our retirement savings are long-term care costs. If you’re a couple and one partner require significant care then those costs may deplete your retirement assets. One way to mitigate this risk is with long term care insurance. It provides a weekly benefit to insured individuals who are no longer able to function independently, or unable to perform two activities of daily living, such as feeding or bathing themselves.

The next is inflation risk. I’m going to pass this one off to you Maili

MAILI:

Inflation risk – we want to ensure our clients’ wealth grows faster than the rate of inflation or cost of living. This is where an appropriate asset allocation and a well-managed portfolio come in.

Market risk – markets will fluctuate, and as folks draw down on their investments, its important to be properly diversified and to actively re-balance the portfolio to help the retirement portfolio adapt to various market conditions.

Premature death or divorce – sometimes life events happen unexpectedly. Therefore, we also help our clients plan and introduce financial safety nets using insurance.

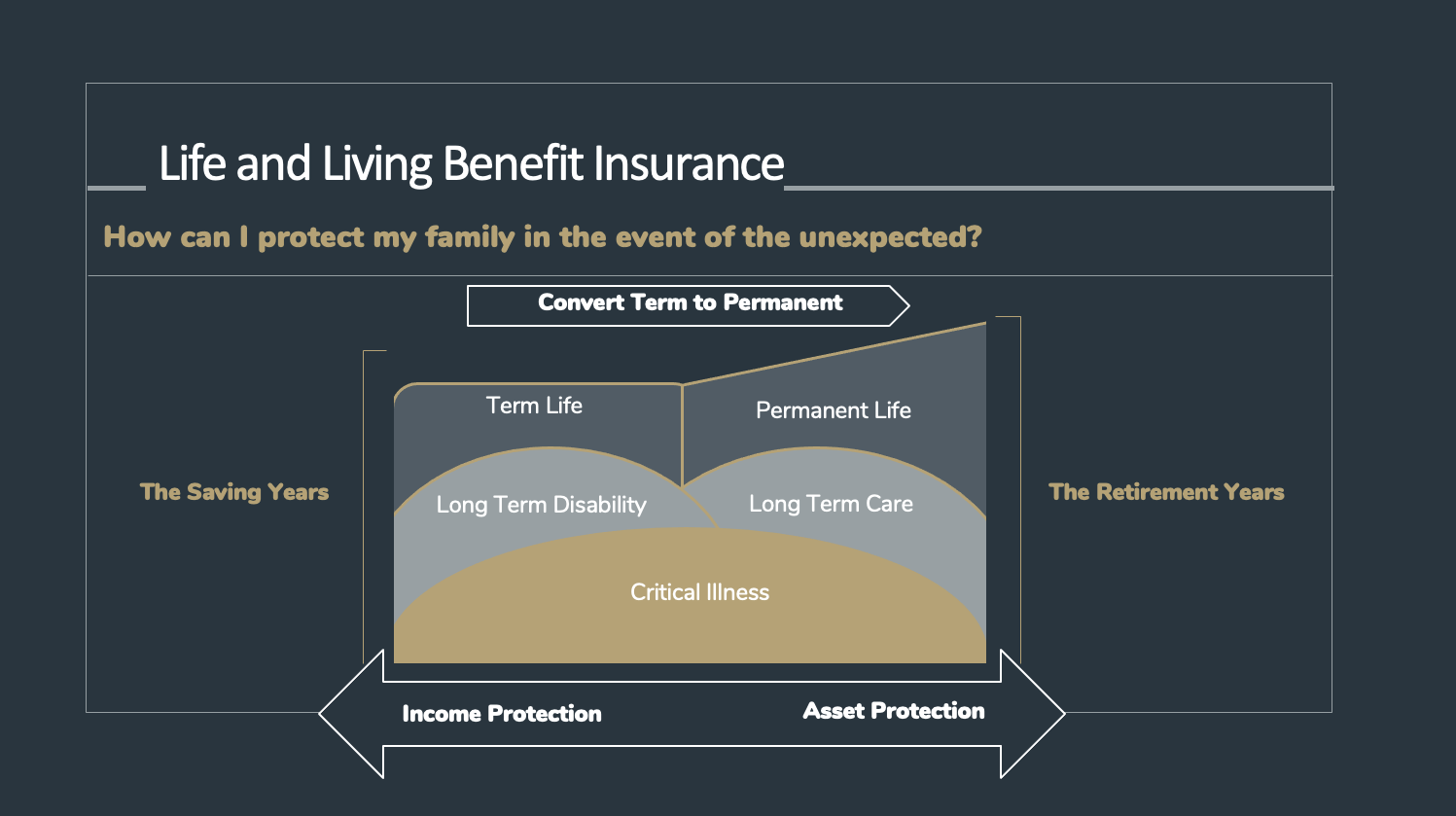

