EXECUTIVE SUMMARY

Investment Management

- Economic recessions and bear markets tend to coincide. In order to get the market right, one has to get the economy right, particularly consumption which represents nearly 70% of total economic output in the U.S.

- While consumption has been a strong driver for economic growth over the last 4 years, there are signs that the consumer is running out of steam.

- Credit conditions remain tight, excess savings that were accumulated through the pandemic has been spent and labour demand is softening. All the above leading indicators point to a recession sometime in late 2024, or early 2025.

- As such, we have reduced equity exposure across portfolios to dampen the impact of a weak period for equities and to create opportunities to reinvest back into stocks at depressed levels, thereby improving the long-term rate of return profile for portfolios.

Family Office

- Prescribed rate – The prescribed rate for new loans to spouses and trusts will remain at 6% for Q2.

- First Home Savings Account – This new investment account allows for first time home buyers to make an annual contribution of $8,000 per year for 5 years for anyone over the age of 18. The contribution is tax deductible, and the eventual withdrawal isn’t taxable. If you would like more information, or would like to discuss what is required to open an account for your kids, or grandkids, please let us know.

- Tax filing deadline – The deadline to file your personal tax return is April 30, 2024, as well as the deadline to pay your taxes. If you would like us to remit payment on your behalf, please let us know prior to April 22.

Cash Management Strategy

In the event you would like to hold some cash for the short to medium term and would like to earn a better rate than your bank account, we have access to several High Interest Savings Accounts (HISA), some of which are tax efficient in nature. Currently yields are in and around the 5% yield area. For taxable accounts, we use an offering that has a 7% tax equivalent yield for high tax rate clients.

Reach out if you would like more information.

New Faces at West Oak Family Office

Kim Linderman – Kim joins us from Scotia McLeod and brings over 18 years of industry experience. Her main role on the team as a Relationship Manager will be client servicing.

Trevor Fiell – Trevor joins us from Richardson Wealth and brings over 5 years experience as a trader/analyst and a passion for all things investment! His main role on the team as Associate Portfolio Manager will be to monitor and execute all trading.

Evan Zhou – Evan joins us from Propel Holdings and brings 4 years of experience in quantitative investment and modelling. Evan’s main role on the team is to build West Oak’s reporting and provide his expertise on everything quantitative related.

INVESTMENT MANAGEMENT FEATURE:

Broadening Participation and Lessons Learnt

We wrote in our last newsletter that high beta growth technology accounted for the vast majority of returns in 2023, an area of the market that we had very little exposure to and thus performance was below expectations, however, this has not been the case for 2024. Yes, the tech heavy NASDAQ index has posted good returns so far this year but so have other areas of the market such as energy, industrials, materials, and health care. This broader participation indicates a far healthier market where the sectors mentioned, which have been exceptionally undervalued for some time, finally began contributing to performance. We have strong exposure to these sectors and the equity portion of the portfolios we manage have produced returns that are in line with expectations, a theme that continues into the current quarter.

As stated in previous reports, our investment thesis focuses on investing in companies that trade at a low price to earnings (P/E) multiple, a high return on equity (ROE) and return on invested capital (ROIC), as well as a high free-cash-flow (FCF) yield. These ratios essentially mean that our process focuses on identifying companies that are trading at a low valuation based on the earnings that the company produces (low price-to-earnings multiple), are efficiently managing their funds to create value for investors (high returns on equity and reinvested capital), and generating strong cash profits (free-cash-flow yield) indicating high sustainability and quality of earnings. These parameters have led to our models investing in a collection of energy and materials stocks, as well as some industrial and health care names. The combination of strong profitability and inexpensive valuations, along with healthy dividend yields, has very often produced higher returns than the comparative benchmarks, and appears to be the case so far this year.

