EXECUTIVE SUMMARY

Investment

- Recession in the U.S. is likely imminent, partly due to tariffs but also due to a weakening economic backdrop before President Trump took office.

- Markets could fall 30-35 per cent should recession take hold.

- We have positioned portfolios for this eventuality, having reduced equity exposure in favour of safe government bonds, which have historically gone up in value during weak equity market periods driven by recession.

- As a consequence of equity markets having fallen 20 per cent from their peak levels on February 19, we have begun shifting Government of Canada bonds back into equities and will continue making shifts as markets decline further.

Family Office

- If you are reporting capital gains or losses on your T1, the Canada Revenue Agency (CRA) has granted relief from late penalties and interest until June 2, 2025.

- The prescribed interest rate is now 4 per cent and heading further lower in the months ahead, which is good news for additional spousal and trust lending.

- The final Canada Carbon Rebate cheque is expected to be received by individuals after they file their T1 tax return this year.

- There is a federal election on April 28, 2025, with advanced polling available Friday, April 18 through to Monday, April 21, 2025.

- There is also a city election scheduled for October 20, 2025.

Our Quarterly Culinary Favourites

An An Kitchen & Bar – Located in the heart of the Beltline, An An Kitchen & Bar beautifully fuses the rich traditions of Vietnam’s culinary heritage with a touch of modern sophistication and contemporary flair. To

learn more, visit anankitchenandbar.com

.

DOPO -An Italian restaurant nestled in the heart of Marda Loop offering authentic Italian cuisine inspired by family recipes, pairing simple ingredients with family hospitality. For more information, visit dopoyyc.com

OUTLOOK

Recessions typically begin when an already vulnerable economy is hit with a shock—think pandemic, global financial crisis, market bubbles, and excessive leverage. The U.S. economy had been showing signs of weakness before President Trump got elected, and the shock has come in the form of tariffs and a global trade war.

Although the S&P 500 has recovered somewhat after falling by 20 percent since it peaked on February 19, we believe that the market will continue to fall in the months ahead and may bottom out somewhere between 30-35 per cent from peak levels before a recovery ensues. Our prognostication is predicated on earnings for the S&P 500 falling 10 per cent, which is very conservative given the last three recessions saw earnings decline by 18 per cent, 40 per cent, and 21 per cent respectively (Source: BCA Research), as well as the earnings multiple for the market falling from a peak level of 22X, to a more normal 17X (the average market multiple between 2015 and 2019, which represented most of Trump’s first term, was 16.8X) (Source: BCA Research).

Ahead of the recent sell off in markets, we had positioned portfolios defensively by reducing equity exposure in favour of low-risk government bonds, which have historically increased in value as stocks decline during recessionary periods. Not only has our tactical portfolio positioning reduced the impact to portfolios from declining equity markets, but it has armed us to take advantage of opportunities, which we did when the market bottomed on April 7, having shifted 20% of the Government of Canada bond exposures within portfolios back into equities.

Our initial view when Trump announced reciprocal tariffs on ‘Liberation Day’ was that he was using tariffs to not only renegotiate trade deals and reshore manufacturing, but also to push the economy into recession in order to bring interest rates down, keep a lid on inflation, and to reduce the risk of the economy being in recession during the midterm elections in November 2026. Our view was predicated on Trump allowing the market to sell off materially without any intervention. Now that we know that the Administration’s basis for pausing reciprocal tariffs was partially economic and market related, this has altered our view, which is that recession is pushed out a bit further.

What this means is that we are not yet out of the woods with respect to market volatility, but rather we are experiencing some near-term and likely short-lived reprieve. Because uncertainty with respect to policy decisions will continue to loom, coupled with an already fragile economy, we believe that markets will fall further in the coming months and that there will be additional opportunities to shift capital from government bonds into equities for improved rates of return.

We won’t sugarcoat that portfolios have experienced a brief and modest decline, which may continue to persist, however, we welcome a weak market period that allows us to reposition portfolios for improved growth opportunities and strong performance.

INVESTMENT MANAGEMENT FEATURE:

Putting Bear Markets into Perspective

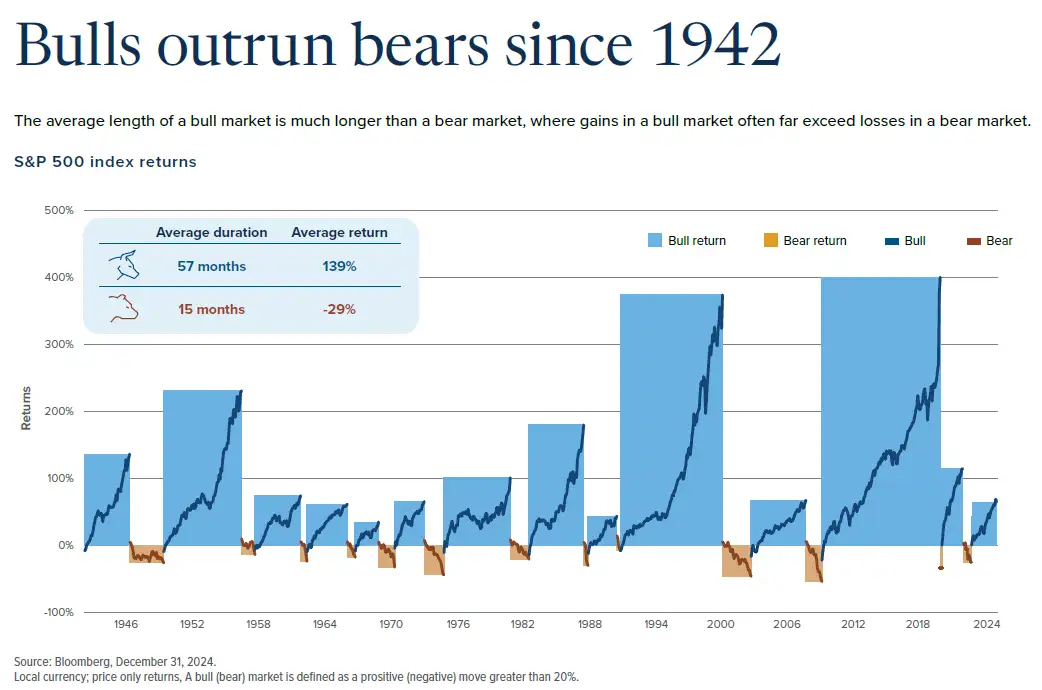

Given the high likelihood that we are entering a weak market period (bear market) and a recession, we thought it would be good to add some perspective relative to what has occurred in the past. The long and short of it is that bear markets don’t usually last as long as market expansions (bull markets). In addition, and generally speaking, bear market declines are relatively muted compared to the gains that accrue during bull market expansions (see chart below).

Inherently, we know that staying invested has been the right call during bear markets, but it is easier said than done. Take the global financial crisis of 2008-2009, for example. The conflux of a housing crash in the U.S., a deterioration of mortgage debt-related securities, and a near collapse of the financial system was a nerve-wracking time. No one knew when the market would bottom, but it eventually did, thanks in large part to government intervention, which led to sustained confidence in the banking and financial system and allowed for a return to normal practices in these systems.

The same could be said for the pandemic bear market. The unemployment rate spiked to +20 per cent within a matter of days and with global economies ostensibly shut down, it was difficult to understand a path forward that didn’t involve a tremendous amount of pain for investors. Again, the government intervened and took measures to support the economy and avoid a cataclysmic disaster.

In the case of the current recession that is likely upon us, there are no major dislocations such as a pandemic or a financial crisis, which leads us to conclude that the drawdown in markets won’t necessarily be as severe or drawn out and is likely to be average rather than deep and prolonged.

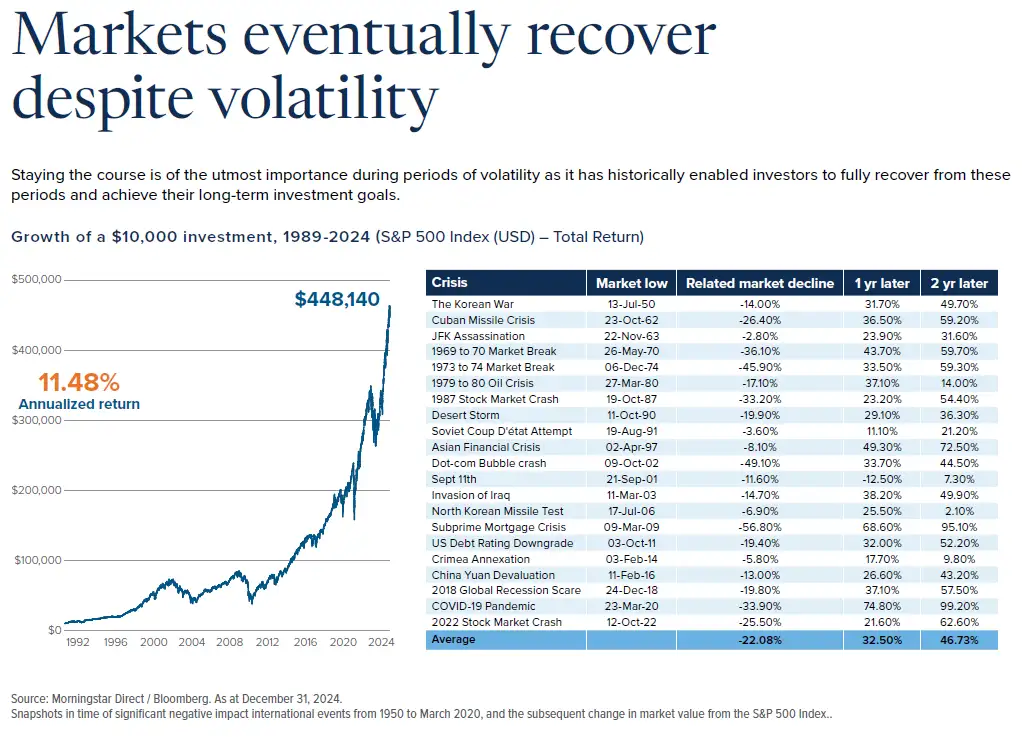

The chart below provides some good detail on how the markets have reacted to significant events that have occurred since 1989. What is most poignant to us are the returns that were achieved after the market decline. The parallel to this is that given current portfolio positioning, we can take advantage of the return opportunities during recovery periods, with the hope and expectation that the one to two year intervening period will produce outsized returns and improve the long-term returns profile.

FAMILY OFFICE FEATURE:

The 2024 Tax Season – Proposed Tax Changes, Delays and Filing Extensions

The 2024 tax season has been fraught with confusion and frustration for individual taxpayers, accountants and everyone involved in the preparation and delivery of tax information.

By way of background, earlier in 2024, the Federal government announced an increase to the capital gains inclusion rate from 50 per cent to 67 per cent in certain scenarios. In preparation for these proposed changes, the CRA, institutions providing T-slips, and tax filing software companies amended their systems and processes to incorporate the 67 per cent inclusion rate. However, this proposed legislation was never passed, and on January 31, 2025, the Minister of Finance subsequently announced that the government would defer the proposed increase in the capital gains inclusion rate until 2026, leaving the rate at 50 per cent. This caused the need to reverse the previously made changes to systems and processes, resulting in delays in certain tax slips being delivered to taxpayers and ultimately leading to the CRA’s decision to extend the tax filing deadlines under certain circumstances. Specifically, the CRA has granted relief from late penalties and interest until June 2, 2025, for T1 personal tax returns (only if you are reporting capital gains or losses).

For those individuals not impacted, the deadline for filing and amounts owed remains April 30, 2025, resulting in one member of a household possibly having an April 30 deadline, while others get the extension to June 2.

If you remain unsure of your filing deadline, please connect with us or your accountant to confirm.

Other Noteworthy News

- The prescribed interest rate is currently 4 per cent (down from a high of 6 per cent in January 2024). As the rate continues to drop, this creates opportunities to split income through the use of spousal and trust loans.

- April 1, 2025 brought the end of the federal fuel surcharge and the associated Canada Carbon Rebate (CCR) program for individuals, resulting in the final CCR payment expected to be received by individuals after they file their T1 tax return. The end of the federal fuel surcharge was immediately noticed as the average price of gas fell 17.6 cents per litre across Canada (11.0 cents per litre in Calgary).

- Many Canadians use their CRA My Account to check contribution limits, balances, and to download T-slips. This year, CRA has been delayed in uploading the T-slips onto their system, so we encourage anyone who files their own taxes to verify the CRA My Account T-slips to the paper copies received in the mail.

We are happy to visit about anything investment or planning related, so please don’t hesitate to reach out.

Sincerely,

Andrew, Kelly, Justin & the West Oak Team