Maili’s Market Insights:

The global investment markets continued their volatility in May, as investors anticipate further interest rate increases amidst slowing economic activity, and fears of recession persist.

As we highlighted in last month’s Market Update video, why is there so much recession fear?

The answer is simple, inflation and rising interest rates. Both of which are being exacerbated by Russia’s invasion of Ukraine and China’s “Zero-Covid Policy.” This constrains both the supply side (lower production of goods and inefficient supply chains), and the demand side (higher prices, higher borrowing costs).

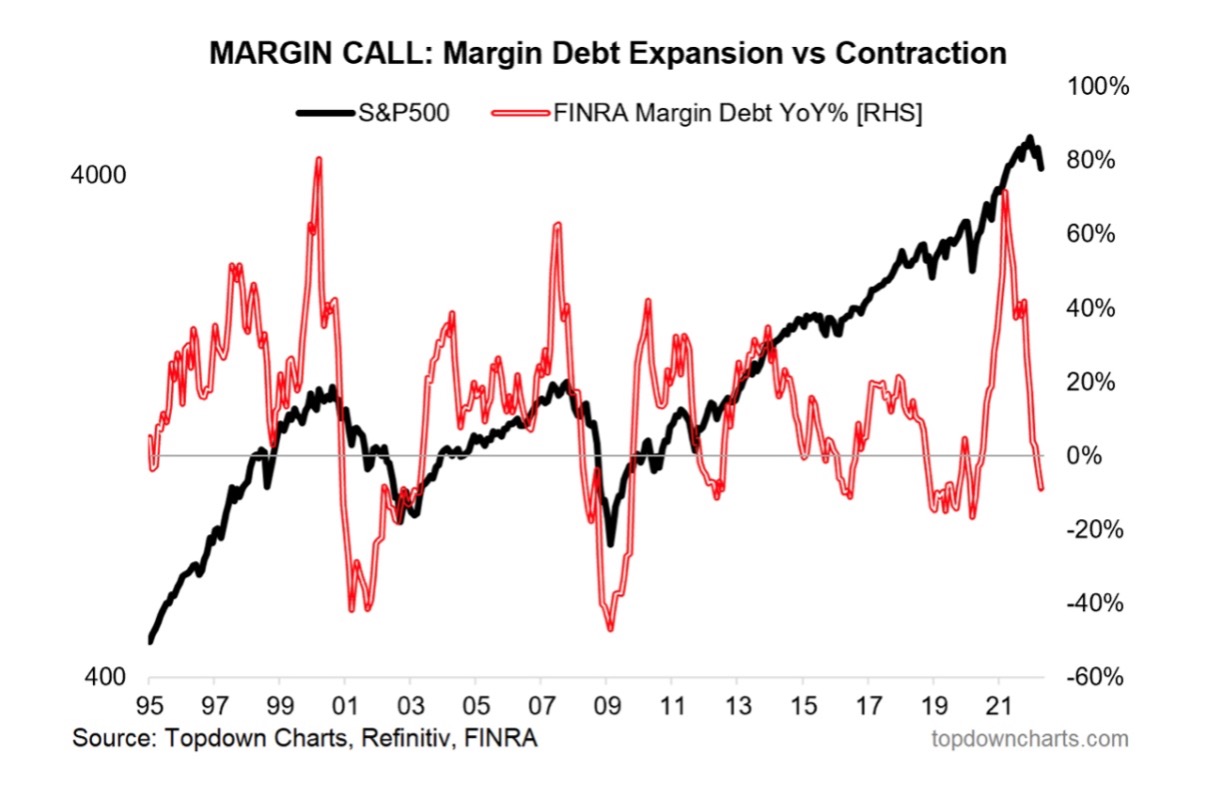

A “glass half full” perspective would be that a significant amount of this recession fear is already discounted into the markets, and a minor recession would not surprise the market. We have already seen a large reduction in the amount investors have borrowed “on margin” (see margin call graph below). We feel a shallow recession may have minor effects on your portfolio and that the market recovery could be quicker than expected.