We have always been, and we remain, students of the market and apply our learnings to portfolios on an ongoing basis. What we learnt in 2023 was that we cannot be significantly underweight a sector that has dominance over the index. The technology sector constitutes nearly 30% of the S&P 500 index which means—if this segment of the market outperforms meaningfully as it did in 2023, and we haven’t allocated enough exposure to it—we are going to underperform and potentially in a meaningful way. As such, we added a position in the NASDAQ index during our rebalance at the beginning of April which brings our exposure to technology to just over half of what the market weight is. This will help smooth returns when the tech sector rips, as it did last year, but because we don’t have a full allocation to tech, it dampens the impact when technology performs poorly, as it did in 2022. We believe that we have struck a good balance of upside capture without exposing portfolios to as much of the volatility that tech can produce along the way.

Family Office Feature – 2024 Federal Budget Highlights

Hold onto your wallets, the latest federal budget promises to spend, spend, spend, and spend some more which means bigger debt payments and less money for actual services. In fact, more of our tax dollars will be spent on debt interest payment than on healthcare transfer payments to the provinces.

How will the 2024 budget affect your finances you ask? A good question, and here are our thoughts.

The new capital gains inclusion rate

There has been speculation for years about an increase in the capital gains inclusion rate. The rate has been 50% since 2000. and the 2024 budget now introduces increases for most capital gains.

- For all corporations and trusts, the inclusion rate will increase to 2/3rds (or 66.7%). Thinking out loud here, but this certainly will not incentivize businesses to bring their capital to Canada or to grow.

- Individuals continue to enjoy a 50% inclusion rate but only for the first $250,000 of capital gains realized in a year. Capital gains above$250,000 will now be subject to a 2/3rd inclusion rate starting on June 25, 2024.

- At the top Alberta tax rate, your tax rate will be between 24% and 32% depending on the size of your capital gains.

- Quick example:

- With a $1 million capital gain, at the top Alberta rate, your tax rate has been 24% (50% of 48%).

- Effective June 25, 2024, the same $1 M capital gain will be taxed at 30% (24%on $250,000 plus 32% on the remaining $750,000).

- Before the inclusion rate increases, now could be the time to trigger larger capital gains and save tax!

Alternative Minimum Tax (AMT)

AMT is a separate and parallel tax calculation to ensure that all individuals who take advantage of a lot of tax benefits pay a minimum amount of tax. Although AMT affects very few taxpayers, the government expanded the AMT calculation in their 2023 budget, however, this budget appeared to discourage philanthropy with its proposed reduction of the charitable donation credit to 50%. The 2024 budget has increased this credit to 80%. These rules are still proposed, but perhaps with this revision there will be new AMT legislation coming very soon.

Lifetime capital gains exemption

Any sale or transfer of private corporate shares should include planning well in advance so you can claim this exemption (and ideally have family members claim it as well). On June 25, 2024, the exemption limit will increase to $1.25 million. This means the exemption can be used to reduce capital gains of qualifying private corporate shares of $1.25 million.

We will be analyzing the impact of these changes and planning opportunities in the weeks ahead. If you would like to discuss further, please let us know and we would be happy to arrange a time to visit.

PORTFOLIO POSITIONING

We believe the probability of a recession has increased and have therefore taken a more defensive approach with the portfolios we manage by reducing equity exposure in favour of fixed income. This will help insulate portfolios during a recession-driven bear market, but, more importantly, provides the opportunity to shift back to equities at more depressed levels down the road.

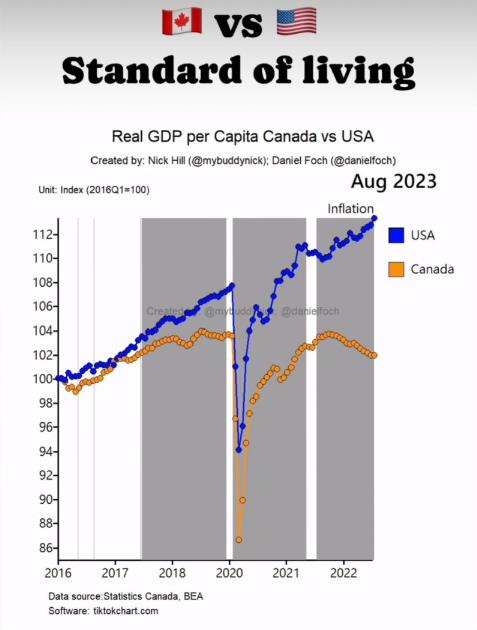

During our rebalance at the beginning of April, we reduced our exposure to Canadian equity from a 40% weighting within the equity component of portfolios, down to 25%. We have increased U.S. equity from 50% to 60% and international equity from 10% to 15%. We view Canada as carrying potentially more risk than the U.S. or other parts of the developed world due to high levels of household debt, over-valued real estate in certain parts of the country, as well as declining productivity and negative GDP growth on a per-capita basis (see: Chart A). In addition, the U.S. dollar tends to rally against the loonie during recessionary periods, adding yet another lever to the return profile of portfolios.

Lastly, we have had little exposure to high beta growth technology, which represents a significant component of the U.S. equity market, and which led to performance in 2023 being below expectations. We have since added a position in the NASDAQ index (representing 15% of the U.S. component of portfolios) to allow for more consistent performance relative to the benchmark S&P 500 index.

Chart A: GDP is Shrinking on a Per-Capita Basis in Canada

OUTLOOK

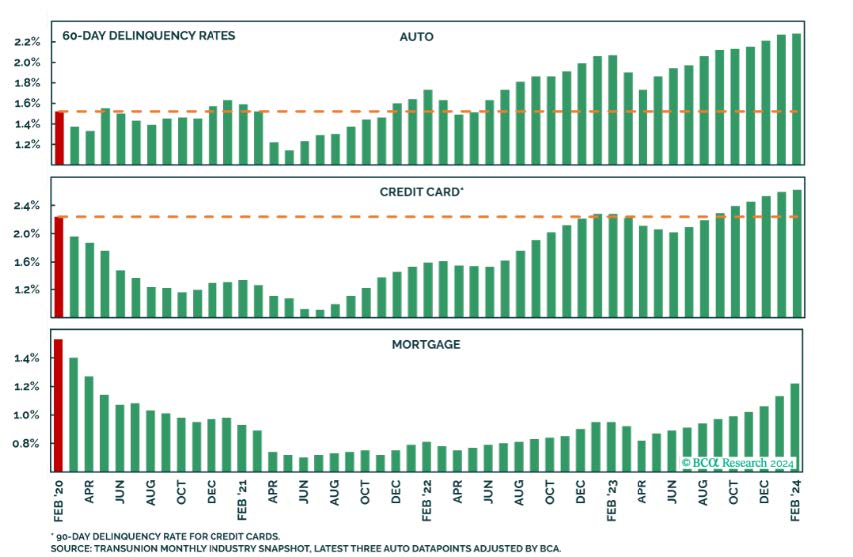

The U.S. economy grew by 2.5% in 2023 despite the consensus call for there to be a recession in the face of high inflation and rising interest rates. The reason that the economy didn’t tip into recession is that the consumer was able to remain resilient thanks to excess pandemic savings, a tight labour market which gave rise to rising wages, and large fiscal deficits on the part of government. With this said, excess savings have been depleted, wage growth is slowing and the labour market is beginning to show signs of weakening. This, along with tight credit conditions, higher cost of borrowing given lofty interest rates, and credit card and auto loan delinquencies above pre-pandemic levels, leads us to the conclusion that the consumer is about to run out of steam and for the economy to tip into recession later this year or in very early 2025, with equity markets leading the recession by approximately six months.

