EXECUTIVE SUMMARY

Investment Management

- The triple threat of tariffs, tax cuts, and mass deportation under the President Trump administration could create headwinds for growth and not be stimulative, as the market is suggesting.

- We have constructed portfolios for multiple outcomes, with a tilt toward mitigating risk and taking advantage of opportunities as they arise.

- There has only been one instance in the last 55 years where the U.S. dollar has traded above the current levels. We believe the Canadian dollar may be at its point of maximum pessimism and have taken steps to hedge half of the portfolio’s U.S. dollar exposure back to Canadian dollars to lock in currency gains that have accrued over the last number of years.

Family Office

- January 6, 2025, Parliament was prorogued, which means the current session of Parliament and all proceedings before it have been suspended.

- The 2024 Federal Budget proposed to increase the capital gains inclusion rate from 50% to 66.67%, for individuals who have capital gains exceeding $250,000, and for all corporations and trusts, starting June 25, 2024, onwards.

- The prorogation has left many tax filers with questions as they prepare their tax returns, particularly whether to prepare their returns on the basis of the current or proposed tax legislation. Canada Revenue Agency (CRA) has indicated that they will assess returns on the basis of proposed legislation, which has been their longstanding practice.

Our Quarterly Culinary Favorites

Bar Gigi – a charming, intimate little space to share plates. The unique atmosphere and exceptional service make for an exclusive dining experience. Click here for more information

Cassis Bistro – a cosmopolitan bistro with elevated French cuisine. Authentically French dishes in a casual atmosphere. Click here for more information

NOTABLE – an approachable, cozy restaurant with great ambiance, offering “gourmet casual” dining. Click here for more information

INVESTMENT MANAGEMENT FEATURE:

How Long Can the U.S. Dollar Strength Persist?

The U.S. has been the best performing developed equity market for over a decade and makes up the vast majority of the equity component within client portfolios. Part of the benefit of having been invested in the U.S. market has been having exposure to the U.S. dollar and its appreciation over the loonie, which has helped to enhance the return within portfolios. With this said, we believe that we may be at a tipping point for the U.S. dollar and its ability to appreciate in a much more meaningful way in the quarters and years to come.

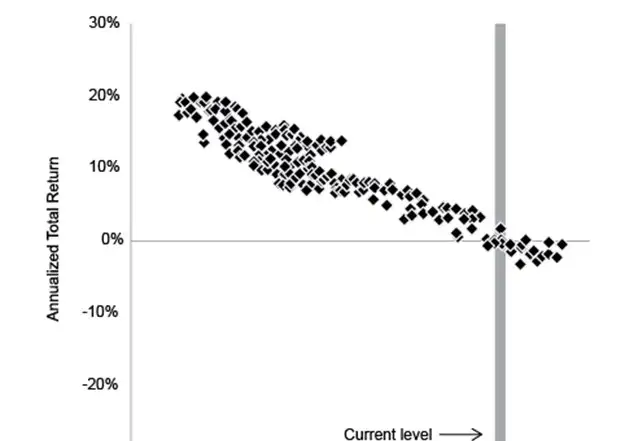

As the chart below demonstrates, there has only been one other time in the last 55 years that the U.S. dollar has been more expensive relative to the Canadian dollar, and that was back in the late 1990’s and early 2000’s when Canada’s debt to gross domestic product (GDP) and debt service levels were considerably higher than those in the U.S.

We believe that there is little appreciation left for the U.S. dollar and we just recently crystalized the gains that have accrued in the U.S. dollar by having hedged half of client portfolio’s U.S. dollar exposure back to Canadian dollars. We still maintain our 65% weight to U.S. equities, within the equity component of portfolios, we have simply shifted half the currency exposure away from the U.S. dollar and back to the Canadian dollar. Given debt today in the U.S. is about 35 to 40% higher than that of Canada, and with U.S. equities relatively expensive after having outperformed the rest of the developed markets, it appears that the U.S. dollar could be priced to perfection.

Source: Bloomberg

Source: Howard Marks – Oaktree Memo

FAMILY OFFICE FEATURE:

Impact of Prorogation on Proposed Tax Changes

On January 6, 2025, Parliament was prorogued, which means the current session of Parliament and all proceedings before it have been suspended until Parliament is set to open on March 24 or an election is called.

We wanted to provide you with a brief summary of the impact that prorogation has on outstanding federal income tax proposals and, predominantly, the increase to the capital gains inclusion rate.

The 2024 Federal Budget proposed to increase the capital gains inclusion rate from 50% to 66.67%, for individuals who have capital gains exceeding $250,000, and for all corporations and trusts, starting June 25, 2024, onwards.

These proposed changes are still in draft form and need to be passed into a bill, but because of prorogation, the proposed changes must be reintroduced or reinstated when Parliament opens on March 24, or when an election is called and a new government chooses to enact this bill. The “frustration” with this, is that trust tax returns are due March 30 and personal tax returns are due April 30, and there were significant capital gains realized in portfolios throughout 2024.

