Maili’s Market Insights:

Investing amidst Market Volatility – Spring Update April 2022

Click the image above to watch the 12 minute video.

Happy Springtime everyone! As we enter the month of May, my team at The Wong Group and I hope you and your family are healthy and well, amidst all that is going on in the world today. We wanted to proactively reach out and share with you our insights on:

- – how the global events and market conditions are affecting today’s investment markets,

- – how we are positioning in client portfolios to adapt to these circumstances, and

- – how to take advantage of current crises as opportunities.

Many of our clients value our team as a stabilizing force during turbulent times. This value has been more important than ever over the past two years, as the world experienced a global pandemic, and the investment markets underwent some tremendous volatility – causing people to feel vulnerable from both a health and wealth perspective.

Fortunately, our team has been present, focused and prepared to apply our Smart Risk approach to navigating these choppy waters.

Most recently, as the peak of the pandemic news fades from the headlines, other global events have found the spotlight in the news, including:

- 1. the geopolitical tensions arising from the war in Ukraine,

- 2. fears of inflation and higher prices potentially leading to a global recession, and

- 3. rising interest rates in Canada and the US, and other parts of the world emerging from the pandemic.

All these issues are giving rise to market swings and renewed volatility over the past few months. But what I hope to illuminate today, is why while market volatility can “feel” uncomfortable to the average investor, it’s very normal, and an expected part of investing. I’ll show how we can take advantage of this volatility, on behalf of our clients to seize the opportunities.

As well, I’m pleased to share that our client portfolios have been very resilient and relatively stable during the past few months, even as most global equity markets like the Nasdaq and S&P500 indexes have experienced drops of 10% to 15% so far this calendar year.

So, let’s address these key global events and market drivers directly:

- 1. The geopolitical tensions arising from the war in Ukraine are among the key news events affecting global markets today. The images of war and social injustice naturally stoke our emotions, can evoke negative feelings, and raise concerns about the stability of world relations.

- – As well, related concerns about the knock-on effects of sanctions and restrictions on trade, are driving commodity prices higher as countries look to secure stable sources of energy, given the heightened risks of oil supplies from Russia.

- – In the past 3 to 6 months within many of our client portfolios, we increased our exposure to energy companies in the oil and gas sector, and added exposure to defense contractors who may benefit from a higher allocation of government spending towards military defense going forward.

- – At a recent board meeting that I attended as a director on the Asia Pacific Foundation, a Canadian intelligence think tank, I took part of a fascinating debate that included the deputy assistant minister of Global Affairs for Canada and other influential decision-makers. One related theme addressed was the potential shift towards de-globalization, as businesses look to move factories and supply chains back “on-shore”, potentially away from China, Russia and other countries with autocratic governments – leading to potentially higher costs being passed along to consumers.

- 2. This brings us to the second key headline item driving market volatility, and that is the fear of inflation and higher prices potentially leading to a global recession.

- – Let’s start with inflation. If inflation persists, you don’t want to be sitting on too much cash or low-interest bearing investments like GIC’s, which may not earn enough to keep up with the rising cost of living. Equities, and in particular, dividend paying equities and shares in profitable companies who can pass along higher input costs in the form of higher prices, can maintain stable profitability and can perform well in times of mild inflation.

- – You may be hearing the term “Recession” a lot. Technically speaking, a recession is defined as 2 consecutive quarters of negative GDP growth. In fact, a short-lived recession may not be a bad environment for stocks, bonds and other risk assets like real estate. What we do know is North American corporate balance sheets are still healthy and credit spreads and the cost of borrowing for businesses is still low. This ultimately means that the probability of a prolonged recession is lower than the media is reporting.

- – In client portfolios, we have tilted towards the highest quality companies – those with strong, stable balance sheets and predictable profits and dividends, which make them most likely to be resilient and able to raise prices and defend their profit margins in an inflationary environment. We have also leaned towards ‘short duration’ in fixed income land, minimizing risk to inflation that can erode values in cash and long-term bonds, and fortify our client portfolios to maintain real value over time, even in the face of inflation.

- 3. Thirdly, rising interest rates in Canada and the US, and other parts of the world are making headlines as the world emerges from the pandemic.