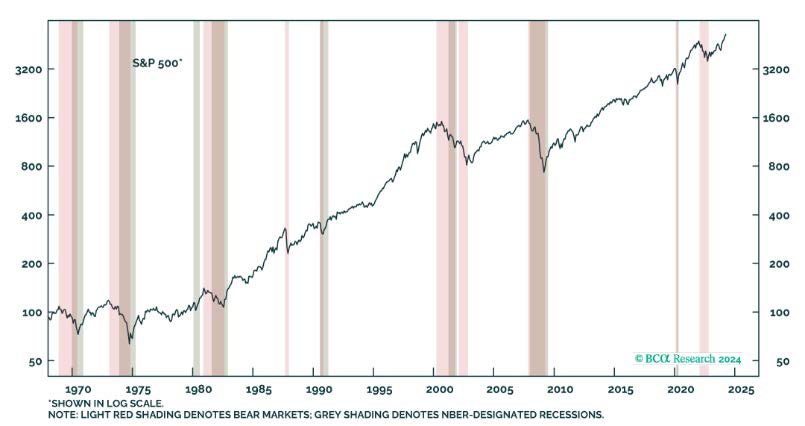

Recessions and bear markets tend to coincide (see below: Chart 1) and although economies grow 89% of the time and equities are in a bull market 82% of the time, recession-driven bear markets can be painful. For example, the S&P 500 fell 58% (excluding dividends) during the Global Financial Crisis (GFC) in 2008/09 and took 5.5 years to reach peak levels experienced in October 2007.

Chart 1: Bear Markets Tend to Coincide with Recessions

Monitoring leading economic and market indicators and being tactical with asset allocation within portfolios can sometimes circumvent long periods of below average growth. While we expect the coming recession to be much more mild and shorter in duration than the GFC, we are cognizant of what the leading indicators are telling us, which is we are nearing the end of the post-pandemic expansion.

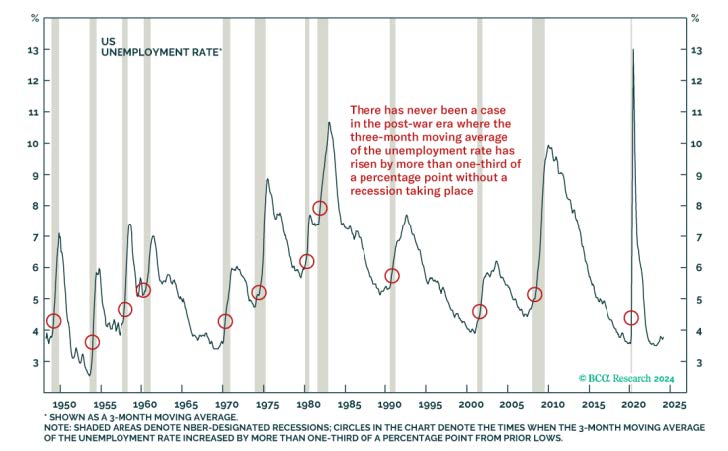

As consumption represents nearly 70% of total U.S. economic activity, one has to get the consumer right in order to get the economy right. The key driver for consumption growth is a strong labour market and history shows that there is a strong correlation between a rise in unemployment and recessions (see below: Chart 2) given the simple notion that less people working means less consumption. Generally speaking, once the unemployment genie is out of the bottle, it is hard to get him back in.

Chart 2: The Unemployment Rate has risen from 3.5% to 3.8%

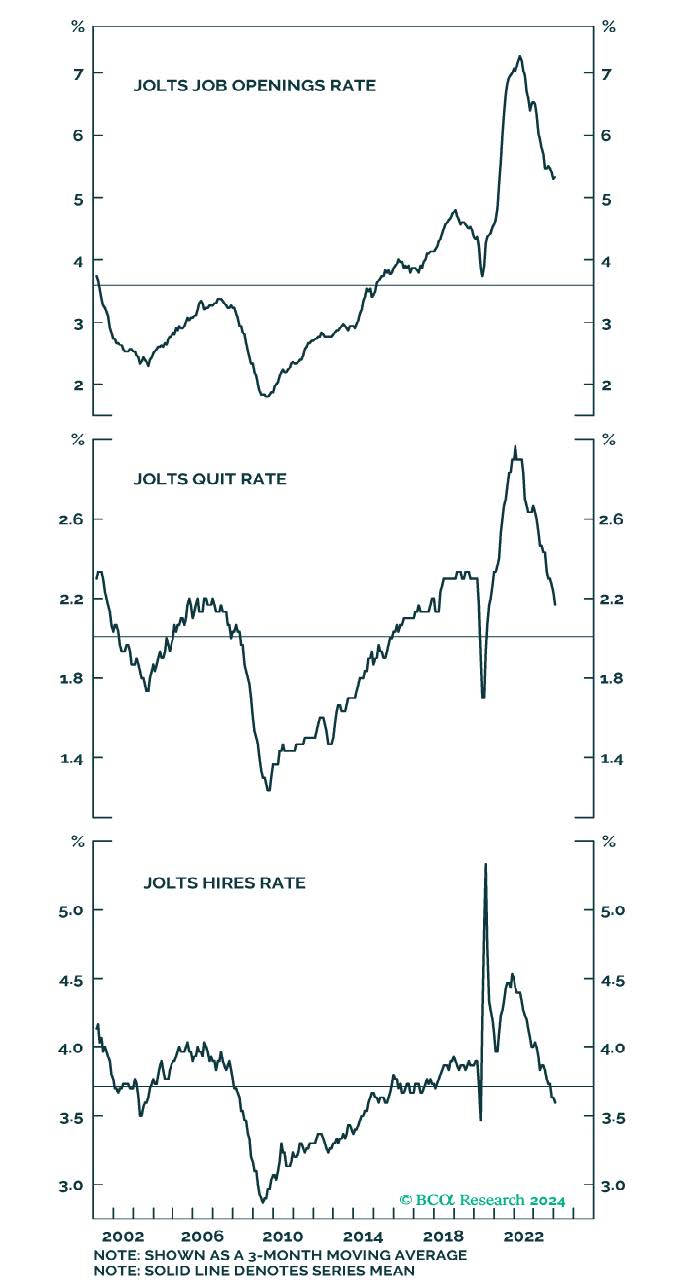

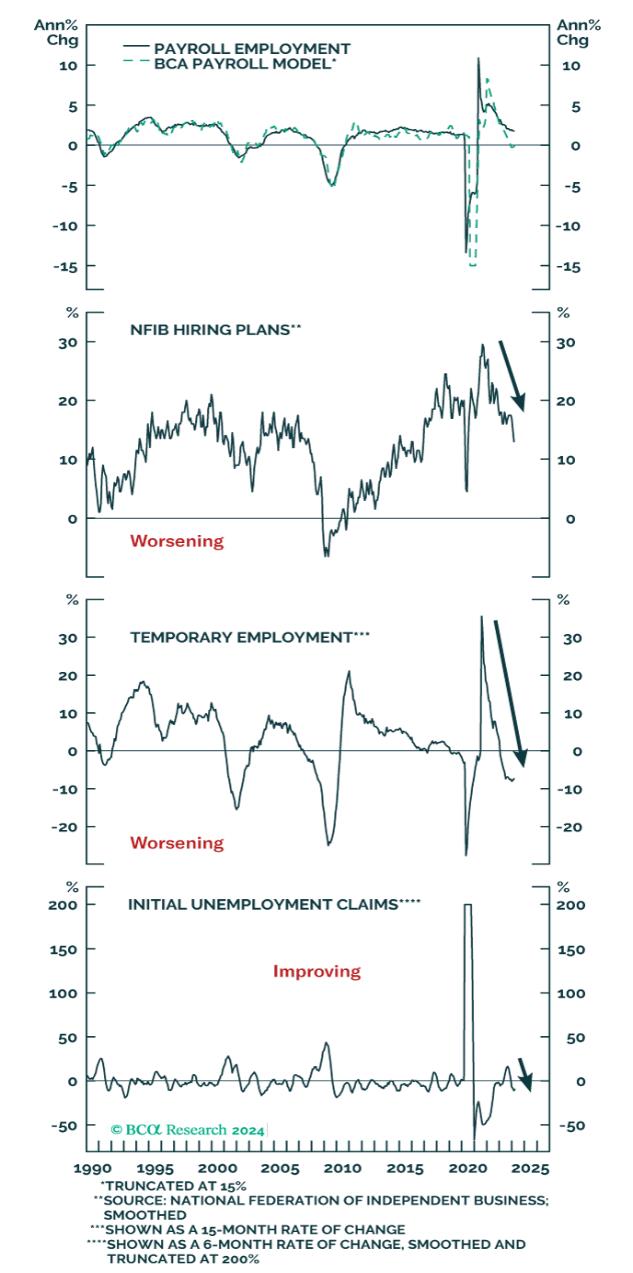

As it relates to leading indicators of labour demand, there are less job openings, less people are quitting their current job to move across the street for better pay, and the rate at which firms are hiring is falling as well (see below: Chart 3). These are all precursors to higher unemployment, as well as a continued deceleration of growth (see below: Chart 4)

Chart 3: Leading Indicators of Labour Demand

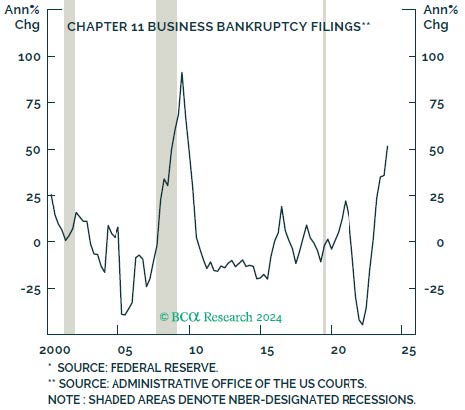

Another key driver to consumption is access and affordability of credit. Rising delinquencies on auto and credit card loans to above pre-pandemic levels suggests that banks may tighten credit standards further in the face of higher loan losses. (see below chart 5). Lastly, corporate bankruptcy filings have surged and are up 50% year-over-year (see below: chart 6).

Chart 4: Decelerating Payroll Growth Ahead

Chart 5: Delinquencies

Chart 6: Business’ Strained by Credit Conditions

Our outlook remains unchanged; we are expecting a mild recession in the U.S. and other developed economies within the next 12 months or so, with a bear market beginning roughly six months in advance of recession. We also see a more material slowdown in Canada due high household debt levels, over-valued real estate, and slowing productivity and our declining GDP per capita. Many signs have pointed towards a recession for quite some time now, but despite deteriorating fundamentals and reliable indicators, the recession just hasn’t arrived yet. In addition to this, we have seen equity markets forge new all-time highs, which has befuddled us and many other market strategists. Now that the equity market rally has broadened out to include smaller cap companies and cyclical commodity stocks, this is a fairly bullish indicator that suggests that this market advance could continue to defy expectations and continue in the short term. Despite this, it is only a matter of time before we ultimately experience an economic slowdown given the previously mentioned deteriorating fundamentals.

In sum, there is no question that these markets have been confusing and difficult to navigate. As such, we believe that it is only a matter of time before a recession begins, and we have taken proactive steps to protect portfolios in advance of this to provide opportunities to tactically shift back to equities at more depressed levels, thereby enhancing the rate of return profile for portfolios. We believe that buying high quality companies with inelastic and economically resilient business models will serve to protect portfolios entering into a period of slowing economic growth. Looking further down the line, we are assessing opportunities to invest in asset classes that will enhance returns coming out of a recessionary period, as over the long term, market volatility often provides opportunities to allocate to various asset classes at attractive valuations.

As always, we appreciate any questions or feedback so please don’t hesitate to reach out should you wish to visit in more detail.

Sincerely,

Andrew, Kelly, Justin & the West Oak Team