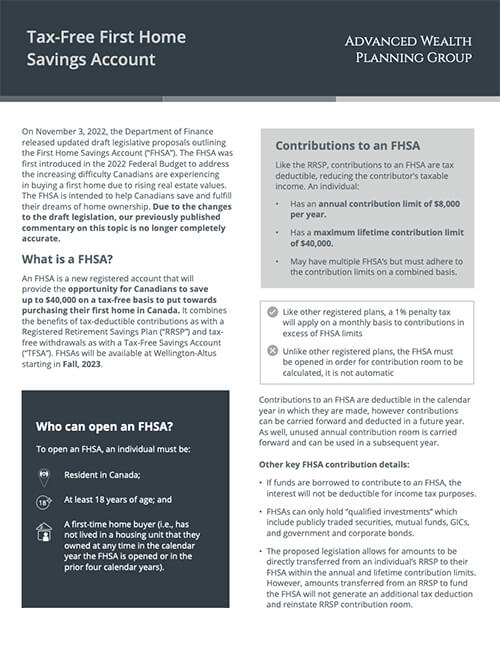

With rising housing prices often outstripping wage increases, it is more challenging than ever for Canadians to enter the housing market. The First Home Savings Account (FHSA) is a tax-efficient new tool to help first-time buyers save up to $40,000 for the purchase of a new home. The FHSA combines tax-deductible contributions (like an RRSP), tax-free growth on amounts in the FHSA, and tax-free withdrawals (like a TFSA) for the purchase of a first home.

The attached article provides additional details and covers the following based on the current draft legislation:

- What is an FHSA?

- Who can open an FHSA?

- Rules for making contributions to and withdrawals from an FHSA

- Closing or winding-up an FHSA

FHSA contribution room ($8,000/year) only starts accruing once the account is opened, so even if a home purchase is not in your or a family member’s immediate plans, it is a good idea to start thinking about opening an FHSA. You can open an FHSA with us starting this fall.