- – Rising interest rates can cause volatility as the proverbial “punchbowl is removed from the party”, making it tougher for folks to afford higher mortgage payments, and businesses facing higher borrowing costs. Remember, however, why interest rates are rising. It’s because the economy is getting back to normal – as opposed to needing emergency support! Central Banks around the world did emergency rate cuts early on in the pandemic, to prevent a global scale financial crisis. Two years later, it’s promising to see these emergency stimulus measures being removed. It’s kind of like being able to remove the sick patient from life support – because the patient is fortunately showing signs of strength. Of course, it’s often a choppy path when the stimulus is being removed, but… it’s a sign of recovery…and it also builds a margin of safety upon which to draw, if needed in the future.

- – While raising interest rates can be a headwind for stock and real estate prices, many interest rate hikes have already been priced into the market. For example, the Bank of Canada announced a 50-basis point rate hike on April 13th. Instead of causing a stock market sell off, TSX actually rose by +0.5% later that day.

- – Our Chief Portfolio Strategist at Wellington Altus, Dr. Jim Thorne who has been a guest speaker on our Wealth Matters webinars, believes that the North American Central banks will pivot and likely raise rates LESS than the market is anticipating, leading to gains in the global equity markets later this year.

So tying this all together, why do these negative headlines lead to market volatility?

Well, as you can imagine, the constant negative news headlines featuring geopolitical uncertainty, Inflation and higher interest rates weigh on consumer confidence, leading to more sellers than buyers, in the near term:

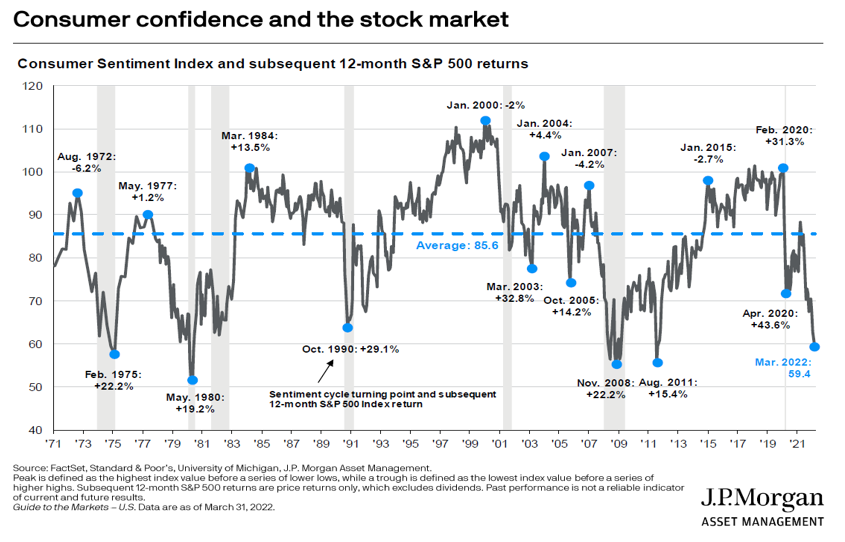

- – This is now showing up as low expectations, also known as “low Market Sentiment” in the financial markets and stress piling onto investors. Interestingly enough, extremely low Market Sentiment can be a very good buying opportunity, as returns after periods of low market sentiments have historically been very high. Like what Mr. Warren Buffett is known to say, “Buy when others are fearful, and sell when others are greedy!”

Right now, thanks to all the negative news out there, investors are fearful. As this graph shows, since 1970s when the black line which represents the measure of consumer confidence is below the blue dashed line which is the long term average, the subsequent 12 month return on the S&P 500 stock market is typically strong and positive. A good example is in April 2020 near the beginning of the pandemic, when the Consumer Sentiment Index hit a low of 70, there was a subsequent positive return in the S&P500 of +43% over the course of the following year. Recently, in March of 2022, the consumer sentiment index hit a low of 60, near the levels we saw in November 2008 and August 2011, both periods that subsequently saw double digit equity market returns over the next year.

What can we expect for the rest of this year?

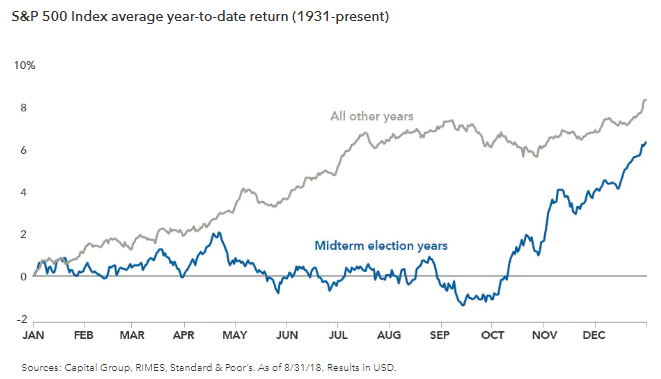

- – Well, as we look ahead to the next 6 to 9 months, we can expect that these news headlines may subside as events like the upcoming US mid-term elections take center stage.

- – Historically Mid-Term election years have followed a similar path of volatility that we’ve seen for the first half of this year, just like we anticipated and highlighted in our earlier Market update a few months ago.

- – The good news is that these types of volatile first halves of the year are most often followed by positive returns in the back half of the year. Currently we are tracking that historical norm and believe we can see something similar this year.

In this graph showing the historical average path of the S&P500 Index of the US equity market, we can see that the blue line, indicating the average path during MidTerm Election years tends to be choppy and sideways for the first 10 months of the year, as compared to the gray line which represents non-MidTerm Election years. But the back half of the year for Mid-Term election years tends to catch up and perform well, even compared to non-MidTerm Election years.

So how are we positioning client portfolios to adapt to the current and anticipated market environment?

Well, the investment world is complex and volatile right now, and we are staying focused on what we can control.

We are focused on owning High Quality, and High Profitability companies with stable business models and strong cash flow.

As we enter the next quarterly earnings season, owning companies with High Profitability is key. With rising raw material costs, companies with the ability to raise prices and protect their profit margins while increasing dividends should continue to benefit.

Also, dividend growing equities should benefit as clients continue to get paid to wait, while markets recover.

Since the Fall of 2021, we have gotten more defensive in client portfolios. Specifically, we reduced exposure to certain sectors like Trucking and Restaurants that are pressured by rising commodity prices and took profits and trimmed exposure to high tech stocks that can be more vulnerable to higher interest rates.

In turn we added exposure and tilted towards sectors that are benefitting from the current Global situations such as Energy, Infrastructure and Defense contractors.

Geographically we have also increased our exposure towards Canada. Many of the difficulties facing the Globe are not necessarily bad for Canada because remember, Canada is a stable country rich with natural resources, like oil, gas, fertilizers like potash, and fresh water – all things the world needs. Also, portfolios can benefit from our exposure to large cap high quality assets in the US, because in times of global uncertainty, US assets are often the beneficiary of global money flows seeking a relative safe haven.

So bottom line, here are some important things to remember:

-

1. Markets Reward Discipline:

- Don’t fall victim to emotions that may nag you to do something you may regret later. Stay disciplined and invest for the long term.

- Yes, Global events have a near term and sometimes uncomfortable impact on stock prices. “How much”, “when”, and “What Direction” is uncertain, but what we observe is stock markets recover from negative events, and often recover sooner than you think or before the bad news is over. For instance, in the early stages of the COVID 19 pandemic – the market fell 37% within a short period of time, but then rebounded faster than most expected and well before the pandemic was over.

- Managing uncertainty is why investors get rewarded with higher returns over time.

-

2. It’s not about TIMING the Market, it’s about Time IN the market:

- Don’t get seduced by trying to cash out and then buy back in at a more opportune time. For a successful market timing trade to take place, the investor must know exactly when to exit the market, and ALSO exactly when to re-enter the market. This mathematically reduces the probability of investing success. And let’s be honest, watching a subsequent rebound in the markets from the sideline can often be just as stressful as watching the initial market decline.

-

3. Stay diversified in a high-quality portfolio designed for you:

- Our Smart Risk approach builds a diversified portfolio of asset classes for you, all of which react differently to evolving market conditions. Diversifying across asset classes and across geographies, sectors and businesses helps provide strong defense against major global events, while also retaining the valuable upside.

We’ve been through tough times before and thank you for trusting our process. As always, we are present, focused and prepared to help you, your loved ones, and your portfolio stay resilient and well-positioned to take advantage of the opportunities at hand.

If you’d like to schedule an appointment with me or my team, please contact us at 778 655 2410 or use the chat feature or contact form in the footer below.

I look forward to connecting with you again soon.

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager

Senior Wealth Manager

If you have any questions about how this relates to you or your investment portfolio and financial plan, please give us a call at 778 655 2410 or email us at thewonggroup@wprivate.ca

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©2022, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca