Maili’s Market Insights:

Change is the Only Constant

“A new technology bids to transform the human cognitive process…redefine human knowledge, accelerate changes in the fabric of our reality and reorganize society.” These are the words of Henry Kissinger on the age of artificial intelligence (AI) and the potential impact of ChatGPT — the

AI chatbox that has taken the world by storm. Indeed, the evolution of AI is a reminder that change can come thick and fast.

Likewise, in investing, we are never immune to change. In recent times, we’ve seen the effects

of rapid changes in inflation and interest rates

on the financial markets. Respected investor Howard Marks suggests we are in the midst of a “sea change,” a departure from a low-interest rate environment that provided a tailwind for decades. In his view, higher interest rates and inflation are likely to remain the dominant considerations influencing investing for the years ahead.

These haven’t been easy times for investors. As the central banks continue their fight against inflation, much of the recent market movement was driven by uncertainty over the path forward for interest rates. To start the year, stronger economic news was perceived as bad news by the markets, creating worries that the central banks would continue raising rates. Now, new jitters have emerged as a result of the recent collapse of Silicon Valley Bank in the U.S. — a harsh reminder that the aggressive rate hikes by the central banks were likely to have consequences.

For now, we can expect continued volatility. While it may be hard to see beyond today, we will emerge on the other side of this difficult period. Every financial cycle differs from those that came before and each comes with its own challenges. Throughout time, the companies that have succeeded in meeting the challenge of change have been rewarded with higher stock prices. And, over time, in spite of the many changes, economies have continued to grow, demonstrating our collective ability to adapt and advance. This time is no different.

Moreover, the evolution of AI should remind us of the human pursuit to innovate, which has been a key driver of growth throughout time. Business cycles have operated under long waves of innovation, with new waves emerging as the markets are disrupted by new innovation. Earlier revolutions, such as those sparked by the development of railroads, electricity and the automobile ignited upwaves of economic growth that lasted for many decades. Consider the impact of the global petroleum industry or the assembly line introduced by Henry Ford — the latter changed global manufacturing processes forever.

Despite the many changes, some things remain the same. The principles of longer-term investing success haven’t changed: having a carefully constructed investment plan to guide us, with consideration of risk, value, quality, diversification, tax and personal objectives, and the patience to see through more challenging periods.

At the same time, investors should not overlook the value of thoughtful analysis and evaluation. These skills should be trusted to guide us through the longer term as we endure these periods of inevitable change. Sound portfolio management involves continuously assessing the changing landscape and the potential opportunities to come, all while balancing the risks involved. This is one of the roles we fulfill as advisors as we navigate the changing times.

PERSONAL INCOME TAX SEASON IS HERE

Are You Doing All You Can to Save Tax?

It is personal income tax season, a time when many of us are focused on keeping as much of our hard-earned dollars as possible. As we deal with receipts and returns, it may be a good reminder that we should be doing all we can to minimize taxes. Here are some actions to consider:

Take Advantage of the Deductions and Credits Available

Tax law changes each year. If you prepare your own tax returns, be aware of these changes. You may also consider the support of an expert to assist with your tax return to ensure you are taking full advantage of the credits/deductions available. This can also provide continuity in the event something were to happen to you or a spouse. Encourage younger folks to file a tax return if they have generated income, even if it is below the basic personal exemption so that they can generate Registered Retirement Savings Plan (RRSP) contribution room.

Maximize Tax-Advantaged Accounts

Have you fully contributed to your RRSP and Tax-Free Savings Account (TFSA)? Recent statistics suggest many of us aren’t doing so (see page 3). If you need support, consider setting up a monthly contribution plan for your RRSP or TFSA. If you are working, filing Canada Revenue Agency (CRA) form T1213 Request to Reduce Tax Deductions at Source may decrease withholding taxes on your paycheques as a result of your RRSP contribution.

Optimize Asset Location

The location in which you hold certain types of assets can make a difference. Different types of income — interest, dividends, capital gains — may be taxed differently depending on the type of account from which income is generated. For example, if you hold foreign investments that pay dividends in a non-registered account, you may receive a foreign tax credit for the amount of foreign taxes withheld. If the same asset is held in a TFSA, no foreign tax credit is available. By having a comprehensive view of your assets, there may be opportunities to optimize asset location across different accounts.

Plan with Your Spouse

If you are part of a spousal/common-law partner unit with a higher income and lower-income earner, there may be income-splitting opportunities. For instance, if you expect your spouse to have significantly less income than you in retirement, there may be an opportunity to contribute to a spousal RRSP for the low-income spouse. Or, retirees may be able to split eligible pension income on their tax returns or elect to split Canada Pension Plan benefits.

“Reduce” Your Refund

If you receive a tax refund from the CRA on a regular basis, this shouldn’t be a cause for celebration. You’re effectively providing an interest-free loan to the government. Instead, consider completing a new TD1 form with your employer, the form used to calculate how much tax to deduct from your paycheque.

You may also file CRA form T1213 if you know you’ll have significant deductions in a given year. This will reduce the tax taken from your pay.

If Over 64, Consider Opening a Small RRIF

The pension income tax credit kicks in at age 65, allowing for a tax credit on up to $2,000

of eligible pension income. If you don’t have eligible income, consider setting up a small Registered Retirement Income Fund (RRIF) for the year you turn 65 (or sooner if you’re widowed) to create pension income. You don’t have to convert your RRSP to the RRIF until the year you turn 71, but this way you can still claim the pension tax credit.

These are just a handful of ideas to help minimize taxes. As always, seek the advice of a professional tax advisor as it relates to your personal situation. Saving tax is an all-year exercise; consider taking action today!

INVESTING PERSPECTIVES

Longer-Term Investing: The Long & Short of It

Renowned investor Warren Buffett is well known for saying, “our favourite holding period is forever — When we own portions of outstanding businesses with outstanding managements, we expect to hold them for a long time.”1 Yet, despite his words of wisdom, consider how the average holding period for stocks has changed over time. For the NYSE, back in the 1950s, the average holding period was 100 months or 8 years. By 1990, this dropped to 26 months. And today, it is closer to 5.5 months! 2

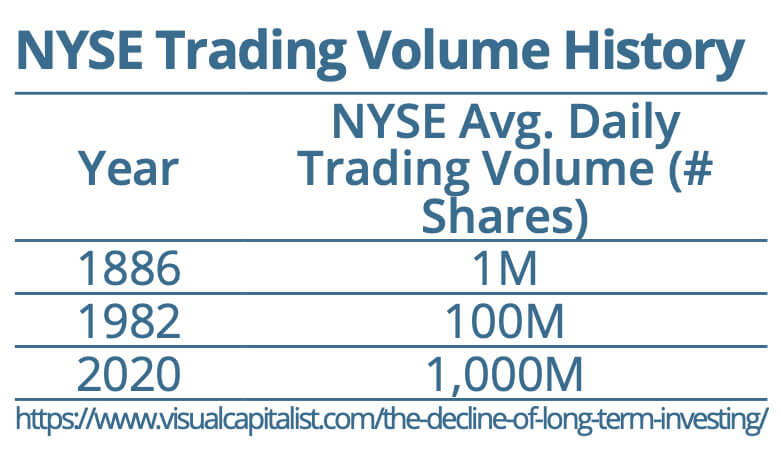

What has caused this decline? Technology has been one of the biggest drivers. Up until the 1970s, trading systems were not automated, which limited the number of trades that could be processed each day. The chart below shows how trading volume has grown over time. Technology has also significantly lowered the cost of transactions. And, with the connectivity of the internet, it has enabled investors of all kinds to trade, with information widely distributed and easy to access.

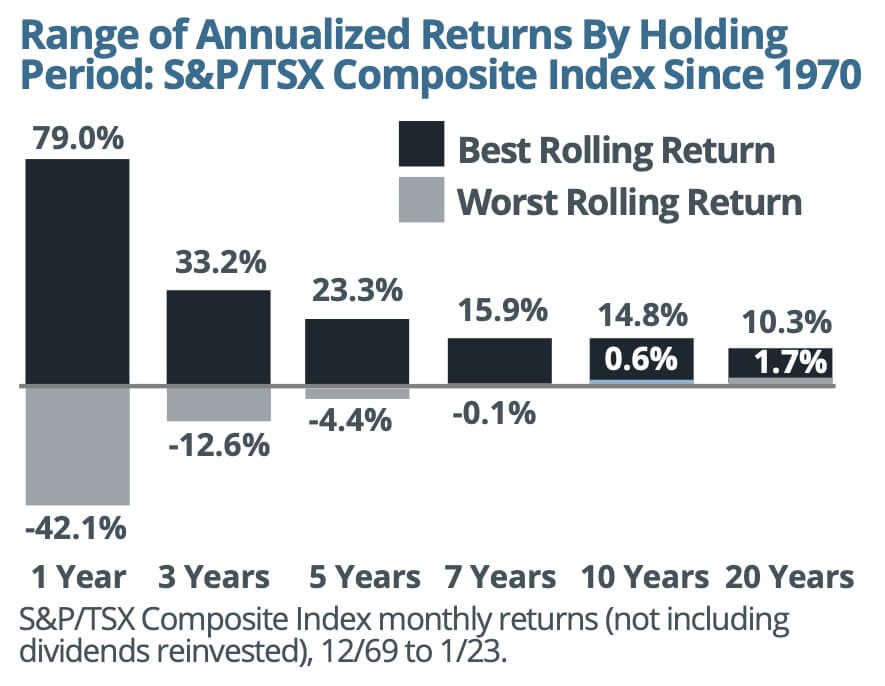

Yet, history shows that when it comes to investing, the longer your ability to focus, the better. Why? The variability of equity market performance smooths out substantially as the investing period grows. The graph shows the range of outcomes for the best and worst dividends reinvested) from 1970 to the start of 2023. These figures were calculated using rolling monthly returns. Over one-year periods, the variability is substantial: historically, you could have experienced a variation in annual returns of between -42.1 percent and +79.0 percent! However, as the time horizon extends to decades, the range of outcomes narrows significantly and the likelihood of negative returns also diminishes.

During volatile times, for some investors, it may be difficult to maintain a longer-term view. But, the long and the short of it is that by extending a time horizon, historical probabilities continue to favour the long-term investor.

1. https://www.berkshirehathaway.com/letters/1988.html

2. https://www.visualcapitalist.com/the-decline-of-long-term-investing/

INVESTING IN “TAX-SMART” WAYS

Have You Maximized Tax-Advantaged Accounts

We aren’t doing a good job fully maximizing TFSA contributions — even the wealthiest Canadians appear to be overlooking the opportunity! The latest reports suggest that only nine percent of TFSA holders have maximized available contribution room.1 For those earning $250,000 or more, only about 30 percent of holders had fully contributed, with an average unused contribution room of around $22,000. During tax season, we often try our best to reduce our taxes as much as possible, so it’s hard to understand why more Canadians don’t take full advantage of the TFSA. As of the start of 2023, eligible Canadians can contribute $88,000 (for those yet to open a TFSA).

Are you taking full advantage of the TFSA? Beyond the significant benefit of growing funds on a tax-free basis, here are some additional reasons why the TFSA is an important planning tool:

Transferring Wealth While Alive

The TFSA may help to gradually transfer wealth to beneficiaries while you are alive. Gifted funds can

be used by adult children to contribute to their own TFSA, which can grow over time. Transferring wealth while alive can simplify an estate and potentially minimize taxes. However, keep in mind that once assets have been gifted, you will have no control over the funds.

Approaching Retirement: RRSP/RRIF Meltdown Strategy

There may be benefit in gradually drawing down RRSP funds as you approach retirement or RRIF funds. One significant reason is if you are in a lower tax bracket than you will be in future years. A strategy may be to use RRSP/RRIF withdrawals to fund TFSA contributions. As the TFSA grows, this tax-free income can augment or replace RRIF withdrawals later. At death, these funds can pass entirely to heirs; residual RRSP/RRIF income would potentially be subject to the highest marginal tax rates.

Funding Retirement

The TFS can help optimize retirement income and cash-flow streams. TFSA withdrawals aren’t considered taxable income so they won’t affect income-tested benefits such as Old Age Security. TFSA withdrawals can also help with tax planning. For example, if you need funds but generating RRIF income will put you in a higher marginal tax bracket, you may be able to minimize tax by withdrawing only the required RRIF amount and using TFSA withdrawals to supplement income. On the other hand, if your marginal tax rate is lower than you expect in the future (or at death), funds in excess of the RRIF minimum requirement may be withdrawn and put into a TFSA where they can continue to grow. This may reduce your overall lifetime tax bill. The TFSA can also supplement cash flow if a retiree chooses to defer Canada Pension Plan benefits.

Your Estate Plan

The TFSA can play a valuable role in your estate plan. At death, an individual is deemed to have sold their capital property, generally resulting in taxes owing on capital gains. However, the TFSA is an exception to this rule and gains made on TFSA assets generally will not be taxed. Consider that even a lump sum investment today of $88,000 would result in over $250,000 in 20 years at a compounded rate of 5.5 percent — not an insignificant bequest by any measure!

The bottom line?

Ensure you have fully contributed to your TFSA!

1. Based on 2019 data released in 2021. This may have changed based on the bull market in 2021. – https://www.canada.ca/content/dam/cra-arc/prog-policy/stats/tfsa-celi/2019/table1c-en.pdf

PROTECTING YORU PERSONAL FINANCES

Be Aware of Evolving Scams

After a difficult year, and as we look to the year ahead, here are three reminders to help keep perspective.

Financial scams continue to be on the rise and the level of sophistication is growing.1 Phishing attacks, where deceptive messages fool victims into providing sensitive information, are increasingly using multiple channels concurrently to target victims, such as phone calls, voicemail, text or email. Scammers leave a voicemail or send a text about an email or call they just made, to add credibility or increase the urgency of the request.

One of the newer financial scams, “pig butchering,” involves scammers building longer-term relationships with victims online or via text, eventually convincing them to invest using websites that look like legitimate trading platforms. Victims are then tricked into thinking their investments are making money and are encouraged to invest more; a strategy called “fattening up the pig.” This scam was initially associated with cryptocurrencies, but has since evolved to focus on the gold market.2

In brief, there are often common signs that may indicate a scam:

It seems too good to be true. This may be as unassuming as an unexpected money transfer sent to your email address. Or, it may be as sophisticated as an investment opportunity that offers significant returns. If it appears too good to be true, it likely is.

Personal/financial information is requested. Be wary when personal or financial information is requested or asked to be confirmed. A credible financial institution is unlikely to ask for this.

There is a sense of urgency. Many scams pressure individuals to act immediately or focus on lost opportunity or penalties to evoke fear.

There is secrecy or you are made to feel guilty. Some scams try to evoke feelings of guilt or shame; others prey on loneliness or isolation. In many cases, you may be asked to keep matters secret.

It goes without saying that we should all maintain a sense of vigilance when it comes to sharing our personal information. Not responding is often one of the best ways to stay safe. Don’t answer a call if you don’t recognize the caller; often a scammer’s goal is to find out if a phone line is active. Never respond to emails, text messages or social media requests from unknown sources. If you aren’t certain if the situation is credible, double check. An internet search can often determine if others have received similar messages/calls. Or, if a source claims to be a legitimate company, try calling a general number found on the internet.

There are also tools available that can add an additional layer of protection. Anti-phishing software and other cyber security tools can help protect against potential attacks. Many mobile phone companies now offer “call control” that can help to screen out robo-callers or other spammers.

Most important, stay updated by educating yourself and others who may be vulnerable about evolving scams and new targeting methods. Many online resources report the latest scams and offer ways to protect against fraud:

Better Business Bureau, www.bbb.org/ca/news/scams

Canadian Anti-Fraud Centre, www.antifraudcentre-centreantifraude.ca

1. https://www.cnbc.com/2023/01/07/phishing-attacks-are-increasing-and-getting-more-sophisticated.html

The Importance of a Wealth Plan: Common Retirement Pitfalls

“Plan on Living Past Your Life Expectancy” — this is the headline of a recent article in the Wall Street Journal that suggests that many of us will live longer than we expect.1 As advisors, we do our best to prepare our clients for retirement and beyond, and one of

the challenges in this planning is that individuals continue to live longer and healthier lives. Indeed, we want to ensure that we have sufficient retirement funds to, in the least, last for our lifetime. However, underestimating our longevity is only one of the factors that can derail the financial success of a retirement plan.

Here are some additional considerations:

Relying on income or capital sources that may not materialize.

You may be planning on working to fund your retirement, but consider the situation where you become physically unable as you age. Or, you might suddenly find yourself without a job before retirement due to business or economic changes. Some Canadians may be counting on an inheritance to help fund a comfortable retirement. However, consider that your parents could outlive you, or that any inheritance may be less than expected.

Miscalculating the costs of dependents.

There used to be a time when parents became empty nesters once a child turned 18 years old. Today, many parents are helping to support children well beyond post-secondary education. Have you planned for this? It may not end there. With elevated housing prices and the higher cost of assuming a mortgage due to rising interest rates, more children have been relying on parents for financial assistance with their home purchases. What if your children struggle to achieve financial independence and remain at home?

Relying on home equity.

As housing prices have risen substantially across many Canadian cities over recent times, it may be tempting to see your home’s value as a potential source of retirement income. But this has its dangers: future real estate prices may fall or be less than expected. Even if a retiree was to downsize, they could fail to understand the true costs of a move to a new residence or not factor in all of the costs associated with a move, such as renovations or maintenance to an old house prior to its sale. For others, selling a lifelong home may end up being too emotionally difficult, which may cause them to reconsider a potential move.

Underestimating health care costs.

Canada is well known around the world for our universal health care system, but we may incorrectly assume that it covers more than it does. Many Canadians are surprised to learn that care within a long-term care facility is not fully covered by the public health care system. Even with government subsidies, private room accommodations can require a co-payment of over $30,000 per year.2 And, private caregiving in your own home could cost up to $130,000 per year.3 While it may be uncomfortable to contemplate a future where we may be afflicted with a health condition, be aware of the financial impact should care be required, especially over the long term.

Unanticipated divorce or death of a spouse.

While no one plans on getting divorced or losing a spouse, many underestimate the potential financial impact. Studies continue to show that family income can significantly decline in both situations.4 The emotional impact of losing a spouse in either circumstance can also make financial management difficult, especially if that spouse was the financial decision-maker. While these events may be unpredictable, having a good understanding of your own financial position is important to help lessen the impact.

The Importance of a Wealth Plan

As a starting point, a wealth plan can be a valuable tool to act as a roadmap for retirement and beyond. Contingencies can be built into this plan to account for any potential risks. There may also be tools or strategies that can be put in place to provide additional support, such as tax or insurance planning — for example, perhaps there may be a need to explore long-term care insurance or an annuity. And as time progresses, the plan should be adjusted as your circumstances change — the wealth planning process is meant to be dynamic.

We Are Here To Help

As part of planning for the future, should any of these pitfalls stick out as roadblocks to achieving your retirement goals, we can help explore solutions. Even if retirement is still years away, now is the time to consider these matters.

1. “Plan On Living Past Your Life Expectancy” Wall Street Journal, Josh Zumbrun, 02/11/23

2. www.seniorcareaccess.com/article/What+Does+Long+Term+Care+Cost%3F

3. www.advisor.ca/news/industry-news/most-canadians-arent-planning-for-long-term-care-costs-survey/ –

At home, based on avg. cost of care of $30/hour, 12 hours/day, 365 days/year

4. https://www150.statcan.gc.ca/n1/pub/11-621-m/11-621-m2004015-eng.htm

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

© 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you have any questions about how this relates to you or your investment portfolio and financial plan, please give us a call at 778 655 2410 or email us at thewonggroup@wellington-altus.ca

Sincerely,

Maili Wong, CFA, CFP, FEA

Senior Portfolio Manager & Senior Wealth Advisor

Wellington-Altus Private Wealth Inc.

Board Director

Wellington-Altus Financial Inc.