Follow the link below for a full in-depth analysis of our current economic environment, as well as 5 reasons to have a positive outlook for the second half of the year:

Here are five reasons to be positive on the market outlook:

-

(1). Your advantage over the largest investment funds in 2022:

Throughout 2022, large institutional investment funds who use high amounts of leverage (i.e. high debt) have been forced to sell their holdings in a “fire sale” to repay their debts. These forced sales have exerted downward pressure on stocks and bonds, to date. They may have viewed these holdings as quality and a great investment moving forward, but simply must sell to cover the margin loans.

Here are two silver linings to this:

- – As disciplined, long-term investors with fewer constraints, we believe this creates an opportunity to buy shares of high quality companies, like Apple, at rarely discounted prices “on sale”.

- – Debt in the market has already significantly repaid in 2022, showing the worst may be behind us. (Figure 1: Margin Call)

-

(2). Equity markets are finally beginning to look cheap!

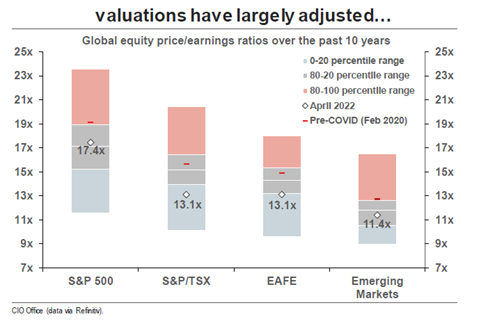

A fundamental way to determine if the stock market is cheap/expensive is to consider how much the total market value of the companies in the stock market are worth per $1 of profit generated by the companies in the stock market. This is called a “Price to Earnings” ratio. The higher the Price to Earnings ratio, the more risk that the market is over-valued; the lower the Price to Earnings ratio, the more likely it is that the equity market is under-valued (aka cheap).

Today we believe we are at a point in which many equity market indices are below their long-run Price to Earnings ratios, for the first time in many years! This means equities are looking cheap and a large amount of risk has already been priced into the market.

-

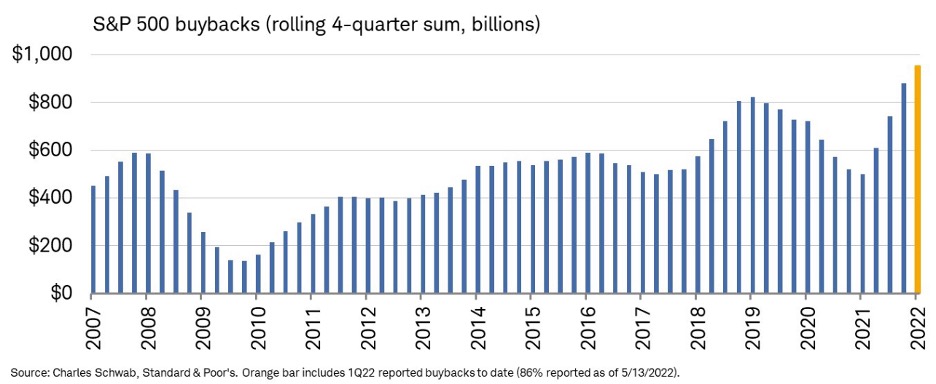

(3). Companies have been increasingly buying back their own shares.

Simply put, if company management believes their shares are under-valued, or they have excess cash they want to redistribute cash to their shareholders, they will buy back their own shares. This is what appears to be happening now! See below as the yellow bar represents the increasing share buybacks, which has continued into this most recent quarter.

