In this video, Maili Wong provides an insightful update on navigating recent market volatility and tariffs. Learn about the impact on client portfolios and the proactive steps being taken to ensure financial stability during this turbulent period.

What is happening?

Last week, the S&P 500 U.S. equity index dropped over 10% following President Donald Trump’s announcement of new tariffs. These tariffs, labeled as reciprocal, were much higher than expected and seemed to lack sound business or economic rationale. Trump’s declaration aims to make America “independent” from bilateral trade deficits, affecting 57 nations with penalties ranging from 1% to 40%. These actions essentially amount to a 22% import tax rate, the highest since 1910.

What does this mean for investors?

This disruptive and contentious policy decision triggered concerns about higher costs leading to lower profits and growth, and possibly a U.S. recession, triggering the market sell-off. It comes at a time when the U.S. economy was already in good shape, with low unemployment, strong corporate profits, and low credit spreads.

The good news is that underlying business fundamentals are not the issue here, but rather unpredictable policy decisions that could be reversed as part of a negotiating tactic.

Is this time different?

While every situation is unique, the solution this time could be less complicated. Unlike the structural economic issues or high debt levels in 2008, the extreme valuations of the 2000 tech bubble, or the global pandemic of 2020, this is a policy error that will not last forever. There are several administration off-ramps like trade deals that could see a change in the policies announced.

What are we doing?

At The Wong Group, we are committed to looking for opportunities, managing risk, and staying diversified. We are in constant contact with our investment professionals around the world, gaining clarity and insight from the top investment minds.

In the long term, we anticipate that international securities may finally begin to perform after a decade of U.S. stock dominance. This shift could occur as investors pull money from the U.S. and direct it towards governments that are increasing spending.

Last week, we trimmed some U.S. holdings that could see continued tariff risks, while adding to international companies with strong businesses.

What do we suggest?

Our advice remains consistent: be patient, stay diversified, and stay invested. Reflecting on past crises, we have seen that investing or holding during times of uncertainty can be beneficial. Markets tend to recover sooner than one thinks, and during these times, you get paid to wait with high-quality dividends and interest from fixed income investments.

You get paid to wait for the markets to recover!

What we expect:

We anticipate continued volatility in the near term, as we are still in a highly fluid policy environment. Deals being made, retaliations, legal challenges, and social media posts will influence market sentiment. It may be difficult for markets to bounce back until some uncertainty is cleared, but it could happen quickly.

For example, just yesterday morning, a fake headline regarding tariffs being paused caused the U.S. market to gain 5-7% in minutes. We expect to see deals being made, retaliations to occur, legal challenges to arise, and social media posts to influence market sentiment in the near term. It may be difficult for markets to bounce back until some uncertainty is cleared, but it could happen very quickly if so.

