“The secret of change is to focus all of your energy, not on fighting the old, but on building the new.” — Dan Millman, Author

We are living through a period of extreme change because the context that defines our lives has forever changed.

Context – the circumstances that form the setting of an event and upon which informed decisions are made – should not be overlooked by investors. Significant financial and economic regime changes tend to begin during major economic crises, their drivers sometimes inconspicuously lurking behind the scenes. Today is no exception.

We suggest that three major contextual changes are quietly reshaping the financial landscape:

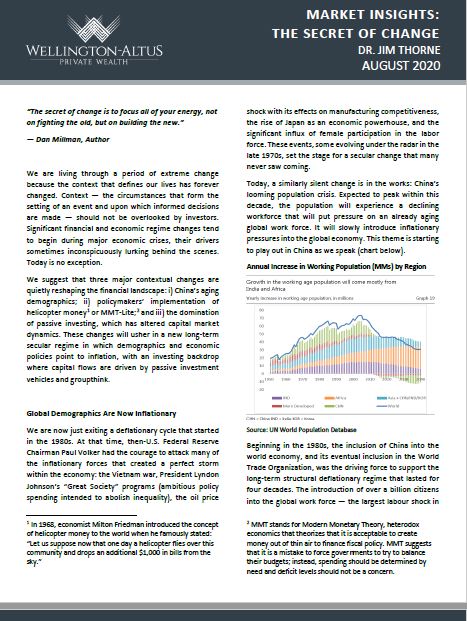

- i) China’s aging demographics;

- ii) Policymakers’ implementation of helicopter money or MMT-Lite

- iii) The domination of passive investing, which has altered capital market dynamics.

These changes will usher in a new long-term secular regime in which demographics and economic policies point to inflation, with an investing backdrop where capital flows are driven by passive investment vehicles and group-think.

Read the rest of the article here.