Maili’s Market Update Video – The Great Re-Structuring 2.0: Global Outlook for 2021

Click the image above to watch the 11 minute video.

Hello and thank you for joining us for this month’s Market Update. In this video and transcript below, we will share a quick summary of our global market outlook and our perspective on how to position investment portfolios in 2021, thanks to the insights from our global research, experience, and shared insights from our portfolio strategist, Dr. Jim Thorne.

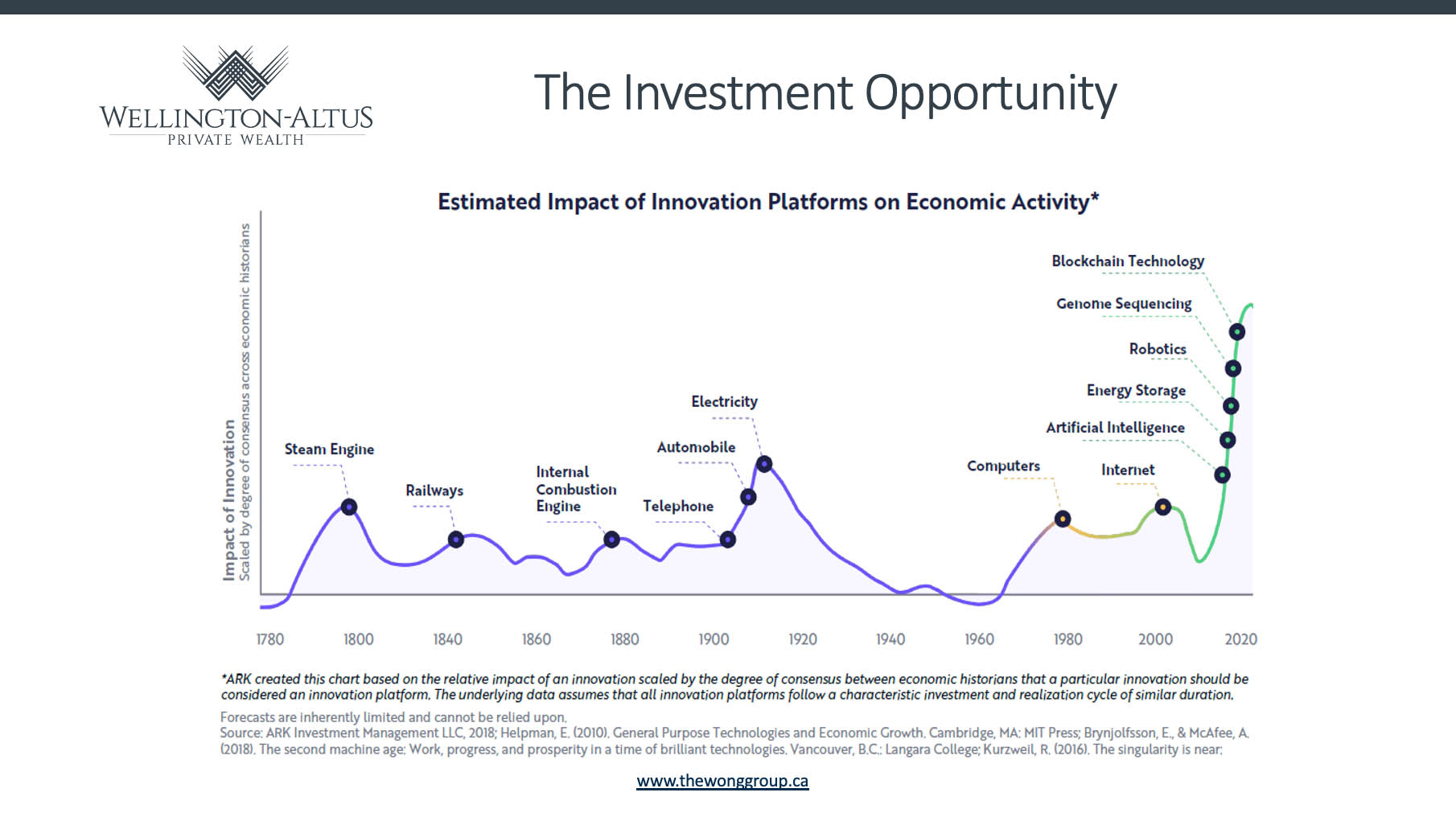

A crisis can accelerate structural changes and innovative forces already present in society.