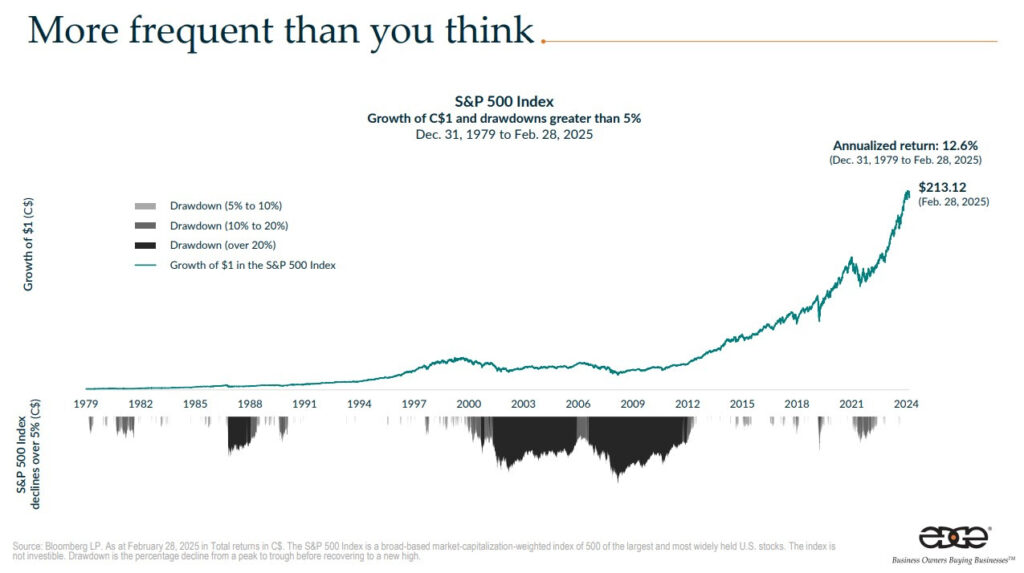

In fact, it’s very normal for the market to correct at least 10% once per year. As this chart shows, drawdowns of 10-20% and even more than 20% happen more frequently than you may think, but still, the market recovers and returns to new highs.

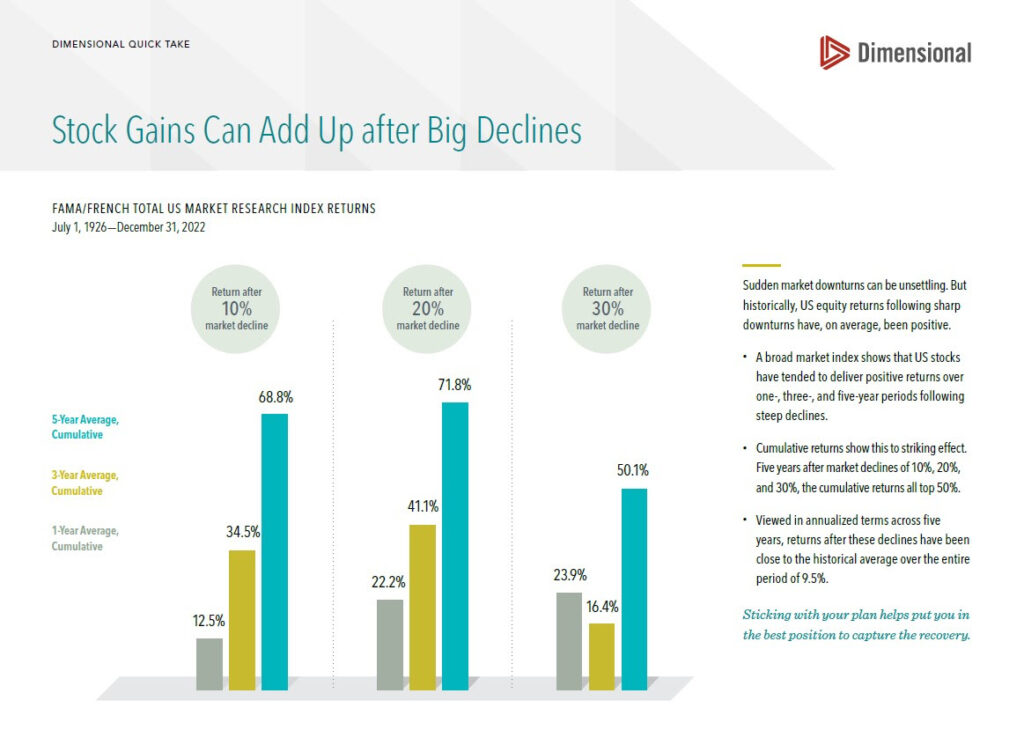

The table below shows the performance of the S&P 500 following prior periods when there were significant declines. As shown, subsequent returns were better than average, and 1, 3, and 5 years later, the S&P 500 was higher almost every time.

We understand that the recent sell-off may be causing concern and anxiety. It’s natural to feel uneasy when the market experiences such volatility. We are here to support you through these challenging times, actively managing risks while looking for opportunities to buy high-quality assets on sale. As always, we remain present, focused and prepared to adjust to what lies ahead.

If you have any questions about how this relates to you or your investment portfolio and financial plan, please give us a call at 778-655-2410 or email us at thewonggroup@wellington-altus.ca

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager & Senior Wealth Advisor

Wellington-Altus Private Wealth Inc.

Board Director

Wellington-Altus Financial Inc.