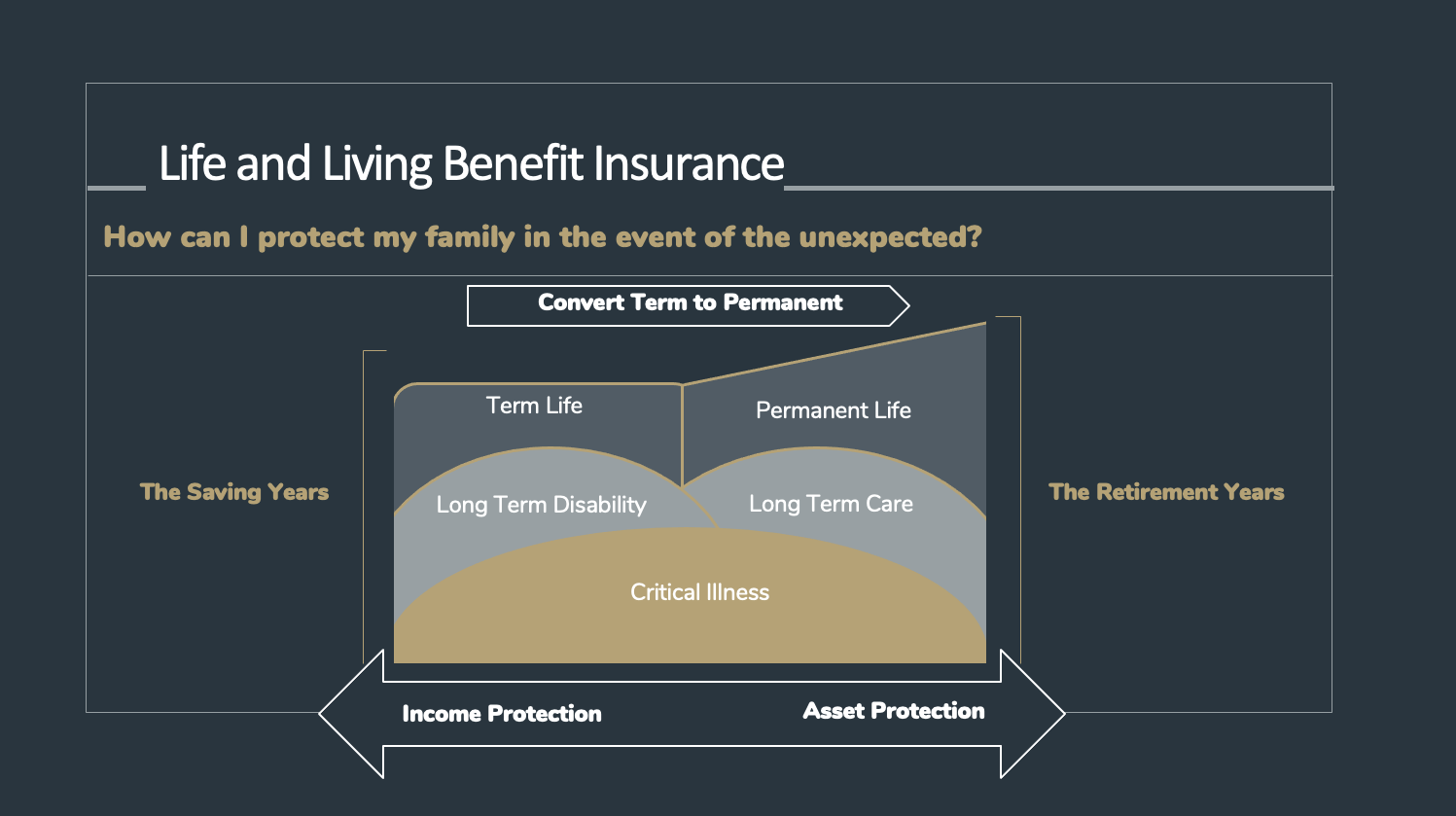

Slide 19: Protecting Your Family and Finances: Lifecycle of Insurance Needs

MAILI:

Life Insurance and Living Benefit insurance (like Disability, or Critical illness insurance) can help you protect your family in the event of the unexpected death, injury, or illness.

During the savings years, some types of insurance are very important, like term life insurance, disability, or critical illness in order to protect you and your family if you lose your income due to death, disability or a critical illness like heart attack, stroke or cancer.

But later in your retirement years, other kinds of insurance can become more important – like permanent life insurance, to help provide liquidity and cash to cover your estate taxes and preserve your assets for your kids or grandchildren. We also consider Long Term Care insurance for clients in this stage, to help provide a tax-free income to cover rising healthcare costs and to help you maintain your financial independence as you age.

Clients feel peace of mind knowing that we can help solve their insurance and investment needs, by looking at their wealth plan holistically.