It is a longstanding practice of the CRA to ask taxpayers to file on the basis of proposed legislation and the CRA has confirmed its intention to administer tax returns based on the proposed increase in the capital gains inclusion rate. They have also adjusted 2024 tax slips to have a box for capital gains before June 25 and a box for capital gains after June 25.

Although taxpayers have the legal option of filing under the current law (ie. at 50% inclusion rate), there may be interest charges if the higher inclusion rate is eventually adopted as proposed. Although a new government may be elected before the proposed tax changes are enacted, the new government may proceed to enact the measures either as proposed, as amended on a prospective basis, or they may dismiss these changes.

There is a strong possibility that an election will occur before March 24, and, as a result, we acknowledge that some clients will wait until this date to file personal tax returns when there will be more clarity as to the inclusion rate and therefore avoid having to possibly amend tax returns. This will make for a very busy tax season for tax preparers, but as a family office, we have the ability to help your tax professionals by providing a complete and accurate picture of your 2024 tax year when the need arises.

OUTLOOK

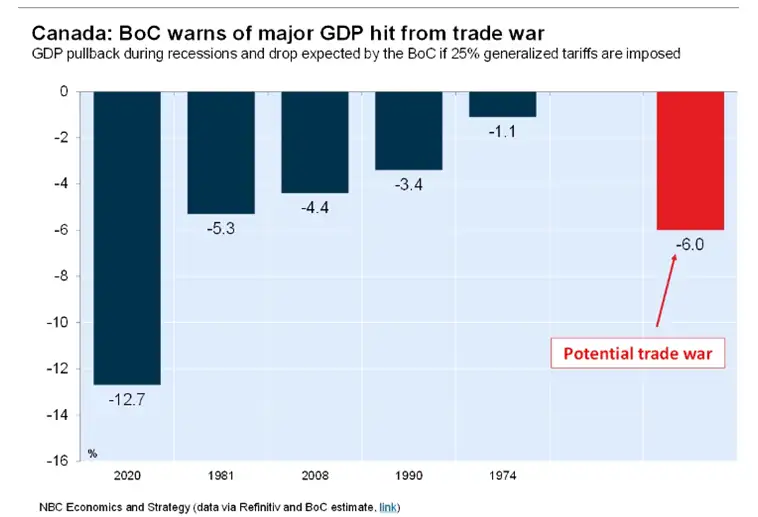

Trump’s triple threat of proposed measures; tariffs, tax cuts, and mass deportations, could be headwinds for both the U.S. and global economy. Tariffs will raise the price of goods that generally end up being passed along to the end consumer, stoking inflation without the benefit of increasing demand (consuming the same or less goods and services with available disposable income). Export driven countries like Canada would be hit relatively hard should the full 25% tariffs be imposed, with a potential recession on par with 1981 depending on how long the tariffs remained in effect (see chart below).

Source: NBC Economics and Strategy (data via Refinitiv and BoC estimate)

Tax cuts are expected to be inflationary to the degree that they create excess demand in the economy, however, the majority of personal tax cuts generally land in the pockets of higher income and net-worth individuals who have a lower propensity to consume extra earned income. During Trump’s first presidency, the corporate tax cuts that he introduced were expected to lead to an increase in capital spending but instead, companies ended up buying back more stock and increasing dividends and not boosting investment spending in any meaningful way. With respect to immigration, the consensus is that decreased immigration and/or deportation will lead to a tighter labour market, adding to inflationary pressures. As much as policy may reduce labour supply, it will also reduce labour demand. Reduced spending on goods and services from that segment of the population, or would be population, along with a decrease in demand for housing leading to reduced residential investment, has negative implications for total economic output.

As a result, we have constructed portfolios to manage through multiple outcomes. We are overweight safe fixed income, and we have balanced exposures in corporate bonds as well as government of Canada bonds, which act as a ballast and opportunity capital, should markets experience a meaningful correction. Within the equity portion of portfolios, we have allocated 65% to U.S. equity, balanced between the S&P 500 and Nasdaq indices and West Oak’s value-based mandate, which owns stocks that trade at a significant discount to the market but are also more than twice the profitability on an earnings and cash-flow basis. Canadian equity exposure stands at 20% and international at 15%—these regions provide more diversified exposure outside of high-beta-growth technology names such as Nvidia, Microsoft, and Google, and have higher dividend yields and trade at more attractive valuations.

We continue to believe that the risk of an economic slowdown or contraction remains elevated, but we are cognizant that the rally in stocks may continue for some time if markets develop into a full-blown bubble environment. As such, we have positioned for a myriad of outcomes to insulate against risks and to take advantage of opportunities as they arise.

As always, we appreciate any questions or feedback so please don’t hesitate to reach out should you wish to visit in more detail.

Sincerely,

Andrew, Kelly, Justin & the West Oak Team