– As we look through history, we get these historical events that trigger acceleration in innovation and structural change. This past one year amidst COVID 19 and the global pandemic, we see patterns that remind us of previous turning points in history, and lead us to the following views on the market that may be different than what you hear about in the media.

In summary:

1) This year we expect global growth to accelerate. While we may experience a possible growth scare in the first half of 2021, we anticipate a favorable year for equities in the year ahead.

2) Expect a high degree of volatility throughout the year and investors may experience an emotional roller coaster.

3) Watch for Re-acceleration of global growth as Covid-19 fears recede and economies return to a new normal, suggesting investors should expect cyclical and inflation assets to have a strong year.

4) Populism will still be with us!

5) Central bankers are likely to let economy run hot. Don’t fight it.

6) The decade long cold war for technology dominance between China and USA is likely to continue.

7) Disruptive innovation and digital deflation continue to take place as a new platform builds for the new data economy (i.e. 5G, Artificial Intelligence, Blockchain, Green, Biotech breakthroughs).

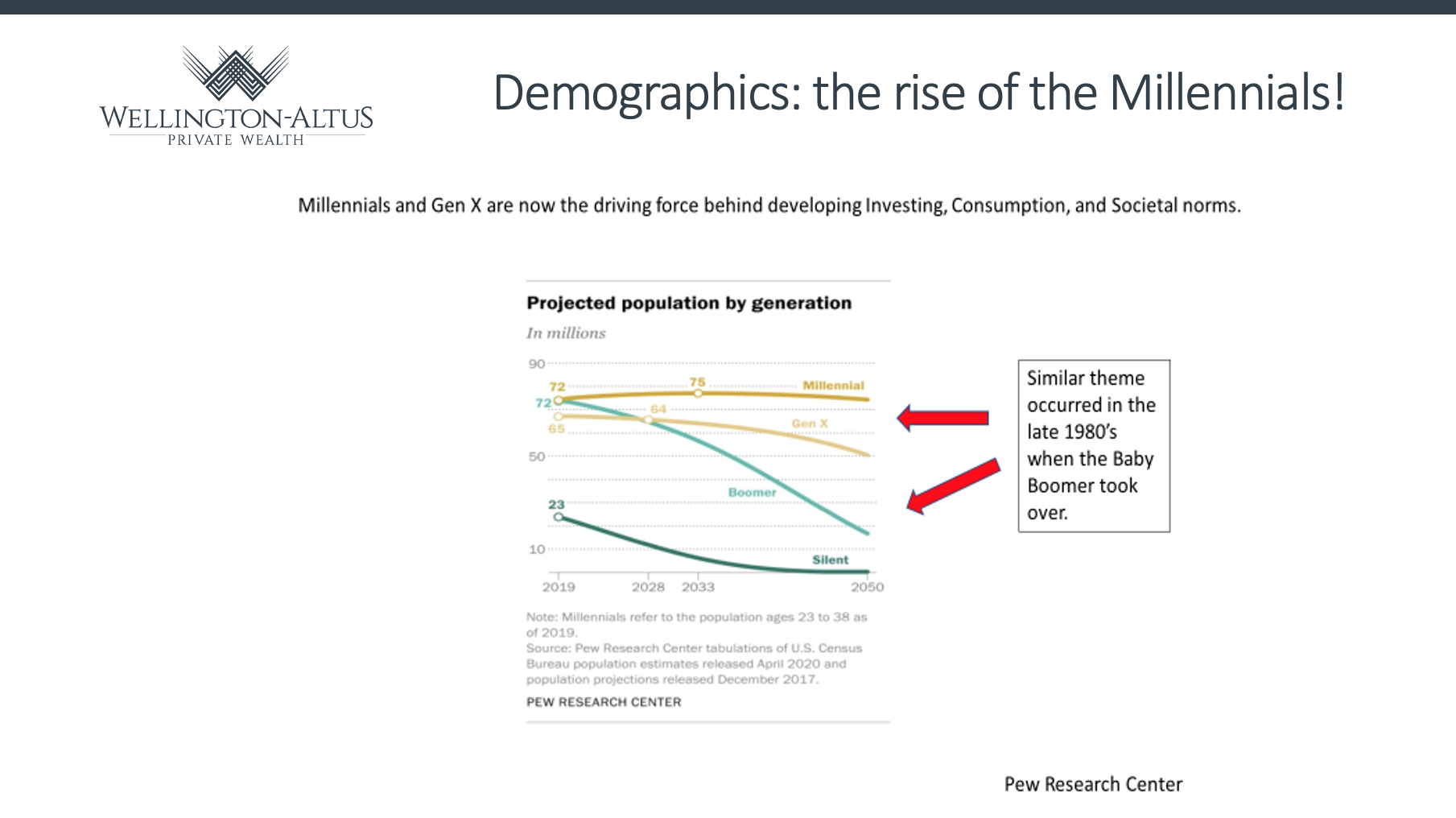

8) Millennials and Gen X’s life cycle of consumption emerges as a strong growth catalyst for the economy.

– In many ways, the effects of COVID19 and the global lockdown of the economy are similar to the economic destruction of a World War, and the economic cycle that follows.

– The global lockdown caught so many individuals and businesses by surprise and the global lockdown acted as a catalyst for the adoption of new technologies.

– We’ve seen this pattern of crisis leading to innovation before.

– If we were to examine the past 250 years, there have been at least 5 significant Technological Revolutions.

– From the 1st industrial revolution in Britain, to the steam engine and railways in the 1800s, followed by heavy engineering, the combustion engine, telephone and electricity, the internet, all of these were born out of challenging times.

– And now a convergence of new disruptive technologies like artificial intelligence, robotics, blockchain technology and genome sequencing are all taking place together, and the pandemic has accelerated these converging new technologies’ impact across all industries.

– And what’s another social impact these technological revolutions seem to have in common? The rise in populism.

– What do we mean by Populism? The rise in activity from ordinary people who feel that their concerns are disregarded by established elite groups, afraid of being left behind.

– Most recently in US politics under Trump, we saw the rise in populism movements, and more recently, financial populism with the recent events on Reddit involving Gamestop.

– So, the big question is then, from an economics and global markets perspective – are the policy makers who have studied history and who are aware of the threats of populism and social unrest, will they then allow the economy to run hot? Maybe so. Will they allow wages to increase to reduce the threat of populism? Maybe so.

– It’s not so much about what happens this year, it’s when do they take it away?

– If world leaders Biden, Trudeau, Christine Lagarde, facing the world as we come out of this pandemic, will they be sincere about creating income equality? We don’t know, but if so, then that means interest rates are likely to stay lower for longer, it likely means more stimulus, allowing the economy run hot.

– Remember The Roaring 1920’s: back in the 1920’s we came out of World War 1 – rise of fascism, rise of communism, rule of monarchy wiped out (except England), then the US Federal Reserve expanded credit because there was massive fear. Massive technological innovation (electricity) and roaring decade followed.

– It wasn’t until a new regime came in and raised interest rates, then it killed the economy. And so today, economic policy makers learning from this history lesson may be more reluctant to raise interest rates so quickly, in order to prevent what happened in the 1930’s.

– The bottom line is that there is a paradigm shift taking place, once that changes the status quo

– Similar to how the baby boomers changed investing, the Millennials are too – comfortable with ETF’s, options, bitcoin

– There is a huge amount of creative destruction taking place, leading to a paradigm shift in how people need to think. Don’t short growth and innovation!

– This is where we are in the early stages of that evolutionary process and Great Restructuring among those companies who choose to innovate and digitize, and those that don’t. Those that fail to recognize they need to digitize; they will go away.

– Three phases of recovery of Covid-19 pandemic: Restrain, Recovery, Reset.

– Global debt levels were 300% of GDP before pandemic. Another $10 trillion in debt was added.

– Combine the effects of Covid-19 with the early implementation of the 4th industrial revolution, the result is the Great Reset.

– Objective is to build a more resilient, inclusive, and sustainable global economy.

– Negotiate new social contracts. More global co-operation.

– The winners: technology and the environment. Growth must be sustainable and inclusive.

– As Klaus Schwab, the Founder and Executive Chairman of The World Economic Forum said himself, “The pandemic represents a rare but narrow window of opportunity to reflect, re-imagine, and reset our world.”

– Just like when countries emerge out of war, it’s natural for policymakers to use the opportunity to make structural adjustments (i.e. greening of economy), so don’t be surprised when these structural adjustments take place.

– What does this mean for us as investors today?

– It starts with understanding that Rise of new technology and this convergence of disruptive technologies can lead to a whole new business cycle stemmed by innovation.

– And a new business cycle can take place over 10 years, which historically has been the average length of time over the past 3 cycles.

– Basically, we could be in the very early in the economic expansion that could last 4 to 10 years

– We had a recession in 2020, and now the clock restarts

– New clients coming into the market looking at the market and world in a new way.

– Baby boomers taking money out of the accounts, and younger clients buying different stuff

– What does this mean for equities and global markets?

– 2021: Market expectations about the Economic recovery coming out of the Covid-19 Pandemic may be too aggressive. A growth scare in early spring is very possible, and we as portfolio managers are preparing for that as a potential buying opportunity.

– Because remember that in 2021, global central bank policy makers are willing to err on the side of keeping interest rates low, allowing credit and liquidity to flow, and willing to let the economy run hot before putting on the brakes, in order to avoid what happened in 2000 and in in the 1930’s.

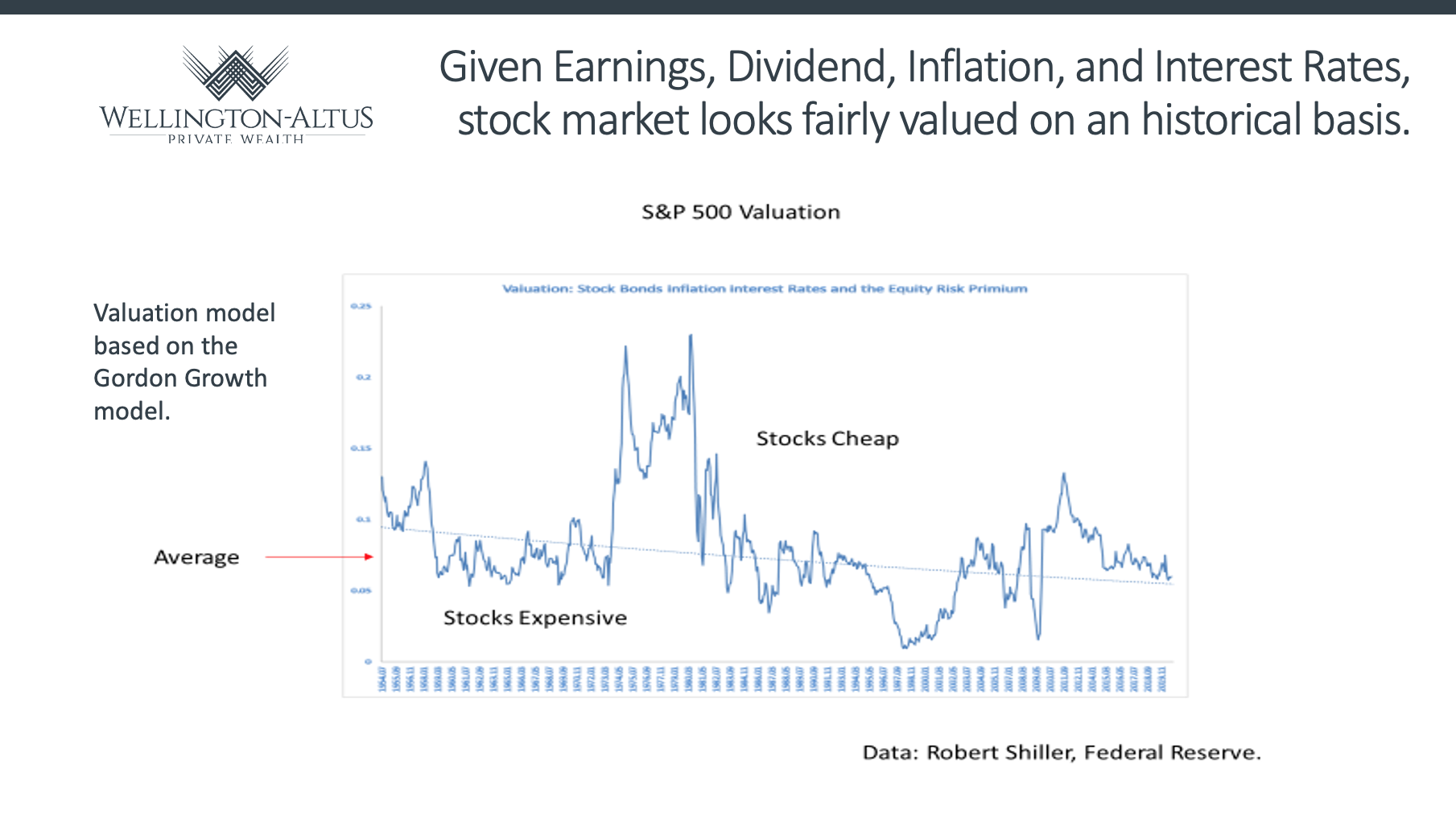

– With interest rates at these low levels, arguably bonds and long-dated fixed income investments appear to be expensive, relative to stocks.

– For example, a 3% yield on investment-grade bonds corresponds to an equivalent P/E of 33 for the S&P 500 Equity Index. In the year 2000, investment grade bond yields represented by BAA yields were close to 9% corresponding to an equivalent P/E of 11x.

– Given the level of profits, dividends, inflation and low interest rates, the US stock market looks fairly valued on a historical basis.

– This chart shows the S&P 500 valued relative to bond yields over time, and the ratio is near its long-term average.

– In the near term, we really do not know what the impact will be as the pandemic-induced lockdowns ease, and it could be choppy along the way.

– As we have said in previous updates and constantly remind clients, it is completely normal for the equity markets to correct at least 10% at least once every year, but that these tend to be good buying opportunities for long term investing.

– And remember, demographics play an important role over the longer term

– Millennials, Gen X, Gen Z are replacing Baby Boomers in determining social norms and spending patterns.

– History of demographics suggests that risk assets will appreciate from some time.

– Millennials purchase access experiences. Want access not ownership.

– Family formation increasing. Watch home builders.

– More is less, and we may be looking at the end of the Mass Consumption Society.

– For Millennials as a cohort, their spending is just getting started. Their prime income years should peak in 2028 to 2038.

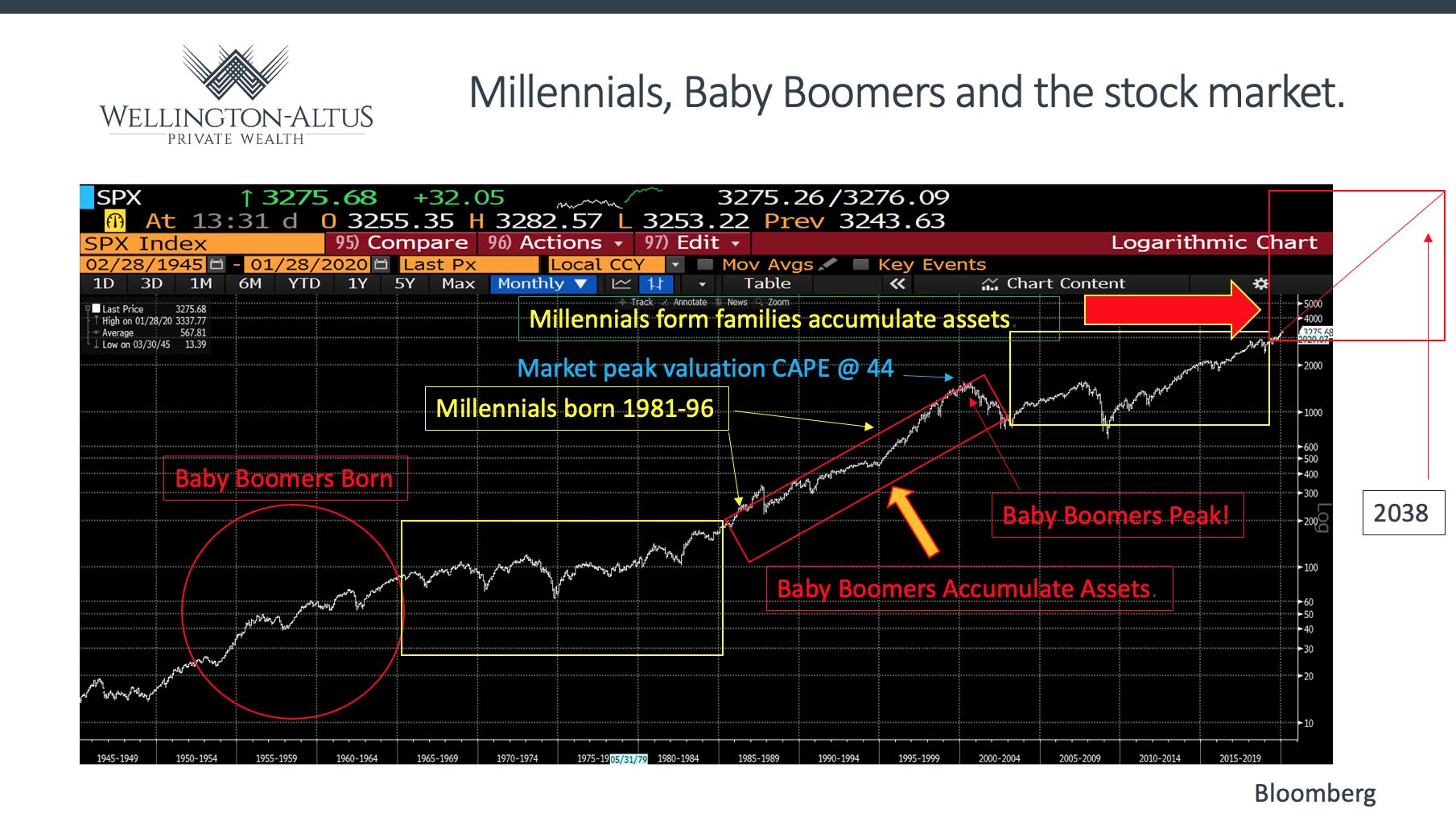

– What does this look like from a stock market perspective?

– This chart of the S&P 500 Index shows the US equity market’s behavior as the Baby Boomers were born, their decades of “accumulating assets” building wealth and investing leading to strong equity markets in the mid-1980’s to early 2000’s.

– Similarly, the Millennials were born from 1981 to 1996 are in the phase of forming families today, and accumulating assets over the next 10 to 20 years, potentially leading to another leg higher similar to the impact of their Baby Boomer parents.

In summary, 2021 we are likely to see:

1) Acceleration in economic growth.

2) Trillion-dollar stimulus package.

3) Fed purchasing assets and not raising rates.

4) Global economy reopens.

5) Low interest rates, accelerating economic growth, strong earnings growth, suggest a strong year for risk assets in 2021.

6) Companies with strong earnings and margin growth will outperform.

– Since Federal Reserve and policy makers appear focused on reducing income inequality and are using a new playbook, our base case scenario is that they will let the economy run hot to create inflation and economic growth with a goal to reduce income inequality.

– Expect generational changes in economic policy, monetary policy and foreign policy to continue.

– Low interest rates, accelerating economic growth, strong earnings growth, suggest a strong year for risk assets in 2021.

– 4th industrial revolution continues, investor continue to focus on technology and Green investment opportunities.

– Early cycle playbook should be followed as economy opens later in 2021.

As always, my team and I at The Wong Group are present, focused and prepared to adapt to these changing market conditions, and delivering complete confidence in our financial advice and relationships.

To learn more about our wealth management services or to learn how to register for our live and interactive client webinars, email us at thewonggroup@wprivate.ca or call us at 778 655 2410.

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager and Executive Vice President

The Wong Group at Wellington-Altus Private Wealth