A Registered Retirement Savings Plan (“RRSP”) is commonly used to help Canadian individual taxpayers (“Canadians”) save for their retirement. As well, Canadians can access the Home Buyers Plan or Lifelong Learning Plan if they have sufficient contributions in their RRSP and the required conditions are met.

The theory behind using the RRSP, is for Canadians to generate a deduction in their higher income earning years, when they are subject to higher marginal tax rates; and withdraw the funds, which are fully taxable as income, in retirement when they are subject to lower marginal tax rates. Investments within an RRSP grow tax-deferred, thus deferring tax on income and capital gains until withdrawn.

Canadians who report earned income generate RRSP contribution room up until the year they turn 71. RRSP contribution room is calculated as 18% of a Canadian’s previous year’s earned income up to an annual maximum (2020 – $27,230; 2021 – $27,830).

What’s the Difference Between an RRSP Contribution and Deduction?

An RRSP contribution is the amount that is invested into the RRSP. An RRSP deduction is the corresponding portion of the contribution that is deducted and reduces a Canadian’s taxable income reported on their T1 Income Tax and Benefit Return (“T1”). Typically, Canadians fully deduct their RRSP contributions each year. However, Canadians have the option to defer their deduction to a future tax year. This may be beneficial if future taxable income is predicted to be higher than in the current year. This strategy would immediately take advantage of the tax-deferred growth in the RRSP but apply the deduction to a higher income tax year.

How much can a Canadian Deduct, and Contribute to their RRSP?

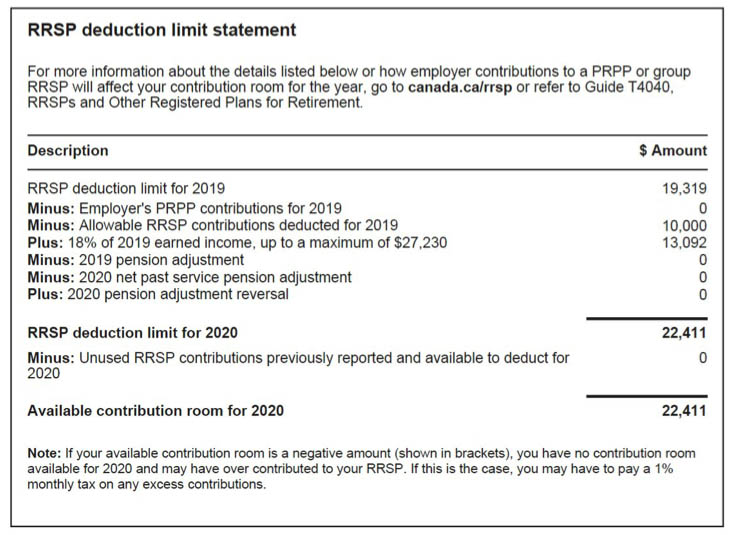

An individual’s RRSP deduction limit can be found on their Notice of Assessment (“NOA”) or CRA’s My Account.

The deadline to make an RRSP contribution is 60 days after year end (March 1st, or February 29th in a leap year, or the following Monday, if March 1st or February 29th falls on a weekend day.)

| In this example, the client’s 2019 Notice of Assessment reflects they had an RRSP deduction limit of $19,319, they contributed and deducted $10,000 and generated additional RRSP deduction room of $13,092.

Thus, for 2020, the client has RRSP deduction limit room of $22,411 and $0 RRSP contributions carry forward. Note CRA allows a $2,000 over-contribution grace amount for over-contributions. |

|---|

An RRSP over–contribution is generally shown as a negative balance on the previously mentioned NOA’s “Available contribution room for 2020”.

The CRA allows a $2,000 over-contribution grace amount with no penalty tax. This is a cumulative, lifetime limit and an RRSP deduction is not available for over-contributions. If the RRSP over-contribution is in excess of $2,000, there is a penalty tax of 1% per month unless the over-contribution is immediately withdrawn or if contributed to a qualifying group plan.

The penalty tax should be paid within 90 days after year-end to avoid further late-filing penalties or interest charges.

RRSP Contributions: A Practical Example

Meredith earns $400,000 annually and maximizes her RRSP deductions each year. Her husband, Derrick earns $70,000 per year and has not maximized his RRSP deductions the last few years. He has $23,000 of RRSP deduction room available.

Scenario #1: Basic Contribution

In 2020, Meredith contributes the maximum $27,230 into her RRSP (reminder, it is 18% of previous years income up to the annual maximum, $27,230 in 2020) and deducts the full amount on her tax return. She has no RRSP deduction limit carryforward.

Derrick contributes $10,000 to his RRSP in 2020. He deducts his $10,000 RRSP contribution on his 2020 tax return. His 2021 RRSP deduction limit would now be $25,600 ($23,000 – $10,000 + $12,600 (18% of $70,000).

Scenario #2: Spousal RRSP Contribution – Who Deducts?

In 2020 Meredith contributes $27,230 into a Spousal RRSP in Derrick’s name. The spousal RRSP contribution reduces Meredith’s RRSP deduction room and does not affect Derrick’s RRSP deduction limit. Meredith makes an RRSP deduction of $27,230 on her income tax return. She has no RRSP deduction limit carryforward.

Derrick makes a $10,000 contribution and deducts the full amount on his tax return. His 2021 RRSP deduction limit remains $25,600.

Scenario #3: Over-contribution and Contribution Carryforward

In 2020, Meredith elects to contribute $29,230 into her RRSP, which is $2,000 over her RRSP contribution limit. She will not be subject to a penalty tax as it is within the $2,000 grace amount of CRA’s over-contribution limit. She will deduct $27,230 on her income tax return, as she cannot make an RRSP deduction on an over-contribution.

Derrick is in his final year of his surgical fellowship and will begin his full-time role as a general surgeon in 2021. In 2020, Derrick contributes $20,000 into his RRSP but elects to defer deduction to a future year when his income will be substantially higher. For 2021, his RRSP deduction limit will be $35,600 ($23,000 + $12,600 (18% of $70,000)) and his NOA will also reflect unused RRSP contributions of $20,000.

Please click below to Download the PDF

If you have any questions about your RRSP, please feel free to call us at 778 655 2410, or email us at thewonggroup@wprivate.ca or chat with us live through our website at www.thewonggroup.ca