Do you have a Jointly owned investment account with your name on legal title for any assets you do not have a particular interest in? If so, you may have a new reporting obligation with the Canada Revenue Agency.

The linked 4 page article provides additional details on the following:

-

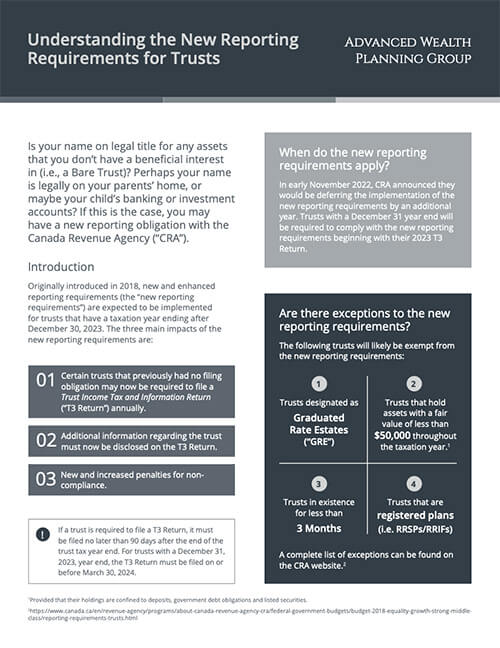

- Understanding the three main impacts of the new reporting requirements

- Understanding the likely exceptions to the new reporting requirements

- Understanding the implications for jointly-owned accounts and Bare trusts

What you need to know:

Though recent changes have bought trusts an extra year under the old reporting regime, there is every indication that these enhanced reporting rules will be in effect for taxation years ending after December 30, 2023. Those clients that may be impacted should reachout to their tax advisor and consider:

- Winding-up Bare Trust arrangements so they are not required to file a T3 Return for future years.

- Gathering the information required to comply with 2023 T3 reporting. Some information, particularly regarding the settlor and contingent beneficiaries, may take some time to track down.

Please feel free to call us with any questions and to discuss planning opportunities.