Continue Looking Forward

Market Update – December 2021

As we begin another year, may we continue to look forward with the hope that the worst of the pandemic is behind us. For almost two years, we’ve each had to endure adversity in our own ways.

Yet, consider that this adversity may help us to advance. An article in the Wall Street Journal reminds us of the human condition to overcome hardship and progress. It followed endurance athletes as they prevailed through extreme emotional and physical challenges, suggesting that we can often emerge stronger, in what psychologists have termed “post-traumatic growth.”

It is, perhaps, a good message for investors as we look to the investing journey ahead. Some market observers have pointed to the current outlook for the financial markets as being uncertain. High levels of government debt, ongoing supply chain issues, the likelihood of rate increases by central banks and persistent inflation continue to dominate the headlines. These uncertainties can often drive short-term market behaviour.

In these times, we can often overlook our capacity to meet the challenge of change. This past earnings season is one such reminder. Many companies continued to post strong earnings despite the challenges — partial economic shutdowns, labour shortages, supply chain issues and rising input costs — and some at record levels.

Let’s also not forget that predictions, which tend to occur this time of year, can often be wrong. Do you remember last year’s outlook? Take the price of oil as one example. A year ago, few would suggest that oil prices would appreciate to pre-pandemic levels within the year.

Uncertainties will always be with us in some form or another. However, portfolios built on a solid foundation, using securities selected with quality, diversification, strategic asset allocation and individual needs in mind, can prove to be enduring within the ever-changing investing landscape.

We should also never underestimate the endurance of companies, economies and the markets. Market strategist Ed Yardeni recently published a series of data that shows how the world has generated unimaginable wealth since the 1940s. Of particular note is the tremendous growth in corporate profits — an upward trajectory over time, regardless of many short-term setbacks. While a deviation occurred during the global financial crisis of 2008-09, it is notable how quickly it reverted. This is a testament to our enduring ability to constantly overcome new challenges and advance.

Last year’s equity market performance should also remind us that sitting on the sidelines is not a prescription for growth. If we are to prepare for the financial future we want, we must participate.

Continue to look forward with confidence, knowing that we have a plan in place to guide the investing journey. Wishing you much health, happiness and prosperity for the year ahead.

If you’d like to schedule an appointment with me or my team, please contact us at 778 655 2410 or use the chat feature or contact form in the footer below.

RETIREMENT PLANNING

Get Ahead with These Six RRSP Considerations

It is Registered Retirement Savings Plan (RRSP) season once again! Beyond the importance of contributing to the RRSP to grow funds for retirement, certain practices can also help to save tax or create a bigger nest egg for the future. Here are six considerations:

1. Making In-Kind Contributions — Some investors may choose to move investments from non-registered accounts to fund their RRSP. If you are considering making in-kind RRSP contributions, be careful not to transfer investments that have declined in value. You will be deemed to have sold these investments at fair market value when transferring them to the RRSP, yet any capital loss will be denied. Instead, consider selling them on the open market and contribute cash to the RRSP so you can claim the loss. Be aware of the superficial loss rulesif you plan on repurchasing them.

2. Timing Your Deduction — With any RRSP contribution, you’re entitled to a tax deduction for the amount contributed so long as it is within the contribution limit. Keep in mind that you don’t have to claim the tax deduction in the year that the RRSP contribution is made. You may carry it forward if you expect income to be higher in future years such that you may be put in a higher tax bracket, potentially generating greater tax savings for a future year.

3. Updating Beneficiary Designations — It may be beneficial to review account beneficiaries on a periodic basis, especially in light of major life changes. For example, in the event of separation or divorce, be aware that named beneficiaries may not be revoked, depending on provincial laws. Therefore, the designation of an ex-spouse may still be i neffect.

4. Benefiting from a Spousal RRSP — For couples in which one spouse will earn a high level of income in retirement while the other may have little retirement income, a spousal RRSP can potentially be a valuable income-splitting tool. However, don’t forget that the attribution rules generally apply to a spousal RRSP. If the higher-income spouse has made contributions to the spousal RRSP in the year or in the immediate two preceding years, and if funds are withdrawn from the plan, they may be taxed to the higher-income spouse, as opposed to the lower-income spousal RRSP owner.