-

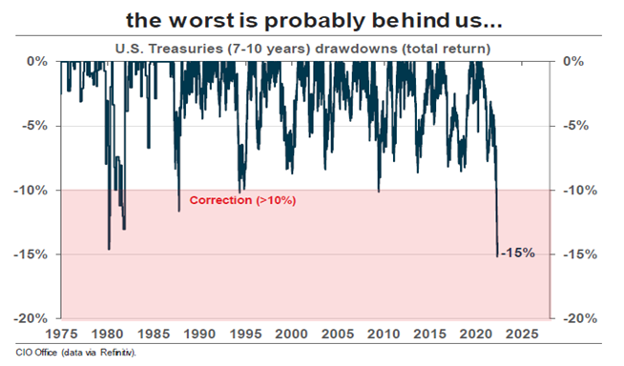

(4). Bonds are now repositioned to play a defensive role in your portfolio.

Year to date as interest rates headed higher, bonds have faced one of their most challenging periods in history, falling almost as much as equities down 15% so far in 2022. But with an additional 75bps+ in interest rate hikes already being priced into the market, bonds may not face the same downside risk going forward and the worst may be behind us.

-

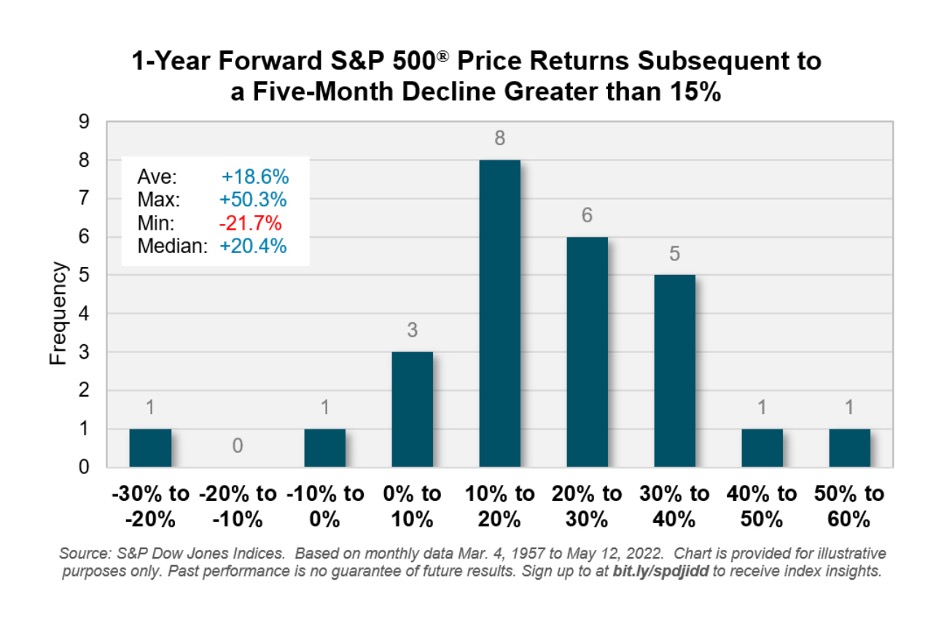

(5) Large equity gains tend to follow periods like we are experiencing now:

Following periods of equity market corrections greater than a drop of -15% like we have seen thus far, the 1 year subsequent equity market return tends to be a positive +18% to +20% gain.

What can we expect for the rest of this year?

