The first quarter of 2023 is complete; markets were strong, but once again the financial world feels “on fire.” Central banks are still raising rates in many parts of the world, inflation continues to make headlines, two of the top 20 U.S. banks were put into receivership, and a major Swiss bank had to be rescued.

So, how do we put these new financial crises into perspective? It is very easy to get sucked into the noise of the abyss and focus on the day-to-day minutiae of putting out fires caused by these financial issues. But in times like these we are here to help navigate the volatility with a seasoned investment strategy and help you zoom out to see the big picture better from a more holistic, healthier, wealthy perspective.

In this video update, we have prepared evidence of how the global financial markets tend to return to normalcy following periods of economic and market challenges. As well, we added some lessons we can take away from these historic crises over the past 100 years.

I know that your time is valuable, so I’m going to start with the lessons learned and our key observations, and then follow up with the supporting data and charts. So, stay with me:

Lessons Learned:

- -> RESILIENCE: Our world always finds a way forward. In fact, things are usually pretty darn good in a surprisingly short period of time after we avoid the frequently anticipated “end of the world.” It is important to remain invested to participate in the rapid bounce back period, which can happen before the economic outlook improves.

- -> ADAPTABILITY: Government intervention, while never ideal, can help solve very complicated and broad problems. In fact, tools developed during past financial crises can be drawn upon to solve similar problems and can be adapted to solve new ones. The goal, though, should be to make much-needed changes in regulation, incentives, and culture throughout our system during periods of relative calm to avoid/minimize future problems and reactive intervention.

- -> STABLE FOUNDATION: People and institutions that don’t have a strong foundation or character can be wiped out at the bottom of the cycle. This has broad implications why the right culture, capital structure, values, discipline, and humility during good times is so important.

- -> COURAGE and DEPTH of CHARACTER: People and institutions that panic or flee when times are at their darkest deprive themselves of participating when the sun comes out once again. We collectively experienced this darkness during the global lockdowns in the COVID-19 pandemic, and yet within a few years the world opened again.

- -> ACHIEVEMENT: People and institutions that buckle up, put out the fires, remain calm, and stay the course even when it feels like there is no reason to are often the ones who get magnified positive results when the storm passes. We are proud of our clients who stayed the course with our investment strategy during the pandemic in 2020, who in turn, enjoyed strong returns and investment rewards in 2021.

- -> ANTICIPATION: The smart, well-fortified, and forward-looking people and institutions that have the luxury and nerve to play offense during these turbulent times can find themselves at another higher level when the sun shines again. With that said, they must play their cards properly and take calculated risks in a disciplined manner.

- -> LONG-TERM FOCUS: The reason why people and institutions who focus on the long-term tend to beat out their short-term counterparts is because this roller coaster never ends. As my dad always taught me, the twists and turns and ups and downs may always look and feel completely different, but when you step back and look from a distance, there are enough patterns and similarities that will help thoughtful minds make sense of it all.

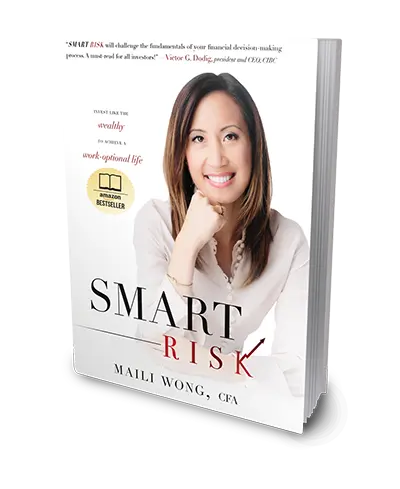

This chart shows the US equity market performance reflected as the growth of $100 invested back in the early 1920’s. The green shaded bars show periods of Recession, and the blue line is the growth of this $100 over time even despite several recessions and financial crises throughout the years.