5. Engaging in a Meltdown Strategy — There may be benefit in gradually drawing down RRSP funds as you approach retirement. This may be useful if an individual is currently in a lower tax bracket than they expect to be in future years. Others may seek to limit future sources of taxable income in order to minimize the possible clawback of income-tested government programs such as Old Age Security. One strategy may be to use RRSP withdrawals to fund Tax-Free Savings Account (TFSA) contributions. As the TFSA grows, there may be greater flexibility to receive tax-free income that can augment or replace Registered Retirement Income Fund (RRIF) withdrawals later. At death, TFSA funds can pass tax-free to heirs, unlike residual RRSP/RRIF funds that are subject to tax, potentially at high marginal tax rates.

6. Seeking Other Options to Pay Down Debt — Consider the implications of making taxable withdrawals from the RRSP to pay down short-term debt. You may be paying more tax on the RRSP withdrawal than you’ll save in interest costs. In addition, once you make a withdrawal from the RRSP, you won’t be able to get back the valuable contribution room. There may be other options, such as a TFSA where contribution room resets itself in the following calendar year.

Seek assistance from tax professionals regarding your situation.

HUMAN EMOTION AND INVESTING

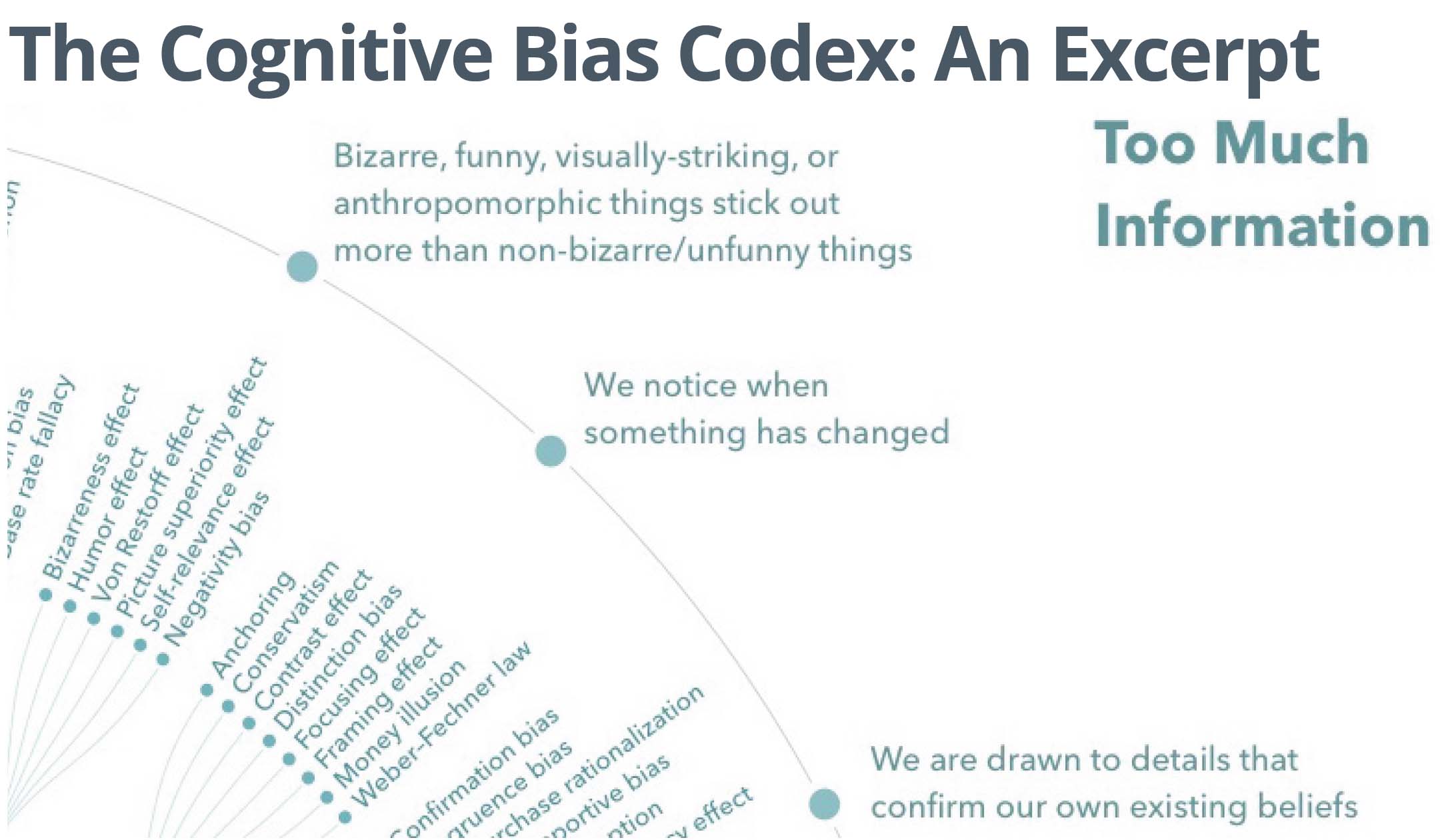

How Cognitive Bias Can Affect Investing?

Why do investors sometimes fall into the trap of buying high or selling low? Why do many of us procrastinate in saving for retirement, despite knowing its importance? Behavioural economists have shown that cognitive biases can prevent us from making the best decisions. Our brains operate in two cognitive states: automatic and reflective. Our automatic system is uncontrolled, fast and unconscious. Our reflective system is controlled, effortful and deductive. Cognitive biases occur when the automatic system, often influenced by the current environment, dominates the reflective system.

These behavioural biases can affect the way we invest. “Herd behaviour,” the tendency to follow the actions of a larger group, can cause investors to buy or sell due to pressure from others who are doing the same. “Recency bias” causes investors to believe that recent patterns or events in the markets will continue into the future. According to scientists there are 188 known cognitive biases that can lead us astray. The visual shows just a handful. See the full infographic at: www.visualcapitalist.com/every-single-cognitive-bias/

The good news? With a bit of effort, we can learn to control these behaviours. Some of the most seasoned investors have trained themselves to avoid emotional impulses. We can also integrate techniques into our investing programs, like regularly rebalancing portfolios, using managed products to put buy and sell decisions in the hands of experts, or incorporating systematic saving or investing programs to avoid market timing.

Most importantly, don’t forget the influence these biases can have on investing and plan ahead before they can have an impact. This may include sticking to your wealth plan during volatile times or avoiding the urge to react to social and media pressure. We are also here to help as we work with you towards achieving longer-term success.

ESTATE PLANNING

For 2022: Resolve to Update Your Estate Plan

As we look forward to another year, why not resolve to review your estate plan? A comprehensive estate plan should consider four basic elements. Do you have these elements in place? If so, when was the last time you reviewed them?

1. Power of Attorney* — Do you have a plan in place to support you in the event you are unable to speak for yourself or make your own decisions? This important legal document allows the chosen individual(s) to make financial or healthcare decisions on yourb ehalf if you cannot act for yourself. While the name, terms and conditions may vary by province, there are generally two separate documents for financial and medical powers of attorney. Under a financial power of attorney, the individual(s) will make financial decisions and manage your property on your behalf. Under a medical power of attorney, they will make healthcare decisions in the event you become incapacitated.

2. Living Will/Advanced Directive — What kind of care would you wish to receive if you are unable to communicate? In provinces where applicable, a living will/advanced directive allows you to specify certain medical or lifestyle decisions should you become unable. It may be useful to indicate your wishes and provide guidance to caregivers, such as instructions for pain relief and palliative care, life-prolonging preferences, artificial life support and do-not-resuscitate orders.

3. Will — How will you pass along assets to your intended beneficiaries? A will helps to direct this distribution according to your personal wishes. If you have minor children, the will should also appoint a guardian. Without a will, you will be considered to die “intestate” and assets will be divided according to rules laid out by your province of residence. These laws vary, such as differences in the amoun tof preferential share of the estate to be received by a spouse or how much must be held in trust by a provincial trustee for minor children.

An executor must be appointed within the will: the person(s)/institution to oversee the estate’s administration and carry out instructions within the will. The duties can be significant and may need to be carried out during a time of grief, such as arranging the funeral, finding, itemizing or managing estate assets, arranging probate (where applicable), calling financial institutions to notify them of the death, managing income tax returns, liquidating or distributing assets and more. As such, it’s not only important to carefully choose the executor, but also ensure they are willing to take on the role.

Planning ahead may help to better pass along assets in the future. For example, the future tax liability of some appreciated assets, such as a business or cottage, may be so significant that an estate will need to liquidate them to cover the expense. Planning today can help address the liability, by reviewing insurance needs analyses and/or applicable tax-planning strategies.

4. Testamentary Trust — If something were to happen to you, would family members need ongoing financial security or support? Establishing a testamentary trust can help to provide asset protection, preservation and growth by limiting access and specifying the timing and amount of distributions to beneficiaries. Trusts can also help to protect assets from creditors, plan to defer capital gains taxes for spouses or safeguard assets from changes in family matrimony.

If you would like an introduction to legal and estate planning professionals to assist with your estate plan, please call the office.