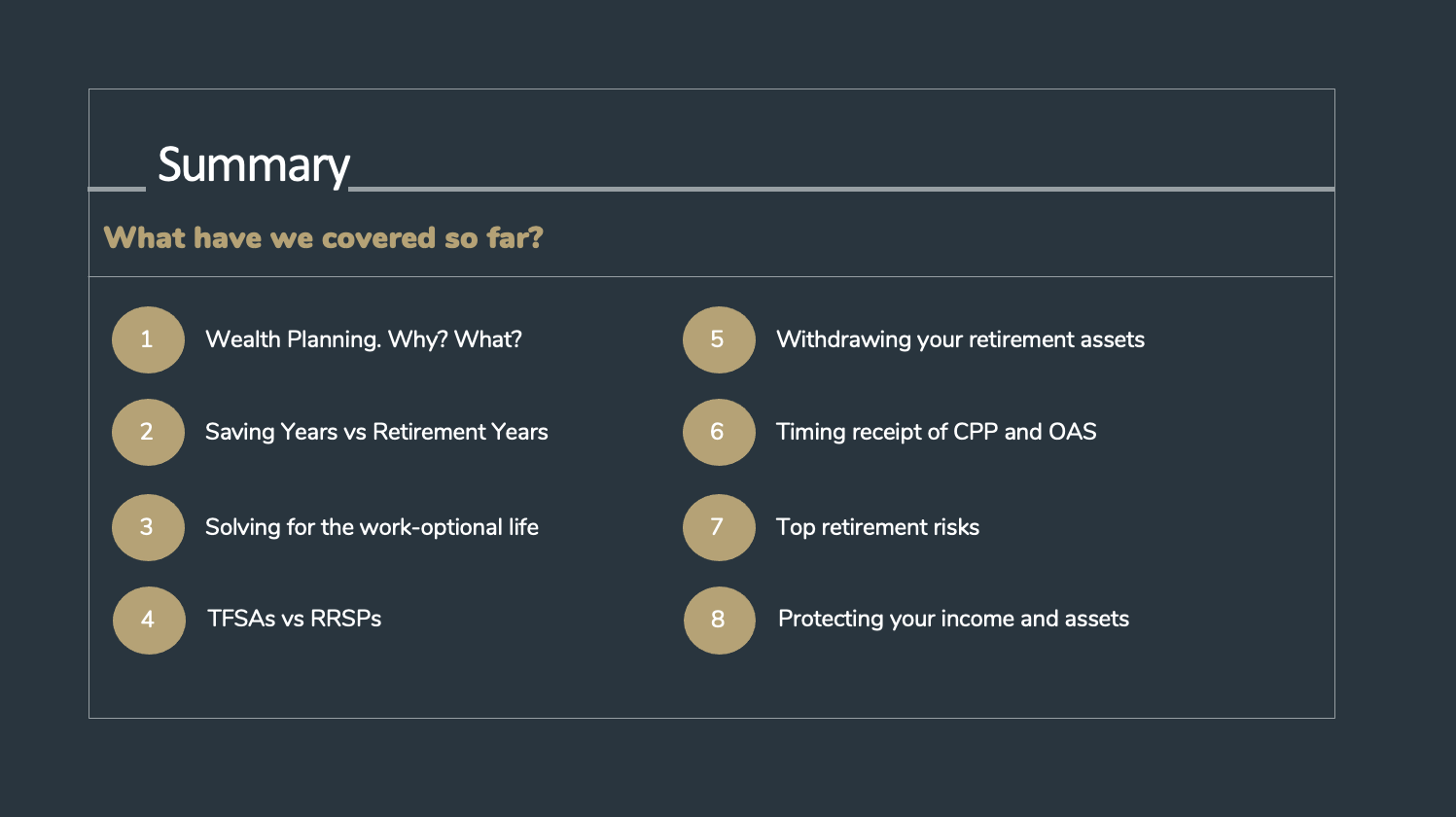

Slide 20: Summary

MAILI:

Before we move on to questions, let’s review what we’ve discussed so far.

Wealth planning. The benefits as well as the process.

- The difference between your Saving Years and Retirement Years and the key questions in each.

- Solving for the work-optional life. How much you need to save to retire at your desired age and desired lifestyle.

- What are some of the factors to consider when contributing to your TFSAs or RRSPs?

Cailie, what else have we covered so far?

CAILIE:

Of course.

- Next, we reviewed the benefits of having multiple buckets of retirement savings and withdrawing for tax efficiency.

- And then, factors to consider when deciding whether to delay receipt of CPP and OAS.

- Some of the other retirement risks you should be aware of and strategies to mitigate them.

- And finally, Maili, you touched upon how to protect your income and assets from the unexpected.

Slide 21: Questions

MAILI:

- Should I add my kids on as Joint owners to my investments or principal residence to avoid Probate?

CAILIE:

To provide context, probate is the process whereby a Will is ‘proved’ in court as a valid document and the court acknowledges the appointment of your executor. To be able to settle your estate, your executor will be required to obtain a grant of probate, so their authority is recognized to handle the assets of the estate. In B.C., a probate fee is collected before a grant of probate will be issued. Probate fees are currently calculated at 1.4% of the gross value of your estate, in excess of $50,000. Some assets may be transferred outside of your estate, and not be subject to probate, such as beneficiary-designated assets or jointly held assets.

The simple answer is – probably not. As you mentioned the primary motivation for adding adult children to a bank account or piece of property as joint owners is to avoid probate. But in many instances probate is a small price to pay when compared to the potential costs or risks of joint ownership. Potential issues may include:

Tax implications. Technically, adding a joint beneficial owner to an asset results in a deemed disposition of that portion of the asset, which may trigger immediate capital gains. In the instance of a house, which gains are shielded from tax using the PRE, the child’s portion is now taxable assuming they have their own house.

Parent’s MTR vs that of their child – if child’s higher – greater income tax.

Next, is if you add an adult child to the asset, it may expose the asset to potential creditors of your child, or in the event of a marital breakdown.

Family conflict. If you put assets into joint title with one of your children and not the others, then on your passing this may be disputed. The child who owns the asset in joint name with you may say, “Mom wanted me to have this.” And the child not included may say, ‘No, she just needed help paying her bills.” This can often result in litigation, costing more than you’ve potentially saved by avoiding probate. And maybe more importantly caused a family rift.

There are instances where a family should engage in probate planning, but there may be more suitable strategies, such as the use of trust, beneficiary designations, or multiple wills.

MAILI:

- When does it make sense (i.e. what dollar amount) to set up a Trust for my adult children or grandchildren?

CAILIE

That’s a good question. Not a simple answer. Let’s assume the goal of the trust is tax efficiency, you’d obviously want your tax savings to be greater than the cost of setting up and administering the trust. The greater the amount of assets in question, likely, the greater the benefit.

In general, some of the benefits include:

- Income splitting with family members in lower tax brackets;

- Reduce future taxes at death

- Provide creditor and marital claim protection; and

- Multiply access to the Lifetime Capital Gains Exemption if the trust is a shareholder of your business

But there are drawbacks. You can’t just transfer in assets with no tax consequences.

- If the trust includes minor beneficiaries or a spouse that complicates matters, which may trigger attribution rules, and negate some of the income-splitting benefits. To mitigate attribution rules you could loan assets to the trust using a prescribed rate loan, as the current prescribed rate if only 1%.

- Assets with built-in gains cannot be rolled into a family trust at ACB, any unrealized gains will need to be realized before contribution.

- There’s a deemed disposition of all assets at fair market value on the 21st anniversary of the trust, which means again any unrealized capital gains are realized at that point, which could have a large tax impact without proper planning

- This is a very high-level answer, we could do a whole presentation on trusts. There’s advantages and disadvantages. If someone is considering a trust, we’d recommend they consult with both their tax and legal advisors to determine if a Trust is the right solution. Set up time with Maili.

MAILI:

Cailie, any final thoughts to leave our viewers with today?

CAILIE:

Yes, work with you Maili, your team, and our Advanced Wealth Planning Group to start planning early, so you can retire comfortably and enjoy a work-optional life.

Slide 22 – Final Tips

Wonderful, well that’s about all the time we have together today but Thank you so much Cailie for your insights, and to all of you joining us today – be sure to reach out to me or my team with any additional questions you may have, and we would be pleased to address them or your own individual financial planning discovery session.

We here at The Wong Group are committed to thoughtful and progressive solutions.

We are pleased to identify and bring best of breed financial planning expertise and advanced wealth solutions like Estate Planning, Insurance Planning, and Trust and Tax planning to you in order to identify and implement value-add strategies on behalf of our valued clients.

Very often, we are introduced to investors who are tired of the old way.

Fortunately, our team here at Wellington Altus Private Wealth is uniquely positioned as a truly independent wealth management firm with:

- OPEN ARCHITECTURE and

- a progressive, growth mindset to help our clients in the changing post-COVID environment.

To all of you who are here with us, thank you for joining us and our Wealth Matters 4-part webinar series!

Slide 23 – Smart Risk Inner Circle

If you would be interested in continuing the conversation with me and including the people you care about, I invite you to create your own Smart Risk Inner Circle. Simply message my team or me directly for more information about how we can help you host your own private event like this for you and your friends or family.

Slide 24 – Contact Info

As always, if you have any questions or would like to schedule an appointment, call us at 778 655 2410, or email us at thewonggroup@wprivate.ca or chat with us live through our website at www.thewonggroup.ca

Thank you for joining us at The Wong Group at Wellington-Altus Private Wealth.

To request the password or learn more about how to register for our live and interactive client webinars, email us at thewonggroup@wprivate.ca or call us at 778 655 2410.