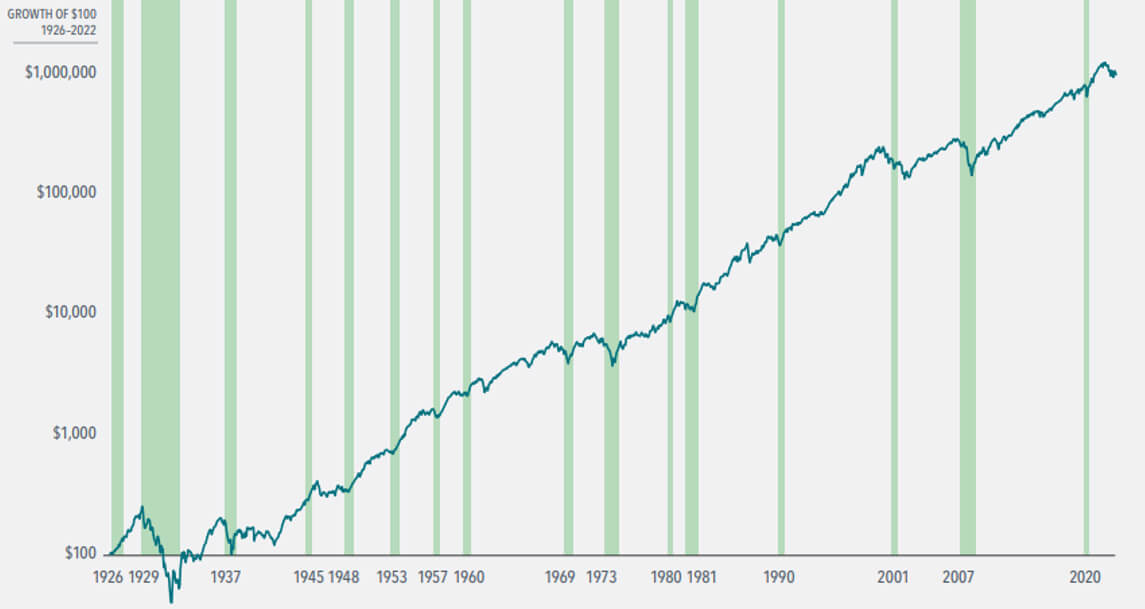

If we break it down into the most significant crises over just the past 35 years, perhaps we can jog your memory of the crisis of that day, the causes of the crisis, the government responses and solutions, and then show the subsequent 3-year and 5-year impact on the global markets and inflation.

It’s from examining these very crises that we developed the Lessons Learned and insights I shared earlier today.

Let’s take a closer look:

- 1990: Savings and Loan Crisis. In 1990 the US banking sector was in a crisis stemming from excess leverage and large asset/liability mismatches. This draws strong parallels to this past month with Silicon Valley Bank. As well, geopolitical tensions saw the onset of the Gulf War that same year. Stocks reacted negatively, dropping 17% that year while the price of oil doubled. Inflation was above historical averages, and the recession lasted 8 months.

- The government response was to overhaul banking reform, which led to a passage of the Financial Reform, Recovery and Enforcement Act. When the market regained its footing, US stocks returned +52% over the next 3 years, and +101% over the next 5 years, and set off to start a nine-year bull market that peaked in the dot-com era.

- 2000 Tech Bubble Boom and Bust. Many of us will remember when the outrageous valuations of the .com companies bubble burst, but investors may not realize the stock market had started the deep decline before the relatively mild recession in March 2001. The US Federal Reserve responded with aggressive rate cuts, and the recession lasted only 8 months. Within 3 years, the major US equity markets had fully recovered back into positive return territory.

- 2008 Global Financial Crisis and Great Recession. During the Global Financial Crisis, the worst of the 50.4% stock market dive happened in the latter half of an 18-month recession that saw unemployment hit 9.4% and industrial production tumble 17%. What was the government response? Global Central Banks cut interest rates to zero, introduced quantitative easing measures, and developed tools to shore up financial systems and boost liquidity and regulation of the financial system. This doozy of a Recession lasted 18 months, but ultimately the global equity markets started an 11-year bull run that included the S&P 500 and Dow Jones doubling in value within 3 years.

Since then, we’ve also experienced market crises in 2011 with the European Debt Crisis, in 2013 when the US government debt got downgraded, and of course the most recent crisis during the Global COVID-19 Pandemic, historic inflation and the market correction in response to a rapid rise in interest rates.

Recent Market Volatility

This past year in 2022, the broader markets have experienced downside amidst higher inflation

Global Pandemic & Recession: January 2020 – Today

Are we currently in a recession? We don’t know yet, but we are likely experiencing one or are going to experience one because of the higher interest rates.

What we do know is that recessions are not new. They may look different and be triggered by different causes, but life and the economy still move onward and upward. In fact, over the past 100 years, there have been 16 US recessions and every one of them has led to a strong recovery. We need to come back to the fundamental principles.

So bottom line, here are some important things to remember:

- -> Markets Reward Discipline

- -> Don’t fall victim to emotions that may nag you to do something you may regret later. Stay disciplined and invest for the long term.

- -> Yes, Global events have a near term and sometimes uncomfortable impact on stock prices. “How much”, “when”, and “What Direction” is uncertain, but what we observe is stock markets recover from negative events, and often recover sooner than you think or before the bad news is over. For instance, in the early stages of the COVID 19 pandemic – the market fell 37% within a short period of time, but then rebounded faster than most expected and well before the pandemic was over.

- -> Managing uncertainty is why investors get rewarded with higher returns over time.

