The Law of The Hammer: A Volcker Shock In 2022?

Market Insights – December 2021

| “It’s burning down the house to roast the pig.”

—Robert Solow, Nobel Prize Winner, Economics (1987) |

|---|

The concept of the “law of the hammer,” attributed to psychologist Abraham Maslow, suggests that humans can often be biased to have an over-reliance on a familiar tool. No more is this evident than in the current debate on inflation. As inflation rates have continued to increase, many economic pundits have anchored their cognitive bias on the Great Inflation of the 1970s and early 1980s. They suggest the need to attack current inflationary pressures with swift rises in interest rates, using the same vigor as then Federal Reserve Chairman Paul Volcker did. As Maslow once said: “I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail.”

We suggest that, for investors, 2022 will be the “Year of the Fed.” We see two distinct paths forward for the Fed in tackling the current inflationary pressures: i) Implement the hammer and replicate the familiar Volcker playbook, in which rates will be quickly raised; or ii) Take a more patient approach, going against the beliefs of the status quo, representing a generational change for the central bank. Whichever path is chosen will have differing and significant implications for investors. However, in periods of extreme change, such as the Fourth Turning we are experiencing today,1 we suggest that investors who are able to temper their cognitive biases can capitalize on the more subtle investing opportunities that may present themselves.

If you’d like to schedule an appointment with me or my team, please contact us at 778 655 2410 or use the chat feature or contact form in the footer below.

First, a Lesson in History: The “Volcker Shock”

Paul Volcker, Chair of the Federal Reserve from 1979 to 1987, is most notably remembered for the Volcker Shock that raised the Fed funds rate to its highest point in history in order to end double-digit inflation. While it put a halt to what had been persistent inflation for over a decade, this success came at a steep price.

In March 1980, Volcker raised the Fed funds rate to a whopping 20% — a figure seemingly incomprehensible by today’s fixed income standards. While the rapid rise in rates would temper inflation, this led to other serious ramifications. During this period, the U.S. economy shed an estimated 2.4 million manufacturing jobs and unemployment climbed from an existing level of 6% to 7.5% within the year, and then above 10% in the years that followed.

Robert Solow of MIT strongly criticized Volcker’s policies in his famous expression: “it’s burning down the house to roast the pig.” Indeed, the consequences would be far reaching. The policies used to fight the inflation of the late 1970s, coupled with globalization and the rapid transition from an analogue to digital economy, sowed the seeds for a decades’ decline in the standard of living for many workers and fueled the rise of populism that we see today. To be clear, Paul Volcker did have a consensus, as well as the political will to inflict pain and defeat inflation. But, at what cost?

Is This Time Different?

Fast forward to today and we should not be surprised that one of the outcomes of the Covid-19 shock has been a rise in inflation. This inflation is largely due to a shock to global supply chains and the sharp increase in aggregate demand that occurred after the shut down and quick reopening of global economies. However, there has been significant short-term hysteria amongst economic pundits, with cries for the Fed to invoke actions similar to those of the 1970s.

We suggest that these calls are unfounded. First, we need to acknowledge that the Fed’s plan to slow the expansion of its balance sheet is not necessarily intrinsically linked to decisions about raising rates. Many have wrongly assumed that long-term interest rates will rise dramatically. However, this is incorrect. The U.S. Treasury Department announced a reduction in its sales of U.S. Treasuries on November 3, which will offset the reduction in purchases from the Fed, which doesn’t implicitly suggest any increase in rates.

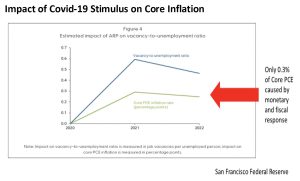

We also maintain that, in 2022, inflationary pressures will decline. To be clear, inflation is a lagging indicator, and its base effects will wear off as supply chains slowly normalize from a period in which economies were largely closed down. Recent research from the San Francisco Federal Reserve suggests that only 0.3% of today’s current inflation can be attributed to the American Rescue Plan’s monetary and fiscal response to Covid-19. This supports the view that inflationary pressures are likely to be more transitory than many consider.

As such, we suggest that the view of the Federal Reserve may be more progressive than consensus may believe; they may be aware that the tools used to fight inflation of the past may not be best used going forward. We propose this, keeping four factors in mind:

- 1) Policymakers have acknowledged that Volcker’s practices caused a rise in populism. After the global financial crisis, we started to hear whispers from the official sector that maybe Solow was right. Perhaps Volcker’s policies in fighting inflation dangerously led to the rise in populism. This was conspicuously referred to in Chairman Powell’s speech two summers ago at Jackson Hole, in which he implicitly denied any value in Mr. Volcker’s playbook. A consensus was quietly building that the decline in standard of living and the rise of income inequality — now acknowledged as one of the more existential threats facing society today — was a result of a decades’ long fight against inflation. This echoed then Managing Director of the IMF Christine Lagarde’s concerns in 2015: “the theme of growing and excessive income inequality…it has become a problem for growth and development.”

- 2) The Fed has no formal working theory on inflation. Perhaps perplexing to some, it should be acknowledged that the Federal Reserve has no working theory on inflation. This may not be surprising to others given that central banks have struggled over many decades with persistently low inflation rates. This has also been explicitly and publicly stated by insiders like Daniel Tarullo, former Head of Supervision at the Fed.

- If there is no working model on inflation and economic recovery continues to face headwinds, we suggest that the Fed will not rush to raise rates. In recent times, Chairman Powell has strongly communicated his desire to move slowly, likely recognizing that there is so much debt in the system that even a small increase in interest rates would have a dramatic effect on the economy. However, we also suggest that Powell remembers the incremental approach taken after the 2008 global financial crisis, which failed to generate strong economic growth. With the experience of QE1, QE2, QE3, and Operation Twist, along with the policy mistake of late 2018, he cannot afford to make a policy error.

- 3) Inflation: precisely what was needed prior to Covid- 19. Let’s not be fooled into forgetting that central bankers have needed a solution to the deflationary headwinds they have faced for many years. By sheer luck, they have been given the exact conditions needed to solve the deflation problem that gripped the global economy prior to Covid-19. In the pre-Covid-19 world, the concerns of many policymakers were high levels of debt, slow economic growth and strong deflationary pressures, which rendered monetary policy ineffective in stimulating economic growth. The world had entered a “liquidity trap.” Concerns about secular stagnation or the “Japanification” of the U.S. and other western economies led to cries for a strong fiscal policy response; central bankers professed that monetary policy was at it limits. How soon we forget!

- As such, we suggest that it would be folly for central bankers to raise rates prior to gaining full clarity on the economic recovery from the Covid-19 pandemic, since moderate inflation levels were precisely what they wanted prior to the pandemic. Are central banks willing to win the battle against inflation by sacrificing the war on deflation and thereby fanning the flames of populism? If there are rate increases, we suggest that they will be much smaller and slower than what many pundits are calling for. In order to solve the deflation problem that existed prior to Covid-19, we need to change the generational belief structure that the Fed will act aggressively to stop inflation at the 2% level. By moving too early, the Fed loses an important chance to change this belief.

- 4) Policymakers understand the need to reduce excessive levels of debt. Debt levels have been exacerbated by stimulus efforts to fight the pandemic. How can we reduce these excessive levels of debt? Economics 101 suggests that strong nominal GDP growth and wage growth are the answers. Recall that nominal GDP = real GDP + inflation. Policymakers are aware of this, hence the willingness to allow inflation to rise above the old central bank tolerance level of 2%. (To be clear, the old inflation target of 2% was not supported by any scientific research!)

- A lesson in history reminds us that during the period between the late 1940s and 1997, strong nominal GDP growth allowed for the slow reduction of the debt-to- GDP ratio. As such, allowing the economy to run hot and permitting wages to rise, so long as inflation is well behaved, can be tolerated and can achieve policy goals. Yes, price stability remains an important objective of central bankers. But, let’s not forget that one can still maintain price stability at slightly higher inflation rates of around 3%. As well, increasing rates to achieve some distance above the zero bound will provide greater ammunition for central banks in the event of a negative economic shock. Policymakers know how to defeat inflation, by raising rates to extreme levels, but, as we have seen over recent decades, they still have yet to solve the problem of successfully defeating deflation.

Where to for Investors?

Indeed, the path forward for the year 2022 will be dependent on the actions of the central banks. Are central bankers willing to implement a new playbook? Or will they succumb to cognitive bias and tighten too quickly using the Volcker hammer? We suggest that central banks will use a communication strategy to anchor long-term inflationary expectations. The solution is to “credibly promise to be irresponsible,” to get the street to feel as though they are behind the curve.5 Investors should also not assume that central bankers are monolithic, and in 2022 we are likely to experience diverging paths in policy.

Our base case for 2022 is that the Federal Reserve will continue to slowly taper the expansion of its balance sheet in the first half of the year. To be clear, Powell left open the possibility that, if market and economic conditions require, this program can be adjusted. While inflationary pressures will persist in the first half, by the middle of 2022 we expect inflation to decline. Although we advocate for a patient approach by policymakers, we are also not naïve and accept that if inflation starts to become uncontrollable, swift action should be taken.

Next year is also a midterm election year. In a typical midterm election year, the market peaks in the first quarter, but as the political risk increases throughout the year, the market commonly trades sideways to down. Bull markets tend to happen in the third and fourth years of a presidential cycle. However, if no policy mistakes occur in 2022 and we see more clarity on the economy with respect to the Covid-19 pandemic, we foresee another good year for equities. Should central bankers embrace patience, our S&P 500 target for 2022 is 5300, based on earnings of $240. This is predicated on the assumption that science tempers the Covid-19 pandemic enough to allow for open economies: supply chains will normalize, shortages will slowly be eliminated and fiscal policies under the U.S. Build Back Better program, such as the infrastructure bill, will add to economic growth and fuel a cyclical recovery.

In our base case, investors will need to take a nuanced approach to investing in 2022. Those investors who see beyond the comfort of reverting to the same proverbial hammer will be able to take advantage of the opportunities presented by the divergence from consensus beliefs. Subsectors in both growth and value will benefit. Digitization, crypto, AI, decentralized platforms, FinTech and 5G will continue to have strong secular tailwinds; yet, the revenge of the old economy will continue to be a present theme. Commodities benefiting from the transition to the green economy will be winners. We are in the midst of extreme structural change, yet this continues to be ignored by those still succumbing to the cognitive biases that were planted in the old world order.

However, should policymakers move too quickly, be prepared for a volatile ride. To be clear, a policy mistake by central bankers in tightening too quickly will mean that the bond bull market is not dead. Yet, with the excessive levels of debt, rising interest rates are sure to have dramatic and negative effects on economic growth and the equity markets. Reverting to the old playbook will reinforce that policymakers learned nothing from the willingness of their predecessors in the 1970s to “burn down the house to roast the pig,” a scenario we hope not to see in 2022.

- – James E. Thorne, Ph.D.

If you’d like to schedule an appointment with me or my team, please contact us at 778 655 2410 or use the chat feature or contact form in the footer below.

I look forward to connecting with you again soon.

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager

Executive Vice-President

If you have any questions about how this relates to you or your investment portfolio and financial plan, please give us a call at 778 655 2410 or email us at thewonggroup@wprivate.ca

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©2021, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca