Global markets continued to ebb and flow along the recovery path higher in July, despite the persistence of COVID19 and the economic lock-down that has come with it.

In the investment world, we are wary of confident predictions of what’s coming next, as life often unfolds in unpredictable ways. In reality, no one can accurately and consistently predict the future. Instead, at The Wong Group we can proactively prepare by assigning probabilities to different scenarios, researching potential strategies, implementing thoughtful solutions, and being flexible to adapt to the changing market environment.

This Smart Risk approach has helped us build resilience in client portfolios throughout the years and builds a strong foundation for adapting to the future.

In this market update, we will address a few of the most common questions we hear in the marketplace today:

How can the stock market be recovering when the COVID19 cases worldwide are still increasing?

Is the equity market becoming over-valued and poised for another correction, like in 1999-2000 when the Technology Bubble burst?

Should you own gold as an alternative investment?

How will the outcome of the US election impact the markets?

How can the market be recovering when the COVID19 cases worldwide are still increasing?

The equity market is a forward-looking mechanism, and so while near-term the global economy is in recession triggered by COVID19, the market is anticipating an eventual return to growth, stimulated by additional government spending and lowered interest rates designed to get the economy going again.

While the number of COVID19 cases continue to increase and is widely reported in mainstream media, at the same time the mortality rate is going down, which is a positive sign that is often overlooked. And while the continued uptick in COVID-19 cases is indeed a setback, we don’t expect it to lead to complete shut-down of economic activity world-wide, as more targeted measures and responses take place to address future outbreaks.

At the same time, disruptive innovation themes (like digital productivity) that we were in place before the COVID19 recession are accelerating. Companies who can adapt are becoming more efficient, which can lead to higher profit margins and then back towards economic expansion. Almost every industry is now in some way, a technology industry.

We may never go back to the “old normal”, but it’s highly unlikely the global economy will remain shut down over the long run.

Is the equity market becoming over-valued and poised for another correction, like in 1999-2000 when the Technology Bubble burst?

Similar to the 1999-2000 time frame, today a handful of technology stocks i.e Facebook, Apple, Amazon, Netflix and Google are among the top performers by size and equity returns. However, a key difference is that today, the 5 big tech stocks FAANG (Facebook, Apple, Amazon, Netflix and Google (Alphabet)) account for over 20% of the profits earned by companies in the S&P500 US equity market, and contribute to most of the earnings growth as well. So this is unlike the 1999-2000 Tech bubble, back when the technology companies like Nortel, Lucent, and Worldcom did not contribute any meaningful profits or cash flow to the S&P500 Index at all.

Back in 1999, we were managing a diversified equity and fixed income portfolio for the University of British Columbia, as part of the Portfolio Management Foundation. Nortel Networks was greater than 30% of the Canadian Equity Market Toronto Stock Exchange Index, and we did not own a single share as it did not meet our investment criteria. Nortel generated no profits and zero cash flow, but was trading at sky-high valuations. Technology companies today are very different, and some, including Apple, have more cash on their balance sheets than some countries’ governments.

Overall, equity and fixed income valuations are not cheap, but the risk reward measures we follow still rank equities favorably, relative to other asset classes. We are indeed, however, finding valuations outside of the US becoming more attractive, and thus finding good opportunities beyond the US as well.

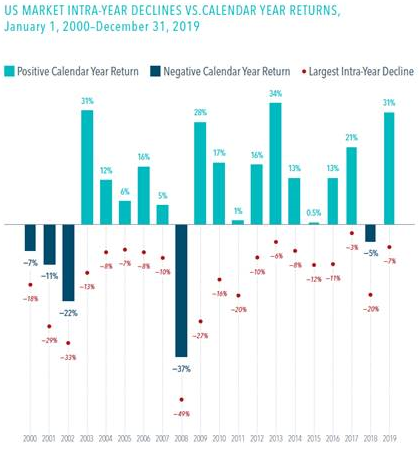

“We still expect volatility and corrections along the way. Volatility is a normal part of investing. Tumbles may be scary, but they shouldn’t be surprising.” – Maili Wong, CFA Senior Portfolio Manager at The Wong Group

The chart below shows how in almost every calendar year over the past 20 years, there has been a sizable correction (shown by the red dots), but still the US market managed to generate a positive calendar year return most years (light blue bars), especially following years of negative returns (dark blue bars):

Source: Dimensional Fund Advisors Research

Should you own gold as an alternative investment?

Gold has been a strong performer this year, as investors fear the impact of government spending and stimulus on the level of prices potentially leading to inflation, and looking at gold as a “safe haven”.

We do own gold exposure in many client portfolios as part of a hedge against future inflation or as an alternative asset for diversification.

We are also mindful of the proportion of gold to own, due to the risks involved. For example, while investors have historically seen gold as a way to protect against inflation, inflation did not spike the last time the economy was flooded with stimulus and gold prices retreated to lower levels for almost a decade.

Our analysis shows that the price of gold is best explained by four key variables over the past decade: the US dollar, stock market volatility (VIX), real interest rates (10 year TIPS), and inflation (CRB food price index). Our model estimates that no less than $253 dollars of the recent $421 increase can be attributed to the large drop in real interest rates, and given the likelihood of further fiscal stimulus and other drivers as noted above, the risk vs. reward of gold remains favorable.

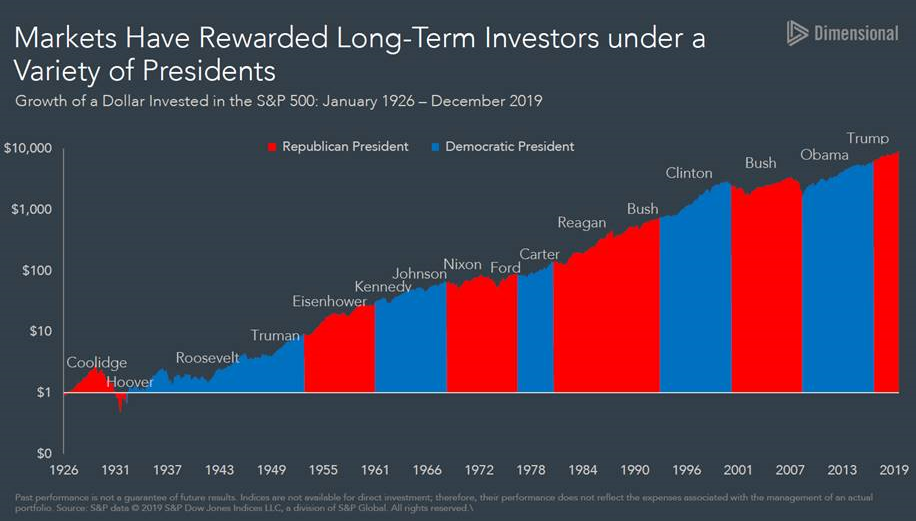

How will the outcome of the US election impact the markets?

Source: Dimensional Fund Advisors Research

While we can expect the news flow and drama surrounding the upcoming US elections may dominate the media in coming months, we are mindful to look beyond the headlines and stay focused on what we can control.

Some investors fear that a change from one political party to another could negatively impact the markets, but in fact, in previous years when there has been a change in political party in power, the markets still moved onwards and upwards. One example is in 2008, when the US Presidency shifted from Republican (under George W. Bush) to Democrat (under Barak Obama) and during a Great Financial Crisis. Despite the near term volatility, the US economy and equity market staged a multi-year recovery.

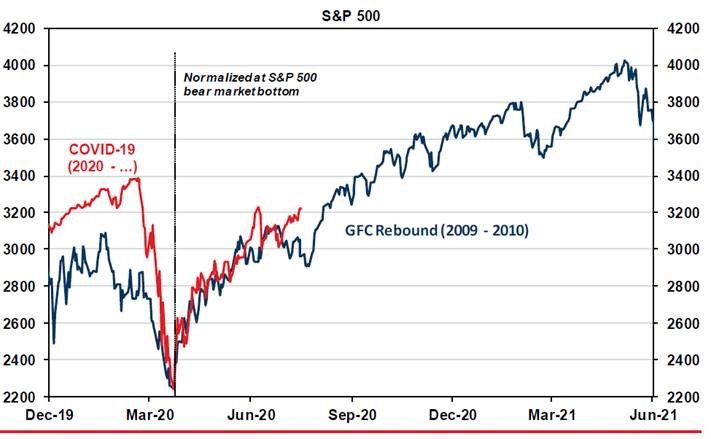

The graph below shows an interesting comparison of the recent COVID19 correction earlier this year to The 2008 – 2009 Great Financial Crisis. Both periods resulted in record amounts of stimulus, and a market rebound that anticipated and took place before the economy showed meaningful signs of strength.

Source: National Bank Economics and Refinitiv data

Bottom Line: Equity markets could remain on an uptrend, but be ready for a dance between “risk on” and “risk off”, meaning volatility along the way. While equities and other asset classes like gold may be getting a boost from large government stimulus packages, we are actively monitoring our risk models and ready to deploy our ‘braking system’ that uses an active Smart Risk Management strategy to tactically reduce risk when warranted by our signals, while remaining diversified and well-positioned to seek returns wherever they occur.

As always, at The Wong Group we remain present, focused, and prepared for opportunities that lay ahead. Please feel free to give us a call at 778 655-2410 with any questions and we welcome hearing from you.