- -> It’s not about TIMING the Market, it’s about Time IN the market:

- -> Don’t get seduced by trying to cash out and then buy back in at a more opportune time. For a successful market timing trade to take place, the investor must know exactly when to exit the market, and ALSO exactly when to re-enter the market. This mathematically reduces the probability of investing success. And let’s be honest, watching a subsequent rebound in the markets from the sideline can often be just as stressful as watching the initial market decline.

- -> A disciplined investor looks beyond the concerns of today to the long-term growth potential of markets.

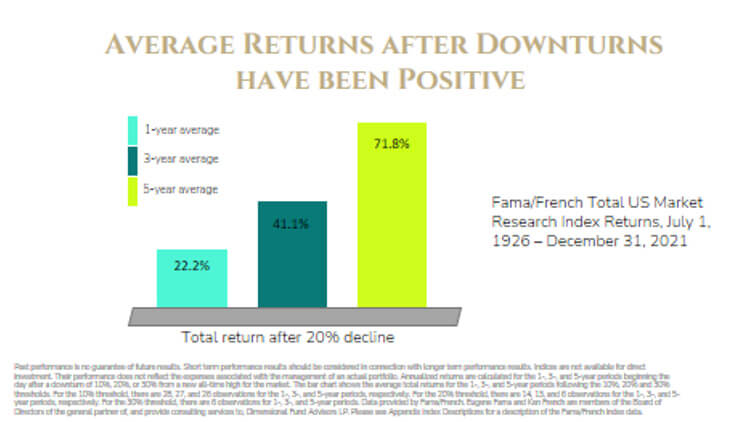

Remember, Average Returns after markets have been POSITIVE

History has shown, when markets are down 20%, one year out, on average, they are back up about 22%; 3 years out, 41%, and 5 years out, up 71%.

Focus on What You Can Control

- -> Create an investment plan to fit your needs and risk tolerance

- -> Structure a portfolio along the dimensions of expected returns

- -> Diversify globally in high-quality growth assets

- -> Our Smart Risk approach builds a diversified portfolio of asset classes for you, all of which react differently to evolving market conditions. Diversifying across asset classes and across geographies, sectors and businesses helps provide strong defense against major global events, while also retaining the valuable upside.

- -> Uncertainty and returns are related – consider market dips as opportunities to buy high quality assets “on sale”

- -> Stay disciplined through market dips and swings

- -> Look beyond the headlines – there could be more than what the media tells you

Logic + Evidence + Diversification + Long-Term Approach = Smart Risk

When we look back at these past two decades at The Wong Group, we marvel at our wonderful clients who have demonstrated loyalty and success, navigating the storms with us along the way.

We have seen (and hopefully helped) our clients build amazing world-class companies, create incredible multi-generational families, and drive positive economic and social value.

We have also seen (and hopefully helped) our clients generate steady long-term investment returns that have enabled them to live long and joyful “work optional” lives into retirement and beyond.

We are grateful for the opportunity to help you remain resilient and well prepared to achieve and maintain your financial purpose and goals, and in that way, allow us to live our purpose of creating exponential positive impact.

I am also very thankful to my team at The Wong Group who works so very hard every day to be present, focused, and prepared on behalf of our clients to ensure an outstanding client experience.

Humble, hungry, and smart. These are a few of the characteristics we seek and reward at The Wong Group, to build a strong foundation both in capital and culture. This team shares the gift of zero arrogance and the ability to adapt to change.

This ability to humbly adapt to change is so important, as I highlight how many times the global markets have faced financial crises, but then recovered to new highs. As you’ve heard me say before, while market volatility can “feel” uncomfortable to the average investor, it’s very normal, and an expected part of investing.

We’ve been through tough times before and thank you for trusting our process. As always, we are present, focused and prepared to help you, your loved ones, and your portfolio stay resilient and well-positioned to take advantage of the opportunities at hand.

We remain committed to building value with all of you by focusing on the long term, regardless of the current climate, crisis or calamity.

Once again in the bunker with each of you but enjoying every moment as we persevere and continue to build together and knowing that we will all come out together on the other side, sooner than we might expect.

If you’d like to meet with me or one of my associates, please contact us at 778 655 2410 or through our website at www.thewonggroup.ca.

I look forward to connecting with you again soon. Thank you.

Maili Wong, CFA, CFP®, FEA

Senior Portfolio Manager, Senior Wealth Advisor

Wellington-Altus Private Wealth Inc.

Board Director

Wellington-Altus Financial Inc.

Maili Wong is a senior portfolio manager and senior wealth advisor at The Wong Group at Wellington-Altus Private Wealth, and the Amazon best-selling author of ‘Smart Risk’. She has over two decades of experience in the finance industry and was named a Top Wealth Advisor and one of the Best in Province in the 2022 rankings produced by The Globe and Mail and SHOOK Research.