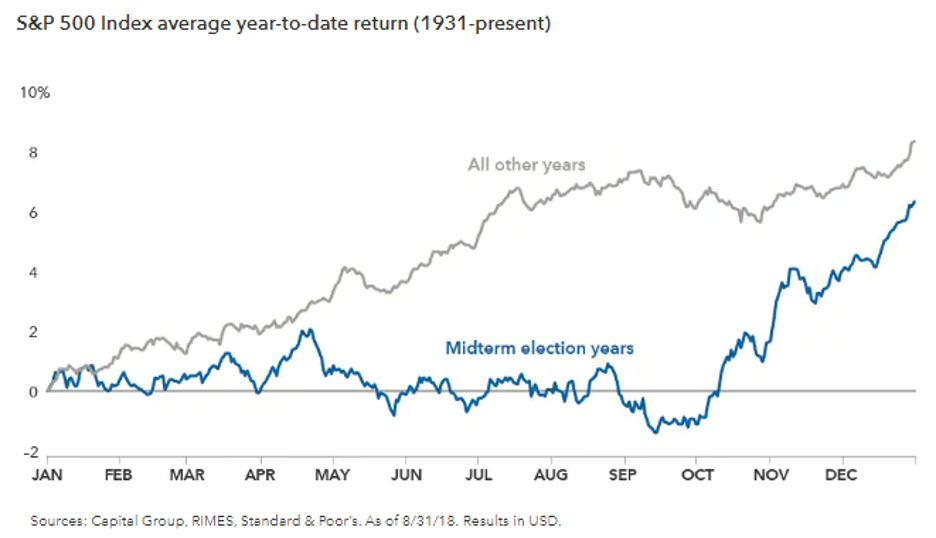

- – Well, as we look ahead to the next 6 to 9 months, we can expect that these news headlines may subside as events like the upcoming US mid-term elections take center stage.

- – Historically Mid-Term election years have followed a similar path of volatility that we’ve seen for the first half of this year, just like we anticipated and highlighted in our earlier Market update a few months ago.

- – The good news is that these types of volatile first halves of the year are most often followed by positive returns in the back half of the year. Currently we are tracking that historical norm and believe we can see something similar this year.

In this graph showing the historical average path of the S&P500 Index of the US equity market, we can see that the blue line, indicating the average path during MidTerm Election years tends to be choppy and sideways for the first 10 months of the year, as compared to the gray line which represents non-MidTerm Election years. But the back half of the year for Mid-Term election years tends to catch up and perform well, even compared to non-MidTerm Election years.

So how are we positioning client portfolios to adapt to the current and anticipated market environment?

Overall, we are still positioned defensively, with tilts toward high-quality companies.

Now is a great time to seek out quality companies that have overshot of the downside, with an opportunity to exceed expectations going forward.

Bottom line, here are some important things to remember:

1. Markets Reward Discipline:

- – Don’t fall victim to emotions that may nag you to do something you may regret later. Stay disciplined and invest for the long term.

- – Yes, Global events have a near term and sometimes uncomfortable impact on stock prices. “How much”, “when”, and “What direction” is uncertain, but what we observe is stock markets recover from negative events, and often recover sooner than you think or before the bad news is over. For instance, in the early stages of the COVID 19 pandemic – the market fell 37% within a short period of time, but then rebounded faster than most expected and well before the pandemic was over.

- – Managing uncertainty is why investors get rewarded with higher returns over time.

2. It’s not about TIMING the Market, it’s about time IN the market:

- – Don’t get seduced by trying to cash out and then buy back in at a more opportune time. For a successful market timing trade to take place, the investor must know exactly when to exit the market, and ALSO exactly when to re-enter the market. This mathematically reduces the probability of investing success. And let’s be honest, watching a subsequent rebound in the markets from the sideline can often be just as stressful as watching the initial market decline.

3. Stay diversified in a high-quality portfolio designed for you:

- – Our Smart Risk approach builds a diversified portfolio of asset classes for you, all of which react differently to evolving market conditions. Diversifying across asset classes and across geographies, sectors and businesses helps provide strong defense against major global events, while also retaining the valuable upside.

We’ve been through tough times before and thank you for trusting our process. As always, we are present, focused and prepared to help you, your loved ones, and your portfolio stay resilient and well-positioned to take advantage of the opportunities at hand.

If you’d like to schedule an appointment with me or my team, please contact us at 778 655 2410 or use the chat feature or contact form in the footer below.

I look forward to connecting with you again soon.

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager

Senior Wealth Manager

If you have any questions about how this relates to you or your investment portfolio and financial plan, please give us a call at 778 655 2410 or email us at thewonggroup@wprivate.ca

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©2022, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca