Maili’s Market Insights

Investing amidst Market Volatility and New Market Highs – Summer Update 2021

Welcome to our Summer 2021 update! My team at The Wong Group and I hope you and your family are taking some time to enjoy the summer sunshine.

We are excited to share with you an update on the global markets, how we are positioning our client portfolios, and some important action items to prepare for what’s ahead. In this update vlog, we will cover:

- – Maili’s Market Update

- – The Wong Group Portfolio Positioning

- – What’s Next

Click above to watch Maili’s 9-minute vlog or read below.

Many of our clients value our team as a stabilizing force during turbulent times. This value has been more important than ever over the past year and a half, as the world experienced a global pandemic and the investment markets underwent some tremendous volatility – causing people to feel vulnerable from both a health and wealth perspective.

Fortunately, our team has been present, focused and prepared to apply our Smart Risk approach to navigating these choppy waters.

Over the past 6 months since the start of this year, even as vaccines became more widely available giving hope that the most extreme risks of COVID19 could be mitigated, global markets still found much to worry about, including:

Key Market Risks:

- – the Delta variant and its impact on human lives and economic recovery

- – the ongoing debate between Inflation (rising cost of goods) and Deflation (the opposite – downward pressure on prices and profits)

- – the threat of rising interest rates, which can slow down growth as individuals and businesses find it more challenging to service debt

- – and more locally, the blazing wildfires and the devastating impact of climate change

All these issues gave rise to market swings and renewed volatility over the past several months.

But what I hope to illuminate today, is why while market volatility can “feel” uncomfortable to the average investor, it’s very normal, and an expected part of investing. I’ll share how we can take advantage of this volatility, on behalf of our clients to seize the opportunities.

The Wong Group Portfolio Positioning:

So how are we managing portfolios amidst these key market risks? First, let’s consider the risk of the Delta COVID variant on the markets. The higher concerns about the Delta COVID variant slowing economic growth, could shift the market back to favoring growth over value stocks. Alternatively, it could also incentivize a re-acceleration towards higher vaccination rates in the US – leading for the “cyclical” or more economic-sensitive value stocks to outperform.

In our client portfolios, we have added some exposure to companies who benefit from higher inflation, and have recently taken large profits on copper producers that we bought a year ago when the shares were very cheap.

Medium to long term interest rates have moved higher during the first part of this year, then back down again over the past couple of months, causing a lot of volatility in the bond market in particular, as the battle between Inflationary and Deflationary impact continues.

It’s normal for the markets to experience volatility along the way – and this battle between Inflationary and Deflationary forces may be transitionary, but not tidy.

It’s important not to over-react to short term volatility, as the profit cycle is still improving, as evidenced by the recent quarterly earnings announcements by publicly-traded companies the past few weeks. Our risk measurement tools (i.e. Polarization amidst valuation and credit spreads) have reset and do not suggest racing for the hills.

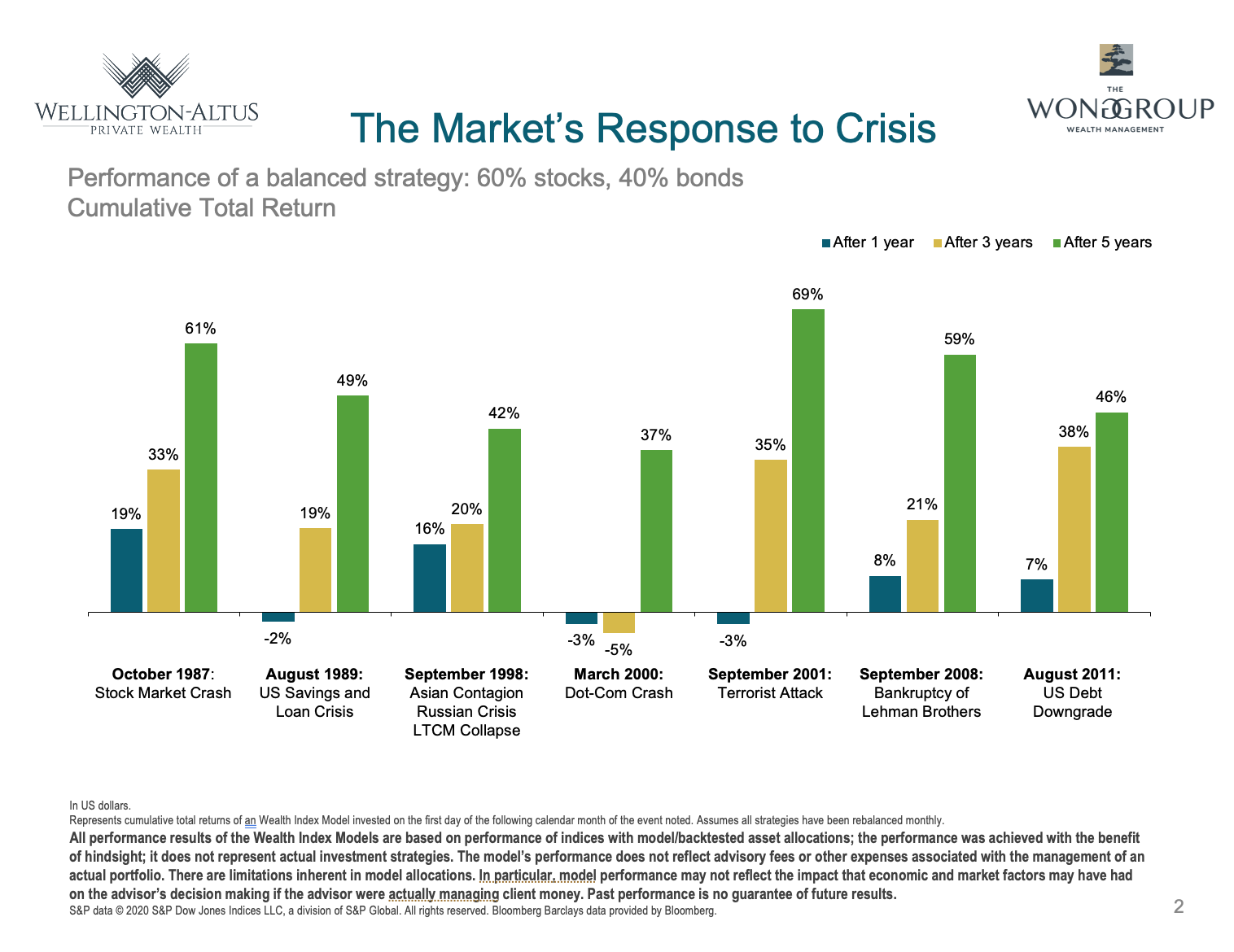

Slide 2: The Market’s Response to Volatility

This slide shows performance of a balanced investment strategy following a series of major crises that have taken place over history – From the October 1987 Crash, to the March 2000 Internet Bubble Dot Com Crash, to the September 2001 Terrorist Attacks in 2001, and even the 2008 Global Financial Crisis. Each of these periods saw huge equity market declines like what we saw last year with the COVID19 global pandemic market decline.

Although a global investment strategy would have suffered losses immediately following most of these events, the financial markets recovered over time, as indicated by the positive five-year cumulative returns. As you can see in this chart, the subsequent 1 year returns (in blue), 3 year returns (in yellow) and 5 year returns (in green) show that even in major crises, markets are likely to recover within a few years’ time.

Negative events such as these may tempt investors to flee the financial markets. But diversification and a long-term perspective can help investors apply discipline to ride out the storm.

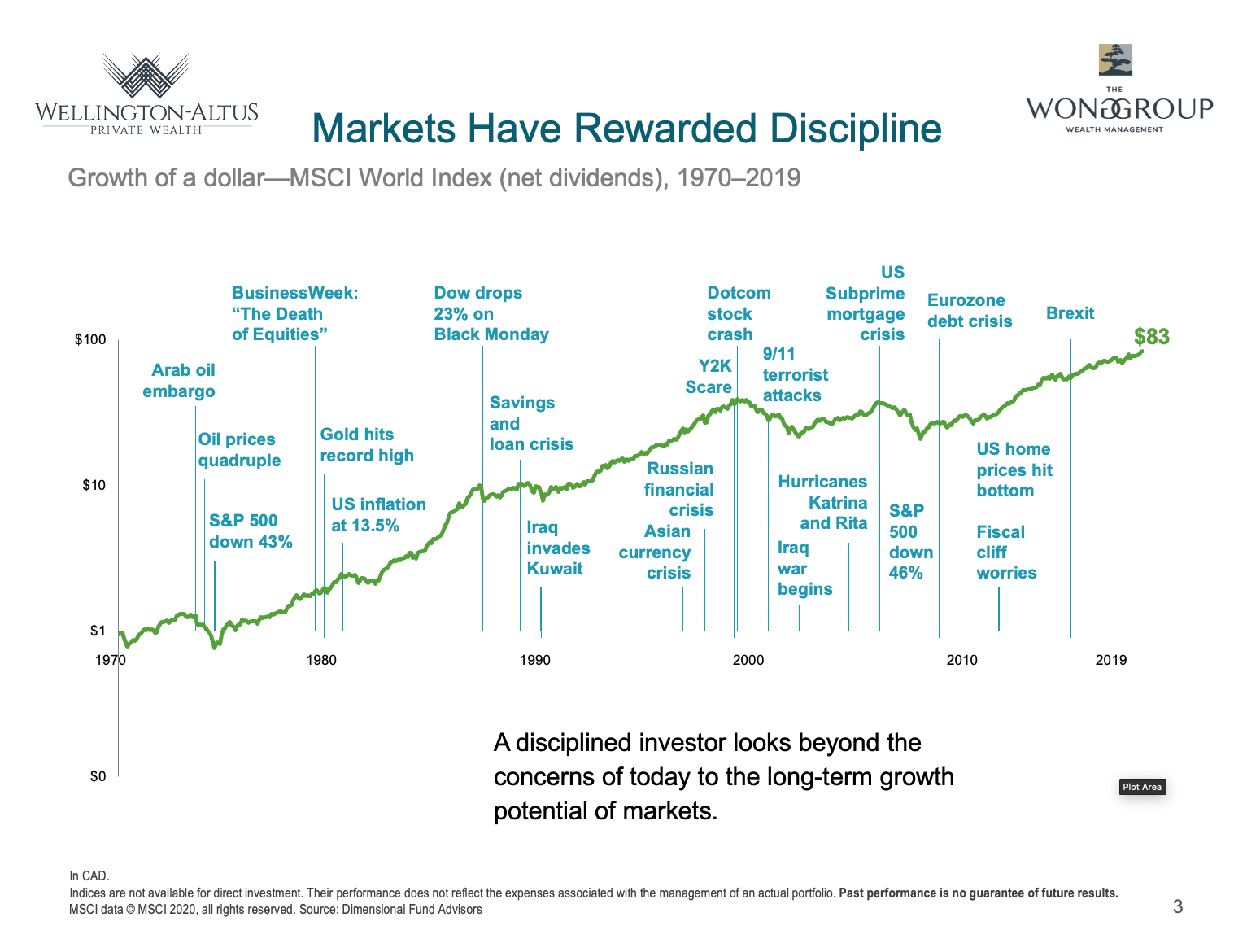

Slide 3: Markets Have Rewarded Discipline

What we also know, is that despite a lot of scary world events and dramatic crises, investing in global equities have rewarded investors who have stayed disciplined.

This chart shows the growth of $1 CAD invested back in 1970, despite all of these historic events like the Arab Oil Embargo, the huge inflation of the 70’s and the subsequent 43% drop in the S&P500, the Businessweek magazine cover “The Death of Equities, and all the other events, that $1 CAD would now be worth $83. 83 times your money.

Now that 83x your money wasn’t a straight line of growth. No way. But what I want to show you is how it’s totally Normal and Expected for the markets be experience volatility, and yet recover and continue to new highs.

Overall, we remain optimistic on how the market deals with the higher COVID variant news over time, as global vaccination rates continue to improve in many parts of the world. We will continue to engage in pruning the portfolios, trimming and taking profits on some of the more cyclical names to add to more high quality large cap names for a bit of defense in the near term without abandoning our overall long term growth thesis.

Remember, it is normal for equity markets to pull back by at least 10%, at least once a year!

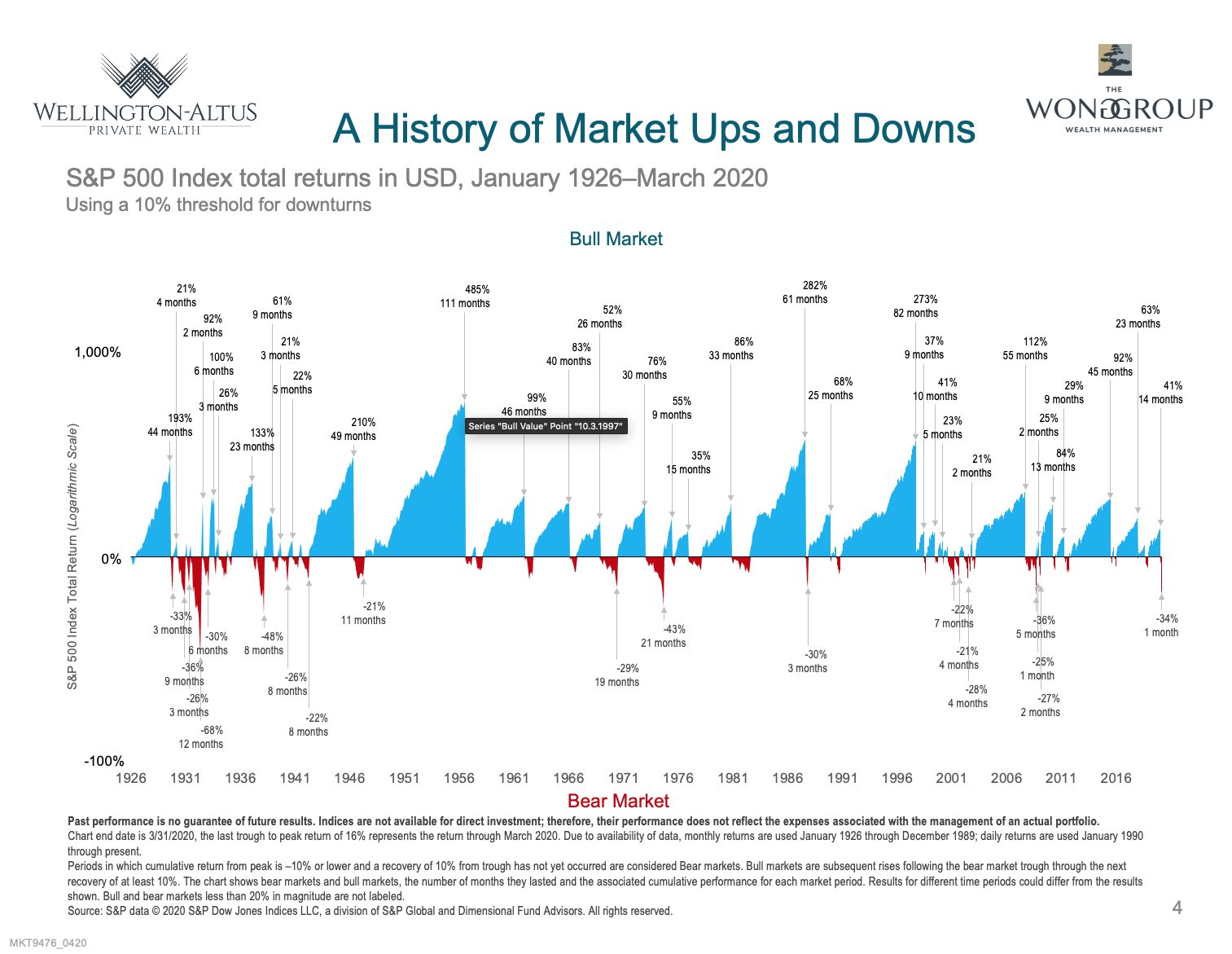

Slide 4: A History of Market Ups and Downs

Some good news as well, is that the good times typically last longer than the bad times. This chart shows a timeline from 1920 to the end of last year, with the blue being periods of the US Equity market growing, punctuated by brief red periods of market declines of 10% or more.

We can see from the chart that good times for the market have been disproportionately longer than the bad times, and the duration of the bull run is not a useful indicator of future performance. We expect positive returns every day, and while there is no consistent way to predict when realized performance will be positive or negative, investors staying the course have been rewarded over the long term.

But I get it. With all the negative news headlines bombarding us every day, many investors may become concerned during periods like now, fearing a downturn must be right around the corner. But history suggests that a surging market and new index highs do not necessarily lead to a subsequent plunge.

And remember, that as a Portfolio Manager, we embrace volatility as it can be a good time to switch from low price to low price, and upgrade to higher quality stocks, on sale.

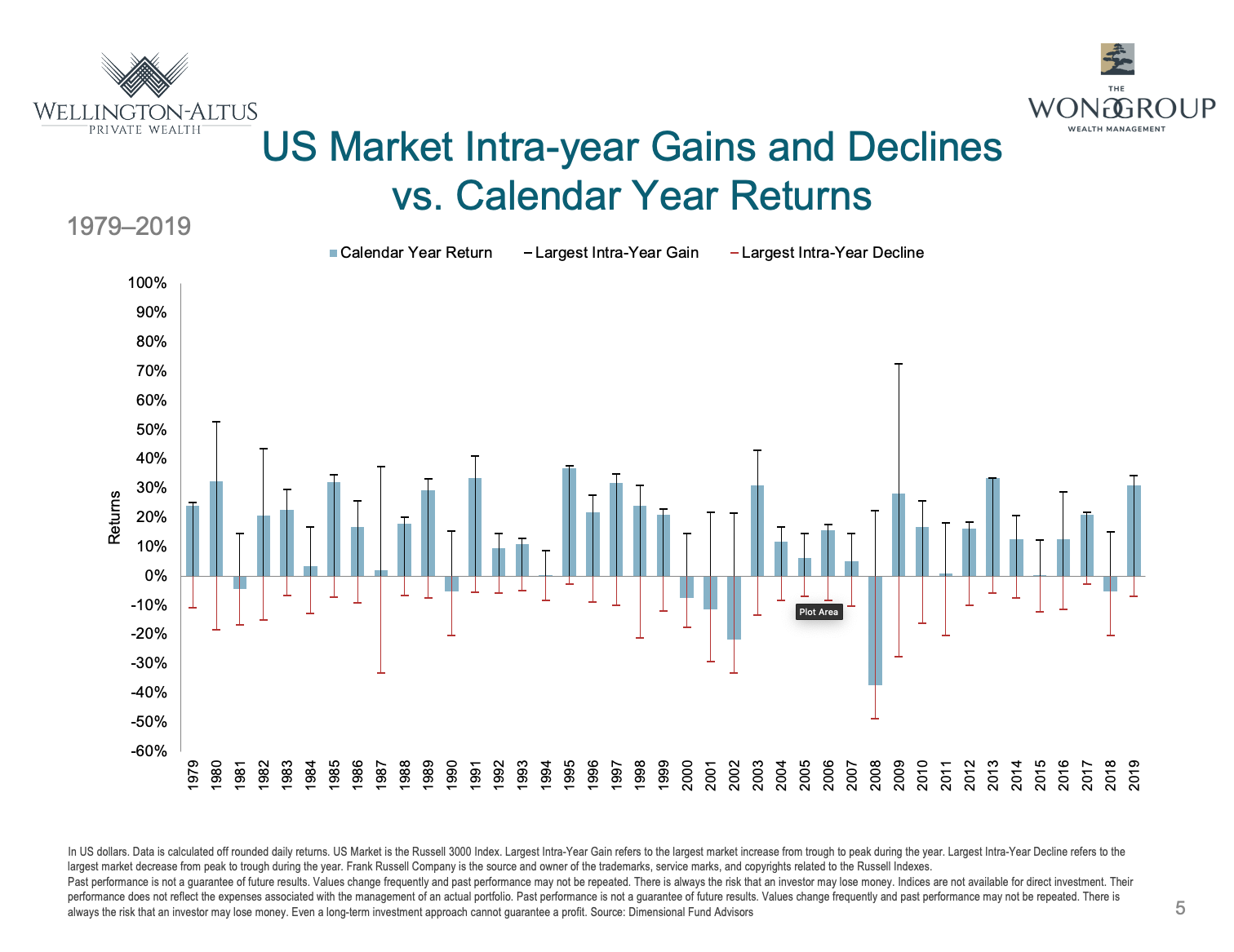

Slide 5: US Market Intra-Year Gains and Declines vs. Calendar Year Returns

I show you this chart only to illustrate one point. That is that over the past 40 years, while the US equity market ends up with a positive return, almost every year experiences at least 1 correction of at least 10% or more. The blue bars show the US equity market returns each year. The black and red whiskers show the largest gain and decline within each year.

Even in years with high calendar-year returns, a large intra-year decline may have occurred. The performance for any given time period does not need to prompt action. A long-term focus can help block out the noise.

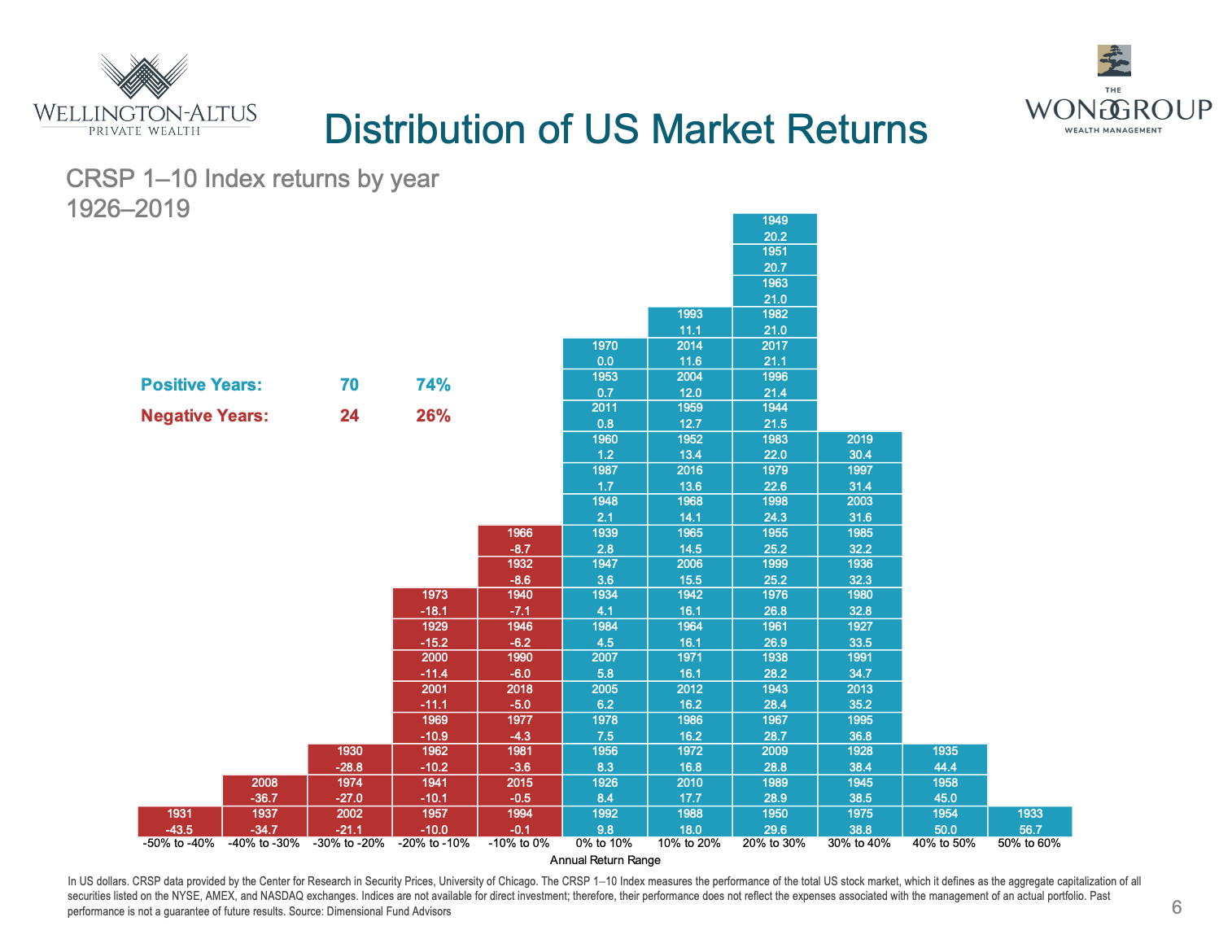

Slide 6: Distribution of US Market Returns

Yes, there can be bad years, but the good news is that there are more often good equity market years than there are bad.

The above chart shows the historical distribution of US market returns since 1926. The blue boxes are years where the US market delivered a positive return, while the red boxes are years where it delivered a negative return. 74% of the years were positive, and only 26% were negative, over the past 95 years.

History shows that the stock market has rewarded investors who can bear the risk of stocks and stay committed through various periods of performance.

The important take away is to STICK TO THE PROCESS! We are grateful to our clients who continued to trust our process and have subsequently achieved performance that delivers peace of mind.

Slide 7: Focus on what you can control

At the Wong Group at Wellington-Altus Private Wealth, we use our expertise, care and guidance to help you focus on actions that add value, and to focus on the things you can control, in order for you to have an outstanding client investment experience.

It starts with working with an experienced advisor to create a financial and an investment plan based on market principles, informed by financial science, and tailored to a client’s specific needs and goals. Along the way, we can help you focus on actions that add investment value, such as managing expenses and portfolio turnover while maintaining broad diversification.

Equally important, we can provide knowledge and encouragement to help you stay disciplined through various market conditions.

As always, my team and I are here to help you and your loved ones have a positive client experience while achieving your financial dreams and goals.

If you’d like to schedule an appointment with me or my team, please contact us at 778 655 2410 or use the chat feature or contact form in the footer below.

I look forward to connecting with you again soon.

Enjoy a wonderful summer, and may the Smart Risks ever be in your favor.

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager

Executive Vice-President