EXECUTIVE SUMMARY

Investment Management

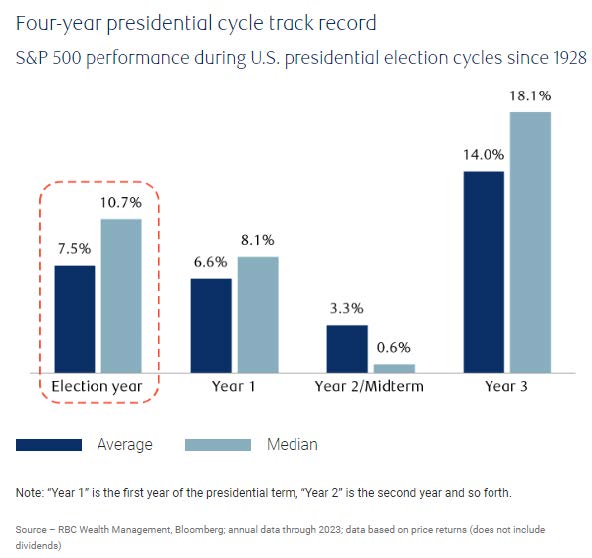

U.S. Presidential Cycles – History shows that during a presidential election year, market volatility typically increases during the months leading up to the election, however, overall returns are reasonably strong for stocks.

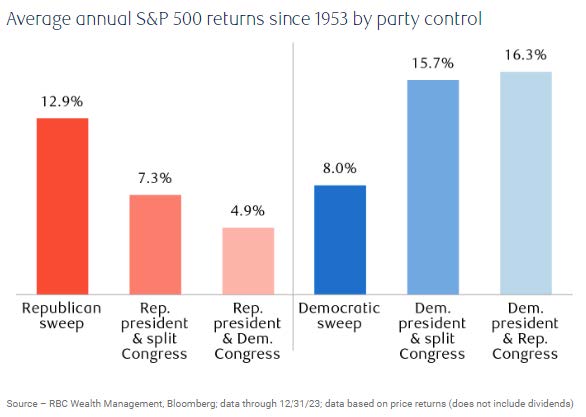

More importantly, history shows that having a split government between Democrats and Republicans produces better returns for markets as this provides more certainty for investors, consumers, and business given less policy change.

Outlook – We continue to expect a mild recession in the U.S. sometime in 2025, however, it appears this could be pushed out a bit due to abnormally high government spending (deficits) and recent Chinese stimulus that might extend the cycle beyond our original view.

Family Office

Charitable Donations – Thanksgiving is a time of reflection, being thankful and spending time with family, but it is also a time to think of others less fortunate and consider ways to support the community.

Philanthropy can be rewarding in many non-financial ways, but charitable donations also give rise to tax savings. There should be some planning around the timing of donations, especially when significant, but in Alberta a charitable donation can result in a tax savings of approximately 54% of the donation amount. There is also a bit of a double dip if you donate securities in-kind, because any capital gains on that security (securities) are not subject to tax. In this year of good returns, maybe this is tax planning to take to heart.

Prescribed rate – The prescribed rate for new loans to spouses and trusts is now 5%. With interest rates in Canada declining, we expect to see the prescribed rate start to decrease as early as Q1 2025.

Christmas Markets and Events in YYC

Millarville Christmas Market – Nov 7-10 and 14-17. For more information click here.

Spruce Meadows Christmas Market – Nov 15-17, 22-24 and Nov 29-Dec 1. Click here for tickets and more information.

Saskatoon Farm Christmas Market – Nov 29 – Dec 1, Dec 6-8. Click here for more information.

The Polar Express Train Ride – Various dates and times throughout November and December at Aspen Crossing. A fun family friendly event! Click here for tickets and more information.

INVESTMENT MANAGEMENT FEATURE: The Presidential Cycle and Equity Market Performance

With the U.S. presidential election only a month away, we thought it appropriate to outline some of the performance patterns that the S&P 500 has produced through each of the 4-year presidential cycles.

Year 1: There is generally a fair bit of uncertainty in the first year of the cycle as campaign promises either do or don’t get enacted, resulting in concerns about the impact on the economy. Historically, the first year produces below-average returns.

Year 2: The midterm election year often creates additional uncertainty that weighs on investor sentiment, particularly given the fact that it is rare the presiding party holds a majority in the executive branch, Senate and House of Representatives. This can lead to a fair bit of market volatility, but with improving conditions once there is more clarity on policy trajectory.

Year 3: The strongest year for performance given the incumbent administration often introducing stimulative measures and a ramp up in spending to boost economic growth in hopes of getting re-elected.

Year 4: The election year that we currently find ourselves in has produced moderate positive returns. If the incumbent is likely to win, it reduces volatility in the market. However, if the race is tight, as is the case right now, and there are competing policies, it increases market volatility. Market performance has been very good so far this year and has been driven by underlying corporate fundamentals and economic conditions and outlooks. We have seen little evidence that the current tight race has had much, if any, impact on the market. However, the spillover from the large budget deficit invoked last year and carried through this year has definitely helped on the economic growth front.

FAMILY OFFICE FEATURE: Charitable Donations

Happy fall and welcome to tax planning season! Each year it is like a light switch is dimmed — summer comes to an end, there is a noticeable chill in the air and our thoughts turn to Thanksgiving and taxes! (or maybe that’s just us?). Thanksgiving is a time of reflection, being thankful and spending time with family but it is also a time to think of others less fortunate and consider ways to support the community.

We have had many great conversations this year with clients and our returns have made this easier. This won’t be news, but there is a direct correlation with taxable income and taxes payable—i.e. the more taxable income, the more taxes payable. We have seen many tax strategies shut down over the years; however, charitable donations still provide a great way to reduce your taxes payable.

Perhaps this old Chinese proverb has some truth: “If you want happiness for an hour, take a nap. “If you want happiness for a day, go fishing. “If you want happiness for a year, inherit a fortune. “If you want happiness for a lifetime, help somebody.”

The tax deduction from a donation is really a non-refundable tax credit on your tax return which means once your tax liability is calculated, a donation tax credit reduces this tax. Further, given the change in the alternative minimum tax calculation, you want to be sure you have enough taxable income taxed at your normal tax rates. We can certainly help with this planning but here are some general rules:

- It is usually best for the higher income spouse to claim all donations and the resulting donation tax credit—this is because they are paying tax at a higher tax rate, so the tax savings is also at this higher rate.

- Donations can be claimed in the year they are made or carried forward for five years—flexibility to claim when you can save the most tax.

- You can claim a donation amount up to 75% of a taxpayer’s net income. In the year of death, the limit increases to 100% and it can be carried back to the year prior to death.

- The donation tax credit, at the top Alberta rate, is approximately 54%. Assuming that the donor is in the top tax bracket, a donation for $100,000 will reduce their tax liability by about $54,000.

- You can donate cash, but many charities also accept in-kind donations of securities which provides another tax advantage. Choose securities with the largest unrealized capital gains as these gains are reported on your tax return, but the gain is NOT taxed.

For example, let’s say you have a security with a fair market value of $100,000 and a cost base of $25,000. If you are in the top tax bracket and decide to donate this security in-kind to a charitable organization.

- The $100,000 donation amount will correspond to the donation receipt.

- The $75,000 capital gain on the disposition of this security is reported on your tax return but is not taxed.

- The tax savings on this gain could be somewhere between $18,000 and $24,000 (given the new inclusion rate if your capital gains are greater than $250,000).

- Assuming you have sufficient other taxable income, you will claim the $100,000 of donations on your tax return which will reduce your taxes payable by $54,000.

- To recap, you donated a security with a fair market value of $100,000 and saved taxes between $72,000 and $78,000.

OUTLOOK

We expect the economy to tip into recession at some point in the coming year, with equities beginning to selloff 3-6 months in advance of the recession hitting. We see growing risks, particularly with slowing consumption in the U.S., along with rising unemployment, which signals a potential equity market downturn. In our last newsletter we opined a correction in the range of 30-35%, from peak levels of 5,750 to a level of roughly 3,800 for the S&P 500 index, which is predicated on a modest contraction of 10% in corporate profits, alongside a more realistic earnings multiple of 16-17 X relative to the current 22 X.

Because 70% of total economic output in the U.S. is attributable to consumption, our focus is on factors that drive consumer spending. Given unemployment has increased from a low of 3.5% last year to 4.1% currently, along with high interest rates which makes borrowing for housing, cars, and other durable items more expensive, this foretells a slowdown in consumption. A secondary consequence to slowing consumption and employment trends is the impact it will have on corporate profitability, particularly in areas of the market that are more reliant on consumer spending and discretionary income.

The rising unemployment rate signals a broader slowdown in labour demand. Looking further, a report we monitor closely, called the JOLTS (job opening to labour turnover, which measures labour demand against available labour—see chart 1) is signalling further deterioration in labour demand and higher unemployment rates. Job openings are declining and manufacturing is already indicating a downturn in new orders and investments. Historically, these have reliable indicators of forthcoming recessions and increases the downside risks for stocks.

Lastly, there has been a marked increase in credit card and auto loan delinquencies which signals that household financial stress is increasing. Rising loan delinquencies are generally a precursor to banks beginning to tighten lendingstandards, further reducing consumer borrowing and spending.

As a result, we have taken steps to help insulate portfolios from weakness by reducing equity exposure and allocating more capital to safe and secure bonds, which not only hold their value but often increase in value during recessionary periods. This allows us to redeploy back into stocks at more attractive levels and improves the rate of return profile for portfolios over the long-term.

Chart 1: Job opening to labour turnover (source: BCA)

As always, we appreciate any questions or feedback so please don’t hesitate to reach out should you wish to visit in more detail.

Sincerely,

Andrew, Kelly, Justin & the West Oak Team