INVESTING PERSPECTIVES

Invest at Market Highs? Time is the Great Equalizer

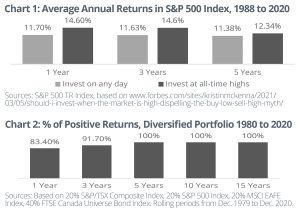

When is the best time to put new money to work in the markets? After equity markets reached new highs throughout 2021, some investors may feel hesitant. However, a recent Forbes article attempted to debunk the belief that investing at market highs is likely to lead to lower returns. Using historical S&P 500 Index data, it suggests that the returns for investing at all-time highs have been close to the average (chart 1). Of course, we should never discount the opportunity to invest at lower prices: lower valuations, higher dividend yields and better price points can help to enhance overall wealth. This is why many investors embrace market corrections when they occur.

For investors concerned about buying at highs and then seeing a decline, it’s worth repeating that history tends to favour long-term investors. The likelihood of negative returns reduces significantly as a holding period increases (chart 2). Time is the great equalizer! Systematic investing programs can also help to take emotion out of the investing decision. After all, being invested can be one of the best ways to generate wealth over the longer-term.

For investors concerned about buying at highs and then seeing a decline, it’s worth repeating that history tends to favour long-term investors. The likelihood of negative returns reduces significantly as a holding period increases (chart 2). Time is the great equalizer! Systematic investing programs can also help to take emotion out of the investing decision. After all, being invested can be one of the best ways to generate wealth over the longer-term.

OPTIMISM FOR THE YEAR AHEAD:

The Timeless Wisdom of Warren Buffett

We may all benefit from some investing perspective as we enter into 2022. Who better to draw on for that wisdom than one of the most successful investors of our time, Warren Buffett. Many of Buffett’s messages are timeless. In fact, a more recent academic study analyzed years of Buffett’s shareholder meetings, which have attracted tens of thousands of investors from around the world, and confirmed that the Oracle of Omaha’s key messages have recurring themes.1 Here are four:

Don’t overlook the power of patience in investing. After a year of strong performance in the equity markets, it may be easy to forget that success in investing can often take time. Consider that even though Buffett has been investing since he was young, over 90 percent of his wealth was made after the age of 65.2 Time and the power of compounding continue to be the key drivers of wealth creation.

“The nature of compound interest is it behaves like a snowball of sticky snow. And the trick is to have a very long hill.”

Invest with a view for the longer term. When Buffett invests in a company, he views himself as an owner and takes a thoughtful and longer-term view of its prospects. He worries less about what happens in the short term, and focuses on businesses that continue to have a competitive advantage over the longer term.

“Nobody buys a farm based on whether they think it’s going to rain next year. They buy it because they think it’s a good investment over 10 or 20 years.”

Maintain self-discipline. Buffett has always said that temperament is key to investing. In this digital age, in which we are constantly being fed news and opinion, Buffett reminds us that investing requires the ability to detach from the views of others and make decisions based on the facts.

“You need to be able to look at the facts about a business, about an industry, and evaluate a business unaffected by what other people think. That is very difficult for most people… Don’t do anything in life where the answer is, “everybody else is doing it.” If you cancel that as a rationale for doing an activity in life, you’ll live a better life whether it’s in the stock market or any place else.”

Have a plan in place… and stick to it during good times and bad. Buffett has always emphasized the importance of having a plan in place to drive the investment process and prevent emotions from influencing decision making. In strong market times, such as those experienced this past year, it can help to prevent investors from taking undue risks due to the fear of missing out. Risk controls remain an important part of every investor’s wealth plan. In down-market times, adhering to an investment plan can help investors avoid the urge to sell investments because of the pressure from others doing the same.

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.”

In Looking Forward

During the height of the pandemic, Buffett offered his perspectives on overcoming the challenges, with a continued view of optimism for the future. These words may be worth repeating as we begin another year, with the hope that the worst of the pandemic is now behind us:

“This is a terrible event. But there will be other things that happen in the world in the next 5, 10, or 20 years. That’s how the world works; it’s not a totally even course. The progress of mankind has been incredible and that won’t stop…there will be interruptions, but I also know that we’ll come out better on the other end.”

Thank you to Warren Buffett for the permission to share his timeless wisdom.

If you’d like to schedule an appointment with me or my team, please contact us at 778 655 2410 or use the chat feature or contact form in the footer below.

I look forward to connecting with you again soon.

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager

Executive Vice-President

If you have any questions about how this relates to you or your investment portfolio and financial plan, please give us a call at 778 655 2410 or email us at thewonggroup@wprivate.ca

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©2021, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca